Please note this offer is no longer available. You can find current offers here.

It has finally happened.

After much waiting and anticipation, the combined Marriott Rewards and Starwood Preferred Guest program has a new name: Marriott Bonvoy.

And that means we can officially retire the Starwood brand.

The American Express SPG Card has also been rebranded to the

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

The new Marriott Bonvoy Amex credit card

Don’t have this card yet? Here are the details.

Welcome bonus

Get 50,000 Marriott points after spending $1,500 in the first 3 months.

Earning points

And, here’s what you’ll earn on all of your spending with the card:

- 5 points per $1 spent at Marriott properties, and

- 2 points per $1 spent on all other purchases.

We value a single Marriott point at 0.97 cents, giving you a return of 1.94% on your base spend, and a whopping 4.85% at any of Marriott’s 7,000+ properties.

What else can your points be used for besides free night stays? What are they worth? Read more in our complete guide to Marriott Bonvoy.

And remember, points cover any taxes and fees as well.

Marriott perks

There’s also some great Marriott perks as well:

- a free night stay every year on your card’s anniversary, up to a category 5 hotel (a free night stay at a category 5 requires 35,000 points),

- automatic Silver Elite Status

- 15 Elite night credits awarded every calendar year you have the card, and

- Gold Elite Status, if you spend 30,000 per year.

Let’s recap: You get a free night stay and upgraded status. These 2 benefits alone more than offsets the annual fee of $120.

Get the details here:

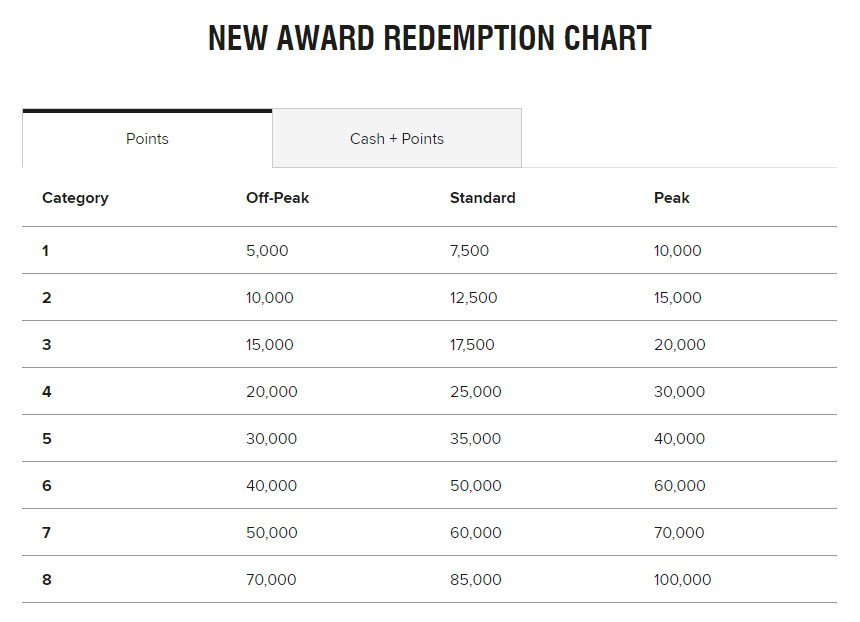

A new hotel redemption chart

A new hotel redemption chart is also in place.

Now there is peak and off peak rewards pricing, in addition to the standard rates.

Here is what the new chart looks like:

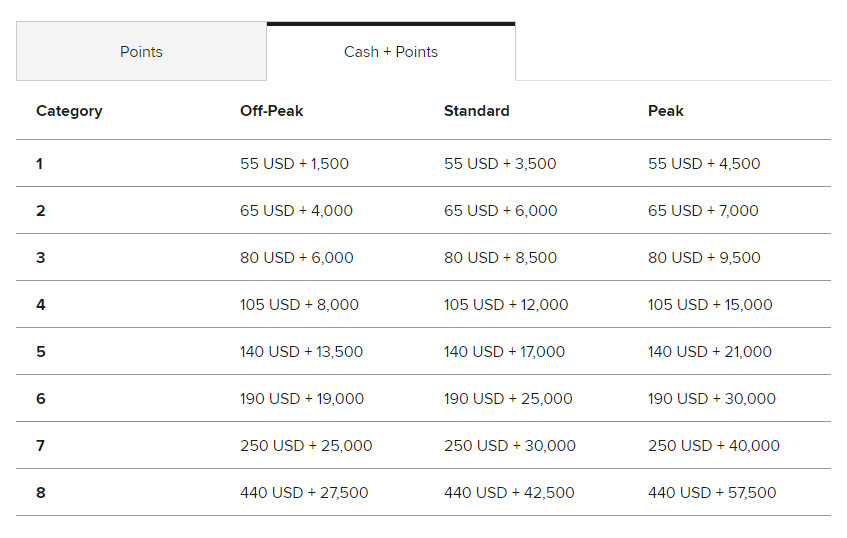

And, if you don’t have enough points for a free stay, there’s a points and cash chart as well:

What constitutes peak and off peak pricing? It all depends on the hotel availability. When a hotel is really busy, you’ll see peak pricing, when it’s not, off peak pricing will take effect, with standard rates lying somewhere in the middle.

Want to know more about redeeming for hotel stays? Here’s our guide to getting the most out of Marriott Bonvoy.

Is there anything you have to do?

If you haven’t combined your SPG and Marriott accounts yet, this should definitely be on your to-do list in order to pool your points together.

If you use the Starwood or Ritz-Carlton apps on your phone, they’re being deactivated. You’ll have to download the Marriott app instead.

If you’re eager to get your hands on the new card design, after reaching out to American Express customer service we can confirm that you’ll be getting newly designed credit card when the original card expires unless you put in a request for a replacement. It’s important to keep in mind though that by requesting a replacement, your credit card number will change. If you have any automated payments set up, they’ll have to be re-entered with the new card number.

But that’s it for now.

As far as we can tell, nothing is changing yet regarding the hotel program you know and love. It’s just a different name and a fresh new look. All your points, login info, program number, and statuses are the same.

Alternatives to Marriott Bonvoy

Looking for some alternatives to Marriott Bonvoy? Here are some other options to consider for free stays at hotels. But first, here’s a quick comparison:

| Loyalty Program | Loyalty Card Typical Earn Rate | Hotel Stay Point Value | Typical Return On Spending | Do points also cover taxes and fees? |

|---|---|---|---|---|

| Marriott Bonvoy | 10 points per $1 USD* | 0.83 cents per point | 7.19% | Yes |

| American Express Membership Rewards | N/A | 1.16 cents per point | 2% | Yes |

| Air Miles | 1 mile per $20 | 12.3 cents per mile | 0.62% | No |

| Aeroplan | 1 mile per $1 | 0.73 cents per mile | 0.73% | Yes |

| Best Western Rewards | 10 points per $1 | 0.6 cents per point | 6% | Yes |

*Marriott converts your eligible spending to USD first before awarding points.

Keep in mind, the above earn rates when it comes to Marriott and Best Western are only at their hotel properties. Air Miles and Aeroplan can be earned much more broadly.

American Express Membership Rewards

American Express Membership Rewards credit cards are great for hotel bookings.

Why? First, you can transfer your points at a 5:6 ratio to Marriott Bonvoy. This effectively raises the value of a Marriott point 20%, from 0.97 to 1.16 cents.

You can also transfer your points at a 1:1 ratio to Hilton Honors.

And if you prefer, simply book any hotel from any provider and use your points to pay for your stay. Each point is worth 1 cent when redeemed this way.

The best credit card for Membership Rewards is the

Earn piles of points at these rates:

- 5 points per $1 spent on groceries and eligible dining,

- 2 points per $1 spent on gas, transit and travel purchases, and

- 1 point per $1 spent on all other purchases.

Based on a typical spend, you’d earn 51,600 points per year. Transfer them to Marriott and that becomes 61,920 Marriott points.

The other great card to consider is the

While it won’t earn as many points, it does come with a really long list of perks, one of which is automatic Marriott Bonvoy Gold Elite status. Get free upgraded status and earn more points on stays and get complimentary room upgrades just for having this card.

It doesn’t stop there. Here’s a taste of what else this card offers:

- annual $200 travel credit,

- free airport lounge visits for you and a guest at over 1,200 lounges,

- VIP benefits at Toronto-Pearson airport, and

- discounted flights on premium economy, business and first class seats on select airlines.

If you can handle the $699 annual fee, this card will give you great treatment wherever you go.

Get the full details here:

GC: $100

MBNA Best Western Platinum Plus Mastercard

The only other hotel branded credit card in Canada is the

A no fee card, earn Best Western points on all of your purchases:

- 5 points per $1 spent at Best Western hotels, and

- 1 point per $1 spent on everything else.

Each point is only worth roughly 0.6 cents, a much poorer return than what Amex and Marriott offer.

Plus, the only benefit you receive is Gold status after your first purchase, and Diamond status after spending $10,000 in one year.

It does come with a sign up bonus of 20,000 points, enough for a free night stay at a Best Western property.

However, for a no fee card, if you stay frequently at Best Western properties, you can accelerate your earn rate. And you have the option to transfer them to AIR MILES and Aeroplan.

Full details here:

Related: Complete 2 Stays At Best Western Hotels ‒ And Get Your 3rd Night Free

AIR MILES

Did you know that you can redeem Air Miles for hotel stays? Just keep in mind that your points do not cover any taxes and fees.

We have a typical value of 12.3 cents per mile when you redeem your miles for a free hotel night.

This number is quite a bit lower than redeeming for flights, where we have an average value of 17.2 cents for each mile.

So while you can use your points for hotel stays, it’s not the best way to make use of your miles.

Aeroplan

Similar to AIR MILES, you can also use Aeroplan miles to redeem for hotel stays.

We value a single Aeroplan mile at 0.73 cents for hotel stays. Compared to a value of 2.5 cents when redeemed for flights, you’re getting quite a poor value for the miles you have earned.

Sure, it’s an option that exists. But Aeroplan miles are best suited for flights.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner  $100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 6 comments