Please note that all these balance transfer offers are out of date. You can find current offers by reviewing the top balance transfer credit cards.

COVID-19 has had quite an impact on the financial world, whether that be mortgages, interest rates, or credit cards.

Unfortunately, one of the areas it’s hitting credit cards the hardest is introductory balance transfer offers.

Just recently, MBNA removed the 0% balance transfer offers on both the

While it’s obviously less than ideal, there are still some decent balance transfer offers out there that can save you upwards of 20% in credit card interest.

Just keep in mind that these offers can change anytime. If you have some credit card debt and want to tackle it, here are the best options at your disposal. Will they change or be removed? No one really knows.

But it might be best to act sooner rather than later.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Best balance transfer offers in Canada

So, here are some of the best balance transfer offers currently available in Canada, to help get rid of unwanted credit card debt.

Just remember with balance transfer offers – don’t use your credit card to make new purchases once you make your balance transfer. Payments are generally applied to the portion of the balance with the lowest interest rate. So you’ll be paying off your low interest debt first, leaving your new purchases to earn interest at the regular interest rates.

Related: Balance Transfer Credit Cards 101

| Credit Card | Balance Transfer Offer | Regular Balance Transfer Interest Rate | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| BMO CashBack Mastercard | 1.99% for 9 months (terms) | 22.99% | * $0 * $15K personal income requirement |

Apply Now |

| BMO Preferred Rate Mastercard | 3.99% for 9 months (terms) | 12.99% | * $20, first year free * $15K personal income requirement |

Apply Now |

GC: $20

One of the best balance transfer credit cards in Canada is with the

You’ll get an introductory balance transfer rate of 1.99% for the first 9 months, with a transfer fee of 1%.

Like the previous card however, make sure you get your debt paid off by the end of 9 months, as the rate will increase to 22.99%.

This balance transfer offer is also available on the

Our last top recommendation is with the

The offer with this card is 3.99% for 9 months, with a transfer fee of 1%.

And while the offer is not as good as the others mentioned, the interest rate after your 9 months are up is much lower – only 12.99%.

Meaning, you’re still much better off with this card if you have any unpaid debt left after your introductory offer is over.

Your turn

It’s never great when there’s a downgrade in credit cards. Thankfully, there are still some good balance transfer offers to take advantage of for now.

Do you have any credit card debt you need to tackle?

Are you planning on taking advantage of any of these offers?

Let us know in the comments below.

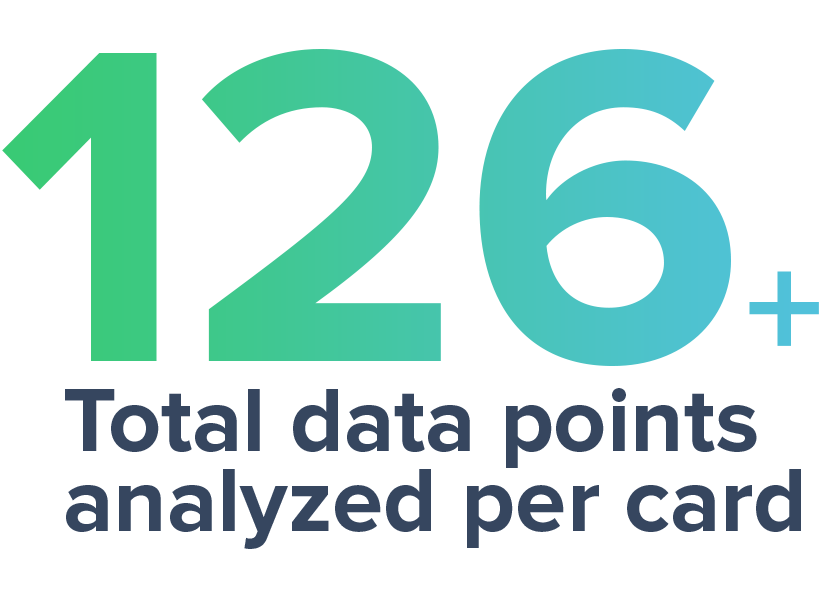

creditcardGenius is the only tool that compares 126+ features of 229 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 229 cards is for you.

$20 GeniusCash + Up to 5% cash back + No annual fee.*

$20 GeniusCash + Up to 5% cash back + No annual fee.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 5 comments