Dollar stores in Canada – for many, they’re terrific alternatives to big box stores, with lower prices on a variety of items.

One of the largest dollar store retailers in Canada is Dollarama.

But how much can you save at Dollarama compared to others? What do they excel at? What should be avoided?

The answers to these questions and more are here.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Intro to Dollarama

Canada’s largest dollar store, Dollarama, offers a large selection of products for around the house.

Here’s some things to know about what this store has to offer.

Shopping online at Dollarama

Like to shop online? Dollarama has this option.

But, there’s a few things to know about it. First – it’s not available everywhere in Canada. Generally speaking, it’s not available in remote areas.

There’s also no free shipping option. Depending on where you live, you can simply be charged a flat rate of $9.99 for shipping. This only applies to major urban areas, and you can either ship it to your home, or to a UPS location of your choice. For others, shipping is calculated at checkout.

To find out if you qualify for flat rate shipping, at the bottom-right of the home page, click on “Shipping Fees” and enter your postal code. You’ll be told if you qualify. If not, you can see what the charge would be when you go to checkout.

With all that said – here’s the real kicker. You can’t just buy singles of several products at Dollarama online – you have to buy whole cases.

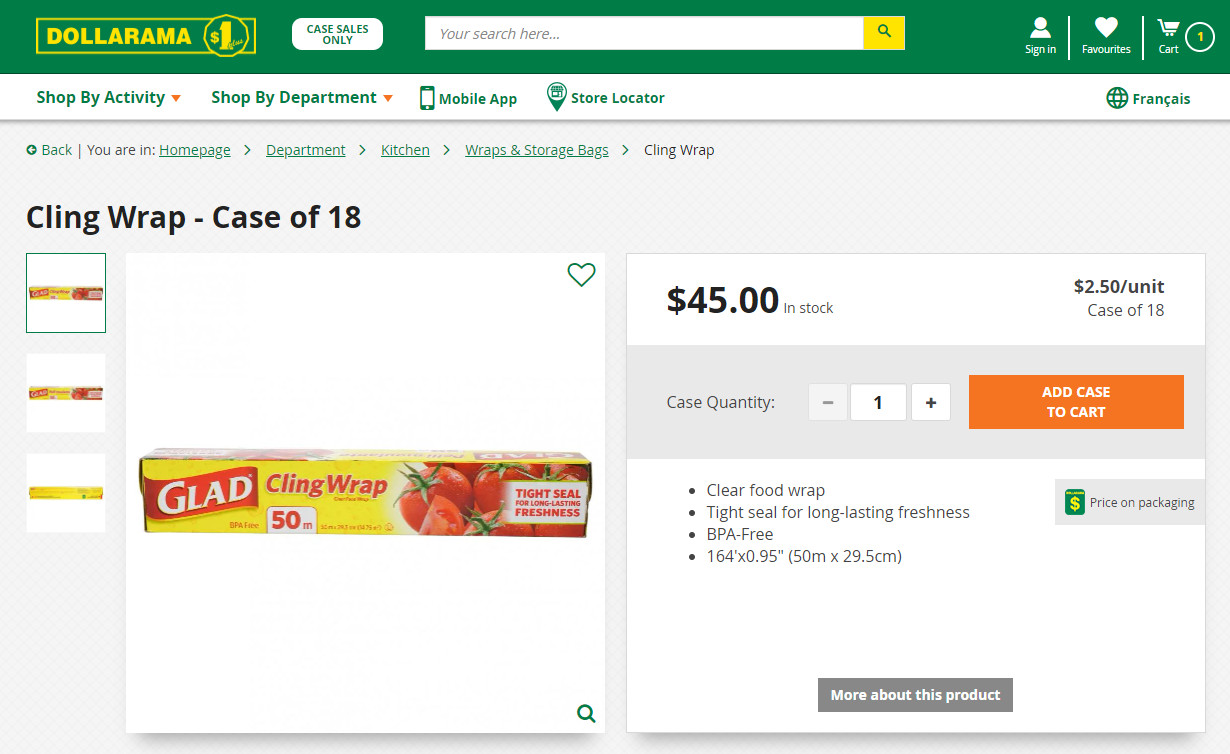

As an example of what we mean, here’s a simple product – a 50 metre roll of Glad Cling Wrap. Normally, you can buy a single roll for $2.50.

But to buy this online, you have to buy a whole case, which contains 18 rolls – a lot of plastic wrap to store at home.

Unless you need large quantities of basic products, online shopping at Dollarama may not be overly useful.

And to shop online, you’ll need a credit card too. You can view our top credit cards for Dollarama below.

Dollarama locations

There are over 1,000 Dollarama locations in Canada, so finding one near you shouldn’t be too difficult. There’s locations in Toronto, Montreal, Edmonton, Windsor, to name a few places.

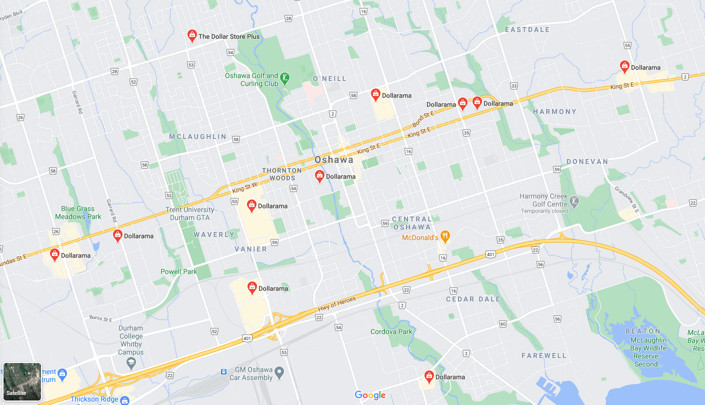

There are 2 ways you can do this. The easiest way is to go to Google Maps and enter Dollarama in the search box, and you can see the ones nearest you.

Here are the results for someone who may live in Oshawa.

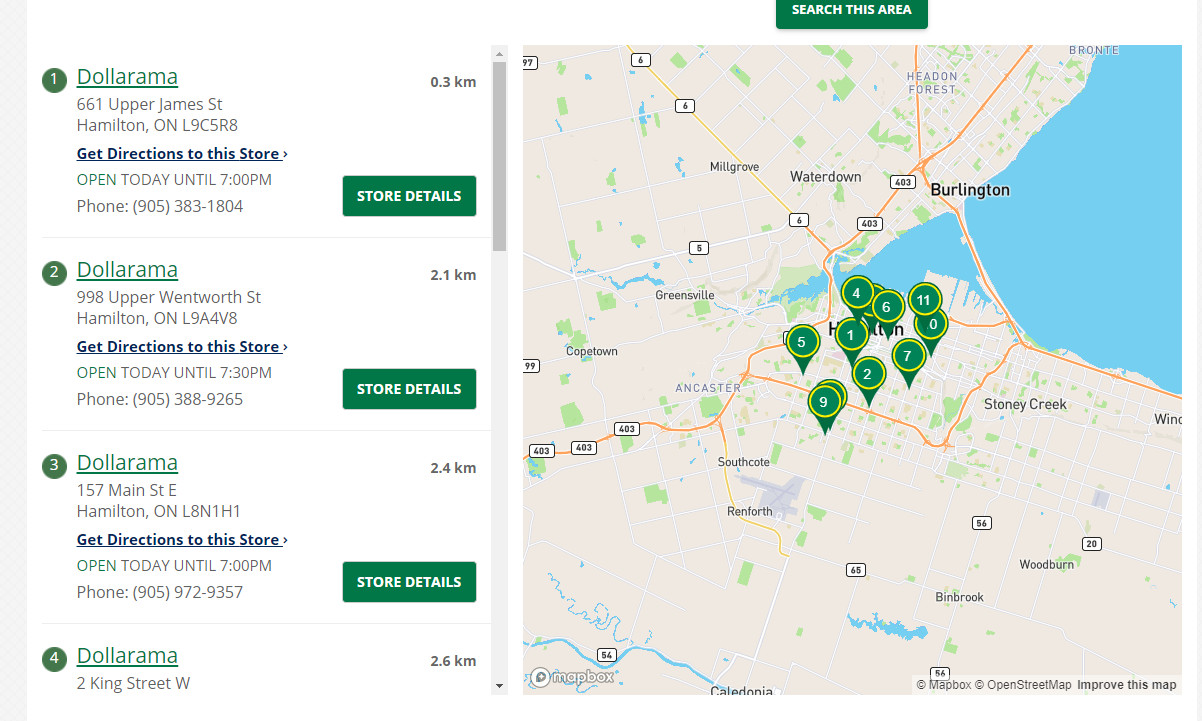

The other way is to go to the Dollarama home page. At the top, click on “Store Locator“. You can either click on “Use Current Location”, or enter in your postal code.

Here’s an example of the results for someone who lives in Hamilton.

Since Dollarama stores are typically easy to find, you won’t have to worry about paying extra to head to one of their stores.

Dollarama hours

So how can you find out the hours of your nearest store?

Simply use one of the 2 methods above. The search results will show the stores opening hours for the current day.

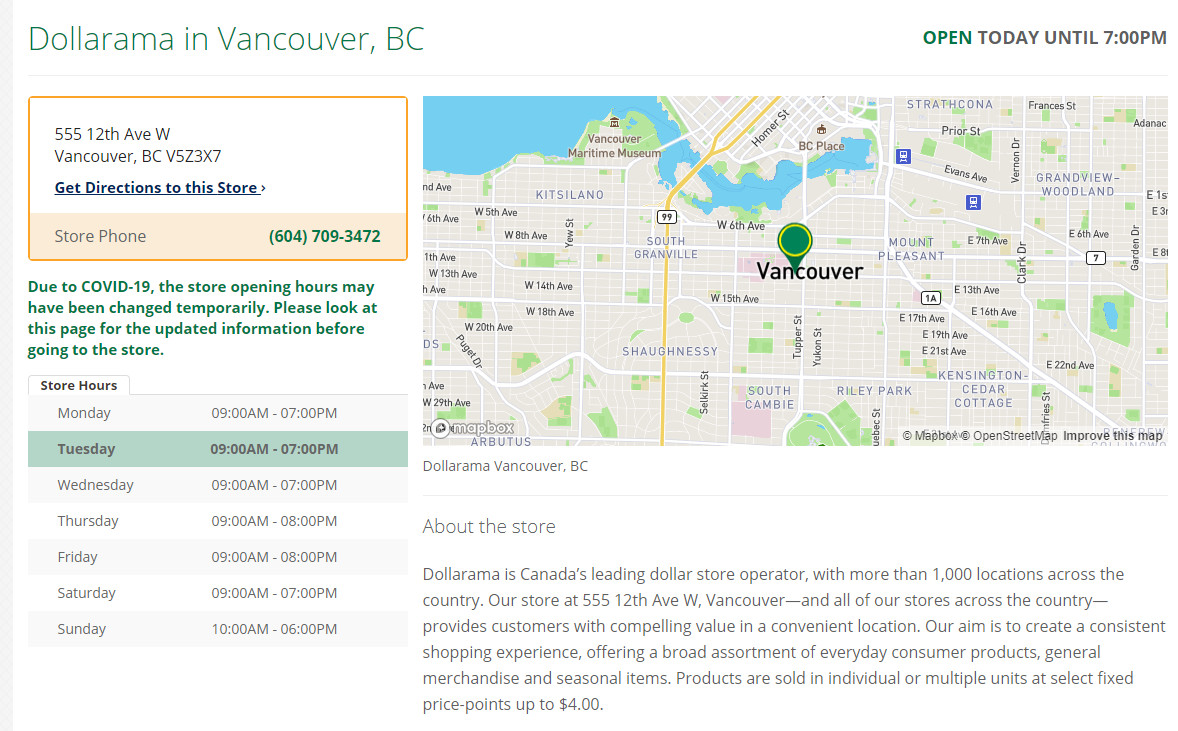

On the Dollarama page, click on “Store Details”, and you’ll see the opening hours for a store. Here’s the hours for a Dollarama located in Vancouver.

Google Maps also has this as well. After searching for Dollarama, click on a store either on the map or in the results list, and you’ll be able to view the hours for your store. Here’s what they are for this store in Winnipeg:

10 things to buy at Dollarama

Dollarama stores are great for basic essentials. Think of things like party supplies (balloons, paper plates, wrapping paper), food storage containers and bags, paper towels, and school supplies (pens, pencils, markers, notebooks).

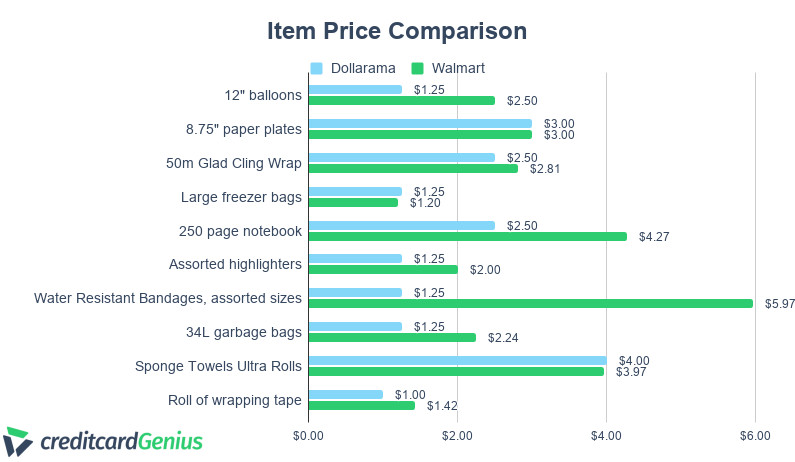

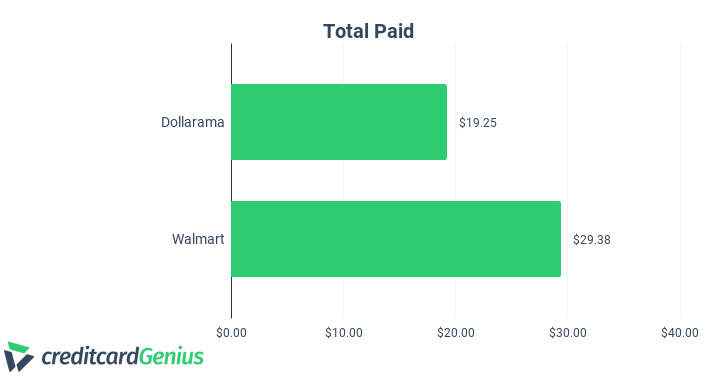

Here are 10 things that fall under these categories that can be bought at Dollarama, and how they compare to Walmart – a big box retailer.

It’s not always possible to get the exact same quantities when comparing packages, so we scaled the Walmart price when necessary.

We also went with the store brands where possible (is there really much of a difference between freezer bags?), but we did compare a few brand names as well.

| Item | Quantity | Dollarama Price | Walmart Price |

|---|---|---|---|

| 12″ balloons | 10 | $1.25 | $2.50 |

| 8.75″ paper plates | 20 | $3.00 | $3.00 |

| 50m Glad Cling Wrap | 1 | $2.50 | $2.81 |

| Large freezer bags | 8 | $1.25 | $1.20 |

| 250 page notebook | 1 | $2.50 | $4.27 |

| Assorted highlighters | 5 | $1.25 | $2.00 |

| Water Resistant Bandages, assorted sizes | 60 | $1.25 | $5.97 |

| 34L garbage bags | 20 | $1.25 | $2.24 |

| Sponge Towels Ultra Rolls | 2 | $4.00 | $3.97 |

| Roll of wrapping tape | 1 | $1.00 | $1.42 |

| Total Spent | $19.25 | $29.38 |

We didn’t spend much on these small items, but there was still a $10 difference between these 2 stores, meaning you’ve spent 50% more at Walmart.

For basics, the Dollarama is a good alternative to the big box stores.

And one thing to keep in mind – Dollarama accepts credit cards, so you won’t be missing out on any credit card rewards.

Want to see more ways to save money? Here are 99 tips you can use.

4 things to avoid buying at Dollarama

While their prices are low, there are things to avoid buying, mostly for reasons of quality. These are things that you will be keeping or using for a long time, and it makes sense to invest a little more.

Here are a few things I tend to avoid buying at Dollarama.

1. Toys

Yes, my kids love getting a new toy at Dollarama (they get one on occasion). And while they are cheap, they definitely fall under the category of “you get what you pay for”.

These toys don’t last long, break frequently, and end up in the garbage can to then sit in a landfill.

As a personal example, one of my sons got a toy concrete mixer. Within minutes of playing with it, the mixing drum fell off. After popping it back in, it continued to come off, and he would get frustrated and angry with it. And you may have guessed correctly – he no longer uses it.

There’s nothing wrong with getting the odd toy every now and then, but try to avoid getting all your toys from a dollar store.

2. Batteries

They’re cheap, but there’s a reason for that. The batteries available at Dollarama aren’t of the same quality, and won’t last as long as the better batteries you find elsewhere.

And since you’re going to be buying more batteries, that’s more of them that need to be disposed of properly.

3. Tools

A lot of basic tools can be found at Dollarama, including things like screwdrivers and paint brushes. For the occasional use, they’ll do. But if you use them a lot, they don’t have the best features (think of things like handles) and may not work as well as what you could find elsewhere.

4. Electronics

The last set of items I don’t purchase at Dollarama are electronics. It can be tempting to buy their cheaper cables and headphones, but these are things where you’re better paying for something with better quality.

These are also things you’ll have for a long time, so paying a few extra bucks in the end doesn’t make that big of a difference.

Want to save on your grocery bill? Here are 51 ways to help save money and eat better.

Dollarama vs. Great Canadian Dollar Store

Dollarama isn’t the only dollar store in Canada.

Another top option is the Great Canadian Dollar store. When it comes to selection and prices, these stores are quite similar.

The biggest difference between them are the locations. Dollarama has more than 1,000 locations all over Canada.

On the other hand, the Great Canadian Dollar Store only operates just over 100 stores, with none in Quebec.

If you do have one in your area though, it’s an alternative dollar store to visit.

Credit cards to use at Dollarama

Making the most out of credit card rewards on basic purchases also helps with finances.

And luckily, Dollarama accepts all credit cards, including American Express cards.

Here are a variety of credit cards that provide lots of rewards at Dollarama, with some premium, some no annual fee, and even a prepaid card listed.

| Credit Card | Welcome Bonus | Earn Rate At Dollarama | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| American Express Cobalt |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) |

1 point per $1 spent | * $191.88, charged out as $15.99 per month * No income requirements |

Apply Now |

| Brim Mastercard | None | 1% cash back | * $0 * $15K personal income requirement |

Apply Now |

| American Express SimplyCash Preferred | 10% cash back for the first 3 months + $50 (terms) | 2% cash back | * $99 * No income requirements |

Apply Now |

1. Best credit card in Canada

GC: $100

Our top rated credit card in Canada – the

It only earns 1 point per $1 spent on purchases at Dollarama, seemingly not much for a premium card. But, with an Amex Membership Rewards point worth up to 2 cents each, it looks much more impressive – 2% on your Dollarama purchases.

And you’ll even more point on these categories:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

On your other purchases, you’re looking at a return of up to 10%.

This card provides incredible value on your purchases, for a typical annual fee of $191.88, charged out as $15.99 per month.

Want to learn more about where Amex cards are accepted? Here’s where you can find out more.

2. Best no annual fee cash back credit card

The Brim family of Mastercards are good choices for using credit cards at Dollarama with their high base earn rate.

So we’ll take a closer look at their no fee card – the

You’ll earn a simple 1% cash back on every purchase made with the card. Shop with Brim’s retail partners, and you can earn bonus rewards on your purchase – up to 40% with the right retailer.

Plus, you’ll get no foreign exchange fees, 5 types of insurance, and get top notch security features.

Of course, Brim’s other 2 credit cards also make good cards for Dollarama. For annual fees of $99 or $199, you can earn up to 2% back on your purchases.

3. A premium cash back credit card

The American Express SimplyCash lineup works well with Dollarama. We’ll highlight the

You’ll earn unlimited 2% cash back on all of your purchases, which is increased to 4% on gas and groceries.

It also includes 9 types of insurance coverage for an annual fee of $119.88, which is fair compared to other premium credit cards.

Not willing to pay an annual fee? There’s also the regular version of the card, the

Comparing the top credit cards for Dollarama

How do these credit cards compare? Here’s our comparison in a few key areas.

Earn rates

Earning rewards – the top thing on (most) people’s minds when getting a new credit card.

Here’s the average earn rate for all of these credit cards when shopping at Dollarama Canada stores.

The Amex SimplyCash Preferred and Cobalt have the advantage, with their flat rate of 2% on all Dollarama purchases.

Annual Fees

There are also the annual fees to consider. Here’s what each card will charge you annually when you keep the card in your wallet.

We have 2 no annual fee cards here, but of note is the Amex SimplyCash card, which has a lower annual fee of $99 compared to the other 2 premium credit cards.

Income requirements

Finally, the income requirements for each card:

In summary

Dollarama stores are one way you can save on household basics. Of course, there are a few things with a “buyer beware” label with them.

What do you think of Dollarama stores? What do you tend to purchase from them?

Let us know in the comments below.

FAQ

What credit cards are accepted at Dollarama?

Dollarama Canada locations accept all credit cards, which includes American Express.

What is the best no annual fee credit card for shopping at Dollarama?

The best no annual fee credit card for shopping at Dollarama is the Brim Mastercard, which offers 1% on all purchases, including Dollarama stores.

How can I find the nearest Dollarama store?

You can find the nearest Dollarama store 2 ways – by searching Dollarama on Google Maps, or by using the Dollarama site (either letting them find your location or entering your postal code).

What kind of items should I purchase at Dollarama?

In our opinion, Dollarama stores are best for basic essentials such as party supplies, school supplies, and basic household items like paper towels.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.