Every child (and dentist’s) favourite holiday is coming soon – Halloween. And for many, on top of getting costumes ready, you also need to purchase Halloween treats to give out (unless you want to be that person who does tricks instead).

If you get plenty of kids at your house, the cost of your treats can add up quickly.

What are some ways to save some money on it? Here are our 7 tips to save on your Halloween candy.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

7 tips to save on Halloween candy

There’s a potential to spend a lot on your Halloween candy. Here are 7 tips we’ve come up with to cut down on your costs.

1. Determine how much halloween candy you actually need

The first step – how much candy do you actually need. After all, you may just end up consuming any excess yourself.

To do this, you’ll need to know approximately how many kids you’ll see. If you’ve been living in your current residence for some time, you may have an idea. But it’s always good to keep track of how many kids you’ll see so you can adjust for next year.

Recently moved? Ask a neighbour and see if they can give you an idea of how many kids to expect.

Once you have your idea, then you can go out and get what you need and not find yourself overspending (and eating yourself into oblivion – you probably already did that a few weeks ago during Thanksgiving!).

2. Watch the flyers

A few weeks before Halloween, you’ll start seeing a lot more orange, jack-o-lanterns, and other spooky things in your flyers that don’t have anything to do with inflation. That means Halloween season is officially on – this is the time to be on the lookout for sweet deals on Halloween candy.

Pay close attention to grocery store flyers at the end of September. Just be aware, they won’t last long, and they definitely won’t be giving out deals right before Halloween.

3. Check the Scene+ and PC Optimum apps

On occasion, Loblaws and Sobeys stores will run point offers on Halloween candy through their Scene+ and PC Optimum programs.

While it’s not immediate savings, it’s easy to earn points you can use towards future grocery store savings.

4. Costco Halloween candy

Buying things in bulk is kind of Costco’s thing. And because you’re buying more, they usually have cheaper prices.

Here’s an example for some Nestle mini chocolate bars.

First, here’s what Costco had on my last trip to the warehouse (which were also on sale).

That works out to 16 cents per bar at regular price (13.6 cents with this sale).

At my Superstore, here was their regular price, which works out to 17 cents per bar since the Costco ones had more candies per box.

It’s not a huge savings – at their regular prices, this works out to $1 in savings over 100 bars. But it is something.

If you’re not a member, it’s definitely not worth it just to get some Halloween candy. But if you are, it should be your go-to place for your treats.

5. Buy candy in bulk

Places like the Bulk Barn offer excellent prices to get candy in bulk. It’s especially good for things that are pre-wrapped like Rockets and lollipops.

Fill a container with all the treats you need, and you’ll pay a lower price for them.

Keep an eye out for your mail coupons too, as you may luck out in getting coupons that will give you a percent discount if you spend a minimum amount (like $20).

6. Load up after Halloween is over

Whether this tip will work or not all depends on you, and whether or not you won’t dip into your stash.

After Halloween is over, stores will try and sell their unused treat inventory, and will usually offer significant discounts to get rid of it. You can use this time to stack up for next year, provided nothing will expire before then (for things like chips and chocolate bars, you should be fine).

However, it’s also a good way to get cheaper candy for future parties, or maybe just some little treats for yourself once in a while.

7. Don’t wait until the last minute

Finally, never wait until the last minute. Stores will know that anyone looking for candy at the last minute will be desperate. There will be no sales, and a worst case scenario is they run out of the regular Halloween stuff, forcing you to buy more expensive treats or the less popular ones that will make your house the least popular and most gossipped about by candy connoisseurs.

Take care of it early (say late September), and you could have been like me getting a deal at Costco on your treats – those were on sale the 3rd week of September.

Looking for some ideas on grocery savings? Here are 51 tips to save money at the grocery store.

Earn rewards on your Halloween candy with a credit card

When getting your Halloween candy, you’ll likely be going to a grocery store (including Walmart Supercentres) or Costco.

Here are some of the best credit cards for earning rewards on groceries.

| Credit Card | Welcome Bonus | Earn Rates | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| American Express Cobalt Card |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) |

* 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases |

* $191.88 * None |

Apply Now |

| MBNA Rewards World Elite Mastercard |  $20 GeniusCash + 30,000 bonus points (terms) $20 GeniusCash + 30,000 bonus points (terms) |

* 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category) * 1 point per $1 spent on all other purchases |

* $120 * $80,000 personal, $150,000 household |

Apply Now |

| Scotia Momentum Visa Infinite Card |  $20 GeniusCash + 10% cash back for the first 3 months, first year free (terms) $20 GeniusCash + 10% cash back for the first 3 months, first year free (terms) |

* 4% cash back on groceries and recurring bill payments * 2% cash back on gas, transit, rideshares, and food delivery * 1% cash back on all other purchases |

* $120 * $60,000 personal, $100,000 household |

Apply Now |

| National Bank World Elite Mastercard | Up to 40,000 bonus points (terms) | * 5 points per $1 spent on groceries and restaurants, up to $2,500 in total spend per month (2 points after) * 2 points per $1 spent on gas, electric vehicle charging, recurring bills, and travel booked through À La Carte Rewards * 1 point per $1 spent on all other purchases |

* $150 * $80,000 personal, $150,000 household |

Apply Now |

| Brim World Elite Mastercard | None | * 1% cash back on all purchases |

* $89 * $80,000 personal, $150,000 household |

Apply Now |

| Tangerine Money-Back Credit Card |  $80 GeniusCash + 10% extra cash back for the first 2 months (terms) $80 GeniusCash + 10% extra cash back for the first 2 months (terms) |

* 2% cash back on purchases in up to 3 Money-Back Categories * 0.5% cash back on all other purchases |

* $0 * None |

Apply Now |

1. The best credit card for groceries

GC: $100

When it comes to rewards on groceries (and restaurants), the American Express Cobalt Card blows the competition out of the water.

First, here’s what you’ll get for rewards on all your purchases:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

Now, there are several cards that earn users 5x the points on food. What separates this card from the rest of the pack is what your points are worth. Each Membership Rewards points is worth up to 2 cents, giving an astronomical return of up to 2%.

It’s a rate that can’t be matched by other credit cards.

2. The best flexible rewards card for groceries

GC: $20

There are plenty of Visa and Mastercards with high rewards on groceries (just not as high). One of those is the MBNA Rewards World Elite Mastercard.

Here’s what you’ll earn for rewards:

- 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category)

- 1 point per $1 spent on all other purchases

That’s a lot of points to earn, and will get you a return of up to 5% on your food.

But there’s more. Each year on your birthday, you’ll get 10% bonus points on what you’ve earned, up to a maximum of 15,000 bonus points.

And since it’s a Mastercard, you’ll earn this high rate at Walmart Supercentres. Only Mastercard considers Walmart Supercentre to be grocery stores.

3. The best cash back credit card for groceries

GC: $20

Prefer to earn cash back? The Scotia Momentum Visa Infinite Card earns you plenty of cash back on groceries.

Here’s what you’ll get:

- 4% cash back on groceries and recurring bill payments

- 2% cash back on gas, transit, rideshares, and food delivery

- 1% cash back on all other purchases

That’s a lot of cash back on your purchases. And even though it’s a cash back card, you’ll still get a couple of excellent travel features. They are:

- 11 types of insurance, and

- Visa Infinite benefits.

4. A card to earn rewards and save on travel fees

The National Bank World Elite Mastercard is a unique credit card that not only offers plenty of rewards on purchases, but also a way to save money when you’re actually travelling.

First, here’s what you’ll get:

- 5 points per $1 spent on groceries and restaurants, up to $2,500 in total spend per month (2 points after)

- 2 points per $1 spent on gas, electric vehicle charging, recurring bills, and travel booked through À La Carte Rewards

- 1 point per $1 spent on all other purchases

That’s a return of up to 1% on your purchases.

But there’s more. You can get rebated up to $150 per year on these travel fees:

- Checked bags,

- Airport parking,

- Seat selection,

- Airline seat upgrades, and

- Airport lounge access.

Use the full amount and you’ve offset the $150 annual fee.

5. The best credit card for Costco

If you’re a Costco shopper, you need these 2 things in a credit card:

- whatever card you have needs to be a Mastercard, and

- it should have a high base earn rate, as Costco doesn’t fall into any credit card bonus categories.

The Brim Mastercard lineup covers both these points. For here, we’ll look at the Brim World Elite Mastercard.

Here’s what it earns for cash back on purchases:

- 1% cash back on all purchases

Plenty of cash back on your purchases.

It also includes:

- 12 types of insurance,

- no foreign exchange fees, and

- installment plans.

Just note – the card has a high annual fee of $89. If that’s too much for you to handle, Brim has these other cards you can look at.

6. The best no annual fee credit card for groceries

GC: $80

Many people just prefer a card with no annual fee. And if that describes you, one of our suggestions is the Tangerine Money-Back Credit Card.

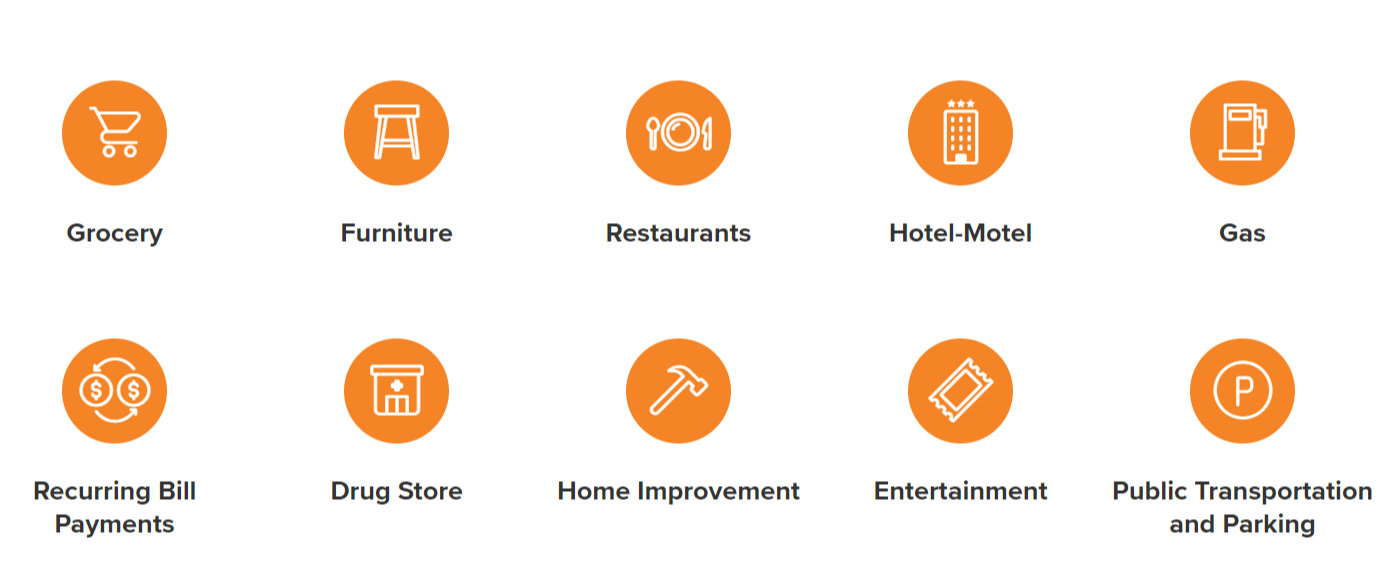

Why this one? You get to decide which categories earn you 2% cash back. You get to pick from these 10:

You get to choose 2 if you get rewards applied as a statement credit. Or, get them deposited into a Tangerine Savings account, and you get to pick 3. You’ll earn 0.5% back on all other purchases.

What are your Halloween candy savings tips?

Getting Halloween treats for over 200 kids can be daunting and expensive, and hopefully we’ve given you some tips to save on it.

What are your Halloween savings tips?

Share them with everyone in the comments below.

FAQ

What are some ways to save on Halloween candy?

Here are a few tips to save on Halloween treats:

- don’t wait until the last minute,

- shop the sales, and

- buy in bulk.

Is Costco a good option for Halloween candy?

If you have plenty of kids coming to your house, Costco is an excellent place to get your candy. You can generally save more on bulk purchases at Costco.

Is it a good idea to wait until after the season is over?

It can be a good idea to wait until the season is over. If stores have anything left, they’ll discount the price to clear their stock. Just make sure it won’t expire before next year.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.