If you ever bought a ticket to a concert or sporting event, you probably bought it through Ticketmaster Canada.

When it comes to concerts for popular shows, it can be hard to get tickets – they can be limited and tend to sell out in minutes.

Is there a better way to get concert tickets? Luckily for you, there is with the magic of Amex Front Of The Line. Thanks to Amex’s partnership with Ticketmaster, you can get access to presale tickets before the public does.

Here’s how to do Ticketmaster better so you’re not scrambling for the last 2 nosebleeds where your favourite artists will be reduced to the size of ants.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

My latest experience with Ticketmaster Canada

Needless to say, my last experience with Ticketmaster was less than stellar.

I was trying to get a pair of tickets for a concert in Los Angeles.

There was only one show, and the rush was on to get tickets when they became available. There were about 20,000 seats available, with many more than that looking to get tickets.

As a little bit of background, this was a k-pop show (I’m so cultured), and LA is one of the two fastest-selling stops on a k-pop tour usually. With only one show announced, it would be a race to get on and a whole lot of luck to get the tickets. I was not fortunate enough to get a line in the pre-sale, so I had to wait a few days until the general tickets were available.

In the end, I ended up having to buy resale tickets off of Stubhub at a marked up rate as only the “Platinum tickets” (to jump the presale line) were the only other option, and single tickets were over $1,000 each.

Luckily, it’s all online now. If these were in person, I’d imagine myself as Frank Costanza when he came up with Festivus:

As I rained blows upon him I realized there had to be another way!

But thanks to American Express, there is another way – Front Of The Line.

All about American Express Front Of The Line

What’s a better way? Let’s introduce you to American Express Front Of The Line.

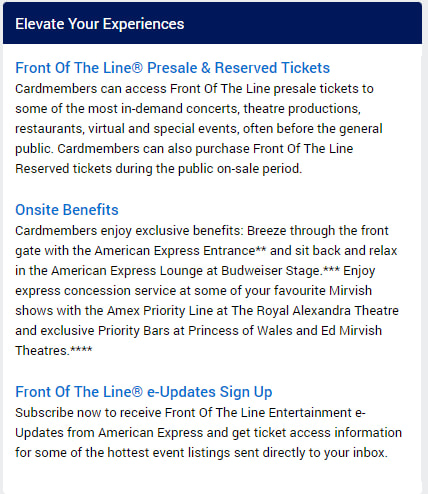

What is it? Let’s let Amex explain it.

Now, I don’t know if my concert was available there, but I would have used it…if I had an Amex card!

So how does it work? First, head over to this special Ticketmaster site for American Express.

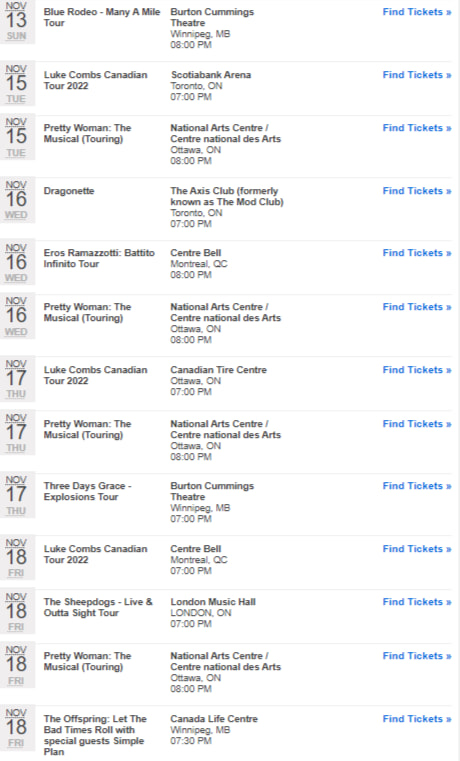

From there, you can do several things. First, there’s the pre-sale tab. You can purchase tickets ahead of the crowd. If you see a show listed here, others aren’t yet able to purchase tickets.

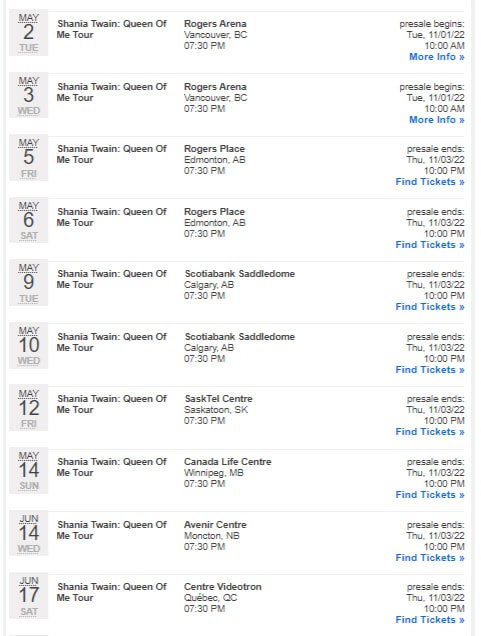

Here’s an example listing (anyone a Shania Twain fan?)

The other tab of importance are Reserved Tickets. These are concerts where anyone can buy tickets, but these tickets are reserved for Amex members.

To look at both of these at the same time, just click on the “Current Events” tab.

To get notified of new events as they become available, you can click here and get an email in case something you may be interested in comes up.

In short, Amex and Ticketmaster have a way to beat at least some of the crowd when it comes to popular events.

Best American Express credit cards

To get access to Front Of The Line, you need an Amex card. And it can be any Amex card – from the super-premium to the no fee cards.

And it doesn’t have to be issued by Amex either – Scotiabank Amex cards can also access this unique perk.

As one final bonus, if you have an Amex Membership Rewards card, you can use your points to help pay for your tickets. 1,000 points will save you $10 on your tickets.

Here are a handful of our favourite Amex cards. You can also view the full list on our best Amex credit cards page. Oh, and don’t forget – Amex issued cards have no income requirements, and those issued by Scotiabank have only a $12,000 personal income requirement.

| Amex Card | Welcome Bonus | Earn Rates | Annual Fee | Apply Now |

|---|---|---|---|---|

| American Express Cobalt Card |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) |

* 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases |

$191.88 | Apply Now |

| Scotiabank Gold American Express Card |  $100 GeniusCash + Up to 45,000 bonus points, first year free (terms) $100 GeniusCash + Up to 45,000 bonus points, first year free (terms) |

* 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more * 5 Scene+ points per $1 spent on groceries, dining, and entertainment * 3 Scene+ points per $1 spent on gas, select streaming services, and transit * 1 Scene+ point per $1 spent on foreign currency purchases * 1 Scene+ point per $1 spent on all other purchases |

$120 | Apply Now |

| SimplyCash Preferred Card from American Express | 10% cash back for the first 3 months + $50 (terms) | * 4% cash back on gas and groceries * 2% cash back on all other purchases |

$119.88 | Apply Now |

| American Express Green Card | 10,000 bonus points (terms) | * 1 point per $1 spent on all purchases |

$0 | Apply Now |

| Marriott Bonvoy American Express Card | 110,000 bonus points (terms) | * 5 points per $1 spent at Marriott properties * 2 points per $1 spent on all other purchases |

$120 | Apply Now |

1. The best Amex credit card

GC: $100

The crown of best Amex (as well as best credit card) belongs to the American Express Cobalt Card.

Why this card? It’s all in the rewards:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

Combined with each Membership Rewards point being worth 2 cents, and you can get an average return of up to 4.5% on your purchases.

And yes, this card’s points can be used towards Ticketmaster purchases.

Unlike a few other cards, it doesn’t have an extensive list of extra features, just offering typical Amex benefits and 10 types of insurance, but the rewards are unmatched.

2. The best Scotiabank Amex credit card

GC: $100

What about Scotiabank? They issue an excellent lineup of Amex credit cards, all led by the Scotiabank Gold American Express Card.

These cards are part of the Scene+ family – here’s what this one earns for rewards:

- 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more

- 5 Scene+ points per $1 spent on groceries, dining, and entertainment

- 3 Scene+ points per $1 spent on gas, select streaming services, and transit

- 1 Scene+ point per $1 spent on foreign currency purchases

- 1 Scene+ point per $1 spent on all other purchases

Plenty of categories earning high rewards, including entertainment. Overall, you could expect to see a return of 2.45%.

It also has these excellent features:

- no foreign exchange fees,

- 12 types of insurance, and

- Discount on a Priority Pass membership.

Scotia also issues 2 other Amex cards you can think about if this isn’t the right card for you.

3. The best Amex cash back credit card

For a cash back credit card, the recently revamped SimplyCash Preferred Card from American Express is one of the best cash back cards in Canada.

Here’s what you’ll earn on every purchase:

- 4% cash back on gas and groceries

- 2% cash back on all other purchases

There aren’t any cash back cards offering a base rate of 2% back on all purchases while still earning more on a couple of categories.

The annual fee for all this cash back is $119.88, that gets charged out as $9.99 per month.

There’s also a no fee version of this card you can take a look at. It has slightly reduced rewards, but it’s still a good card to have.

GC: $50

4. The best no annual fee Amex card

The title of best no annual fee Amex card belongs to the American Express Green Card.

The rewards are seemingly average, just earning 1 point per $1 spent on all purchases. But when you factor in that each point is worth up to 2 cents (like other Membership Rewards cards) you’ve got a return of up to 2%.

This is an incredible amount of rewards for a card that doesn’t have an annual fee.

5. The best Amex card to save on hotels

Staying at a hotel is a big part of travelling. And luckily, Amex has an excellent credit card to save on hotels with the Marriott Bonvoy American Express Card.

A part of the Marriott Bonvoy program, here’s what you earn on purchases:

- 5 points per $1 spent at Marriott properties

- 2 points per $1 spent on all other purchases

Each point is worth 0.97 cents, for a return of 1.94% on all purchases (4.85% at Marriott hotels).

But there’s more. It has a major perk every year that gives you a free hotel night. It comes with an annual free night certificate worth up to 35,000 points. Simply find any rewards night for 35,000 points or less, and you’ve got a free night just by having this card.

On top of that, you’ll also get automatic Marriott Bonvoy Silver Elite status, which means you’ll get extra perks on any stay.

And the annual fee for all this? It’s just a standard $120.

Share your experiences with Ticketmaster

This is simply one tale about using Ticketmaster. And while not great, hopefully Front Of The Line has tickets to the next concert I want to attend.

Do you have any Ticketmaster stories to tell?

Any experiences using Front Of The Line?

Let us know in the comments below.

FAQ

What is Ticketmaster?

Ticketmaster is a ticket sales and distribution company that operates all over the world. They manage ticket inventory for artists and stadiums. Ticketmaster is the world’s largest ticket marketplace and a source for a lot of tickets for concerts and sporting events.

What is Amex Front Of The Line?

Amex Front Of The Line is an Amex benefit that lets card members access special pre-sale and reserved ticketing for major events through Ticketmaster.

What is the best American Express credit card?

The best American Express credit card is the Amex Cobalt. It has the best rewards of any credit card, earning up to 5 points per $1 spent on purchases.

creditcardGenius is the only tool that compares 126+ features of 227 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 227 cards is for you.

×9 Award winner

×9 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.