Ever since merchants were allowed to charge extra for customers who use credit cards for payment, we've all been watching to see if anyone follows through.

And to this point, it's been relatively smooth sailing (at least from this author's perspective). Telus did start charging a 1.5% fee, but then quietly stopped in June 2023.

But a new merchant has entered the fray in charging credit card fees – Flair Airlines. You'll now pay anywhere from 1.4% to 2% when you use a credit card. Personally, if I booked a flight on Flair, I would still use a credit card – this fee doesn't outweigh the travel insurance I have on my travel cards.

Let's test out how much you could pay, how the fee varies with different credit cards, and alternatives you can use to avoid this fee.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

How much you'll pay to use a credit card with Flair Airlines

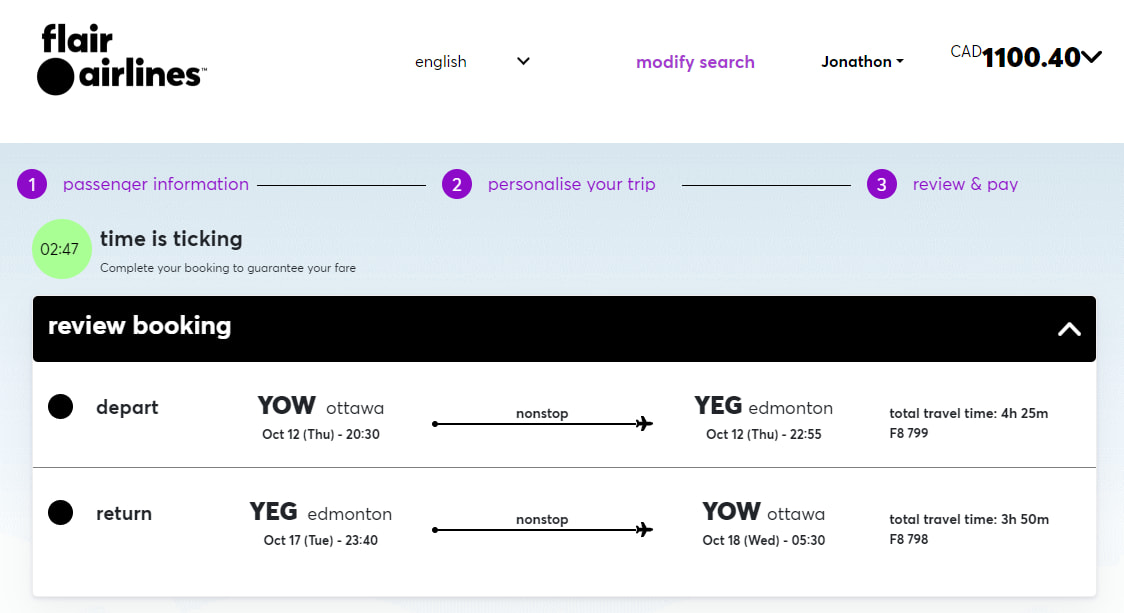

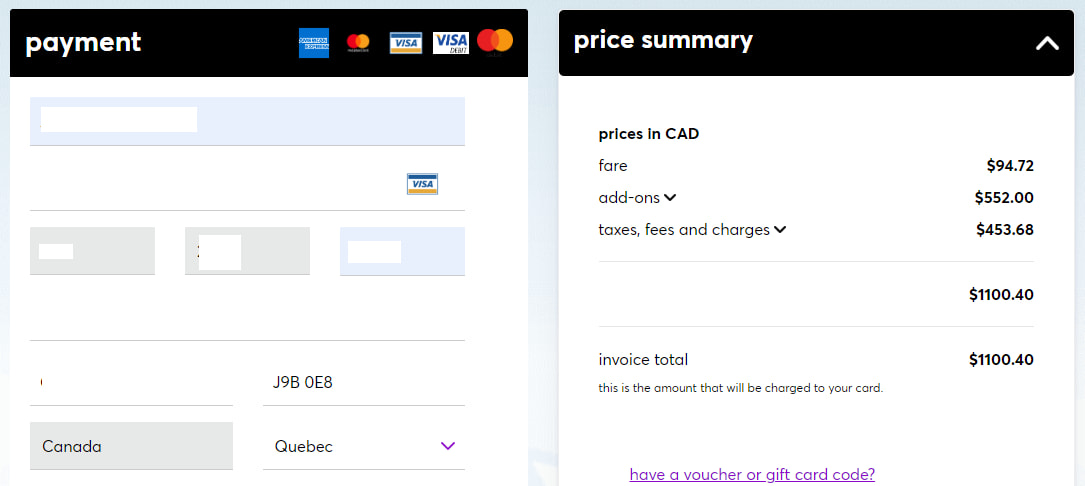

So what kind of fee are you looking at? We'll start by looking at this trip from Ottawa to Edmonton, where we're pre-paying for a carry-on and seat selection for everyone.

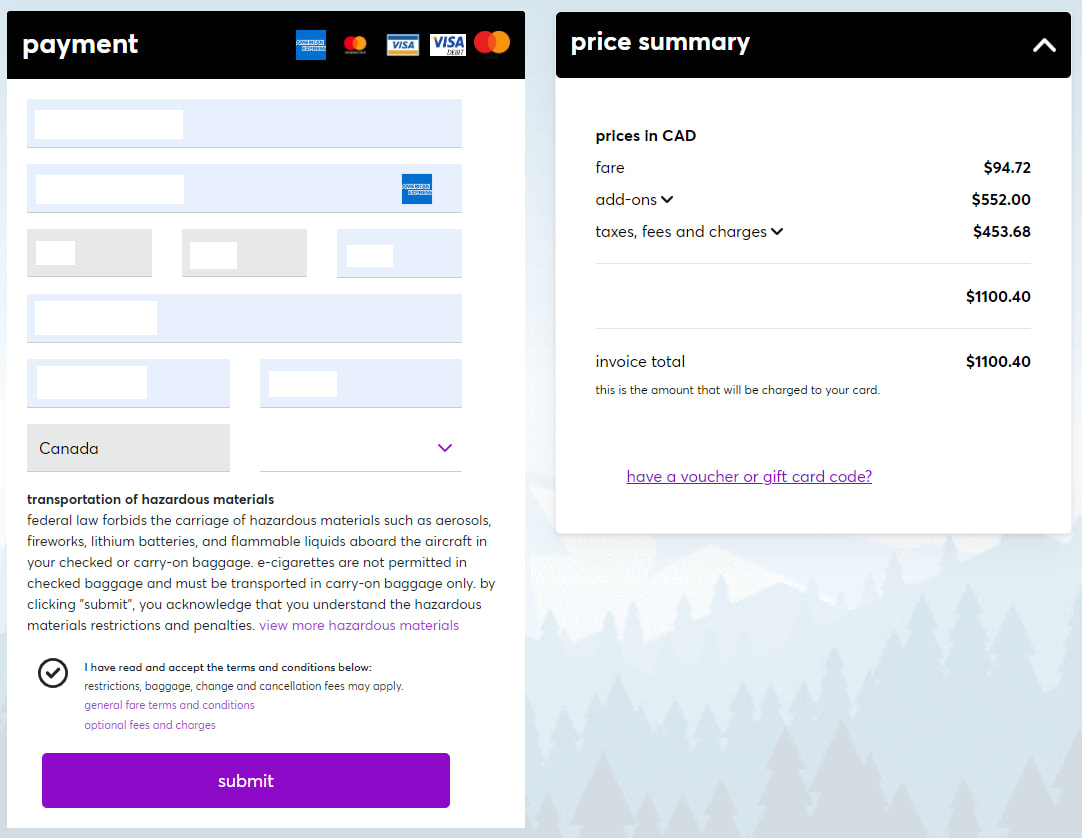

My go-to credit card when it comes to booking travel is the American Express Aeroplan Reserve Card. Strangely enough, when I enter in my credit card info and my address, it doesn't add a fee.

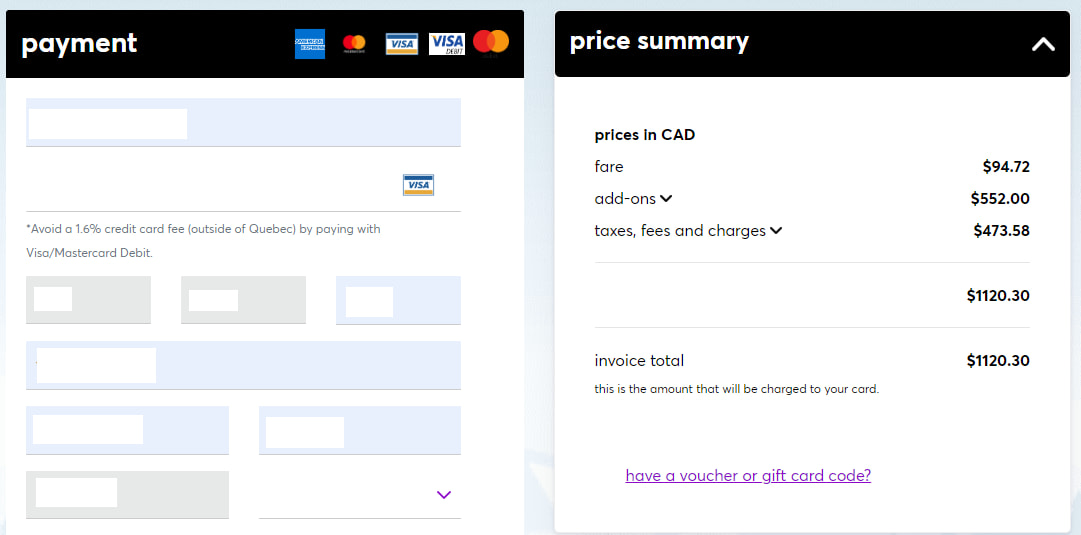

So then I tried a Visa Infinite card – the Scotiabank Passport Visa Infinite Card. And sure enough, a 1.6% fee gets added.

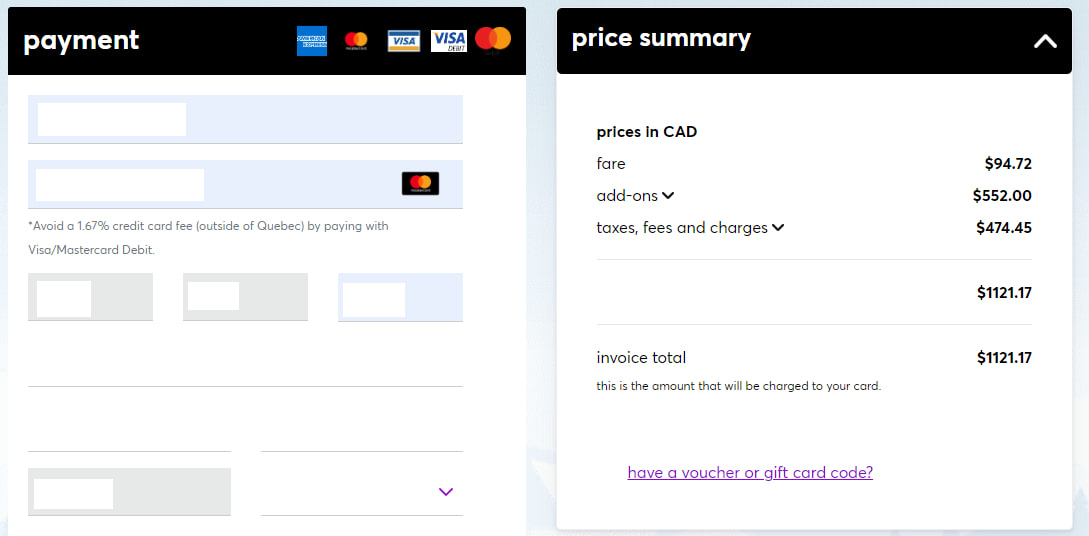

I also tried a World Elite Mastercard (the MBNA Rewards World Elite Mastercard) for good measure, and Flair added in a 1.67% fee.

To test this out for a resident of Quebec, I changed my postal code and province to Quebec, and the fee disappeared.

So the fee varies by the type of credit card. I don't have a basic Visa or Mastercard, but my guess is it would be the minimum Flair states – 1.4%.

So based on what I found, here's the summary of the credit card fee you'll pay.

- American Express – None

- Residents of Quebec – None

- Visa Infinite cards – 1.6%

- World Elite Mastercards – 1.67%

With Amex cards, this could very well change in the future. Flair's mentions of credit card fees aren't specific to any networks, it's just a general notice on all credit cards. They could start adding a fee to them at any time.

But at the time of writing (August 23, 2023), Flair isn't charging a fee to use an Amex.

For me, I would continue to use a credit card to book a flight, even if I have to pay a fee. And it's because of travel insurance. If I don't use a credit card to book it, I'll lose out on any protections my credit card provides. It's a small price to pay to get some fall back in case I need it.

Using a Visa or Mastercard debit card

One way to avoid paying a credit card fee is to use a Visa or Mastercard debit card. As you can see in the screenshots above, Flair even mentions this.

And despite the fact that these are debit cards, you can still initiate chargebacks if Flair doesn't deliver and won't get you a refund.

If your credit card doesn't include much for travel insurance, this is one of the best ways to avoid a credit card fee.

Your thoughts on Flair's credit card fee

We certainly don't like to see credit card fees but they may become more common in the future.

What are your thoughts on Flair's new fee? Would you expect the same out of other low cost carriers in Canada?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.