Please note this news post is out of date. You can find current offers here.

Do you have a TD credit card?

Do you either carry a balance or not always pay it in full every month?

If so, changes are coming to interest payments on TD credit cards you may want to be aware of.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

TD credit cards to start compounding interest & charging overlimit fees

Yes, TD credit cards are starting to punish cardholders who tend to hold a balance more severely.

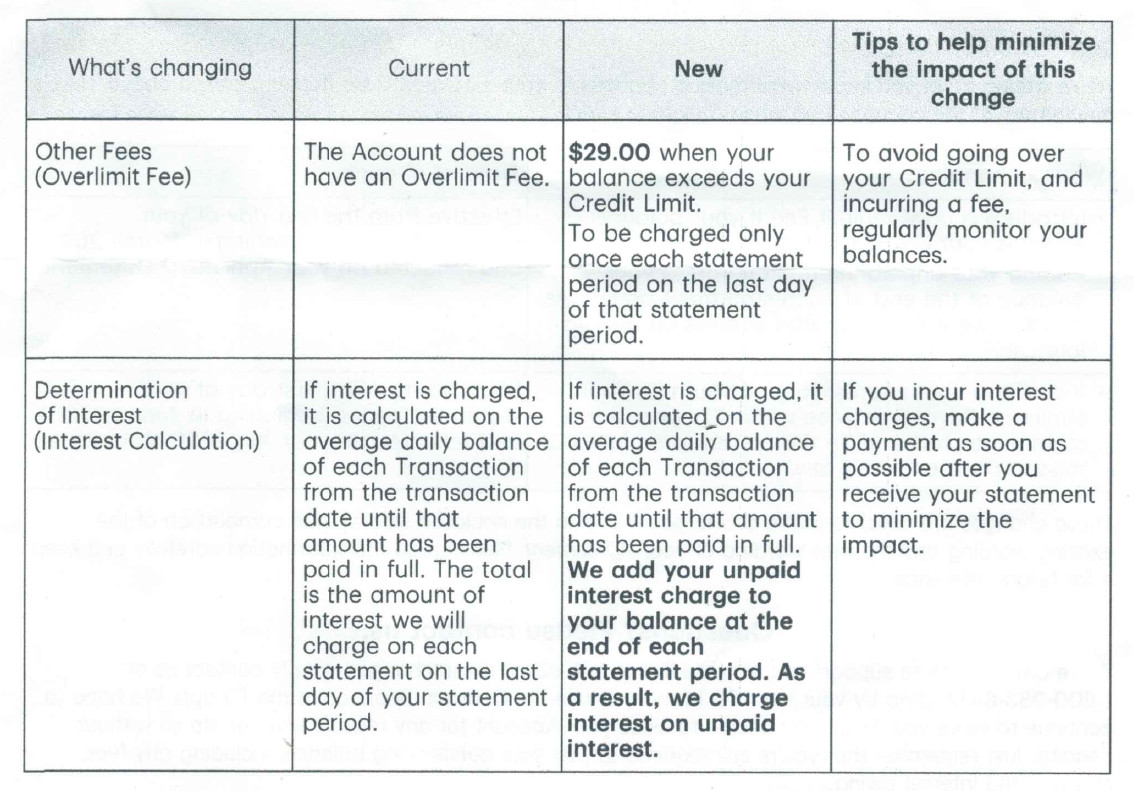

Not only will your interest start to be compounded (so you’ll be paying interest on your interest charges too), but they’re also introducing an overlimit fee of $29 for Visa Infinite cards (it exists already on other TD cards).

All this is a big reminder NOT to carry a balance on your credit card in the first place. There are loans with cheaper interest rates available for that if absolutely necessary.

These changes take effect on the first day of your March statement.

Everything was outlined in a letter received for a

How will this affect me?

Currently, interest is only calculated on your card balance and doesn’t include interest that has already been accumulated.

But starting in March, TD will add unpaid interest charges to your balance, and start charging interest on top of your interest.

So, say for example your interest rate is 20%, and you have an unpaid balance of $1,000. Your monthly interest charge would be roughly $16.95.

If you don’t fully pay off your interest by making at least your minimum payment, that $16.95 amount gets added to your statement balance, meaning next month you’d pay interest on a balance of $1,016.95 instead. That’s about an additional $0.29 in interest next month that you otherwise wouldn’t have had to pay – and it’ll only keep adding up.

If you have a TD credit card and pay your balance in full, there’s nothing for you to worry about as this won’t impact you.

But if you do carry a balance, your interest charges may start to rise, pulling even more money out of your wallet. However, payments you make get applied to interest charges first, so as long as you make at least your minimum payment (which for TD cards is $10 plus interest and fees charged) you should be alright.

Low interest credit card alternatives

If you have a large balance on your card, or don’t always pay in full every month – here’s an option for both cases.

Related: Balance Transfer Credit Cards 101

| Credit Card | Offer | Annual Fee, Income Requirement | Apply Now |

|---|---|---|---|

| BMO CashBack Mastercard | Balance transfer offer of 1.99% for 9 months (terms) | * $0 * 15K personal |

Apply Now |

| MBNA True Line Gold Mastercard | Low purchase and balance transfer rate of 8.99% (terms) | * $39 * None |

Apply Now |

Best balance transfer card for TD cardholders

GC: $20

Normally, we would recommend the

So, the best non-MBNA balance transfer card right now is the

You’ll get a balance transfer promotion of 1.99% for 9 months, with a low 1% fee to pay on the balance transferred. If you have a TD credit card with a large balance you want to transfer, it’s your best option right now.

Best low interest card

This offer is not availble to residents of Quebec. For residents of Quebec, please click here.

If you don’t have a balance to transfer, but don’t always make your payments on time or in full every month, then consider the

You’ll get a low permanent interest rate of 8.99% on both purchases and balance transfers, for a low annual fee of $39.

Your turn

What are your thoughts on these interest changes with TD credit cards? What about the new overlimit fee?

Are they making you consider other cards?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 227 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 227 cards is for you.

$20 GeniusCash + Up to 5% cash back + No annual fee.*

$20 GeniusCash + Up to 5% cash back + No annual fee.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.