The prime rate in Canada is currently 2.45%.

This is something you hear people talk about in the news or on the radio, and it’s always discussed by very serious people talking about very serious things.

But what exactly is the prime rate, and why should any of us care?

Long story short, the prime rate, also known as the prime lending rate, is the annual interest rate that Canada’s banks and financial institutions use to set the interest rates they charge (or pay out) for a variety of products, such as loans, lines of credit, mortgages, and savings accounts.

So, the prime rate matters to regular Canadians, because it influences how much we’ll pay to borrow money, or earn on our savings.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Current low interest rates in Canada

Since late March 2020, the Bank of Canada has kept the prime rate at a low 2.45%.

This is in response to the pandemic, of course, and the financial crisis we’re undergoing both as individuals and as a country.

In fact the Bank of Canada slashed its “benchmark” interest rate (the rate at which banks borrow and lend one-day funds among themselves) to 0.25% and has pledged to keep it that low until at least 2023.

The reason for this is that low interest rates encourage lending and borrowing, meaning that money will continue circulating, thus keeping the economy afloat.

On the flip side, of course, is that more money in circulation can cause inflation. When this happens, the Bank of Canada will raise interest rates to keep inflation in check.

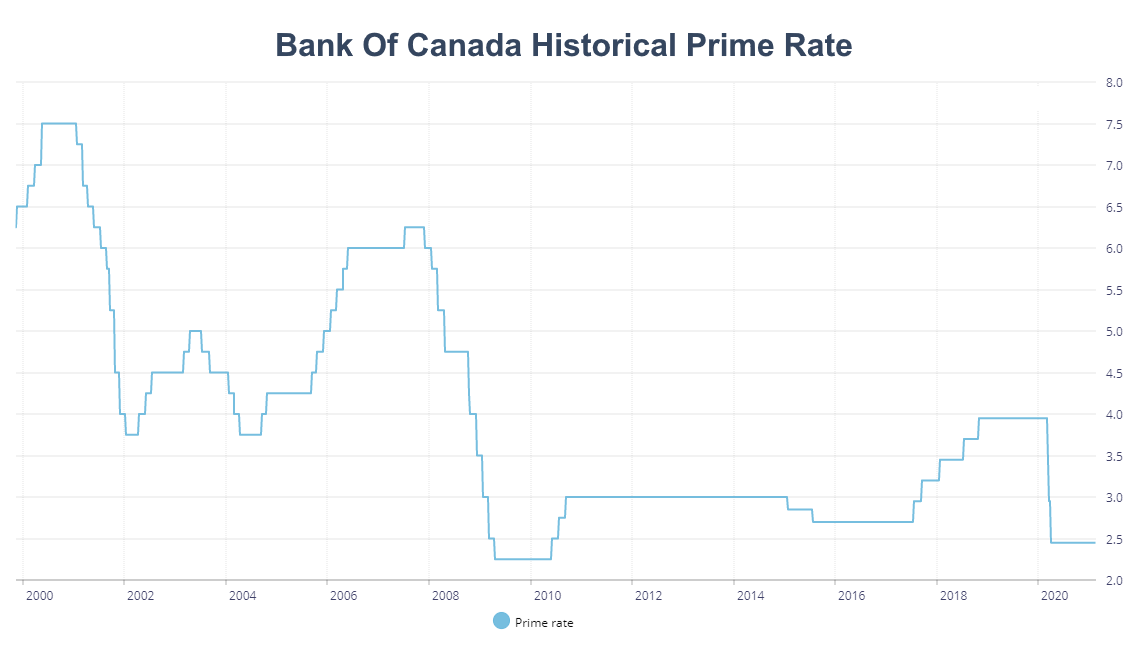

Here’s what the prime rate has looked like since 2000.

As you can see, since 2000, the prime rate has gone from a high of 7.5% in 2000 and 2001, to a low of 2.25% in 2009 and 2010.

While our current rate isn’t the lowest it’s been, it is likely that it will stay this low until we start to see some economic recovery in post-pandemic times.

Types of interest rates

So, that’s the prime interest rate, but what about all of the other types of interest rates?

It turns out that most interest rates are influenced fairly directly by the prime rate, rising and falling in tandem. Of course only variable rates actually change that often, but other interest rates will rise and fall accordingly over time as well.

Mortgage interest rates

Mortgage rates are the interest rates you will pay on the loan you get to buy a home or other piece of property.

With the prime rate being as low as it is, we’re seeing some of the best interest rates in history, with current mortgage rates at a record low, which is causing a bit of a real estate boom, in spite of the pandemic.

There are 2 basic types of mortgage – fixed rate mortgages, and variable rate mortgages.

Fixed interest rates

Fixed rate mortgages will have the same interest rate through the entire term of the mortgage.

If you get a 5 year fixed rate mortgage at 2.95%, you will only ever pay 2.95% interest over the 5 years. When the 5 years are up, you will get a new mortgage, at a different rate.

With mortgage rates being as low as they are, people are taking advantage and securing longer-term fixed mortgages to lock the best interest rates in for as long as they can.

Variable interest rates

On the other hand, the interest rate on a variable rate mortgage will rise and fall in relation to the Bank of Canada prime rate.

If you get a 5 year variable mortgage at 2.95% and the interest rate drops by 1% for a year, you’ll only pay 1.95%. If the interest rate goes up by 2%, however, you’ll pay 4.95% until the interest rate changes again.

Getting a variable rate mortgage is a bit of a gamble, of course, but if you get one when interest rates are high, you could save some money if interest rates drop during the term of your mortgages.

With interest rates being as low as they are, however, a variable rate mortgage is a bit riskier, since rates have really nowhere to go but up right now.

Personal loan interest rates

Personal loan interest rates tend to be higher than mortgage rates, since they’re generally unsecured, meaning the bank is taking a greater risk of losing money if you don’t pay it back.

With a mortgage, the bank can just take possession of your house if you stop making payments, meaning there’s less chance they lose money.

The interest you’ll pay on a personal loan can vary based on your personal creditworthiness. People with good or excellent credit tend to pay lower interest rates than people with poor credit.

People with good credit are also more likely to get loans from more established lenders such as banks, while people with poor credit may have to resort to non-traditional lenders in order to secure a loan. And non-traditional lenders tend to charge higher interest rates.

Credit card interest rates

Credit card interest rates, for the most part, aren’t influenced by the Bank of Canada prime rate, staying pretty steady from year to year (and often only changing if they go up).

By and large, you’ll find that credit card purchase interest rates are around 20%, which is very high. Of course, you should do everything you can to avoid carrying a balance on your credit card.

Savings account rates

Savings account interest rates also tend to go up and down with the Bank of Canada prime rate, although not as quickly as variable rate loans and mortgages.

Savings accounts are the one place where a higher interest rate works in your favour. The higher the rate, the more interest you’ll earn on your savings.

While most of Canada’s Big Five bank’s savings accounts have relatively low interest rates, usually under 1%, there are some high interest savings accounts with higher rates that can help you grow your savings more quickly.

One example is the Neo Money account, which has a 1.8% interest rate.

Earn 1.8% interest with one of Canada’s best high interest savings accounts: Neo Money account

Pros of low interest rates

For the most part, low interest rates work in your favour, allowing you to pay less on any money you borrow.

Low mortgage interest rates

If you’re looking to purchase a house or other piece of property, you’re going to want to get the lowest interest rate you can.

The difference in only a few percentage points can save you an absolutely enormous amount of money over the course of your mortgage.

For example, here’s what you’d pay in interest for a $500,000 5 year fixed rate mortgage at various interest rates, given a 25 year amortization.

| Interest rate | Total paid in 5 years | Principal remaining after 5 years | Interest paid |

|---|---|---|---|

| 1.74% | $123,393.00 | $416,591.48 | $39,984.48 |

| 2.04% | $127.741.20 | $419,280.49 | $47,021.69 |

| 4.79% | $171,726.00 | $441,403.02 | $113,129.02 |

| 5.60% | $186,022.20 | $447,030.46 | $133,052.66 |

If you had a 5 year fixed rate mortgage at 5.60%, you’d pay a staggering $93,068.18 more in interest than if you got the lower 1.74% rate.

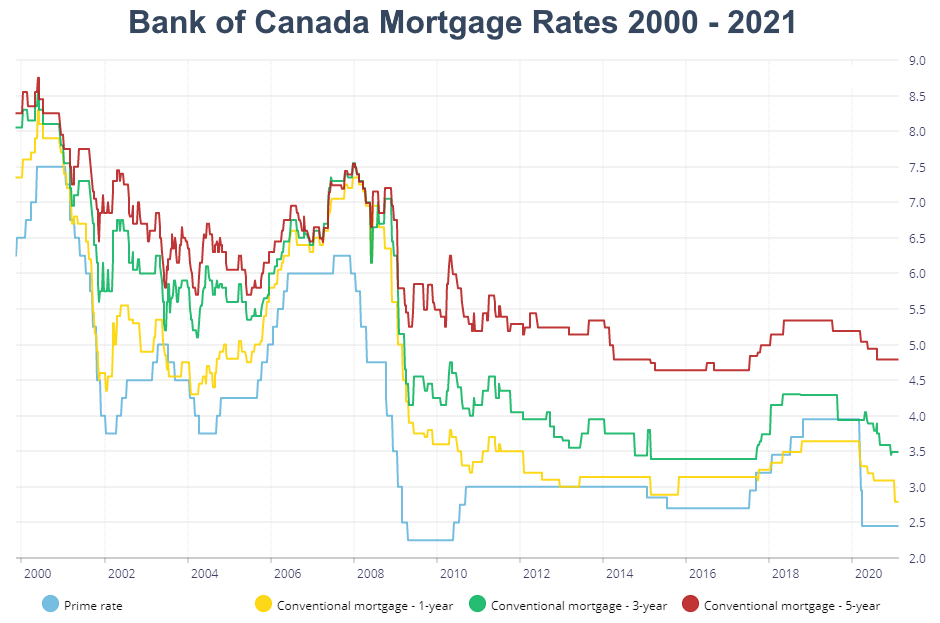

In 2020 and 2021, Canadian mortgage rates are at an historic low, as illustrated by the Bank of Canada’s analysis of the interest rates posted for products posted by the major chartered banks.

Here you can see how mortgage rates are influenced by the prime rate. It’s not a perfect mirroring, but the lower the prime rate, the lower mortgage rates tend to be.

Low rates on home equity loans and lines of credit

Like mortgages, home equity loans and lines of credit tend to have lower interest rates when the prime rate is lower.

If you own your home, a home equity loan or line of credit can be a great way to leverage the equity you have in your home to do renovations, pay tuition, take a whirlwind vacation (when it’s possible to travel, at least), or to consolidate any higher interest outstanding debt you may be dealing with.

There are risks of course, since these types of loans and lines of credit use your house as security on the loan. If your financial situation changes and you’re unable to pay these debts, there is the possibility that you could lose your house – just as with a regular mortgage.

Low rates on other loans and lines of credit

Similarly, a low prime rate makes it more likely that you’ll be able to secure a more favourable interest rate for unsecured loans and lines of credit.

If you’re able to get a loan when rates are low, you’ll save money on interest payments over time.

Cons of low interest rates

While low interest rates are in your favour when you’re borrowing money, such is the opposite if you’re trying to save money or build your nest egg.

HISA rates have been dropping

The interest rates available for high interest savings accounts have been dropping over the past year or so. These drops aren’t in lock-step with drops in the prime rate, but there have been significant changes, meaning that Canadians aren’t able to earn as much interest on their savings in these accounts as they were previously.

We did a quick comparison of what several Canadian banks had to offer.

| Bank | Account | Rate |

|---|---|---|

| BMO interest rates | BMO Savings Builder | Up to 0.35% |

| CIBC interest rates | CIBC eAdvantage Savings Account | 0.05% |

| RBC interest rates | RBC High Interest eSavings | 0.05% |

| Scotiabank interest rates | Scotia Momentum Plus Savings Account | Up to 0.75% |

| TD interest rates | TD ePremium Savings Account | Up to 0.1% |

| EQ Bank interest rates | Savings Plus Account | 1.50%* |

| Implicity interest rates | High Interest Savings Account | 1.20% |

| Laurentian Bank interest rates | LBC Digital HISA | 1.40% |

| Maxa interest rates | High Interest Savings Account | 1.20% |

| Motive interest rates | Savvy Savings Account | 1.55% |

| Oaken interest rates | Savings Account | 1.25% |

*Interest calculated daily on the total closing balance and paid monthly. Rates per annum and subject to change without notice.

As you can see, the Big Five banks’ HISA rates are lower than those offered by some of Canada’s online-only banks.

While the online-only banks’ rates are higher, they’re still lower than they used to be.

While we don’t have all the info on past interest rates at these banks, here’s a comparison of the online banks’ rates from February 2020 (just before the pandemic).

| Online bank | Interest rate in February 2020 | Interest rate in February 2021 |

|---|---|---|

| EQ Bank’s Savings Plus Account | 2.45% | 1.50%* |

| Implicity High Interest Savings Account | 2.3% | 1.2% |

| LBC Digital HISA | 3.3% | 1.4% |

| Maxa High Interest Savings Account | 2.45% | 1.2% |

| Motive Savvy Savings Account | 2.8% | 1.55% |

| Oaken Savings Account | 2.3% | 1.25% |

As you can see, these rates have dropped significantly in the past year, which is a shame, but to be expected.

RRSP and TFSA interest rates drop as well

Like high interest savings accounts, RRSP and TFSA savings accounts interest rates have taken a similar hit as the prime rate has dropped.

These RRSP and TFSA interest rates tend to be slightly higher than HISA interest rates, but, as registered accounts, they’re subject to other restrictions that can make it trickier to get at your money if you need it.

Looking to refinance your mortgage? Learn about the best mortgage rates in Canada.

How to take advantage of low interest rates

Since low interest rates can make it less expensive to borrow money, there are a few ways you can take advantage of these rates.

Refinance your mortgage

If you have a mortgage, it might be a good time to look at refinancing and locking in these historically low rates while you can.

Here’s what the Big Five banks and 5 online banks are offering for mortgage rates in February 2021. Note that these are posted rates, and lower special rates may be available.

| Bank | 5 year fixed mortgage rate | 10 year fixed mortgage rate | 5 year variable mortgage rate |

|---|---|---|---|

| BMO interest rates | 4.79% | 5.80% | 2.45% |

| CIBC interest rates | 4.79% | 6.09% | 2.45% |

| RBC interest rates | 4.79% | 5.80% | 2.48% |

| Scotiabank interest rates | 4.79% | 5.69% | 2.65% |

| TD Bank interest rates | 4.59% | 5.60% | 1.75% |

| motusbank interest rates | 4.59% | N/A | 1.70% |

| Tangerine interest rates | 1.74% | 2.14% | 1.45% |

| Manulife interest rates | 2.39% | 4.64% | N/A |

| Simplii interest rates | 4.74% | 6.25% | 2.45% |

Please note: A mortgage rates change often. Please refer to each bank’s website for the most up to date rates.

Mortgage interest rate calculator

Wondering how much your monthly payments will be at each of these rates?

We have built our own handy mortgage interest rate calculator for you to use.

Mortgage Information

To figure out your payment, you’ll need to punch in numbers for:

- amortization (total length of time to pay back the mortgage),

- annual interest rate,

- term length, and

- principal (amount borrowed).

Hit the “calculate” button and you’ll see how much you’ll pay, and how much principal you’ll have left over at the end of the term.

Get a home equity loan or line of credit

As we mentioned earlier, a low prime rate means that you may be able to get a home equity loan or line of credit with a low interest rate as well.

Of course, you’ll need to have at least 20% equity in your home, and there will be other hoops you’ll have to jump through. You can read more about home equity loans here.

It can be difficult to find home equity loan and line of credit interest rates online. In many cases the banks don’t advertise line of credit interest rates, so you’ll often have to speak with a bank representative to get specific information.

Consolidate your debt

If you’re able to get a low interest loan or line of credit, you can use that to consolidate any higher interest debt you may have lingering around. Debt consolidation can make your debt more manageable, and can reduce the stress and worry it causes.

By lowering the interest you’re paying on your debt, of course, you can save a great deal of money, and you can use those savings to pay down your debt more quickly.

Get a low interest credit card

While credit card interest rates aren’t tied to the BoC prime rate the way other types of credit are, there are some credit cards with lower interest rates that can help you save money if you tend to carry a balance.

Of course, you should do everything you can to pay off your credit card bill on time and in full every month – this helps you save money and will protect your credit score – but if you can’t…then a low interest credit card might be a good choice for you.

Best low interest credit cards in Canada

Here are the 2 best low interest Mastercards in Canada.

| Credit Card | Interest Rates | Current Promotion | Learn More |

|---|---|---|---|

| MBNA True Line Gold Mastercard | 10.99% on purchases, and balance transfers | None | Learn More |

| BMO Preferred Rate Mastercard | 13.99% on purchases | 0.99% on balance transfers for 9 months (terms) | Learn More |

Let’s take a quick look at these 2 low interest credit cards. If you prefer a Visa, you might want to take a look at the

Best low interest credit card in Canada

First up, we have the

With this credit card you'll only pay 10.99% interest on purchases, and balance transfers (cash advances are still high at 24.99%).

You'll also enjoy extended warranty, purchase protection, and car rental insurance. And this is all for a low $39 annual fee.

Best introductory low interest balance transfer offer credit card

If you have some high interest credit card debt lingering around, you might want to take advantage of the introductory low interest balance transfer offered by the

While you won't earn any rewards with this credit card, you can save some expensive interest payments with the introductory 0.99% interest on balance transfers.

This card also offers extended warranty and purchase protection coverage. And all for a low $29 annual fee, waived for the first year, saving you even more.

Struggling with debt? Take advantage of low interest rates and consolidate your debt.

Bottom line

So there’s a quick overview of how low interest rates can be beneficial, if you’re able to take advantage of them.

Have you done anything to take advantage of these low interest rates?

Is there anything you are thinking about doing to take advantage?

Tell us all about it in the comments!

FAQ

What is the current prime rate in Canada?

As of February 2021, the current prime rate in Canada is 2.45%.

Are interest rates going down in Canada?

In early 2020, the prime rate in Canada dropped to 2.45%, and has held steady for nearly a year. In response, other interest rates have also dropped, including mortgage rates, and, unfortunately, high interest savings account rates.

Who has the best mortgage interest rates in Canada?

Many banks in Canada offer special mortgage rates, and these tend to bounce around fairly frequently. From what we’ve seen, some of the online banks have the most competitive rates, but you’ll want to take a look at what all of the banks have to offer before making a final decision.

Are low interest rates bad?

Low interest rates aren’t bad – they make it possible for Canadians to borrow money at lower costs, which can help bolster the economy when the overall financial situation is a bit rocky. Of course, on the flip side, low interest rates mean that savings accounts will also generally have lower rates, which means you’ll earn less money on your hard earned savings.

What do you do when interest rates are low?

If you’re able to take advantage of lower interest rates to renegotiate your mortgage, or to consolidate some higher interest debt, that can be a quick way to save some money. Of course, it’s always best to pay no interest on anything at all, so if you don’t need to borrow money, it might be best to avoid it entirely.

creditcardGenius is the only tool that compares 126+ features of 229 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 229 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.