Unless you’re Scrooge McDuck and are diving into a vault full of money, loans are probably going to be a part of your life. You most likely need one for buying a house, but you may also need one to get a car, do a major home renovation, or cover any other semi-large expense.

One loan product that’s readily available to nearly anyone that may not be the first to come to mind is a credit card. How do they fit into the loan equation?

Here are the differences, including a look at a personal line of credit vs. a credit card.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is a loan?

So what is a loan? It’s an agreement you enter into with a lender. They loan you a set amount of money (called the principal), and in return you have to pay back the full amount, with interest added on top.

You’ll receive a set payment schedule you’ll have to follow to avoid going into default on your loan. Depending on the loan you’ve agreed to, and what the lender offers, you may also be able to make extra payments so you can pay it off faster and avoid interest without penalty.

How can you calculate the amount of interest you may pay on a loan? It’s not easy to do. As you make your payments, you’re cutting into the amount you owe, and every time you make a payment (which can change depending on the type of loan), the amount of interest you’re paying decreases.

The easiest thing to do is to find an online loan calculator (like this one), punch in the relevant numbers, and you’ll get an idea of how much you’ll pay.

There is a way, of course, to calculate it yourself. First, you’ll need to divide the interest rate (these are annual rates) by the number of payment periods in one year. You’ll then multiply that number by the amount owed on your loan.

Interest paid = Interest Rate / Payment Period x Principal Remaining

Subtract this from your monthly payment, and you’ll have the principal remaining for your next payment. You can keep repeating this until your principal is down to zero.

Secured vs. unsecured loans

Loans also fall into 2 broad categories – secured and unsecured.

A secured loan uses assets that you own as collateral, such as the equity you have in your home. The benefit of these loans is you’ll get lower interest rates since you’re providing collateral in case you don’t make your payments, lowering the relative risk for the lender.

An unsecured loan is the opposite. The lender is taking a greater risk of losing their money, but also charges higher interest rates, making unsecured loans more expensive. You don’t require any collateral for an unsecured loan, but they’re also harder to get.

Types of loans

So what types of loans are there? Here’s a listing of the major types of loans you can get.

| Type of loan | What it's used for |

|---|---|

| Personal loan | * A one-time use loan, to aid in making larger purchases |

| Line of credit | * A flexible loan that can be used at any time for making purchases * Can borrow as little or as much as is needed |

| Home equity line of credit | * Same as a line of credit, but uses your home equity as collateral |

| Payday loan | * A very high-interest loan to get an advance on your pay cheque * Avoid these at all costs |

| Mortgage | * Buy a house |

| Student loan | * Pay for education |

4 pros of loans

What are some pros of personal loans? Here are some of their advantages.

1. Lower interest rates

The biggest advantage of loans is that they generally have the lowest rates available for borrowing money.

When thinking about making a large purchase, for something like a car or major renovations, you may need a loan to help cover all the costs. With a loan, you'll pay a lower interest rate than if you used your credit card for these purchases.

2. Different types of loans to suit your needs

There’s a variety of different loans you can get to fit what you need. Obviously, if you’re buying a house, you’ll need a mortgage, which generally has a much lower interest rate than personal loans, and longer terms to pay for your investment.

If you’re a student, you can get student loans to help finance your education. These loans don’t have to be paid back while you’re a full-time student, and you generally don’t have to start making payments until 6 months after you’ve graduated.

On the personal loans side, you can get one-time loans for making bigger purchases. Alternatively, you can also get a line of credit, which is a set amount of funds available to you at any time. With a line of credit, you only have to pay interest on what you borrow, not the total available credit.

Or, you could get a secured loan using the equity of your house as an example, and get even lower rates. Just beware that if you don’t make your payments, you risk losing your home.

3. Improve your credit score

These loan products all appear on your credit report. Make your payments on time, and you’ll be able to increase your credit score.

And as your score increases, the more likely you are to be approved for loans and see lower interest rates.

4. Can be used for almost anything

The money you get from a personal loan can be used towards almost anything.

As you’ll see with a credit card, there are restrictions on what they can be used for.

2 cons of loans

There are a few things to keep in mind with loans.

1. Excellent credit required for low interest rates

It should be no surprise, but to qualify for loans with lower interest rates, you’ll need to have a good credit score.

Yes, anyone can get payday loans, or loans geared towards those with poor credit, but the interest rates can be sky high – upwards of 46%.

If you have poor credit, you may want to work on that first before applying for a loan.

2. Risks with secured loans

Secured loans are a good way to lower interest rates. But they come with their own risks as well.

Start missing payments, and the lender can come after the collateral you’ve used to secure the loan.

So beware when putting up collateral for a personal loan.

How do credit cards work?

Credit cards can also be viewed as a type of loan – they are, after all, considered a revolving credit product on your credit report.

For almost all credit cards, you’re assigned a credit limit, which is the maximum balance that can be carried on the credit card.

You can make purchases up to your credit limit. Afterwards you won’t be able to make more until it’s paid. With a credit card, you don’t have to pay the balance in full – you can pay a minimum payment instead.

There are 2 ways minimum payments are generally calculated. The first is you’ll pay either 2.5% of the balance (5% in Quebec), or $10, whichever is more (this can vary by issuer).

The other is you’ll pay a flat $10 (regardless of balance), plus any accrued interest.

The only exception is Amex charge cards. Amex charge cards do give issuers a credit limit. However, it can be exceeded. Amex charge cards actually have no preset spending limit. That credit limit is simply what you’re allowed to carry for a balance. Any amounts over your assigned limit have to be paid back in full.

How credit cards work as a loan

So how can credit cards work as a loan?

Well, simply make purchases on your credit card. When your monthly bill comes in, you can pay it in full, or only make a partial payment, which must be at least your minimum payment.

You can then keep making payments as you’re able to, so long as you make your minimum payment.

As interest starts to accrue, it gets added to the card’s minimum payment every month.

3 pros of credit cards for loans

So what are some pros to using credit cards as a loan? There are a few of them.

1. Easy to access credit

Credit cards are relatively easy to get. You can get approval for many credit cards with a good credit score, which starts at 660. Even if you have poor credit, you can still access secured credit cards which allow you to accumulate a balance.

2. Small monthly payments

The monthly payment you have to make on a credit card is relatively small. On a balance of $5,000, you only need to pay $125 to keep your account in good standing, or could possibly be as low as $10, depending on the issuer.

3. Earn rewards

This depends on the credit card, but you can also earn credit card rewards on your purchases. You can then use these rewards to help with other areas of your budget.

3 cons of credit cards for loans

But there are a few cons (including one big one) to using a credit card for a loan.

1. High interest rates

The interest rates on a credit are far higher than what you could get with most loans.

The typical purchase interest rate of a credit card is around 20%. Yes, there are low interest credit cards out there, but most of them still have interest rates that hover around 12%.

Coupled with low minimum payments, you can get into some large credit card debt quite quickly.

Take our previous example. If you only paid $125, your outstanding balance is $4,875. If you made no new purchases, the next month you’ll be charged approximately $81.25 in interest.

Your minimum payment for the next month becomes $4,875 x 2.5% = $122. Since interest is paid first, you’re only going to decrease your balance by $40.75.

Meaning, it’s going to be a long time paying off your debt (about 30 years) if you only make minimum payments.

Want to learn more about how credit card interest works in Canada? Here’s everything you need to know.

2. Can negatively affect your credit score

One aspect of your credit score is credit utilization – how much of your available credit you are using.

The general rule is to keep this under 30% to maximize your credit score.

If you carry a balance on your credit card, you’re going to increase this number, and possibly start seeing a decline in your credit score.

3. Limited uses as a loan avenue

What you can use a credit card as a loan for is limited to what you can purchase with it.

Bigger purchases like cars can’t be done with a credit card, so getting a personal loan is the only way to finance a new car.

And even if you get a high credit limit, the issuer will limit the size of any one purchase.

Buying a car is just one example, but you’ll be limited to both the size of your limit and the places you can use credit cards for purchases.

The differences between personal loans and credit cards

So here we have (essentially) 2 different ways to get a loan – with a traditional loan, or with a credit card.

But there are definitely some differences.

Interest rates

Interest rates are the biggest difference between them. Assuming you have good credit, you’ll get a much lower interest rate with a traditional loan than what a credit card would provide.

You’ll save much more by getting a loan over a credit card.

Here’s an example

So how much could you save with a loan over a credit card?

We’ll compare 3 examples – a personal loan, a low interest credit card, and a standard credit card.

We’ll look at a loan of $5,000 that will be paid back in one year. And this also assumes no new purchases are being made on the credit card.

| Tool used | Interest rate | Total paid | Total interest paid |

|---|---|---|---|

| Loan | 7% | $5,219.28 | $191.56 |

| Low Interest Credit Card | 12% | $5,330.88 | $330.88 |

| Regular Credit Card | 20% | $5,558.04 | $558.04 |

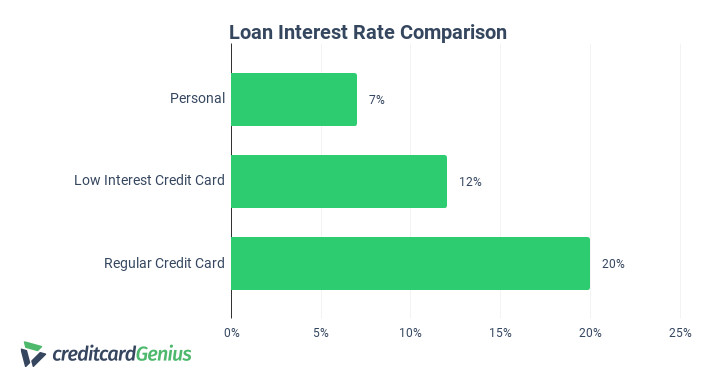

First, here’s the comparison of the interest rates of all 3 products:

Obviously quite the difference in rates, as the regular credit card has a rate almost 3 times as much as the loan.

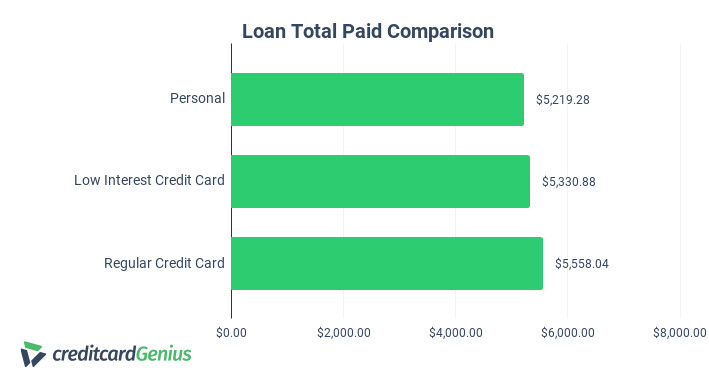

In terms of total paid, there may not seem to be much of a difference between the loan and the 2 credit cards:

There’s roughly a $300 difference. It should be noted that there are potential credit card annual fees to take into consideration as well.

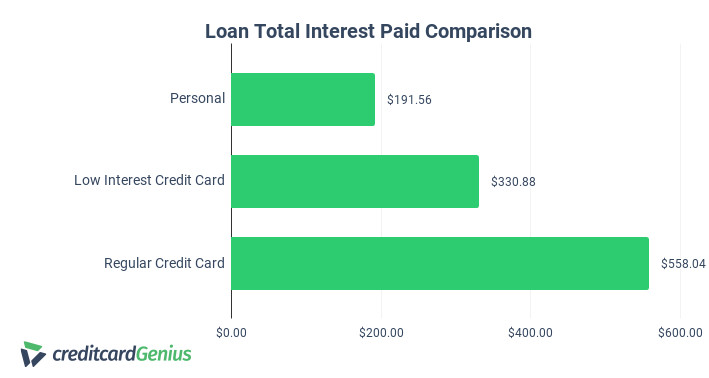

When it comes to interest paid, however, the differences become much more stark:

Just on total interest paid, with the low interest credit card you pay almost 1.75 times more.

Comparing the loan to the regular credit card, and you’ve paid almost triple the amount of interest.

Being smart with where you borrow money from can lead to a lot of savings in your pocket.

Want to see how much you’re paying to the banks in credit card interest? Our interest calculator is here to help.

What you can use them for

The other big difference is what these different forms of credit can be used for. A regular loan can be used to pay for just about anything, whether it’s a car, your education (with a student loan), or any other large expense, you can use your loan to cover it.

But the same isn’t true with a credit card. You’ll be restricted to what you’re able to purchase with your credit card, which won’t include some of the big ticket items listed above.

Personal line of credit vs. credit card

There’s one loan product that is actually similar to a credit card – a line of credit.

A line of credit is a revolving credit product. When you open up a line of credit from a bank, you’ll be given a limit as to how much you borrow. Sound familiar?

More than that, you only have to make payments on your line of credit when you actually borrow some money. Also sound familiar?

For these 2 reasons, a personal loan is similar to a credit card. When it comes to getting access to your line of credit, banks will give you a few ways to access it.

It will vary by lender but some of the ways include:

- transfer money to a chequing account,

- write a cheque, or

- get cash from an ATM.

As to how much you have to pay off? It’s quite low, and can be as small as simply paying the interest owed. But generally speaking, you only need to pay back 2% of what’s currently borrowed plus interest.

All of this is similar to a credit card. The main difference is how you use them. A credit card is used to make purchases at a point of sale, whereas to use your line of credit, you withdraw funds in advance.

Another major distinction – interest rates. It’s difficult to obtain an interest rate for a line of credit without actually applying for one. However, a general estimate of the interest rate you could get is between 7% to 8% with a good credit score.

Even the best low interest credit cards won’t be able to touch those interest rates. Generally speaking, the best interest rate a credit card gets you is 9%.

But overall, these products are remarkably similar.

Best low interest credit cards in Canada

If a low interest credit card feels like an easier option that you’re willing to pay for, there are a few choices you can look at.

For most of these cards, all they offer are low interest rates – there isn’t much else that comes with them. They have one purpose, which is to save on credit card interest.

Here are our best credit cards with low, permanent interest rates.

| Credit Card | Standard Interest Rates | Current Promotion | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| MBNA True Line Gold Mastercard | * 10.99% purchase interest * 13.99% balance transfer * 24.99% cash advance |

None | * $39 * None |

Apply Now |

| BMO Preferred Rate Mastercard | * 13.99% purchase interest * 15.99% balance transfer * 15.99% cash advance |

0.99% interest on balance transfers for 9 months (terms) | * $29 * None |

Apply Now |

| National Bank Syncro Mastercard | * 8.9% purchase interest * 12.9% balance transfer * 12.9% cash advance |

None | * $35 * None |

Apply Now |

| Scotiabank Value Visa | * 13.99% purchase interest * 13.99% balance transfer * 13.99% cash advance |

0.99% interest on balance transfers for 9 months (terms) | * $29 * $12,000 personal income requirement |

Apply Now |

1. Credit card with the lowest permanent rates

For the lowest, permanent interest rates you can get on a credit card in Canada, you’ll want to look at the

With this card, you’ll get low interest rates of 10.99% on both purchases and balance transfers. However, cash advances have a high interest rate of 24.99%.

This card has an annual fee of $39, with no income requirements.

2. Best balance transfer offer on a low interest credit card

For low interest rates and a promotional balance transfer offer, there’s the

For permanent low rates, you’ll get 13.99% on purchases and 15.99% on balance transfer, and cash advances.

However, you’ll get a promotional balance transfer offer of 0.99% for the first 9 months, with a transfer fee of 0.99%.

This card has an annual fee of $29, and no personal income requirements.

3. Lowest possible purchase interest rates on a credit card

If you just want the lowest possible interest rates, the

The interest rates on these credit cards vary with the prime rate. Here’s what they are:

- prime plus 4% on purchases, with a minimum rate of 8.9%, and

- prime plus 8% on balance transfer and cash advances, with a minimum rate of 12.9%.

As long as the prime rate is less than 4.9% (and it’s nowhere near that right now), you’ll get the lowest possible credit card interest rate on new purchases.

This card has an annual fee of $29 and no income requirements.

4. Best low interest Visa credit card

All of our credit cards to this point have been Mastercards. If for some reason you would prefer a Visa, then the

You’ll get low permanent interest rates of 13.99% on purchases, balance transfers, and cash advances.

This card has an annual fee of $29, and a personal income requirement of $12,000.

Comparison of the best low interest credit cards

So how do these 5 credit cards compare?

Here’s the breakdown in a few key areas.

Annual fee

First the annual fees. When it comes to low interest credit cards, most of them have annual fees, and these cards are no exception.

These annual fees are low – ranging from $29 to $39, but it’s a fee to pay just to enjoy low interest rates.

Interest rates

As for the interest rates themselves, here are the rates for all 5 cards:

All of these interest rates are below 13%, with the exception of the cash advance rate on the MBNA True Line Gold Mastercard, which has a cash advance rate of 24.99%.

Balance transfer promotions

The last area is with balance transfer promotions. 2 of these cards currently run a balance transfer offer to save on existing credit card debt.

The BMO Preferred Rate Mastercard has a longer term at 9 months, but a higher rate at 3.99%.

The Scotia Value Visa promotion is only for 6 months, but at a lower rate of 0.99%.

Which one is better depends on how fast you can finish paying off your debt. If you can do it in 6 months, go with the Scotia card. If not, then the BMO Preferred Rate Mastercard is the better choice.

The bottom line

While it may be tempting to use a credit card as a mechanism for a loan, it’s not the best solution.

Getting an actual loan, while it may be a little more effort, will definitely save you money in the long run. In many cases when you complete an application you can get instant approval as well.

Do you ever use a credit card as a source for a loan? Or do you stick to loans instead?

Let us know in the comments below.

FAQ

What’s the difference between a loan and credit card?

Loans and credit cards are both credit products. However, the biggest differences are in how they’re used and the interest rates you’ll pay. Credit cards tend to have much higher interest rates, and their usefulness as a loan is limited to what you can purchase with a credit card.

What’s the best low interest credit card in Canada?

The best low interest credit card in Canada is the HSBC +Rewards Mastercard, which is a rare credit card that offers both low interest rates and rewards on purchases.

How does credit card interest work?

When it comes to purchases, credit cards typically have a grace period of 21 days after you receive your statement before interest begins to apply. For balance transfer and cash advances, interest begins to accrue right away.

How does loan interest work?

When it comes to loans, you’ll pay interest according to the size of the loan. A predetermined payment schedule is part of the agreement, where you can review how much interest you’ll pay over the course of the loan.

Should I get a loan or a credit card?

If you want to save the most money, loans are the better avenue as they generally have lower interest rates. However, a credit card can be easier to get. You’ll generally won’t need as high of a credit score to qualify for a credit card. If your credit score is lower, you’ll likely be charged more interest on a loan.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments