If you’re in desperate need of some cash, one option you can turn to is a payday loan. Most payday loans can get you some cash quickly, and usually with no credit check.

There’s a big catch to these loans – the fees are high. Like, sky high. These loans should be avoided at all costs unless you have no other option.

Here are the details on what these loans are, what they cost, and 1 alternative to consider.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What are payday loans?

A payday loan is a short-term loan. It’s a quick way to borrow some cash to help pay for expenses. These loans can also be called high-cost loans and high cost credit.

Most of the time, you’ll pay a set fee, which when translated to an interest rate can be up to 400%. The money has to be paid back within 62 days.

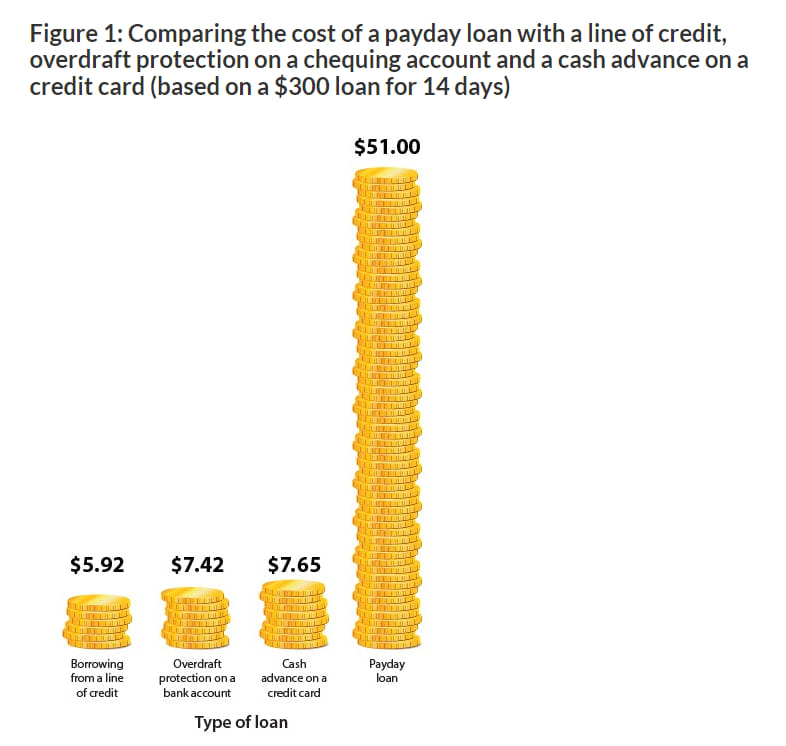

The government of Canada has an excellent graphic showing the cost of a $300 payday loan for 14 days when compared to a few other options.

That’s a staggering amount to pay for a loan. And, because these are quick loans, you’re often not even subjected to a credit check, which impacts the rates.

Because of the high cost, you’re limited as to how much you can borrow, which is usually $1,500.

And as the name of the loan is “payday,” up to 75% your next paycheque goes towards paying your loan. And this continues until you finish.

Now, it’s not to say you’ll always be approved. They may or may not conduct a credit check. But things like your current income will factor in, and they may not approve you if the risk is too great.

In short, these kinds of loans are an absolute last resort if you need cash. The Government of Canada has a full page dedicated to information on payday loans.

Your options for no refusal payday loans Canada

What are some options for payday loans in Canada? There are plenty of lenders that offer them. They can lend you up to $1,500 in cash, with a fee of up to $17 per $100 borrowed, depending on your province of residence.

Here’s a sampling of lenders in Canada who offer them.

1. Speedy Cash

Located in most provinces and territories in Canada, Speedy Cash offers no refusal payday loans.

With Speedy Cash, you can borrow up to $1,500. What you get charged per $100 depends on where you live.

Here’s the summary, and the annual interest rate based on a $300 loan for 14 days.

Here’s where you can learn more about Speedy Cash.

2. Mynextpay

Mynextpay offers payday loans of up to $1,500 in all provinces except for Manitoba.

They can get you up to $1,500 within 24 hours of receiving your applications, and they don’t require any credit checks.

Unfortunately, Mynextpay doesn’t advertise the fees for their payday loans.

Learn more about Mynextpay payday loans.

3. Focus Cash Loans

Focus Cash Loans can get you a payday loan fast. If you apply during business hours, you can get an email transfer in as little as 30 minutes.

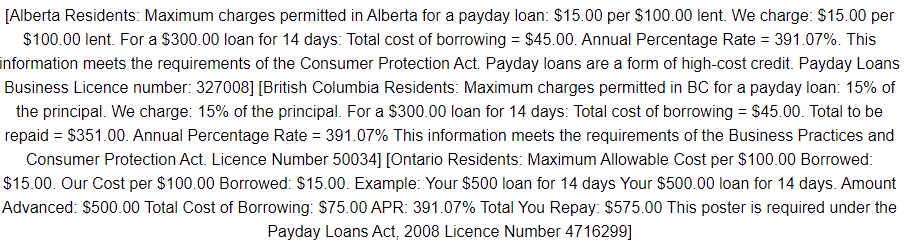

For a no refusal loan, they can get you $1,500. You’ll pay $15 for every $100 borrowed. Focus Cash Loans are only available in Ontario, Alberta, and British Columbia.

Here’s how the borrowing charges convert to an annual interest rate.

Here are more details on Focus Cash Loans.

4. GoDay

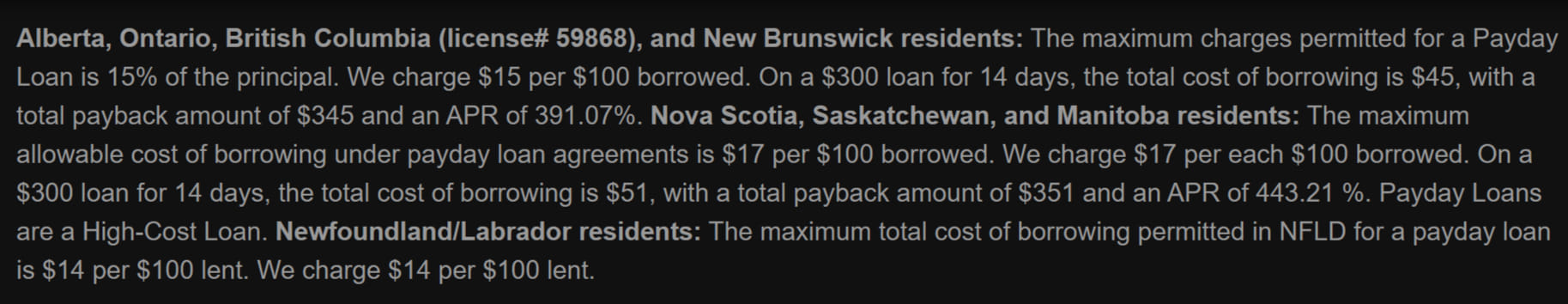

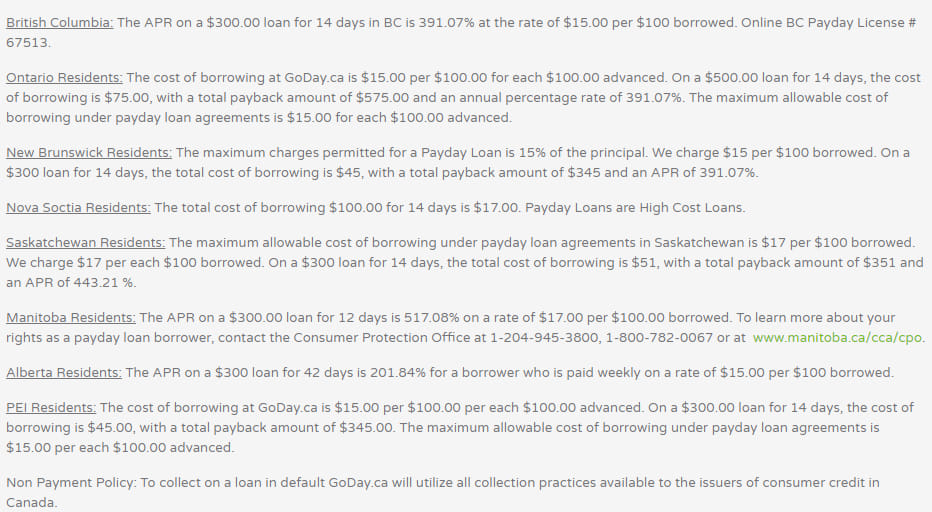

GoDay offers payday loans of up to $1,500 in all provinces except for Quebec. You can find out in as little as 5 minutes if you’re approved, and you can get your cash within an hour.

Depending on where you live, you’ll pay between $15 to $17 per $100 borrowed.

You can see GoDay’s loans site here.

5. Cash 4 You

The last lender we’ll take a look at is Cash 4 You. They offer payday loans of up to $1,500 in British Columbia and Ontario.

For either province, the cost of borrowing is $15 per $100. Here are the disclosures.

With Cash 4 You, you can apply either in-store or online. If you’re approved in-store, they’ll give your cash right there on the spot.

Learn more about Cash 4 You here.

Consider a low interest credit card

If you find yourself needing a break from day to day expenses once in a while, you may want to consider a low interest credit card instead of a no refusal payday loan.

If you can’t quite cover your expenses, use your credit card. You can get interest rates as low as 9%, much lower than the typical 20% interest rate you’ll find.

Now, these credit cards won’t have near guaranteed approval. If your credit score is less than impeccable, you may get declined. And if you need one now, you’ll be waiting at least a week for your card after you’ve been approved. But at the very least, it’s an alternative worth exploring.

Here are some top low interest credit cards.

| Credit Card | Interest Rates | Other Benefits | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| MBNA True Line Gold Mastercard | * Purchase: 10.99% * Cash Advance: 24.99% * Balance Transfer: 13.99% |

None | * $39 * None |

Apply Now |

| MBNA True Line Mastercard | * Purchase: 12.99% * Cash Advance: 24.99% * Balance Transfer: 17.99% |

Balance transfer offer of 0% for 12 months | * $0 * None |

Apply Now |

| Scotiabank Value Visa Card | * Purchase: 13.99% * Cash Advance: 13.99% * Balance Transfer: 13.99% |

Balance transfer offer of 0.99% for 9 months | * $29 * None |

Apply Now |

1. The lowest interest rates on a credit card

For the lowest interest rates on a credit card, the MBNA True Line Gold Mastercard offers excellent interest rates on purchases and balance transfers. The interest rate for them is 10.99%. However, if you’re looking to get cash, this card should be avoided as it has a high interest rate of 24.99% on cash advances.

There is an annual fee to pay for this – it’s $39. But if you do carry a balance on your card from time to time, you may offset that in interest savings.

2. A low interest credit card with an excellent balance transfer offer

MBNA has another low interest card you can look at in the MBNA True Line Mastercard. This card has no annual fee, and to get that, you’ll face slightly higher interest rates:

- purchases: 12.99%

- cash advances: 24.99%

- balance transfers: 17.99%

However, it also comes with an excellent balance transfer offer if you have existing credit card debt. You’ll get a rate of 0% for 12 months.

3. A low interest Visa credit card

If you’re looking for a low interest credit card with low rates across the board. The Scotiabank Value Visa Card is an option.

The interest rate is 13.99% on purchases, cash advances, and balance transfers.

It also has a balance transfer offer of 0.99% for 9 months.

Keep in mind, though, the card has an annual fee of $29.

Your experiences with payday loans

Payday loans are to be avoided at all costs. While easy to get, they only represent short term relief, and you’ll be paying very high fees to get one.

Have you ever gotten a payday loan? What was your experience?

Let us know in the comments below.

FAQ

What are no refusal payday loans in Canada?

No refusal payday loans are short term loans of typically up to $1,500. You pay a set fee of around $15 per $100 borrowed and have a short time frame to pay them back. Most lenders won’t subject you to a credit check, and you can get your money within 24 hours, with many handing it over sooner than that.

What are some options for payday loans in Canada?

There are plenty of lenders that offer payday loans in Canada. A few of them include:

- Speedy Cash,

- Mynextpay,

- Focus Cash Loans

- GoDay, and

- Cash 4 You.

What is an alternative to a payday loan?

One alternative you can look at instead of payday loans are low interest credit cards. These cards have much lower interest rates than regular credit cards. Some options include:

- MBNA True Line Gold Mastercard

- MBNA True Line Mastercard

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments