Applying for a credit card has never been easier since the advent of instant approval credit cards. When you apply for these cards, you'll know near-instantly if you've been approved.

Since so many cards now fall under the umbrella of instant approval, it's hard to differentiate these cards from our normal list of best credit cards. That said, we’ll highlight the best instant approval cards by category so it’s easier for you to find the right card for your situation.

Key Takeaways

- Credit cards with instant approval will let you know in minutes whether or not you’re approved or not.

- Most issuers have credit cards with instant approval.

- You will generally still need to undergo a hard credit check to get an instant approval credit card.

- Though many cards offer instant approval, it's not guaranteed and something in your application could trigger a longer wait time.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is an instant approval credit card?

As you can probably guess, an instant approval card is a credit card that promises to give you an approval decision within minutes of submitting your application.

To quickly give you a decision, credit card issuers require you to:

- Provide proof that you’re a Canadian citizen or permanent resident

- Be at least the age of majority in your province

- Not be in a state of bankruptcy

If you meet these requirements, you can easily submit an application online. You’ll have to provide ID, proof of employment and income, current credit card details, your current living arrangement (whether you rent or own), and the amount of recurring payments.

Once your bank has the answers to these simple questions, their algorithms will quickly decide whether or not you qualify for the card.

Remember: If there is an issue with your application, you may have to wait for manual approval.

Instant approval vs. guaranteed approval credit card

These names might be used interchangeably, but instant and guaranteed approval credit cards are very different:

| Instant approval credit card | Guaranteed approval credit card | |

|---|---|---|

| Type of security deposit | Unsecured | Secured |

| Requires hard credit pull | Yes | No |

| Security deposit required | No | Yes |

| Good credit score required | Yes | No |

| Available to people with no credit | Not usually | Yes |

As you can see, instant approval credit cards consider your credit score and have more requirements. These cards might come with rewards and benefits.

On the other hand, guaranteed approval credit cards are available to anyone who can put down a security deposit (and, in some cases, meet a minimum credit score). These are useful options for people building credit.

Learn more: Guaranteed approval credit cards in Canada

Best instant approval credit cards

Here are some of the best credit cads that offer instant (or near-instant) approval for online applications.

Best for cash back: MBNA Rewards World Elite Mastercard

If you’re looking to put money back in your pocket, the MBNA Rewards World Elite Mastercard might be the card for you. You’ll earn up to 5 points per $1 spent on restaurants, groceries, and select recurring bills, and up to 1 point per $1 spent on all other purchases.

Why we like it:

- Up to 30,000 bonus points

- 10% bonus points every year on your birthday

- 12 types of insurance

Things to consider:

- Income requirements of $80,000 personal or $150,000 household

- $120 annual fee

Best for rewards: American Express Cobalt Card

The American Express Cobalt Card is another solid rewards card. It offers up to 5 points per $1 spent on categories like restaurants, groceries, streaming services, and travel. But where this card really shines is in its redemption opportunities. You can use your points towards flights, hotels, other travel, charities, and the usual cash back.

Why we like it:

- Up to 15,000 welcome bonus points

- 10 types of insurance included

- High-value flight redemption options

Things to consider:

- Lower acceptance as an Amex

- $155.88 annual fee

Best for lower credit: Tangerine Money-Back Credit Card

Your chances of being approved are better if you have a good credit score (we’re talking over 660), but if you’ve got fair credit, take a look at the Tangerine Money-Back Credit Card. In addition to having a lower credit requirement, there’s also no annual fee – plus, you can take advantage of a balance transfer offer if you need help paying off an existing balance on another card.

Why we like it:

- Earn an extra 10% cash back for the first 2 months, up to $1,000 spent

- 2% cash back on up to 3 categories of your choice

- 1.95 interest on balance transfers for 6 months

- Better approval odds than other cards

Things to consider:

- Only earns 0.5% cash back on non-category purchases

- Limited insurance included

Best secured: Neo Secured Credit

The Neo Secured Credit card is another to consider if you’re building your credit. Since it’s a secured card, you pay a deposit of at least $50 – but you’re guaranteed to be approved. Unfortunately, you won’t earn many rewards outside of Neo partners and there is an annual fee of $95.88, though it’s waived for the first year.

Why we like it:

- Earn an average of 5% cash back with Neo retail partners

- Earn 1% back on gas and groceries

- Ability to upgrade to Neo Premium to get more rewards

Things to consider:

- No insurance or bank rewards included

- Limited rewards outside of Neo partners

Best for students: BMO CashBack Mastercard for students

As a student, you want a card that works for you and doesn’t cost a lot in fees. Enter the BMO CashBack Mastercard for students. There’s no annual fee, you earn generous rewards, and you’ll even enjoy a discount on gas at Shell stations.

Why we like it:

- 5% cash back for the first 3 months, up to $2,500 in spend

- Up to 3% cash back on purchases

- Low minimum credit score required

Things to consider:

- Only 0.5% cash back outside of bonus categories

- Limited insurance included

Best prepaid: Wealthsimple Prepaid Mastercard

Our final instant approval card is the best prepaid option: the Wealthsimple Prepaid Mastercard. There’s no annual fee and you’ll earn high savings rates on the money you’ve deposited. This card isn’t a great choice if you’re trying to build credit, though, as it’s not technically a credit product.

Why we like it:

- No foreign exchange fees

- Earns 1% back on all purchases

- Option to get cash or cryptocurrency rewards

- Earns 4% interest on your account balance

Things to consider:

- No insurance included

- Doesn’t help build credit

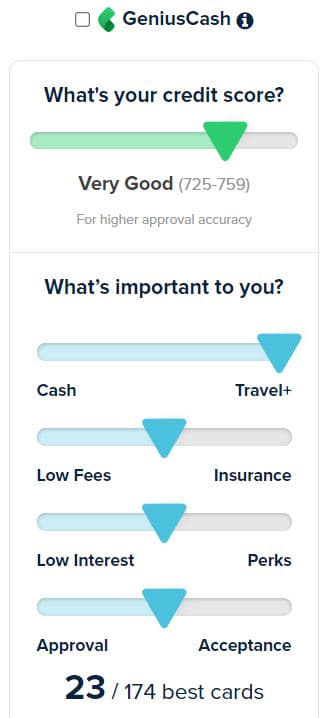

How to find the credit score requirements for all cards

Since card score requirements can vary tremendously by issuer and even card type, it can take time to look up eligibility requirements.

Luckily for you, we’ve created a tool for comparing credit cards. Just set the credit score slider at the top to match your current score and you’ll immediately see cards that you might be eligible for with your credit score.

Play around with the tool’s filters to customize card offers based on your preferences.

Using the filters above, you’ll only see cards that you’ll likely be accepted for.

Checking your credit score

If you don’t know what your credit score is at the moment, don’t worry – there are a few ways you can get that important information:

- Equifax: Once per month, you can sign into your free Equifax account to check your credit file and see your score at no cost.

- TransUnion: The other major credit bureau, TransUnion, also offers free access to your credit file on their website (and by mail). You can subscribe to their credit monitoring service for $24.95 per month.

- Major banks: If you have a banking package with a major Canadian bank, it doesn’t hurt to ask if you have free access to your credit files and scores.

- Credit score sites: Credit sites like Credit Karma and Borrowell also offer access to one of your credit files and scores, though they are third parties so be sure to use common sense when sharing your identification information.

How to increase your instant approval odds

No one likes spending time filling out an application only to have it denied. Before you hit that submit button, try to get your finances in order so you’re more likely to get that new credit card.

Since you generally need a credit score of at least 660 to be approved, the best thing you can do is improve your credit score. Here are a few strategies you can try:

- Pay off debt: Credit card companies will check your debt-to-income (DTI) ratio and deny you if you’ve used most of the credit available to you. Pay off as much debt as you can to lower that DTI.

- Increase your income: While this might be easier said than done, earning more money also moves that DTI ratio in your favor. Look for ways you could up your income to improve your credit card approval chances.

- Make on-time payments: Creditors don’t like seeing missed payments when they pull your history. Even if you can’t make full payments on existing credit cards, always pay the minimum on your monthly statement.

- Check your credit report for errors: Mistakes happen and even credit reporting agencies might list inaccurate information on your account. Take some time to check your report for errors and dispute anything incorrect that you find – you never know which ones might negatively affect your credit.

FAQ

Do all credit cards approve or deny you instantly?

No, it’s not uncommon for a card issuer to take a few days or longer to make a decision. Only cards designated for instant approval will give you an immediate answer.

How long does it take to get a credit card after instant approval?

It depends on the card and issuer. Some card companies give you immediate access to your new credit card number so you can begin using it. The physical credit card typically takes a week or so to arrive in the mail.

What banks offer instant approval credit cards?

You can apply for instant approval credit cards from BMO, TD, Scotiabank, National Bank, and RBC, among others. In fact, many cards that allow online applications provide quick – though not always instant – decisions.

Do you get instant access to your credit card number?

Some credit card issuers will give you the new credit card number right after your instant approval, but it depends on the company. In most cases, you’ll need to wait until you receive the physical card in the mail.

creditcardGenius is the only tool that compares 126+ features of 229 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 229 cards is for you.

×4 Award winner

×4 Award winner  $150 GC Boost + Up to 30,000 bonus points + birthday bonus worth up to 15k points.*

$150 GC Boost + Up to 30,000 bonus points + birthday bonus worth up to 15k points.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 27 comments