Between flights, hotels, transportation, and food, there are plenty of costs involved in travelling. Luckily, little things like travelling during the week vs. weekends, renting your car at a non-airport location, and staying at a hotel that includes breakfast can save you considerable amounts.

This article covers seven different tips for saving while travelling, though it doesn't mention our most important tip: using a top-rated travel credit card.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Save money on flights

One of the biggest travel costs is your flight. If you’ve got a free place to stay on the other side, it may be your only cost.

We’re not here to improve the deal of the flight you got.

We know you’ve scoured sites like Google Flights, Kayak, Expedia, and probably various airlines sites to find the best bang for your buck.

But, when, and where are you flying? You can see some big savings just by flying at the right time.

Here are 3 ways to help cut down on your flight costs.

Travel during the week

While flying on a weekend can be more convenient, and requires taking less time off work, Tuesday through Thursday are usually the best times to travel.

So be flexible when you want to travel. Just a couple of days in either direction can make a big difference in the weight of your wallet.

Avoid travelling during peak travel season

It goes without saying that you want to avoid these times of the year:

- Summer high season– July through August,

- Winter holidays – December through the first week of January, and

- Spring break – first two weeks of March.

However, sometimes vacationing outside of these times can’t be avoided – especially if you’re bringing kids, and don’t want to pull them out of school for extended periods.

Search for flights at alternative airports

Don’t be set on just looking at one airport for both your departing and returning flights.

Keep an open mind about other airports available. You may add to your driving time, but you’ll also have good potential to save on flights.

This is particularly true in Toronto (where you can choose from Pearson, Billy-Bishop, and Hamilton airports – depending on where you want to fly), New York City, as well as Europe, where low cost carriers don’t tend to fly into main airports.

As a personal example, Charlottetown is my closest airport.

However, by driving an extra 45 mins to Moncton (and paying the Confederation Bridge toll), flight costs are usually cheaper, and more than offset the extra driving time, even the $48 bridge fare.

Tip: Google Flights is particularly good at this.

Related: Google Flights Canada – How To Score The Best Flight Deal

Baggage fees

Now that you’ve paid for the flight and you’re in the dreaded check-in line at the airport – remember the charges don’t end there.

Depending on your airline and destination, you can expect to pay a price of $60 or more for the airline to check your bag.

Minimize your amount of checked bags. Use every last pound and bag dimensions the airlines will give you (hockey bags can be great for this).

And of course, many airlines like Flair and Swoop are also charging you if you have to put your bag in the overhead bins.

One way to save on bag fees is to prepay online before you check in. Many airlines will offer you a discount just by paying ahead of time, instead of at the airport.

Of course, the right credit card will save you on baggage fees as well.

Save money on hotels

Like flights, we aren’t concerned with the actual price you paid for your hotel. You’ve scoured plenty of hotel booking sites, as well as the hotel sites themselves.

Or maybe you went the Airbnb route – either way, you probably got a good deal on your hotel.

But the location of your hotel makes a difference. Obviously staying near the action is a significant plus, as you’ll save time (possibly money) travelling into the city, and be able to better enjoy everything your destination has to offer.

But staying in the main tourist areas can also bring higher costs. The closer to the action, the more your hotel is going to cost.

So, where reasonable, try and stay just outside the high traffic areas. You’ll have to do a little travelling, but can also save big while your at it.

Related: How To Maximize The Marriott Bonvoy Rewards Program

Saving money on rental cars

Similar to flights and hotels, we’re not here to question the actual price you’ve paid for your rental car.

Rental cars offer great convenience and the ability for you to go wherever you want – whenever you want.

But there are 3 things you can do to decrease the costs of your rental.

Do you actually need a rental car for your entire trip?

First off, do you actually need one or not.

Besides the cost of the car itself, there are other costs for you to consider, such as parking at the hotel, and local restrictions. For example, in Italy many cities require special permits to drive a vehicle in city centres and other historical areas. Your vehicle won’t be much good to you if you can’t actually drive it where you want to go either.

With that said, there are day trips you may want to make, and you’ll need a car to get to them.

In these cases, feel free to rent a car for the day. Find a local car rental agency by your hotel, and only rent a car when you actually need one and save yourself some money.

Rent your car at an off airport location

Of course, sometimes you do need a vehicle for your whole trip.

Depending on your destination and what you want to do, you’ll need a car, or some sort of transportation, to get just about anywhere.

To save even more on your rental, see if there are off airport locations you can rent from instead. You’ll lose a little convenience, but save some cash as they don’t have to pay any fees the airport may levy. Many of them do offer shuttles to and from the airport as well.

Know what you need for car rental insurance

Car rental insurance can cost up to the rental price of the vehicle as well. You’ll be pushed to get the extra coverages the rental agency provides, but you may not need them. If you own a car, your own car insurance may cover rental cars in Canada and the U.S. – check to see if this applies to you.

Many credit cards also offer car rental insurance. You’ll be able to save on the loss damage waiver, typically the most expensive insurance provided by the rental agency.

Want to know more about car rental insurance? Everything you need to know is here.

The biggest tip: Do your research ahead of time, so you know what you will and won’t need.

Foreign currency exchange fees

Travelling outside the country? You’re going to need foreign currency for all the purchases you make.

Using a credit card that has no foreign exchange fees will save you 2.5% on every purchase you make, compared to a regular credit.

However, you may be thinking “I pay for my flights in Canadian Dollars, and can prepay for hotels and car rentals in Canadian Dollars as well. I just need cash for my food and other small purchases. The bank will give me a great rate for exchanging money.”

The truth?

The banks charge the same rate as a regular credit card for exchanging money.

Don’t believe us?

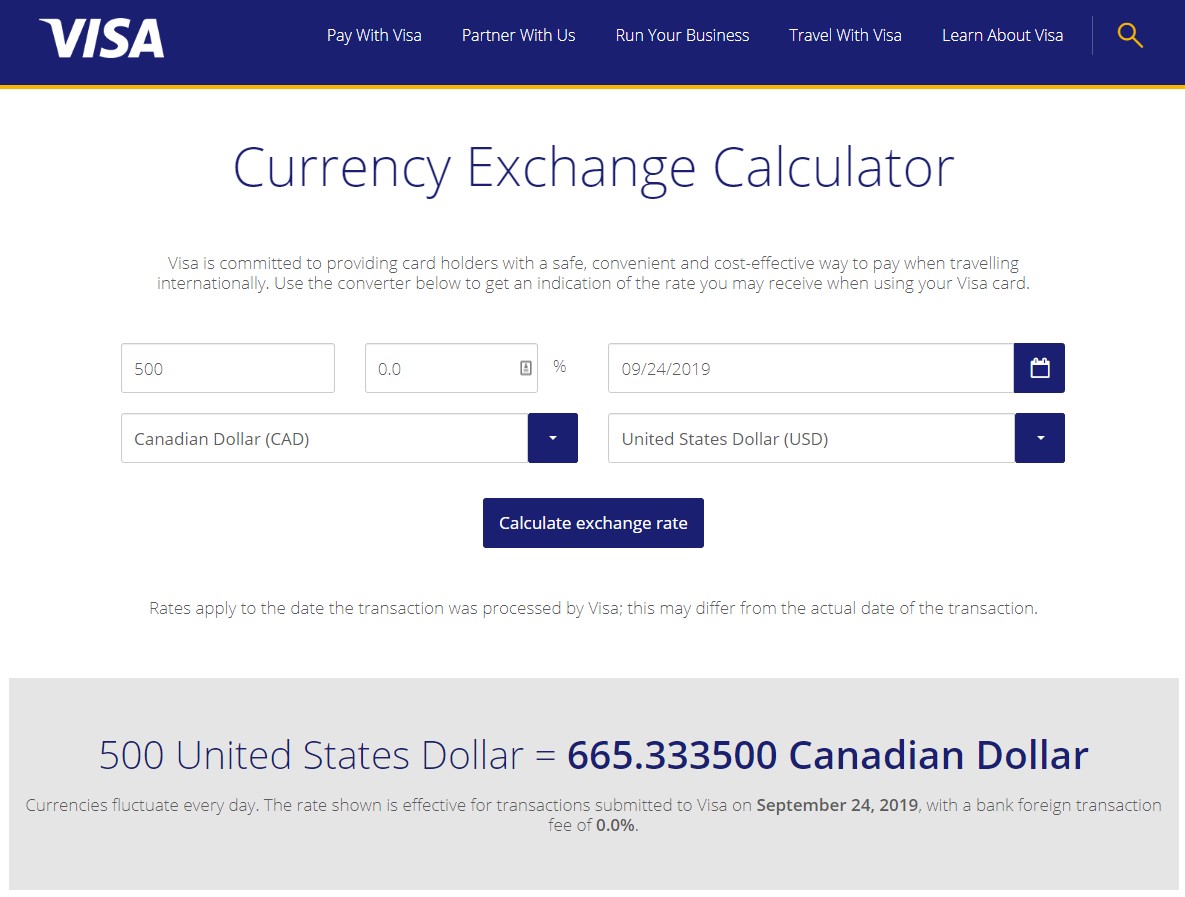

Say you were going to get $500 USD in cash from a Canadian bank.

Here’s what a no foreign exchange fee Visa would charge you in Canadian Dollars for $500 USD:

Mastercard would have a similar rate, and they have a page you can view their exchange rates here.

What would a Canadian bank charge you for that same $500 USD? Here’s what TD would want (other banks we checked had a similar exchange rate):

That’s 2.5% more than what a no foreign exchange fee card would charge. Woof.

And forget about exchanging money at an airport or other convenient location – their fees are going to be even higher.

And while the actual difference isn’t much, it all adds up.

However, you’re probably going to need a little currency on hand for things like toll roads in the U.S., shops that don’t take credit cards, and small purchases where you may not use a credit card.

So, the lesson is to minimize the amount of currency you use, and put as many charges as possible on a no foreign exchange fee credit card.

A great option is the

Eating while on vacation

Another big expense while you’re out travelling is food.

And if you’re eating out for 3 meals a day, these costs can really add up quick.

Eating out is going to be a part of your budget. Here’s a few things to do to cut the cost down.

Stay at a hotel that includes breakfast.

That’s one less meal per day you have to pay for. And just because they have a breakfast spread every morning, doesn’t mean it’s included. I once stayed at a hotel in Holland that had this kind of setup. I thought it was included in the price of our stay – it was not. We got charged 18 euros per person, vastly more than what we could have paid at a local restaurant. So, know what’s included in your hotel rate.

The other option is to get a room with a kitchen unit.This way, you’ll be able to cut down on the number of times you have to go out to eat.

Related: The Ultimate Foodie Credit Cards

Using your cell phone abroad

There’s nothing wrong with wanting to use your phone while you’re away. You’ll want to stay in touch, and if you’re leaving your kids behind, you’ll probably want to see how they’re doing – and if the house is still standing.

Having a phone with a map app can also make it a lot easier to get around.

But don’t just start using your phone when you touch down. You’ll incur high pay-per-use fees for doing so.

Instead, before you leave, contact your phone company and arrange a plan ahead of time. You’ll see some decent savings being prepared, rather than doing nothing at all.

Credit cards to save on travel purchases

To save even more on your travel purchases, consider a top flexible rewards travel card. In addition to these savings, you can cut your costs further by using one of these cards on your day to day purchases.

Want to see more travel cards? You can find the best travel credit cards here.

| Credit Card | Welcome Bonus | Earn Rates | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| American Express Cobalt | Up to 15,000points (terms) |

* 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases |

* $

191.88, charged out as $

15.99per month

* No income requirements |

Apply Now |

| Scotiabank Gold American Express | 45,000points (terms) |

* 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more * 5 Scene+ points per $1 spent on groceries, dining, and entertainment * 3 Scene+ points per $1 spent on gas, select streaming services, and transit * 1 Scene+ point per $1 spent on foreign currency purchases * 1 Scene+ point per $1 spent on all other purchases |

* $

120annual fee

* $12k personal income requirements |

Apply Now |

| BMO eclipse Visa Infinite | Up to 80,000points (terms) |

* 5 BMO Rewards points for every $1 spent on dining ($6,000 per year), groceries ($6,000 per year), gas, and transit * 1 point per $1 spent on all other purchases |

* $

120annual fee, first year free

* $60k personal/$100K household income requirements |

Apply Now |

GC: $100

Our #1 ranked credit card is the

GC: $60

The

GC: $150

If an Amex card isn’t your thing, then consider the

You’ll earn up to 5 points per $1 spent on purchases. Each BMO Rewards point you earn is worth 0.67 cents, for a return of up to 3.35% on your purchases.

In summary

There you have it – 11 tips to help save money while travelling.

Used individually, you’ll see some decent savings.

Put them all together, and you’ve put a good dent in your travel costs.

What about you?

Do you have any tips above the ones we mentioned?

Share them with everyone in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 8 comments