The credit card world is full of different credit cards and rewards. Most of the stuff you’ll come across would fit anyone, whether it’s a free flight, merchandise, or cash back.

But in all of our years researching credit cards, we’ve also stumbled on the downright bizarre when it comes to credit card rewards. Things that are far from normal when it comes to what benefits and perks you’d be accustomed to.

Here are some of the things we’ve found in the world when it comes to weird credit cards, and a quick overview of the best rewards credit cards in Canada.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Counting down the top 8 weird credit card rewards in the world

Here’s our summary of the weird credit card rewards we tracked down.

| Credit Card/Rewards Program | Weird Redemption/Credit Card Feature |

|---|---|

| Magic Credit Card | Magic equipment |

| Virgin Atlantic Flying Club | Flight to outer space |

| Star Trek | Bonus rewards on Star Trek purchases |

| Korean Air SkyPass | Free Coat Check |

| Linux Foundation Credit Card | Support open source software |

| Miles And More | Sock subscription |

| Discover | Sideline tickets to the Orange Bowl |

| Hello Kitty Credit Card | Free Hello Kitty merchandise |

1. Magic props and events

Source: eBay

For the magician, there used to be a magical card (pun intended) available for members of the International Brotherhood of Magicians.

This Visa card allowed members to earn rewards that could be used towards magic props and various events.

These rewards certainly weren’t for everyone, but it’s among the most unique credit cards we’ve ever seen.

Unfortunately, it must have taken part in a disappearing act because it no longer exists, but it’s an excellent example of a group offering a specific credit card for their members’ needs.

2. Space flight in Virgin Galactic spaceship

Looking for a free flight – into outer space?

Forget all those cards offering free flights to boring places like Paris and New York! The Virgin Atlantic Flying Club can help with your first trip to the stars.

How? First, you’ll need 2,000,000 Flying Club points.

With these points, you’ll be able to enter into a draw to win a trip on Virgin Galactic. It’s a 3 day experience. There’s preparation for your space flight, and at the end of it, you’ll get a 2 hour space flight with at least 5 minutes of weightlessness.

If you’re wondering about redeeming your points for nothing (if you don’t win) there is good news – if you’re not selected, your 2,000,000 points will be refunded. So if you have them and this interests you, you won’t lose anything and you’ll be able to spend your points normally on things like movie passes, concert tickets, and flights.

For travel beyond our globe, Virgin Atlantic offers an amazing opportunity. Here are the full details on this wacky draw.

3. A Star Trek credit card

For the avid Star Trek fan, yes, you can take your fandom to a whole new level (or strange new worlds). The NASA Federal credit union allows members to get a Star Trek themed credit card with your choice of design.

As for rewards? It does offer some unique Star Trek perks. It earns 3 points per $1 spent at startrek.com.

And while it doesn’t offer any Star Trek-related items, it offers an assortment of super unique rewards, like being able to fly a helicopter or drive an Indy Car.

These reward options are also available on the NASA credit cards too.

4. A coat check before a Korean Air Flight

When you’re heading to a warmer climate in the middle of winter, your coat can be annoying. You only need to get yourself in the airport, but once you’re inside, you can say adios to it until you come back.

Many airports do offer a coat check if you really don’t want to take it with you, but there’s a cost to that. You can also stuff them in your suitcase so you don’t have to carry it, but that would mean taking up valuable luggage space.

However, if you have any Korean Air Skypass points, you can use them for a free coat check at Incheon International airport. Perfect for a hot summer vacation in one of the trendiest cities in the world.

You’ll pay 400 miles per day if your coat is stored, and you can store your coat for up to 30 days.

5. Linux Foundation Credit Card

Perhaps you don’t care about getting credit card rewards, you’d rather turn them into something for someone else. If you’re interested in paying it forward, Linux has the card for you.

For the techie, there’s the Linux Foundation Credit Card. A percentage of every purchase you make goes toward the Linux Foundation, which helps in the development of open source software.

6. A sock subscription

Find yourself always losing your socks? Or perhaps you’re always frustrated finding a new hole within weeks of getting your latest pair?

The Miles and More program is here to help. You can redeem your miles towards a sock subscription. With a subscription to BLACKSOCKS, you can redeem 3,000 miles and receive several pairs of high quality socks per year, sent right to your mailbox.

7. Sideline tickets to the Orange Bowl

College Bowl Season is big in the U.S.

And back in 2012, Discover took this to new heights as the sponsor of the Orange Bowl. If card members ordered tickets to the Orange Bowl through a special Discover link, and you got a few extras along with your ticket:

Card members even had the option to get a Discover card with the Orange Bowl logo on it. For college football fans, there was a lot to like about having a Discover card at the time.

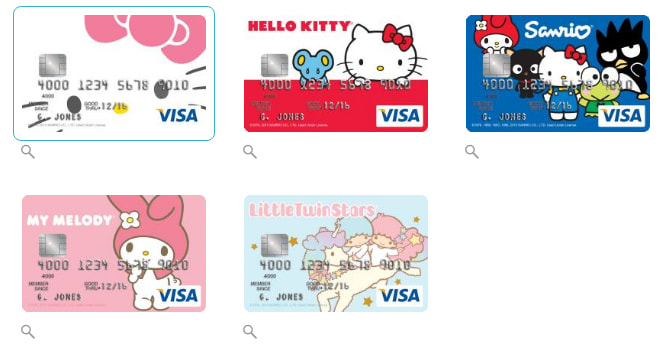

8. A Hello Kitty credit card

Have a little one (or perhaps a manly husband) who’s REALLY into Hello Kitty? There is a credit card for that. The Sanrio Visa Platinum Rewards Card earns rewards you can use at www.sanrio.com.

You can keep your kid happy with all the free merchandise you can get (well, capped on the rewards you’ve earned). Kawaii desu ne!

Want to know your Canadian reward program options? Here are the best rewards programs in Canada.

Best rewards credit cards in Canada

We looked around here in Canada, and couldn’t beat the weird credit cards above.

But there’s plenty of terrific rewards credit cards for Canadians. And though none of them will have any zany rewards, all of them will have some excellent returns for your daily purchases.

Here are some of the best rewards credit cards in Canada.

| Credit Card | Welcome Bonus | Rewards | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| American Express Cobalt |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) |

* 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases |

* $191.88 * None |

Apply Now |

| American Express Aeroplan Reserve |  $150 GeniusCash + Up to 85,000 bonus points (terms) $150 GeniusCash + Up to 85,000 bonus points (terms) |

* 3 points per $1 spent on Air Canada * 2 points per $1 spent on dining and food delivery purchases in Canada * 1.25 points per $1 spent on all other purchases |

* $599 * None |

Apply Now |

| MBNA Rewards World Elite Mastercard |  $20 GeniusCash + 30,000 bonus points (terms) $20 GeniusCash + 30,000 bonus points (terms) |

* 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category) * 1 point per $1 spent on all other purchases |

* $120 * $80K personal /$150K household |

Apply Now |

1. The best rewards credit card in Canada

GC: $100

For earning the most rewards possible, the top dog in terms of Canada’s best rewards credit card is undoubtedly the

It offers not only plenty of points on your purchases, but every single point is also very valuable.

Here’s what you’ll earn on your purchases:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

There are a few credit cards with better earn rates out there. But what they don’t offer is a high point value. Each Amex Membership Rewards point is worth up to 2 cents each. That gives this card an average return of up to 4.5%.

It’s a return not matched by any other credit card.

2. The best Aeroplan rewards credit card

GC: $150

The

Here’s what you’ll get:

- 3 points per $1 spent on Air Canada

- 2 points per $1 spent on dining and food delivery purchases in Canada

- 1.25 points per $1 spent on all other purchases

With each Aeroplan point worth up to 2 cents each, it’s a return of 2.79% on purchases.

This card will also help you make the most out of those Aeroplan points when flying with these benefits:

- preferred pricing on Aeroplan flight rewards,

- first free checked bag,

- priority check-in, boarding, and baggage handling, and

- annual companion voucher when you spend $25,000 annually.

3. Earn the most flexible rewards

GC: $20

If you want to earn the most flexible rewards you can use for anything, we highly recommend the

Here’s what you’ll earn on your purchases:

- 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category)

- 1 point per $1 spent on all other purchases

Each of these MBNA Rewards points are worth 1 cent, giving a return of 2.86%.

And there’s one more bonus. Every year on your birthday, you’ll earn 10% bonus points on what you’ve earned, up to a maximum bonus of 15,000 points.

Comparing the best rewards credit cards

Let’s take a quick peek at these cards side-by-side. Here’s the average rate of return for each of them.

The Cobalt Card has far more rewards than any of these cards. But the other cards are no slouches either, earning better than 2.5% back on all purchases.

What’s the most weird credit card reward you’ve seen

There are plenty of credit card rewards out there, and these are some of the stranger options we’ve seen.

Any strange credit cards or rewards you’ve seen? If you were to create a crazy, niche, weird credit card with its own set of wild rewards, what would you make up?

Let us know in the comments below so others can see what you’ve found or see if you have any friends who’d want a similar card.

FAQ

What are some weird rewards credit cards available?

There are plenty of strange credit card rewards out there. From trying to win a flight to outer space, getting Hello Kitty merchandise, or even a free coat check, there are plenty of different ways you can use credit card rewards.

Is getting weird credit card rewards worth it?

There’s nothing wrong with getting strange rewards. As long as it’s something you’re interested in and find valuable, strange rewards can be worth it.

What is the best rewards credit card in Canada?

The best rewards credit card in Canada is the American Express Cobalt. You’ll earn up to 5 points per $1 spent on purchases, which is combined with each point being worth up to 2 cents. This means a sky-high earn rate of 4.5%.

Why are so many weird credit card rewards discontinued or unavailable?

Many strange credit cards get discontinued because there’s no interest in them. If very few people actually get a credit card, a bank will move on from it and discontinue the card.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.