It's been a wild last month for the Air Miles program, with Air Miles declaring bankruptcy and BMO's intent to purchase the program.

One question we asked (of many) – what would happen with American Express Air Miles credit cards?

Well, now we have our answer for that one.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

American Express discontinuing their Air Miles credit cards

American Express is reacting to BMO's purchase of Air Miles.

First, as of April 10, 2023, all of Amex's Air Miles credit cards were no longer available to new cardholders.

These credit cards are:

- American Express Air Miles,

- American Express Air Miles Platinum,

- American Express Air Miles Reserve,

- American Express Air Miles Business, and

- American Express Air Miles Business Gold.

Here's the official statement from American Express:

"Acquisition offers for American Express AIR MILES products are currently not available. We [American Express] look forward to partnering on a number of acquisition offers for alternative American Express products which provide access to a variety of benefits and services."

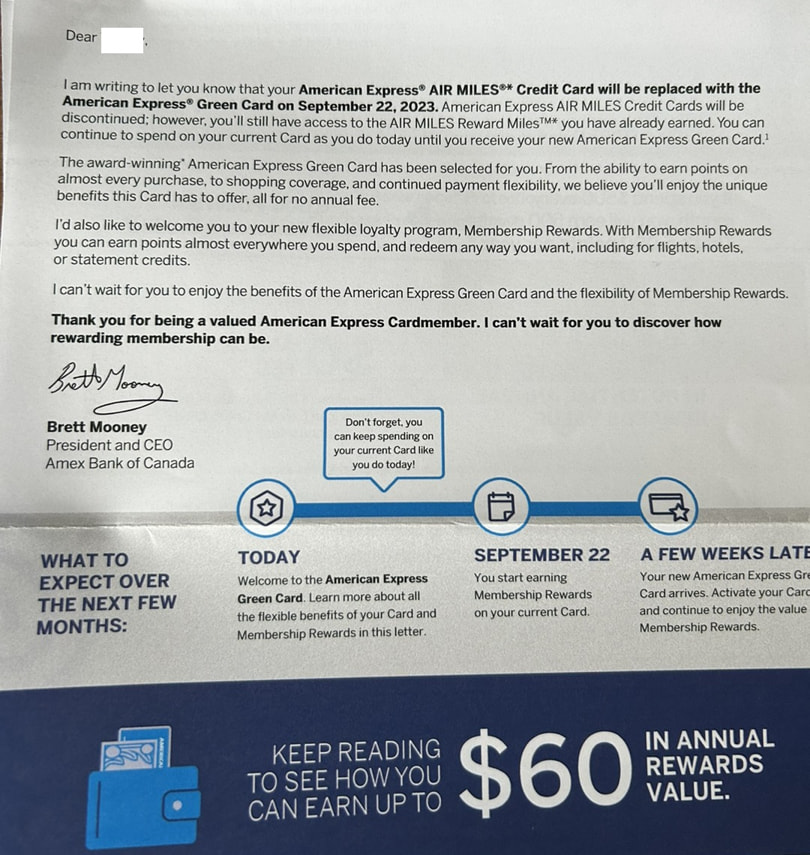

However, Amex is completely ending their Air Miles partnership on September 22, 2023. If you have an Amex Air Miles card, you may have received a letter from Amex stating the change and your new card.

Members are being automatically transitioned to a Membership Rewards card. In the case above, it's the American Express Green Card.

You'll still be able to collect Air Miles on your existing credit card until your switchover date.

Alternative Amex cards

If you have an Amex Air Miles card, here are the details on their 4 personal Membership Rewards cards they offer. Your letter will indicate which card they are going to transition you to.

We can't say for certain which cards are involved, but this would be our best guess based on the letter above and trying to match annual fees as best we can. If you received a letter already, leave a comment as to which card you're getting moved to.

- Amex Air Miles – Amex Green

- Amex Platinum Air Miles – Amex Cobalt

- Amex Reserve Air Miles – Amex Gold Rewards (could possibly be the Amex Platinum card as well)

If these cards don't interest you, you can always call Amex and let them know you want something different. In my experience, Amex provides excellent customer service and I'm sure they'll be happy migrating you to a product of your choice.

You can choose cards offering cash back, Aeroplan points, Marriott Bonvoy points, or a different Membership Rewards card if you're not interested in the card American Express has selected for you.

You can review all current American Express credit cards here.

| Amex Credit Card | Welcome Bonus | Earn Rates | Annual Fee | Apply Now |

|---|---|---|---|---|

| American Express Cobalt Card | Up to 15,000 bonus points (terms) | * 5 points per $1 spent on eligible groceries and restaurants * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases | * $155.88 | Apply Now |

| American Express Gold Rewards Card |  $125 GeniusCash + Up to 60,000 bonus points (terms) $125 GeniusCash + Up to 60,000 bonus points (terms) | * 2 points for every $1 spent on gas, groceries, drugstores, and travel * 1 point for every $1 spent on all other purchases | * $250 | Apply Now |

| American Express Green Card | 10,000 bonus points (terms) | * 1 point per $1 spent on all purchases | * $0 | Apply Now |

| American Express Platinum Card | Up to 100,000 bonus points (terms) | * 2 points per $1 spent on restaurants and travel * 1 point per $1 spent on all other purchases | * $799 | Apply Now |

1. American Express Cobalt

One card many of you will surely be transitioned to also happens to be the best credit card in Canada – the American Express Cobalt Card.

The rewards earned are unsurpassed by any other credit card in Canada.

First, we'll start with how many points you earn on purchases:

- 5 points per $1 spent on eligible groceries and restaurants

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

But that's also combined with high point values. Amex Membership Rewards are super-flexible, and offer you 4 ways to redeem your points for travel. This applies to all Membership Rewards cards.

- transfer to Aeroplan and 4 other programs – up to 2 cents per point (CPP)

- Fixed Points Travel Program – 1.75 CPP

- transfer points to Marriott Bonvoy or Hilton Honors – up to 1.16 CPP

- redeem points towards any purchase – 1 CPP

With these kinds of point values, you're looking at annual rewards of up to $1,080 based on a $2,000 monthly spend.

All for an annual fee of $155.88 that gets charged out as $12.99.

2. American Express Gold Rewards

The American Express Gold Rewards Card consistently ranks as one of the best credit cards in Canada. It offers an excellent combination of rewards and perks.

First, here's what this card earns for rewards:

- 2 points for every $1 spent on gas, groceries, drugstores, and travel

- 1 point for every $1 spent on all other purchases

But there's much more to this card than the rewards. Here are the major perks it offers:

- $100 annual travel credit at Amex Travel,

- 4 free passes per year to Plaza Premium lounges in Canada,

- Priority Pass membership (no free passes), and

- a metal credit card.

All this comes with an annual fee of $250.

3. American Express Green

On the no annual fee front, the American Express Green Card is the best no fee card available (sensing a theme with Amex?).

It earns a simple 1 point per $1 spent on all purchases. But when you factor in that each Membership Rewards point is worth up to 2 cents each, you're looking at a 2% return on everything.

4. American Express Platinum

For the best set of credit card perks you can get, look no further than the American Express Platinum Card.

First, let's talk earn rates for Membership Rewards:

- 2 points per $1 spent on restaurants and travel

- 1 point per $1 spent on all other purchases

But here are just some of the perks that it includes:

- annual $200 travel credit,

- automatic Marriott Bonvoy and Hilton Honors Gold status,

- unlimited airport lounge access at 1,300+ lounges around the world,

- Toronto-Pearson benefits, including priority security, and

- access to Fine Hotels and resorts.

The catch to all this is the $799, so make sure to use all the benefits to get your money's worth.

Alternative Air Miles credit cards

If you want to stick with Air Miles, or you're interested in getting an Air Miles credit card and want to see what's available, BMO is the issuer of Air Miles credit cards.

They offer 2 different cards – here's the quick rundown on each.

| BMO Air Miles Credit Card | Welcome Bonus | Earn Rates | Annual Fee, Income Requirements | Learn More |

|---|---|---|---|---|

| BMO AIR MILES World Elite Mastercard |  $150 GeniusCash + Up to 9,000 bonus miles, first year free (terms) $150 GeniusCash + Up to 9,000 bonus miles, first year free (terms) | * 1 Mile for every $12 spent * 3x the Miles for every $12 at participating Air Miles partners * 2x the Miles for every $12 spent at any eligible grocery, liquor, and wholesale stores | * $120 * $80K personal/$150K household | Apply Now |

| BMO AIR MILES Mastercard |  $20 GeniusCash + Up to 1,200 2,500 bonus miles (terms) $20 GeniusCash + Up to 1,200 2,500 bonus miles (terms) | * 1 Mile per $25 spent on all purchases * 3x the Miles for every $25 at participating Air Miles partners * 2x the Miles for every $25 spent at any eligible grocery, liquor, and wholesale stores | * $0 * $15K personal | Apply Now |

1. Best Air Miles credit card

The title of best Air Miles credit card belongs to the BMO AIR MILES World Elite Mastercard.

Here's what you'll earn for Air Miles on all your purchases:

- 1 Mile for every $12 spent

- 3x the Miles for every $12 at participating Air Miles partners

- 2x the Miles for every $12 spent at any eligible grocery, liquor, and wholesale stores

There are a few benefits with this card. First is the annual flight redemption benefit. Every year, you can save 25% on the cost of 1 Air Miles reward flight per year.

It also comes with automatic Air Miles Onyx status, along with 14 types of insurance.

The annual fee for all this is $120.

2. Best no annual fee Air Miles credit card

If you want a no fee Air Miles card, there's the BMO AIR MILES Mastercard.

Here's are the Air Miles earned by this card:

- 1 Mile per $25 spent on all purchases

- 3x the Miles for every $25 at participating Air Miles partners

- 2x the Miles for every $25 spent at any eligible grocery, liquor, and wholesale stores

Even though it has no annual fee, it still has 1 special perk: you'll get automatic Air Miles Gold status.

Your thoughts on American Express and Air Miles

Ever since BMO bought Air Miles, Amex leaving was always a possibility, and now we know for sure things are ending between Amex and Air Miles.

What are your thoughts on Amex discontinuing their Air Miles cards?

If you have one, what are you planning on doing?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 229 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 229 cards is for you.

×8 Award winner

×8 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.