Travel and grocery rewards get a lot of attention when it comes to credit card cash back, but transit is also a huge opportunity for earning rewards. Whether you’re taking a bus, catching a ferry, or in some cases, calling for a rideshare, you can usually earn a higher reward rate if the travel is designated as transit.

We’ve found your best options for credit cards with high transit rewards, so take a look to see if any match your travel or commute needs. Stick around for extra suggestions on how to save money on public transit.

Key Takeaways

- The best credit cards for public transit give increased rewards for buses, trains, taxis, ferries, parking, and gas.

- The American Express Cobalt Card offers the highest return on transit and overall credit card spending making it the best credit card option.

- Check your credit card’s terms and conditions to see what travel is excluded from increased earn rates.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

How to tell if a credit card is good for public transit

Many credit cards offer increased earn rates for specific spending categories. Transit is just one of these popular categories and it can include a variety of public travel types like:

- Buses

- Taxis

- Subways or light rail systems

- Trains

- Ferries

Note that some credit cards also lump rideshare services in with transit.

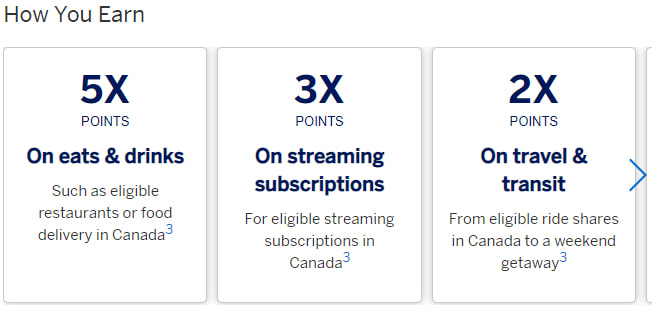

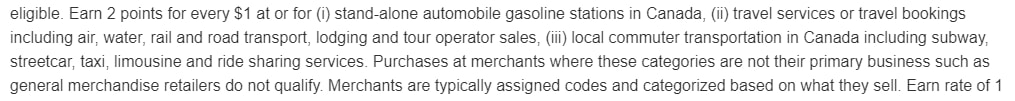

To tell if your card has increased earn rates, read your card’s terms and conditions or hop on the card’s web page to see how you earn rewards. Look for a category called "Transit." For example, here’s what the American Express Cobalt Card earns. Note that it includes rideshare services in its “Travel and Transit” category.

It’s always a good idea to read the fine print. For the Amex Cobalt, we see that this category includes things like limousine and streetcar travel—things other cards may not include.

Be aware that if the travel service is coded as a merchant, you might not earn the increased earn rate. For instance, if you buy a book of bus tickets from a corner store, you wouldn’t earn the bonus rate for transit purchases. Instead, it would likely fall under the "everything else" umbrella. However, if you bought them at a grocery store, you could be earning 5x the points instead.

Best credit cards for public transit

First, here's our summary of the best credit cards that earn you rewards on transit.

| Credit Card | Welcome Bonus | Rewards | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| American Express Cobalt Card |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) | * 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases | * $191.88 * None | Apply Now |

| BMO CashBack World Elite Mastercard | Up to $480 cash back in the first year, first year free (terms) | * 5% cash back on groceries, up to $500 in monthly spend * 4% cash back on transit, up to $300 in monthly spend * 3% cash back on gas, up to $300 in monthly spend * 2% cash back on recurring bills, up to $500 in monthly spend * 1% cash back on all other purchases | * $120 * $80K personal/$150K household | Apply Now |

| Tangerine Money-Back Card | 10% extra cash back for the first 2 months (terms) | * 2% cash back on purchases in up to 3 Money-Back Categories * 0.5% cash back on all other purchases | * $0 * $12K personal | Apply Now |

| BMO eclipse Visa Infinite | Up to 80,000 bonus points, first year free (terms) | * 5 BMO Rewards points for every $1 spent on dining ($6,000 per year), groceries ($6,000 per year), gas, and transit * 1 point per $1 spent on all other purchases | * $120 * $60K personal/$100K household | Apply Now |

| Scotiabank Gold American Express | Up to 45,000 bonus points, first year free (terms) | * 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more * 5 Scene+ points per $1 spent on groceries, dining, and entertainment * 3 Scene+ points per $1 spent on gas, select streaming services, and transit * 1 Scene+ point per $1 spent on foreign currency purchases * 1 Scene+ point per $1 spent on all other purchases | * $120 * $12K personal | Apply Now |

So without further ado, here's our listing of the best credit cards for transit.

American Express Cobalt Card

Why it's good for public transit: Not only will you earn 2 points per $1 spent on public transit, but you’ll also earn the same rate for gas and rideshare services.

Other card details: We love the

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

American Express Membership Rewards are worth up to 2 cents each, giving your transit purchases a return of up to 4%. And as we saw above, this includes public transit, taxis, and rideshares.

BMO CashBack World Elite Mastercard

Why it's good for public transit: You’ll earn a generous 4% back on transit and 3% back on all fuel purchases, making it a great go-to transportation card.

Other card details: The

- 5% cash back on groceries, up to $500 in monthly spend

- 4% cash back on transit, up to $300 in monthly spend

- 3% cash back on gas, up to $300 in monthly spend

- 2% cash back on recurring bills, up to $500 in monthly spend

- 1% cash back on all other purchases

4% cash back is pretty sweet. It’s capped at $300 in spending per month, but many people’s transit expenses won’t exceed this amount.

Unless you're buying more than two monthly passes in most cities, you won't exceed this cap. One exception would be Toronto, where the TTC charges $156 per month. But even then, you would only slightly exceed the limit.

Tangerine Money-Back Credit Card

Why it's good for public transit: Earn 2% cash back if you select transit as one of your high earning categories. Transit includes parking, buses, trans, ferries, taxis, and road tolls.

Other card details:

Many people prefer a credit card that has no annual fee. The

You get to pick two categories if you get your rewards as a statement credit, or three if you deposit them into a Tangerine Savings account. You'll earn 0.5% cash back on all other purchases.

BMO eclipse Visa Infinite Card

Why it's good for public transit: Earn 5x the BMO Rewards points for transit purchases (up to $20,000 in annual spending).

Other card details: For the person who prefers a Visa (or also wants flexible rewards in a non-Amex card), the

Here's what you'll get:

- 5 BMO Rewards points for every $1 spent on dining ($6,000 per year), groceries ($6,000 per year), gas, and transit

- 1 point per $1 spent on all other purchases

Unfortunately, BMO’s terms don't go into full details as to what qualifies as transit. Your rewards will depend on whether BMO categorizes the merchant as transit. Unfortunately, Merchant Category Codes are not standardized.

Scotiabank Gold American Express Card

Why it's good for public transit: You’ll earn 3 Scene+ points per $1 on transit and gas purchases.

Other card details: Our last credit card, the

- 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more

- 5 Scene+ points per $1 spent on groceries, dining, and entertainment

- 3 Scene+ points per $1 spent on gas, select streaming services, and transit

- 1 Scene+ point per $1 spent on foreign currency purchases

- 1 Scene+ point per $1 spent on all other purchases

Of the transit points, you’ll earn 3x the points for rideshare, buses, gas, subways, and any other merchant that’s categorized as transit.

Best credit cards for public transport compared

We’ve mentioned a nice mix of credit card networks and rewards programs, so how do they stack up?

One of the best ways to compare credit cards is to see how their transit earning rates compare.

As you can see, the American Express Cobalt Card and BMO CashBack World Elite Mastercard are your best options for the most transit rewards.

However, the transit rates don’t tell the whole story. When we looked at the overall rate of return considering average spending over all categories, the American Express Cobalt Card was a clear winner. This card provides an astounding return of 4.5% based on a typical $2,000 monthly spend. It's the biggest reason this credit card is the best in Canada.

Looking for the best credit cards for taxis and rideshares? Here are our credit card choices when it comes to taxis, Uber, and Lyft.

Other ways to save on public transit

Using the right transit credit card is just one of several ways to save on getting from point A to point B. Here are some other money-saving strategies:

- Purchase passes or bulk tickets: If you can, buy a monthly or annual public transit pass or purchase a book of tickets you can use as needed. You’ll typically pay less per trip this way. Keep in mind that some cities offer day passes, weekend passes, or 5-day passes, which might fit your travel needs better.

- Take advantage of eligible discounts: Many types of public transit offer discounts to people based on age, number of people travelling, or affiliation. For instance, you might be able to get a senior, student, or group discount.

- Ask your employer if they offer a transit subsidy: If you have to commute for work, check to see if your employer offers a subsidy or discounted public transit. For instance, you might have some of your transit pass taken out of your paycheque and your employer might also contribute, giving you a discount.

- Check out programs for access to affordable transit: If you have low income and meet qualifications for local programs, submit an application to get discounted public transit. For example, in Halifax, if you meet the income requirements, you could qualify for 50% off a monthly transit pass through the Affordable Access Program (AAP).

- Travel during off-peak times: Tickets are generally cheaper during the least-busy travel times. If you can, try to travel when it’s not a popular commuting time and you could save.

- Carpool with fellow students or co-workers: Share the cost of transportation by riding together and splitting the cost of gas, parking, tolls, and other travel fees.

- Plan your trips to be efficient: Multiple trips throughout the day can really add up, so be strategic about your travel. If you can combine errands and reduce the number of trips you take, you can save not only money but also valuable time.

FAQ

Which credit card is best for public transport?

Your best option is the American Express Cobalt Card. It earns 2 points per $1 spent on transit, which combined with a value of 2 cents per points gives a return of 4% on transit purchases.

How do I know if my credit card has rewards for transit?

Read your credit card’s terms and conditions. If you don’t have it printed out, you can hop on the card website to read the legal details or call the customer service number on the back of the card to find out.

Which credit card has the best travel benefits?

Drumroll please. The best travel credit card also happens to be the best transit credit card: the American Express Cobalt. It has the highest rate of return, 10 types of insurance, and Amex travel benefits.

How to get a discount for public transport?

Depending on the type of transit and the programs available in your area, you might qualify for discounts based on age, student status, or income. For instance, you might purchase discounted bus passes by showing a student ID.

How can you save money on transportation?

Planning ahead and researching trip or fare options can help you save on the initial purchase. Plus, purchasing the transit with a high-earning credit card can give you cash back, acting as a discount on transportation.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.