Please note welcome bonuses change all the time - the credit card details you see here were accurate as of inital writing.

American Express recently launched a new offer for the Marriott Bonvoy American Express – the best it's ever had, and an offer I couldn't say no to. I also recently got the American Express Gold Rewards. Putting these together, I have the potential to earn over 267,000 Marriott Bonvoy points in the next year.

This certainly won't be for everyone – it involves 2 premium cards with annual fees. You have to spend quite a bit on these cards to get all the points, and one of them requires a couple of tricks to get you to that final eye-popping points number.

If this interests you, here's my full strategy. That total you see includes the points earned on those purchases. On top of that, I've earned a few other discounts as I use these cards. The whole package has an estimated savings of $2,540.

Key Takeaways

- Using 2 Amex cards, I'm looking at earning 267,000+ Marriott Bonvoy points in a year.

- The cards being used are the Marriott Bonvoy American Express and the American Express Gold Rewards.

- Combining the points earned, other bonuses, and card features, I'm looking at estimated savings of $2,540, which includes annual fees paid.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Quick Amex credit card details

First, here are the quick details on both of these cards.

| Marriott Bonvoy American Express | American Express Gold Rewards | |

|---|---|---|

| Welcome bonus | Up to 110,000 points | Up to 60,000 points |

| Earn rates | * 5 points per $1 spent at Marriott properties * 2 points per $1 spent on all other purchases | * 2 points for every $1 spent on gas, groceries, drugstores, and travel * 1 point for every $1 spent on all other purchases |

| Special features | * Annual free night certificate * Automatic Silver Elite Status * 15 Elite night credits | * $100 annual travel credit * 4 free lounge passes at Plaza Premium Lounges in Canada |

| Insurance coverage | 8 types | 11 types |

| Annual fee | $120 | $250 |

| Income requirements | None | None |

Marriott Bonvoy American Express

The easiest part of getting these points involves the Marriott Bonvoy American Express. If you just want a head start on a points bank or want to keep it simple, this card alone will get you up to 110,000 points.

The offer on this card is only for a limited time – until August 14, 2025.

Here’s how you can earn those points:

- 65,000 points after spending $3,000 in the first 3 months

- 30,000 points after spending $20,000 in the first 12 months

- 15,000 points when you make a purchase between months 15 and 17

Translation: I need to spend $20,000 in the first year and keep the card for another year.

It will take a little focus, but I won't have any problems getting it. I'll basically use this card as much as possible until I reach that $20,000 in spending. I should receive all those points once I hit the spend thresholds (I don't believe I have to wait the full year for those 30,000 points).

Now, I'm also earning points on my everyday spending at these rates:

- 5 points per $1 spent at Marriott properties

- 2 points per $1 spent on all other purchases

I'll assume I won't be staying at a Marriott, but spending $20,000 on the card will earn me another 40,000 Marriott points.

The total so far: 150,000 Marriott Bonvoy points.

Marriott Bonvoy American Express benefits

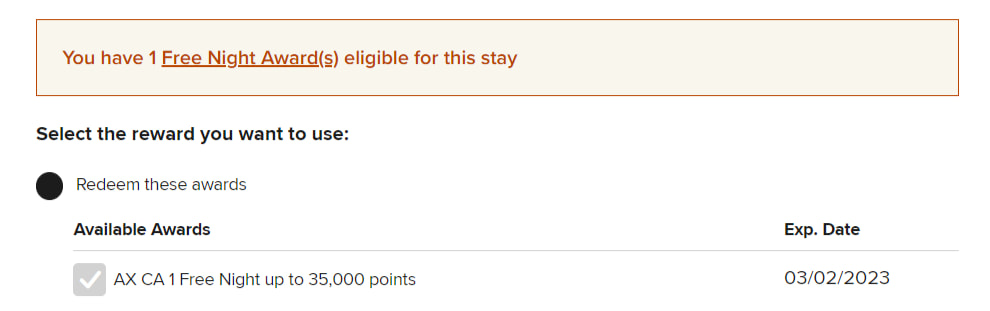

Since I’m keeping the card for another year, I’ve unlocked the annual free night. Every year you keep this card, you'll get a certificate for a free night stay worth up to 35,000 reward points. It looks like this when you go to use it:

And every time you stay, you're getting Silver Elite status, which comes with these benefits:

While there’s nothing monetary here besides some extra points, you’ll enjoy some nice perks on your next stay.

Adding it up

The cost for all this? We've paid the annual fee twice, so that totals $240.

But, we've gotten 150,000 Marriott points and a free night worth up to 35,000 points. Our average value for a Marriott point is a little under 1 cent at 0.97 cents.

The total earn is worth up to $1,795. Subtract the $240 in annual fees and I’m still up $1,555.

American Express Gold Rewards

Now for the second part of this big bonus: the American Express Gold Rewards. This card collects Amex Membership Rewards, which can be transferred to Marriott Bonvoy.

The welcome bonus is 5,000 points for every month you spend $1,000 in the first year – a total of 60,000 points. On those $12,000 in purchases, you’ll also earn regular rewards:

- 2 points for every $1 spent on gas, groceries, drugstores, and travel

- 1 point for every $1 spent on all other purchases

I won't know the exact split on spending, but I'll assume half of it will go towards the bonus categories. That gives me another 18,000 points, for a total of 78,000 Membership Rewards points earned.

Transferring Amex points to Marriott Bonvoy

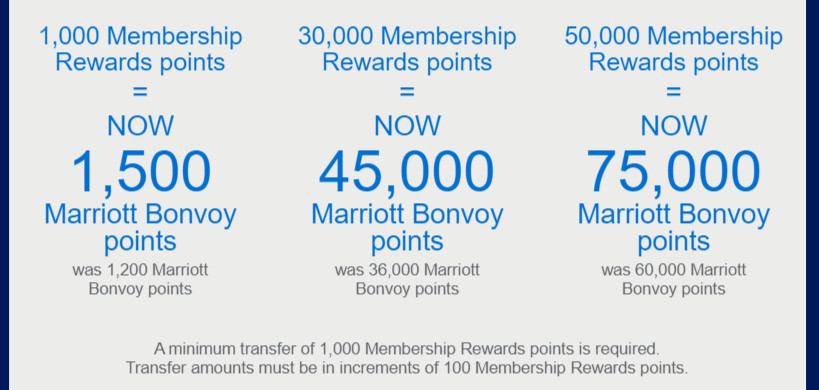

Amex Membership Points transfer to Marriott Bonvoy at a rate of 5:6. That is, 5 Amex points become 6 Marriott points – a 20% increase. That turns my 78,000 points into 93,600 points.

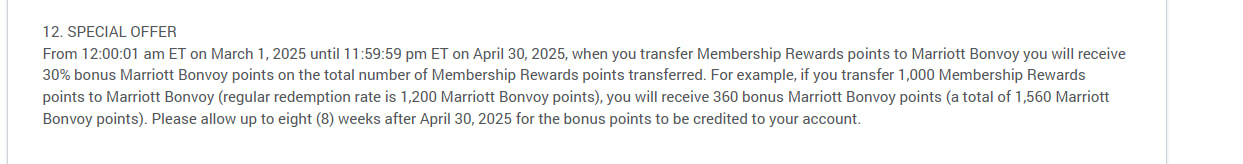

But – and this is key to get to that grand total of 267,000 – Amex periodically runs bonus offers when you transfer points to Marriott, like this 30% bonus:

The offers do change, though. Here's another example offer, back when I had the American Express Platinum card, for a 25% bonus:

These offers multiply on top of each other. Using the 25% offer as my baseline, I get another 25% bonus on top of the transferred amount (not the initial amount) – my 93,600 points then become 117,000. We've come a long way from the initial 78,000 Membership Points I earned.

Depending on the next bonus Amex offers, it could even be a little more.

Amex Gold Rewards features

Before getting into what this offer cost, here are the 2 key benefits this card includes.

- Annual $100 travel credit. You get access to this credit right away. Make any travel booking through American Express Travel that’s at least $100 and you can apply the credit. It's an easy $100 saved.

- Airport lounge access. This card includes 4 free passes to Plaza Premium Lounges in Canada. It also includes a Priority Pass membership, but you have to pay for entry into the lounges.

Adding it up

I only need to keep this card for 1 year to get everything, so that will cost $250 in fees. In exchange, I’ll receive at least 117,000 Marriott points and save $100 on travel.

Total savings:

- 117,000 Marriott points = $1,135

- $100 travel credit

- ($250 annual fee)

- Total savings = $985

Putting it all together

Considering the value of the points, other benefits, and annual fees, I'm looking at $2,540 in savings. The actual amount will vary – it will depend on what I actually get for my Marriott points – but this is a decent estimate.

Here's the summary:

- 150,000 points from the Marriott Amex – $1,455

- 35,000-point annual free night – $340

- 117,000 points from Amex Gold Rewards – $1,135

- $100 travel credit – $100

- Marriott Bonvoy annual fees – ($240)

- Amex Gold Rewards annual fee – ($250)

- Total Estimate – $2,540

I have a little strategy to make sure I get all the bonus points: When my billing cycle starts for my American Express Gold Rewards (which is the 7th of every month), I use it until I've reached the $1,000 in monthly spending. After that, everything goes on my Marriott Bonvoy Amex, which will also be used for any purchases larger than $500.

As for keeping the American Express Gold Rewards past the first year? That I'm unsure of. If I want to keep earning Marriott points, it may be best to turn to the American Express Cobalt Card, which earns up to 5 points per $1 spent and has an annual fee of $155.88. Combined with Marriott transfer bonuses, it increases to 7.5 points per $1.

The Gold card is a more premium card – and in my experience with Amex, these tend to get better offers that can lead to more savings. Basically, my commitment to the Gold Rewards card is 1 year, and then "we'll see."

Lastly, I don't necessarily have to transfer my Membership Rewards points to Marriott points. I could move them over to Aeroplan 1:1 for free flights, or use the Fixed Points Travel Program. I won't use them for statement credits or any travel – they're only worth 1 cent and with the Marriott bonuses combined, it's not worth it. With the other options, I'll need at least 1.5 cents per point to make it worth it.

Get some bonus points for adding extra cardholders

There's one last bonus which I did take advantage of but is not in the totals above. For each card, if you add an authorized user to the account, you'll get 1,000 bonus points.

The Marriott Bonvoy Amex has no extra card fees, and with Gold Rewards you get 1 additional card for free (they're $50 after that). With the Amex transfer bonuses to Marriott, that's another 2,500 Marriott points you can add between the 2 cards.

The final word

Combining credit card offers isn't for everyone, but done right, you can score some big future savings.

If this offer interests you, let us know in the comments below – or share any other thoughts you have on Marriott's offer.

creditcardGenius is the only tool that compares 126+ features of 231 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 231 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments