Bank reward programs solely tied to credit cards offer easy-to-use points that you can use for any travel. That said, most of them require you to use a specific booking site, which means what you can use your points for and how much things cost remain behind closed doors until you open an account for yourself (unless the program offers redemption for travel from anywhere, in which case this doesn't apply).

I’ve had the MBNA Rewards World Elite Mastercard for a few years now and have made 2 large redemptions with MBNA Rewards. Both were excellent uses of points that left me satisfied, but further inspection of the program also shows shortcomings when it comes to travel. And, luckily, MBNA has a very easy way to use your points for day-to-day purchases if you prefer that route.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

My MBNA Rewards redemptions

I've used MBNA Rewards for 2 large redemptions – one for travel and one for gift cards.

Rental car from MBNA Rewards

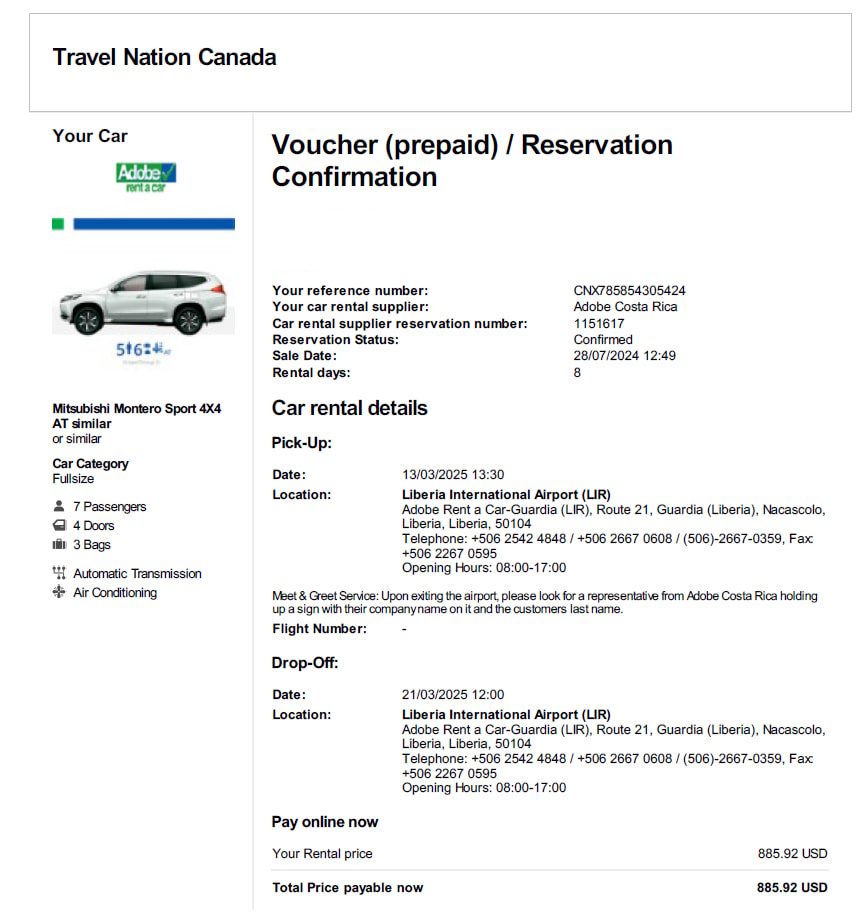

My first ever use of points was for a rental car in Costa Rica, and as you'll see, it was a terrific deal. Here’s what I booked through MBNA Rewards:

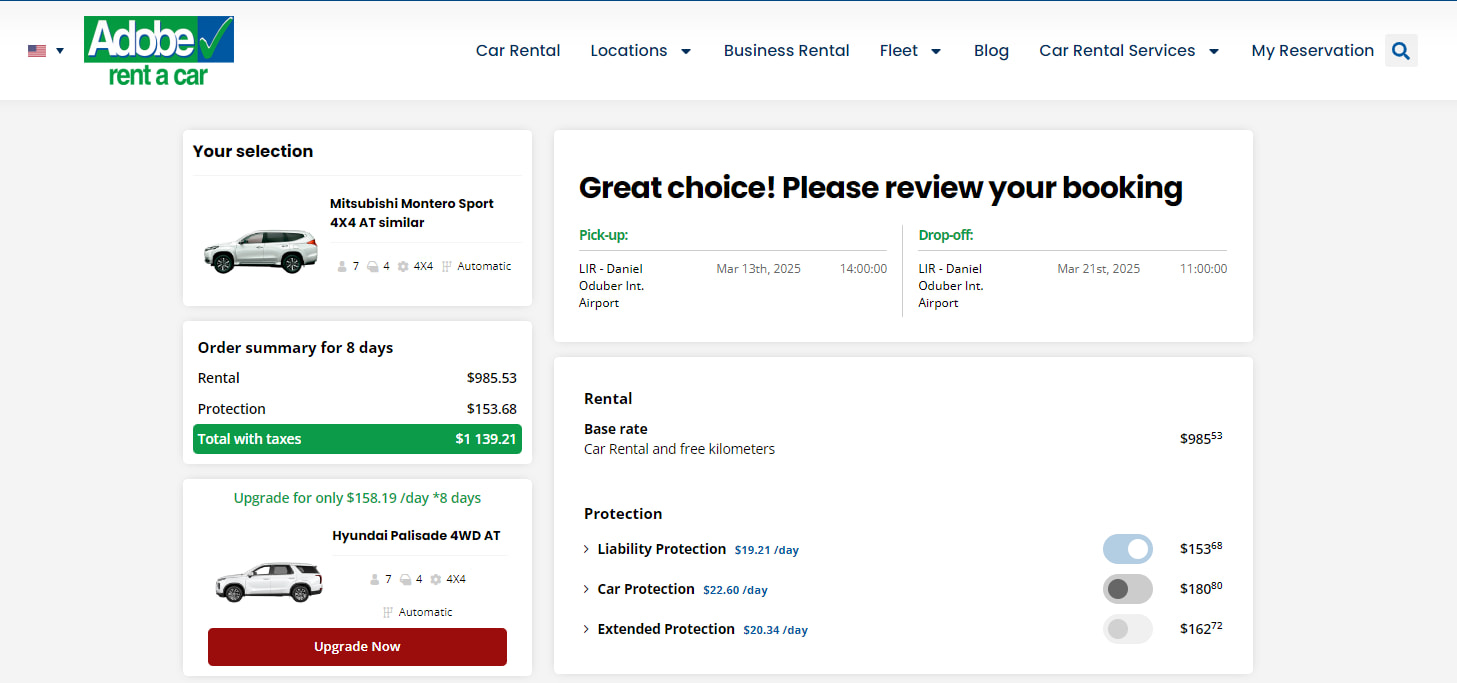

This booking cost me 122,534 MBNA Rewards points (CAD$1,225.34) – but it would have cost more if I had booked it directly through the rental car agency. Here's what their pricing was:

Looking at that total with taxes, I paid about US$250 less. And there were no surprises when I showed up to pick it up – I didn't have to pay anything and all the required taxes, insurance (that liability protection you see is mandatory), and fees were covered with my MBNA Rewards points. I used my credit card to cover the deposit, which was returned to me when I dropped the car off.

Needless to say, the next time I need to rent a car, I'll be back using my MBNA Rewards.

Home Depot e-gift cards

My second redemption was for e-gift cards. I was purchasing a new dryer (a fancy LG heat pump dryer to be precise), and decided to use MBNA Rewards to help pay for it.

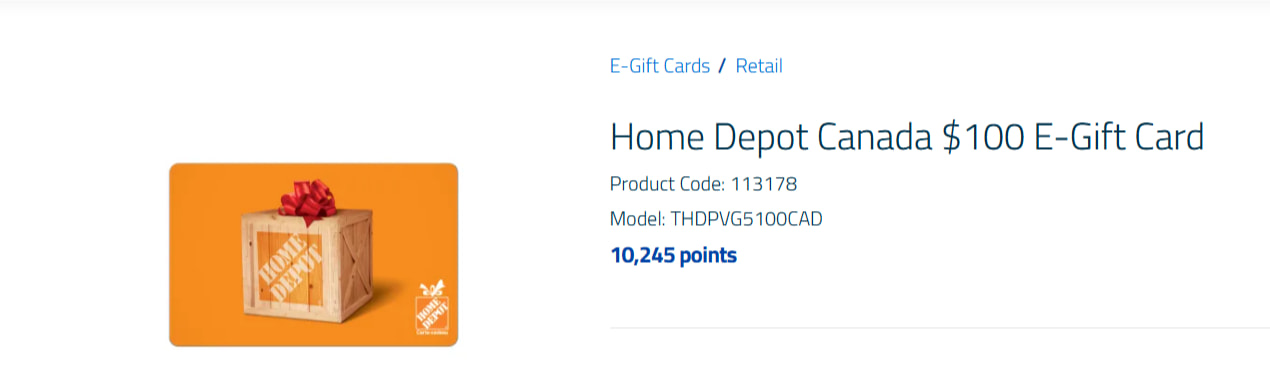

Here is the basic price for a $100 Home Depot e-gift card, the largest denomination that MBNA Rewards offers:

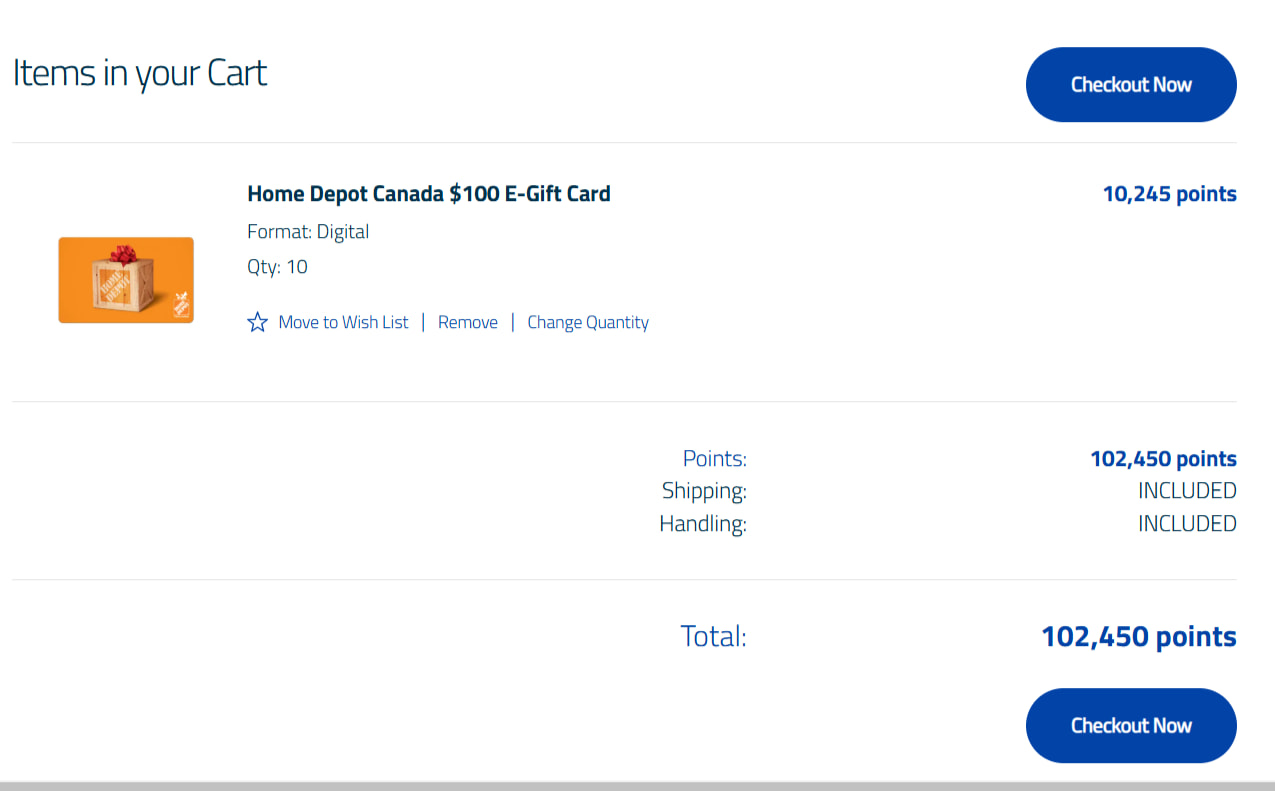

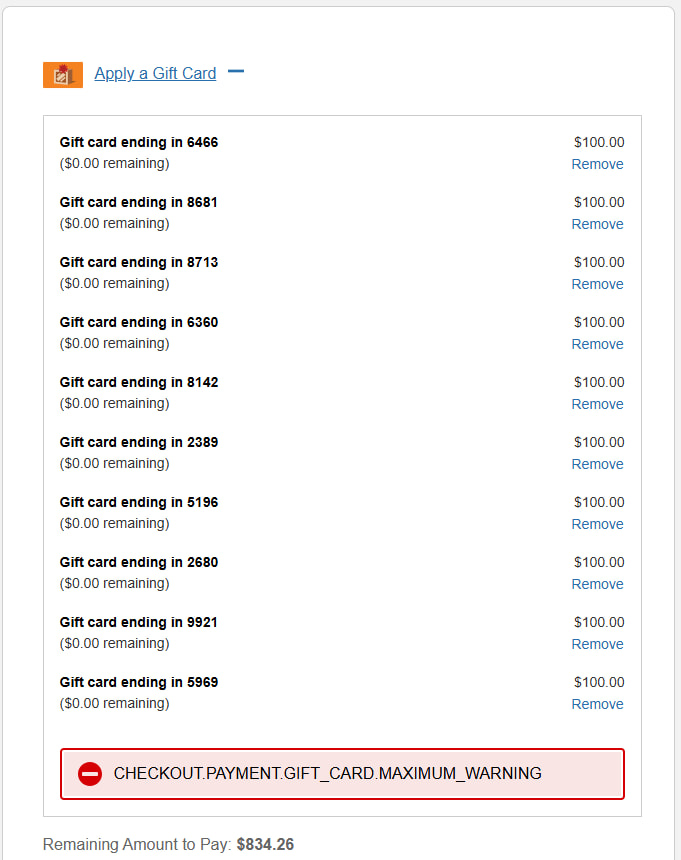

I had enough points to get 15 of these – but before buying them, I checked to see if there was a limit to the number of gift cards that could be used on a single purchase. A simple Google search revealed that you can only use 10 gift cards at a time.

So, I purchased 10 of them for 102,450 points.

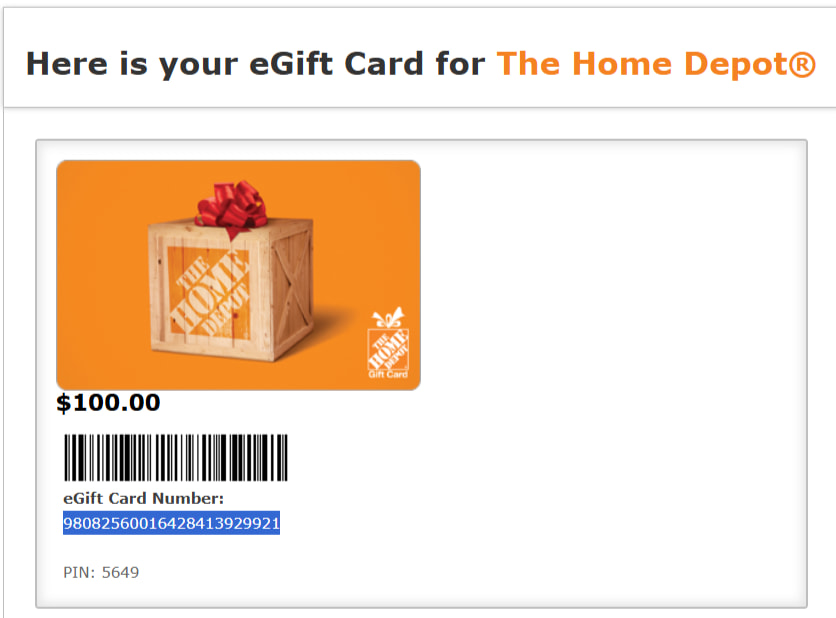

As electronic gift cards, they arrived very quickly – into my inbox in about a minute.

That page included an individual link to open each gift card. Then, I copied and pasted the gift card number and PIN over to my Home Depot checkout page.

After entering them all, I did indeed hit the limit for gift cards – but it was an easy $1,000 saved on a new appliance.

If there's one thing I would like to see improved, it's larger e-gift card amounts. Since there was a limit to how many gift cards I could use, I was limited in how much I saved. Having larger gift cards would remedy this.

And while my delivery was quick, some RedFlagDeals users have reported that with select merchants, it can take several days to get the gift cards. It may not always be instantaneous.

Needless to say, this is a quick and easy way to turn points into everyday savings. The value did drop slightly – from 1 cent to 0.98 cents – but I was able to enjoy savings right away instead of waiting until the next time I travel.

Where MBNA Rewards falls short

To start, we're not going to talk about the non-valuable redemptions like merchandise and regular gift cards. Almost all rewards programs have terrible redemptions in this area, and MBNA is no different (though the e-gift cards are excellent value).

But, MBNA does fall short in the travel department.

With hotels, there are two issues:

- MBNA only offers non-refundable hotels. I generally prefer to pay a little extra and get a refundable rate in case something happens and we don't end up going.

- Selection is limited. Unless you're going to a major city, MBNA may not have hotel options. On one trip, I wanted to use points for a hotel in Woodstock, NB, but the closest option was in Fredericton.

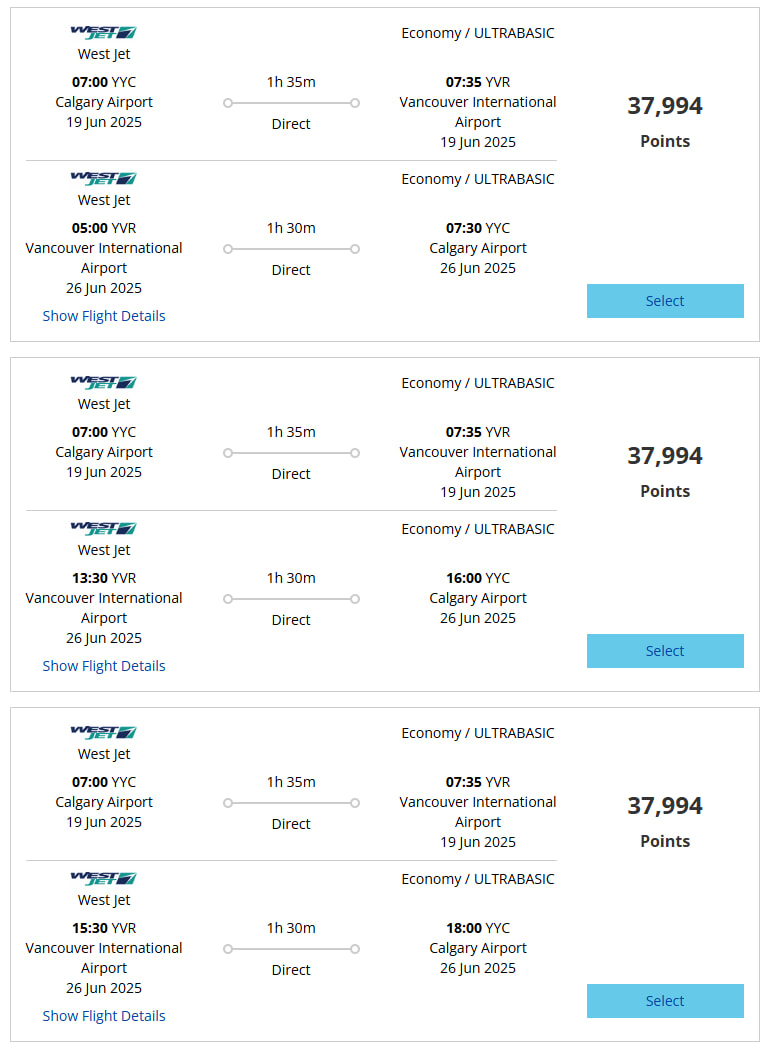

There are also a couple of small issues with flights. Most of the major Canadian airlines have flights available, with the exception of Flair. You can easily find flights with Air Canada, WestJet, Porter, and Air Transat. However:

- You can only book basic airfares. You can’t book flights that allow cancellation or include baggage through MBNA Rewards.

- Searching is a bit of a pain. On return flights, MBNA shows both your departing and returning flight in the same box as pairs, rather than allowing you to choose each one separately. It will take some slider adjustments and plenty of looking to find the exact flights you want – especially on popular routes. Here's an example for Calgary to Vancouver.

MBNA Rewards credit cards

If you want to earn MBNA Rewards cards, you have 2 options to choose from:

| MBNA Rewards World Elite Mastercard | MBNA Rewards Platinum Plus Mastercard | |

|---|---|---|

| Welcome bonus | 30,000 bonus points (terms) | 10,000 bonus points (terms) |

| Earn rates | * 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category) * 1 point per $1 spent on all other purchases | * 2 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $10,000 spent annually per category) * 1 point per $1 spent on all other purchases |

| Insurance included | 12 types | 3 types |

| Annual fee | $120 | $0 |

| Income requirements | * $80,000 personal * $150,000 household | * None |

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×7 Award winner

×7 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.