A popular service for transferring money is PayPal. With the ability to send money for free in Canada, it’s not hard to see why. Or if you have friends and family living abroad, you have a cost effective way to send money to them at your fingertips.

But how does PayPal work? And what are some of your alternatives to PayPal?

Here’s what you need to know.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is PayPal and how does it work?

First, what is PayPal?

Simply put, it’s a payment services provider.

You can read more about the basics (like how to create an account) on this PayPal article.

But here, we’ll take a closer look at how the main functions of PayPal work.

How to send money on PayPal

To send money, login to your PayPal account, and click on the button “Send” at the top of your screen.

Type in the PayPal email address of who you want to send money to, and press send. It’s quite simple.

Are there fees? It depends on where you’re sending the money to (and where the money comes from, in the case of receiving money).

For domestic transfers where the money comes from a linked bank account, there’s no charge to transfer money.

However, if you use a credit card, you’ll pay 2.9% of the transaction plus a fixed fee of $0.30.

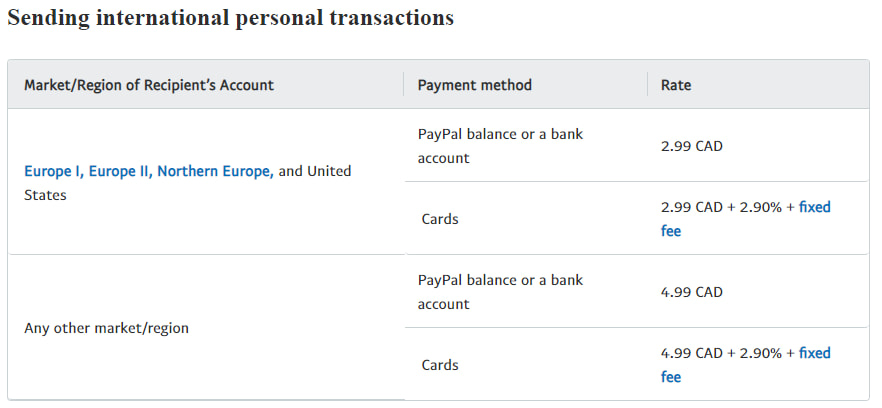

For international transfers, here’s what you’ll pay, based on where the money is going:

You can learn more about PayPal’s fees here.

How does PayPal work for receiving money?

So, you want to receive money from someone. Maybe you’re a student who needs a few bucks from your parents to make rent, or maybe you want to split the restaurant bill, or even pay the babysitter. PayPal can help.

There are 2 ways to receive money – either give the person your email address associated with your PayPal account, or request the payment directly using the app or website.

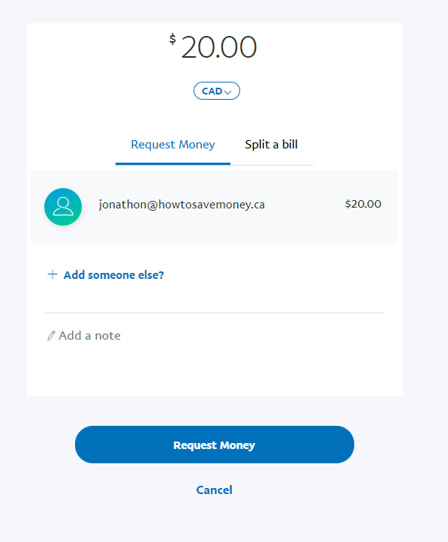

If you want to request a payment through PayPal, you simply click the “Request” button at the top of the page when you login.

Next, enter in the PayPal email address of the person you’re requesting money from. You’ll then be able to request a specified amount of money.

The other way is by telling someone how much money you need and the email address associated with your account. They can just send money through their own account manually.

The payment will automatically be added to your account – there’s no need to accept it or enter a password.

How does PayPal money transfer work?

PayPal money transfers are quite simple. You load your PayPal account balance from a linked bank account. You can also use a credit card, but we recommend avoiding that, since there are additional fees PayPal charges.

Once you have money in your PayPal account, you simply send it to someone else’s PayPal account. From there, they can use the money for whatever they like, including moving it to one of their linked bank accounts.

How do refunds work on PayPal?

Make a purchase online through PayPal, and need to make a return? How you get your money back depends on what you used to make your payment.

If you used a credit card, your refund will simply get put back on your credit card.

If you used your PayPal balance, your refund will get added back to your balance. And of course, if you used both, the appropriate amounts get put back in their original form of payment.

How to get your FREE cash back via PayPal

Want some FREE money to add to your PayPal balance? creditcardGenius is here to help.

Thanks to our GeniusCash program, you can earn free money when you get approved for select credit cards.

We can send your money to a PayPal account of your choosing (as well as via Interac e-Transfer).

You can see all of our current GeniusCash offers here.

4 ways to use PayPal

For the average person, there are 4 major ways PayPal can be useful.

1. Use PayPal for online purchases

If you shop online, one way you can make your payment with many retailers is by using PayPal. And when you go to pay, you can choose to either use your balance, pay with a credit card, or both.

If you don’t have a credit card, it’s one way you can shop online without one.

2. Send money to friends and family

As shown earlier, PayPal is a convenient way to send (and receive) money to family and friends.

And it’s easy to send money to anyone almost anywhere in the world. As long as you know what their PayPal email is, you can send money.

3. Receive payments

If you’re running a small business of any kind, PayPal is one way you can receive payments.

You can use it for online shopping payments, either by manually requesting money, integrating PayPal with your site, or getting paid via a QR code. And for more complicated purchases, you can even send invoices or estimates if you need to.

4. Donate and fundraise

If you’re feeling generous, one thing you can do with your balance is make a donation to charity.

PayPal has plenty of different charities to give money to, so there’s sure to be a cause you may want to support.

They even allow you to donate $1 to your favourite charity right at the checkout of other purchases – making it very easy to support a good cause.

You can see the various charities here.

3 benefits of PayPal

What makes PayPal stand out? Here are 3 things to like about it.

1. Easy to send payments

If you’re the kind of person who sends and receives money from others frequently, PayPal is an easy way to send money to someone else, and even ask to receive it.

There are even ways to transfer money without incurring fees, as long as you both live within the same country.

2. A way to make online purchases without the use of a credit card

When shopping online, you often can’t simply use your debit card to make your purchase (unless it has the Visa or Mastercard logo on it).

However, if the merchant accepts PayPal, you can use your PayPal balance to make purchases. This opens up the door for teenagers, people without credit, and even people with low credit scores to shop online.

3. Easy way to accept online payments and invoice

If you have a home business of any kind, PayPal is an easy way to get started selling things online. You can use PayPal to accept payments for anything you may want to sell, and get the money put straight into your PayPal account.

If you have invoices to send, you can use PayPal for that too, so you can get paid back sooner.

And because there are no fees for having a PayPal account, you can treat it like a free business chequing account.

2 downsides of PayPal

And here are some things you’ll want to keep in mind with PayPal.

1. Can’t be used for all purchases

Money in a PayPal account is nice to have, but with the exception of sending money to others or making purchases online, you can’t use it for much else.

To make it more accessible, you have to transfer it to a linked bank account – which can take a few days. You can also pay a fee to speed things up, but that just means more money is spent just for the privilege of using your own money.

2. Hidden fees on international transactions

When it comes to sending money internationally, the fee structure can be complicated (as seen in the screenshot above).

There may also be hidden fees PayPal doesn’t show. For example, we did a comparison of PayPal vs. Wise on a CAD to USD transfer of $1,000, and we found more than $30 of hidden fees they didn’t mention. These were hidden in the exchange rate.

PayPal alternatives

Are there other alternatives to PayPal? Of course there are.

Here are 2 different products you can use when it comes to either making payments or sending money to others.

Your basic bank account is one. You can send money to almost anyone with Interac e-Transfers and wire transfers, as well as make purchases with a debit card.

And there are prepaid cards – they’re somewhat similar to PayPal. Load your card with your own money, then go and spend it.

| PayPal | Chequing Account | Prepaid cards | |

|---|---|---|---|

| Ways to load your account | * Transfer from linked bank account | * Transfer from linked bank account * Direct deposits * Interac e-Transfers |

* Transfer from linked bank account * Direct deposits * Interac e-Transfers |

| Can you send money to others? | Yes | Yes, with Interac e-Transfers and wire transfers | Depends on the issuer |

| What can you use your balance for? | * Transfer money to others * Make online purchases |

* Make purchases with a debit card * Transfer money via Interac e-Transfers * Transfer money to other bank accounts |

* Make purchases anywhere credit cards are accepted |

| Can be used for online payments | Yes, if the merchant accepts PayPal | No | Yes |

Ways to load your account

For PayPal, the only way to load your balance is from a bank account. With the others, you can also do Interac e-Transfers and get direct deposits.

PayPal does offer the ability to send money to others using a credit card, but you can’t actually add to your balance with a credit card – the only way to add money is through a linked bank account.

Sending money to others

With your bank account, you can use Interac e-Transfers to send money to and receive money from other people. There’s no hassle of moving money somewhere else first.

But depending on your bank account, there can be a cost to these transfers. They typically cost $1.50 everytime you send one, however many bank accounts do waive this fee. Your bank should notify you of any fees before you send money.

You can also send wire transfers to almost any other bank account, but the fees will vary based on your bank.

With PayPal, you get an extra option. You can send money within Canada to someone else’s PayPal account for free if you use your PayPal balance. For a fee of 2.9% plus $0.30 cents, you can also use a credit card if you’re in a jam.

With prepaid cards, this feature depends on who issues your card. Some have free Interac e-Transfers to send money from your account, others can only send money to other members, and some don’t offer it at all.

What else you can use your balance for

This is where prepaid cards have a bit of an advantage. You can use your balance to pay for any purchases where credit cards are accepted. That’s more than PayPal, where your balance can only be used for online purchases, and that’s only where it’s accepted.

PayPal has a few other features, primarily if you have any kind of small business. You can use PayPal to accept online payments, and they also have the ability to send invoices. If you don’t have a business, you can also use your PayPal balance for funding charities, contributing to crowd funds, and more.

As for your bank account, you can use your debit card to make purchases almost anywhere in-person. Where it falls short is online, where it’s only accepted if you have a Visa or Mastercard debit card.

Use your account for online purchases

Again, a prepaid card can have an advantage here. You can use your prepaid Visa or Mastercard to make online purchases wherever credit cards are accepted (which are most places online).

With PayPal, you can make online purchases as long as the merchant has set up PayPal as an option (and this is usually more convenient than the credit card option).

For your bank account, you can only make online purchases if you have a Visa or Mastercard debit card. A regular debit card can’t be used.

Your thoughts

PayPal makes it easy to send money to anyone, as well as make online purchases without the need for a credit card.

Do you use PayPal? What has your experience been like?

Let us know in the comments below.

FAQ

What is PayPal?

PayPal is an online payment processor. With PayPal, you can use your balance for many basic tasks and a lot of the features are even free to boot.

What can PayPal be used for?

PayPal can be used for many things, but for many there are 3 main ways to use it:

- send money to and receive money from others,

- make online purchases, and

- accept online payments and send invoices.

You can also use your PayPal account to receive your GeniusCash payouts, if you’re eligible.

How can I set up a PayPal account?

To set up a PayPal account, all you have to do is go to PayPal.ca, and click “Sign up” at the top right corner to get an account opened. The full details on how to open one can be found here.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.