A refresh is coming to Tangerine Mastercards – cardholders will have three new 2% cash back categories to choose from. These new categories will be available October 25, 2025:

- E-games

- Fitness and sports clubs

- Foreign currency purchases

Of course, this will apply to both the Tangerine Money-Back Credit Card and the Tangerine Money-Back World Mastercard.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Earning cash back with Tangerine Mastercards

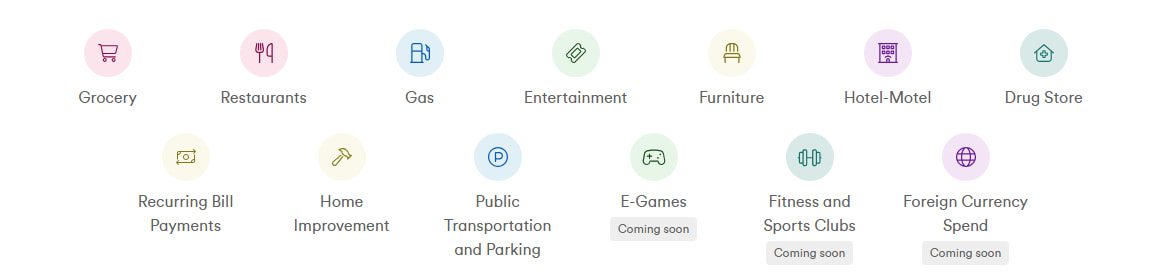

Tangerine cards offer a unique way to earn cash back. You get to choose which categories earn you 2% cash back instead of the default 0.5% cash back you’ll earn on all other purchases. And now, the list is a little longer, with 13 categories in total.

Here's the full list:

How many do you get to choose? It depends on where you get your rewards deposited.

- 2 categories if your cash back is applied as a monthly statement credit

- 3 categories if you deposit your cash back into a Tangerine Savings account

If you spend more money monthly on gaming or a luxury gym than you do on other categories, it’s time to switch up your categories.

Foreign currency spend category

Let’s chat about the foreign currency spend category that's coming, since it’s of interest to many frequent travelers.

It's certainly helpful if you're travelling, but it doesn't replace a true no foreign exchange fee card. And there are these points to consider:

- You are already earning your bonus rate when shopping abroad in any of your chosen categories

- It still does not wipe away the 2.5% fee you'll pay

- You're burning of your 2-3 selections on a category you may not use often

If you already chose groceries and hotels as 2% cash back categories, you aren’t gaining anything when spending in these areas outside of Canada.

Remember that you can't change your categories on a whim. You have to plan ahead if you want to adjust them for foreign travel as it takes 90 days for your changes to take effect. And once your trip is done, you'll have to wait another 90 days to switch back to something else.

With a true no-FX fee card, you're still earning your card’s rewards, plus you're saving the 2.5% fee on top of that.

Our summary – if you travel outside of Canada all the time, sure, this new Tangerine cash back category is valuable. But if not, and it's one of your selections, it isn't actually doing anything much for you, in fact, you could be losing out.

For the occasional foreign currency purchases, we suggest sticking with a true no foreign exchange fee card, especially your no fee options like the Home Trust Preferred Visa and Wealthsimple Prepaid Mastercard. You'll be ahead on Tangerine and avoid the 2.5% fee completely.

All about Tangerine Mastercards

New to these cards? Here's what else they offer on top of the rewards.

The Tangerine Money-Back Credit Card and the Tangerine Money-Back World Mastercard are pretty similar. The only differences are in the insurance and benefits. The Tangerine Money-Back Credit Card includes 2 types of insurance, while the Tangerine Money-Back World Mastercard has 4. The Tangerine Money-Back World Mastercard also includes standard World Mastercard benefits.

The annual fee for these cards? $0.

They also have an intro balance transfer offer – 1.95% for the first 6 months.

Your thoughts on Tangerine's updates

Let us know what you think of what Tangerine has updated with their Mastercards.

Leave us a comment below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.