One of the most important and often most challenging tasks newcomers to Canada face is getting their finances in order. Without a SIN number or bank account, you can't get a job, get paid, secure a place to live, or file taxes – but understanding where and how to get started can be overwhelming.

The following guide is designed for all Canadian newcomers, explaining how to secure the necessary financial products and offering suggestions for top newcomer credit cards, bank accounts, and other services tailored to meet the needs of new Canadians.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Things to do – setting up your finances as a newcomer to Canada

Let’s start with a little checklist. What are some things you have to do?

First, there are 2 key things you’ll want to do:

- get a social insurance number, and

- get a bank account.

A social insurance number (SIN) is key to everything when it comes to money. Without it, you can’t access government programs or benefits. And as for a bank account, you can’t get paid or do anything money-related without it.

Once these 2 things are done, you can then move on to other parts of your finances, which can include:

- getting a credit card,

- setting up investments, and

- getting loans.

And as this is progressing, you’ll also have to make sure you file your taxes, which are typically due at the end of April every year.

While all this is going on, you’ll also want to work on improving your credit score, which is why we’ve listed getting a credit card as one thing to do.

How to get a social insurance number

When it comes to finances, getting a social insurance number (SIN) is step number 1. Without it, you can’t really do much.

Your employer will need it.

Banks may require it.

Credit card and loan companies will need it.

And you will need to provide it when you file your taxes.

In short, it’s a very important 9 digit number. How can you apply for one? The Government Of Canada has a handy site to get the process started.

Answer a few short questions, and you’ll be told all the documentation you need to get yourself a SIN number.

Setting up a bank account – your options as a newcomer

When it comes to setting up a bank account, you’ve got quite a few options to think about.

Online versus traditional banks

There are 2 kinds of banks. There are your more traditional banks, which have locations you can walk into and talk with advisors to find solutions to what you need.

Many of them also have packages for newcomers, which we’ll have more on in a bit.

There are also online-only banks. There are no physical locations, so everything is done online or by phone.

The tradeoff? Online banks have lower fees and tend to offer better interest rates on savings accounts.

Choosing the best bank for you

What are some things to consider when deciding on a bank? Here’s a little checklist of things to think about.

- Proximity: Which one is closest to where you live? The closest bank could make sense if you rely on public transportation.

- Convenience vs. fees: Is convenience really worth it if you’re drowning in monthly fees?

- Technology and customer service: How comfortable are you with doing ALL your banking online? Or do you prefer to deal with someone face-to-face?

Savings and chequing accounts

There are also 2 basic types of bank accounts – chequing and savings.

A chequing account is the primary account you use. It’s where you’ll pay bills, deposit your paycheques, and generally manage your day-to-day finances.

A savings account is as the name applies – for saving money. You put money in there, and you’ll earn interest on it.

Your bank options – packages for newcomers to Canada

Let’s go over your bank options, from what the major banks in Canada offer to the online-only banks.

Big banks in Canada

Each of the major banks in Canada has their own banking packages designed with newcomers in mind.

These banks typically charge monthly fees for their packages. But with these newcomers packages, they offer them for free for a set amount of time, which is typically a year. They may also come with welcome offers and can offer specific credit cards.

Here are the major banks with packages, and where you can go to learn more. You may actually recognize some of them – some of our banks have operations in other countries. For example, I was recently in the Dominican Republic and spotted a couple of Scotiabanks.

| Bank | Learn More |

|---|---|

| BMO | Learn More |

| Scotiabank | Learn More |

| RBC | Learn More |

| TD | Learn More |

| CIBC | Learn More |

| National Bank | Learn More |

Online-only banks for newcomers

What about your online only banks? There are two established financial institutions that offer no fee banking nationwide: Tangerine and Simplii Financial.

Whereas the no-fee monthly banking mentioned above is for up to 12 months, these banks offer permanent no-fee banking.

There are 2 things to consider:

- Tangerine and Simplii Financial have no traditional branches you walk into, and

- you do all of your transactions online or by phone.

Talking to someone in person and processing your documents face-to-face could make the application process much easier.

Here’s where you can see more details of what Simplii offers.

Simplii No Fee Chequing Account

Establishing your credit report as a newcomer with a credit card

Once you get a bank account opened, it’s time to start thinking about establishing your credit report, and with it, your credit score.

You’ll need a good credit score to get better rates on loans and mortgages and to be approved for better credit cards.

If it’s too low, you won’t be able to get approved for anything.

An easy way to start building your credit score is with a credit card. You won’t be able to get just any credit card you want – you’ll be limited at first to the more easily accessible ones.

But since you’re starting a credit file with a clean slate, it shouldn’t take too long before you’ll get an improved score. Here are some cards that you may consider as a newcomer to Canada to start your credit card journey.

But first – what goes into a credit score? Here’s our full guide as to how credit scores work.

Credit cards with lower credit score requirements

There are 2 credit cards that stand out to us for having lower credit score requirements. Both of these cards offer cash back rewards and have no annual fee.

First up is the Tangerine Money-Back Credit Card. It’s a unique credit card that lets you choose which categories you get to earn 2% cash back in. Here are your choices.

You get to choose 2 if you get your rewards applied as a monthly statement credit, and 3 if you get them deposited into a Tangerine Savings account. You’ll earn 0.5% cash back on all other purchases.

GC: $80

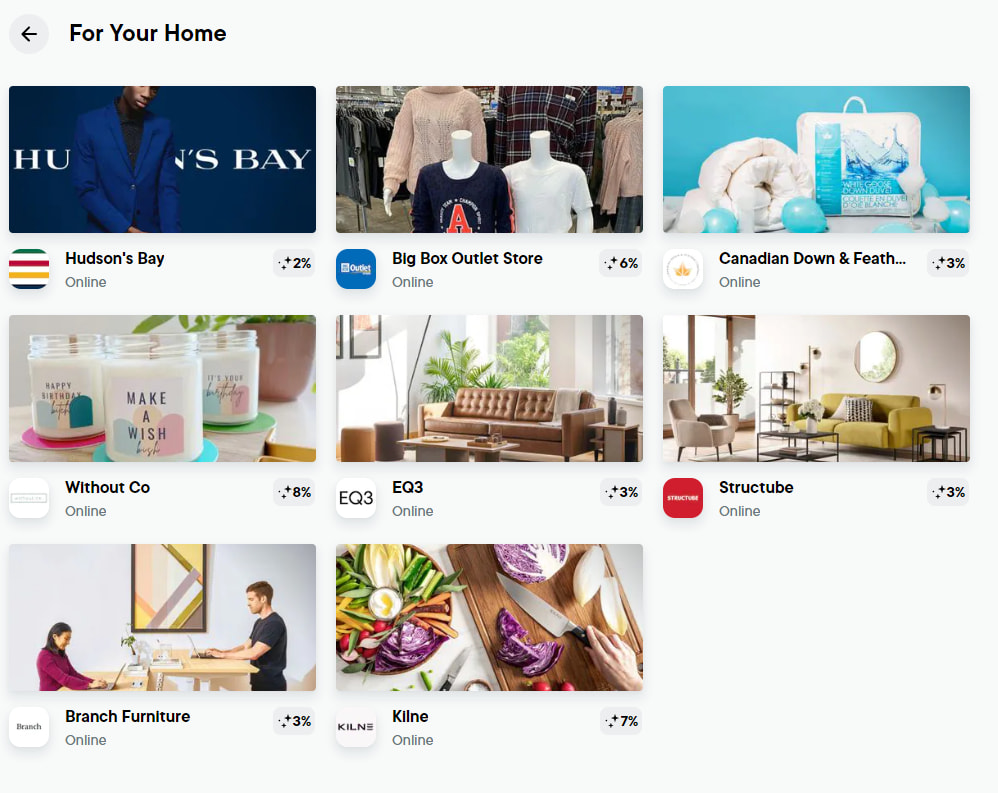

The other credit card to take a look at is the Neo Mastercard. With this card, you earn cash back at varying rates with over 10,000 retail partners – here are some examples.

Outside of partners, you won’t earn any cash back. However, Neo has a minimum cash back guarantee – you’ll be topped up to earning at least 0.5% cash back across all your purchases.

Secured credit cards

There’s a type of credit card that offers almost guaranteed approval – secured credit cards. With these credit cards, you’re required to send in a security deposit for them to issue a card to you. The minimum amount you have to provide varies by lender.

And that’s why almost anyone can get approved. If you fail to make a payment, they have your security deposit standing by to make your payment for you.

Here are 2 secured credit cards, both of which have no annual fee.

The best one? The Neo Mastercard we mentioned above comes in a secured version – the Neo Secured Mastercard.

Everything is identical, except you have to provide a security deposit of at least $50 to get a card issued to you.

The other option you can look at is the Home Trust Secured Visa Card. It doesn’t offer any rewards on purchases, and requires a deposit of $500.

It was one special feature – you’ll pay a slightly lower 2% foreign exchange fee instead of the usual 2.5%.

American Express credit cards

American Express operates in many countries all over the world. And if they operate in your home country, they can help you.

In select countries (Canada is one), you can transfer your American Express account to your new country. This way, you won’t have to apply for a new credit card without an established credit history, as Amex has it from your home country.

And then, you can start building your Canadian history with your new Amex credit card.

Here are some of the top Canadian Amex credit cards you can consider.

GC: $100

There’s one other thing you can try. Amex states this only works in the U.S., but it’s worth a shot in Canada as well.

If you call Amex, they may be able to look up your credit history in another country. It’s not guaranteed to work here in Canada, but it doesn’t hurt to at least ask.

Here’s where you can learn more about what Amex can do for you.

Investments – your options as a newcomer

Banks are set up, and your credit has been established. If you’re at this comfortable stage in Canada, you may be thinking about the next step: investing your money.

Here’s an overview of your options:

Personal accounts

The simplest avenue is personal accounts. There are no special tax implications with them. As your investments grow, you’ll simply be required to pay taxes on your capital gains.

Registered accounts

There are also registered accounts. These accounts have tax benefits associated with them. There are also limitations with them on how much you can contribute and when or how much you can withdraw.

Here’s an overview of the 2 most popular accounts.

Tax Free Savings Account

The first are Tax Free Savings Accounts (TFSA). These were introduced in 2009.

How it works – Canadians over 18 years old can contribute into their TFSA up to a maximum amount per year, which averages around $6,000 per year.

Any unused contribution room in one year can be carried over to the next year so your contribution room is always adding up. After you contribute, your money can grow tax-free and you can withdraw it whenever you want, also tax-free.

When you remove money from your account, you’ll regain that contribution room the following tax year.

Registered Retirement Savings Plan

Another way to invest and save on taxes is through an RRSP.

The amount you invest through your RRSP is tax deductible (it effectively reduces your taxable income by the amount you contribute) and grows tax free as well.

As with the TFSA, there is a limit to how much you can contribute in your RRSP per year which is 18% of your income from the previous year. This amount can be carried forward to future years if not used fully.

Unlike TFSA, withdrawals from your RRSP are taxed at your current income tax rate. This is because RRSP is meant to house your money long-term until you retire.

To get the best value from your RRSP, you want to contribute in years when your income is high and withdraw when your income is lower. Be sure to use your TFSA for low income year contributions (or just max it out if you can).

3 ways to invest

You can hold almost any type of investment with personal and registered accounts.

There are lots of ways to invest, including:

- mutual funds with the help of a financial advisor,

- do-it-yourself index investing,

- using a robo advisor,

- buying individual stocks, or

- maybe investing in a property.

For now, we’ll discuss the first 3 briefly and provide additional resources for further reading.

Mutual Funds

A mutual fund is a group of stocks and bonds overseen by a fund manager who buys and sells mutual funds on behalf of the group of people invested.

As an investor, you own shares of the companies that belong in mutual funds you’ve invested in.

As you get settled and start getting finances in order, you may get a call from a financial advisor who sweet-talks you into managing your hard earned money. But before you do, make sure you do your due diligence. Asking these questions may be a good place to start:

- What asset allocation do they recommend for you?

- How are mutual funds recommended compared to index?

- How much would their management fees (Management Expense Ratios or MERs) be?

- Are there any extra fees for buying or selling the funds they recommend?

If you’re looking to learn more about investing in Canada, check out these 3 books:

- The Millionaire Teacher

- Wealthing Like Rabbits

- What’s Good, Bad and Downright Awful in Canadian Investments Today

Do-It-Yourself (DIY) Index investing

There is no doubt that DIY investing gives you the lowest MERs – and therefore the maximum profit from your investment.

The problem: you need to know what you’re doing.

You’ll need to do lots of research and reading on the subject to be comfortable. And once you’re comfortable with the investing knowledge you’ve gained, the danger becomes overconfidence and making emotional short-sighted decisions.

One approach to DIY investing that minimizes short-sighted and emotional decision-making is the couch-potato approach. A different topic altogether.

Here’s our guide to direct investing, and a couple of options as to where to put your money.

Robo advisors

If mutual fund MERs hold your investment returns back and DIY investing is too time-intensive, the middle ground could be investing with robo advisors.

With a robo advisor, a computer algorithm invests your cash for you. There is a person that oversees everything, but they don’t make decisions. This way, there’s no overreacting to what’s happening in the market.

Here’s a few advisors you can look at.

Newcomers guide to filing your taxes

Filing your taxes for the first time can be daunting and confusing. Luckily, the Canada Revenue Agency (CRA) has a resource that sets out a step-by-step guide on how to do your taxes.

Start a folder for your tax slips, pay stubs, child care receipts, education receipts, and other deductions, credits, and expenses. When in doubt, keep the receipt for now, and then find out if you’ll need it to file your taxes later.

Many online tax software programs can pull some of this info from the CRA for you.

Get help filing your taxes

If your total family annual income is between $30K to $40K, you could qualify to get help by getting your taxes done at a free tax clinic provided by the government. These are offered between February and April each year. Here’s a list by province.

Online tax software

Hiring an accountant is expensive and doing your taxes yourself by paper is very time consuming and confusing. Good tax software will make filing your taxes so much faster and easier than doing it yourself.

Here are some options to consider.

Your stories as a newcomer in setting up your finances

Hopefully we’ve provided some useful information you can use to help get your finances started in Canada.

What are your stories in setting up finances?

Any tips to share?

Let everyone know in the comments below.

FAQ

What are some things to do when starting out as a newcomer in Canada?

When it comes to finances, there are 2 key things you'll want to do: set up a social insurance number and set up a bank account. Once done, you can move onto things like getting a credit card.

Once done, you can move onto things like getting a credit card.

What are some options for bank accounts as a newcomer to Canada?

There are quite a few choices when it comes to getting a bank account. There are traditional banks you can look at, and all of them offer packages for newcomers where they waive their monthly fees for a set period of time.

You can also look at an online only bank. These banks have no fees at all, but it comes at the expense of only being able to bank either online or by phone.

What are your credit card options as a newcomer to Canada?

You have a few options for credit cards as a newcomer. Tangerine and Neo offer credit cards with lower credit score requirements. There are also secured credit cards which offer almost guaranteed approval.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner  $80 GeniusCash + Up to $100 bonus cash back** + No annual fee.*

$80 GeniusCash + Up to $100 bonus cash back** + No annual fee.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments