Porter Airlines‘ big expansion is almost here. Soon they’ll be flying Canadians from coast to coast.

And as part of their new flights with Embraer jet aircraft, Porter is making some big changes to their loyalty program – VIPorter.

Here’s what they entail.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Expansion to VIPorter program on February 1, 2023

VIPorter is getting a pair of new tiers and expanded benefits for members starting on February 1, 2023, which coincides with the launch of Porter’s jet service based out of Toronto-Pearson airport.

Here’s the before and after comparison.

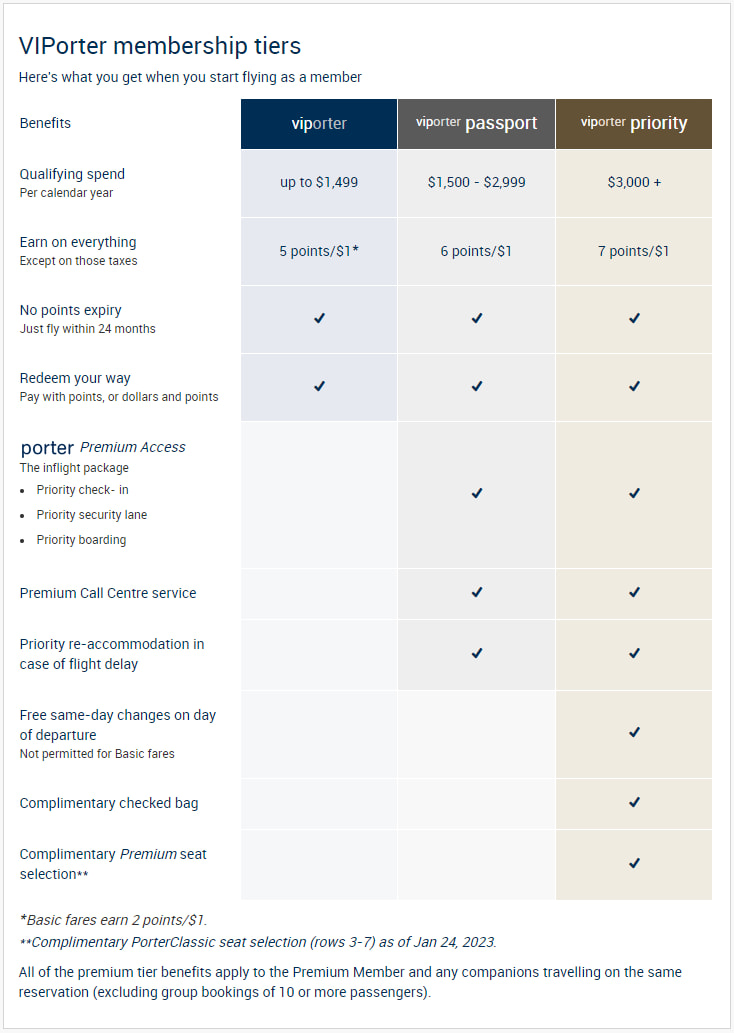

Current VIPorter and tiers

Currently, here are the tiers and benefits of VIPorter.

There’s an extensive list of benefits you’ll get once you move up in the program.

New VIPorter tiers and benefits

With the revamped program, there are now 5 tiers. You can view the full details on the new VIPorter here, but we have the details here.

Here are the tiers, how much you have to spend to qualify, and the basic benefits.

For most of us who are in the base tier, you’ll be earning 5 points per $1 spent on all fares. This is an increase from the 2 points per $1 spent on basic fares that Porter offered on their old program.

The only downside to this chart is you have to spend more to reach the next tier – an extra $500 per year. However, you’ll be able to carry over any unused spending to the next year to make it easier to qualify again (for all levels but basic).

But with that, you’ll get more benefits.

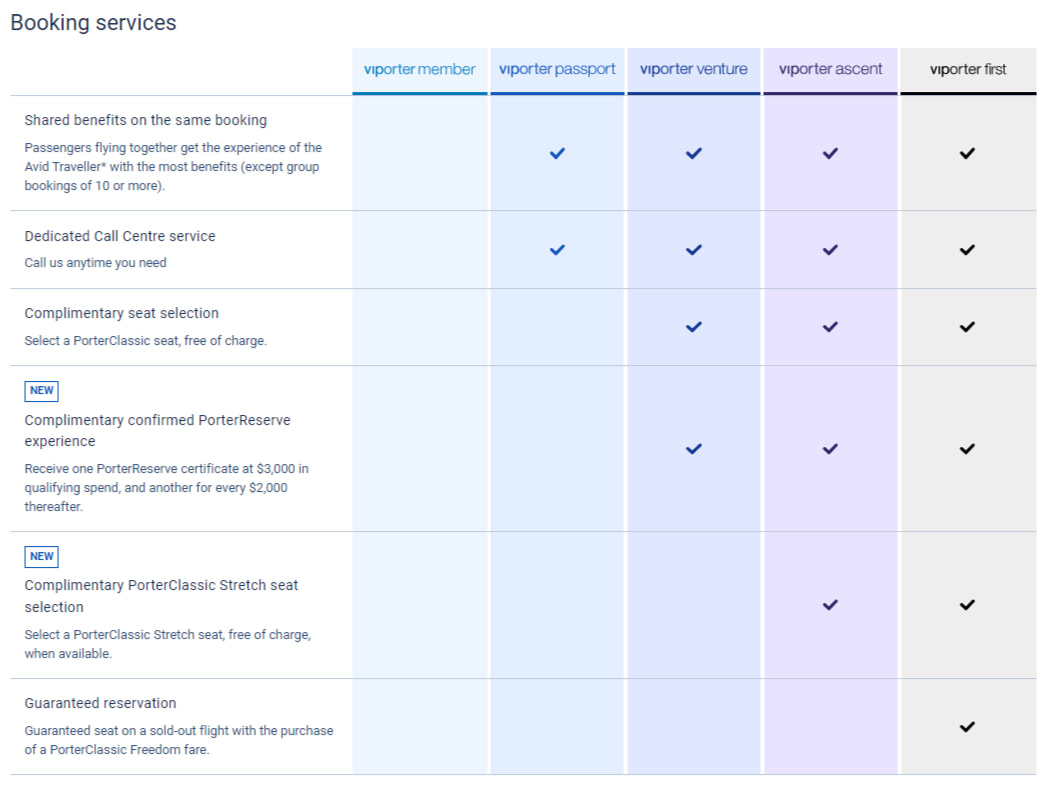

Here are the booking service benefits.

Those free certificates for Porter Reserve seats are nice, as you’ll get a better seat and a meal.

Then, here are the benefits for when you’re actually travelling.

Nothing really new here, other than basic members getting priority re-accommodation.

Overall, Porter has done well here, with more tiers and benefits to be found for the frequent flyer.

Get a free flight on Porter with the best flexible rewards credit cards

Looking to fly for free on Porter Airlines? Porter doesn’t issue any credit cards. If they ever do, we’ll be sure to let you know. (Be sure to sign up for our newsletter to get the news delivered to you.)

So you’ll have to make do with the best flexible rewards credit cards. These credit cards will let you redeem your points for travel.

Here’s a summary of the best options, both with and without annual fees.

| Credit Card | Welcome Bonus | Earn Rates | Annual Fee, Income Requirements | Learn More |

|---|---|---|---|---|

| MBNA Rewards World Elite Mastercard | 30,000 bonus points (terms) | * 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category) * 1 point per $1 spent on all other purchases |

* $120 * $80K personal/$150K household |

Learn More |

| American Express Cobalt Card |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) |

* 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases |

* $191.88 * None |

Learn More |

| Scotiabank Gold American Express Card | Up to 45,000 bonus points, first year free (terms) | * 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more * 5 Scene+ points per $1 spent on groceries, dining, and entertainment * 3 Scene+ points per $1 spent on gas, select streaming services, and transit * 1 Scene+ point per $1 spent on foreign currency purchases * 1 Scene+ point per $1 spent on all other purchases |

* $120 * $12K personal |

Learn More |

| National Bank World Elite Mastercard | Up to 40,000 bonus points (terms) | * 5 points per $1 spent on groceries and restaurants, up to $2,500 in total spend per month (2 points after) * 2 points per $1 spent on gas, electric vehicle charging, recurring bills, and travel booked through À La Carte Rewards * 1 point per $1 spent on all other purchases |

* $150 * $80K personal/$150K household |

Learn More |

| RBC Avion Visa Infinite | 55,000 bonus points (terms) | * 1.25 points per $1 spent on travel * 1 point per $1 spent on all other purchases |

* $120 * $60K personal/$100K household |

Learn More |

| Scotiabank American Express Card | 5,000 bonus points (terms) | * 3 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more * 2 Scene+ points per $1 spent on grocery, dining and entertainment, gas, daily transit, and select streaming services * 1 Scene+ point per $1 spent on all other purchases |

* $0 * $12K personal |

Learn More |

| American Express Green Card | 10,000 bonus points (terms) | * 1 point per $1 spent on all purchases |

* $0 * None |

Learn More |

| MBNA Rewards Platinum Plus Mastercard | 10,000 bonus points (terms) | * 2 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $10,000 spent annually per category) * 1 point per $1 spent on all other purchases |

* $0 * None |

Learn More |

If you collect plenty of Air Miles, you’re able to redeem your Miles for flights on Porter. If you want to stretch your Miles further, this Air Miles credit card offers an annual 25% discount (max savings of 750 Miles) on 1 Air Miles reward flight per year.

| Credit Card | Welcome Bonus | Earn Rates | Annual Fee, Income Requirements | Learn More |

|---|---|---|---|---|

| BMO AIR MILES World Elite Mastercard | Up to 7,000 bonus miles, first year free (terms) | * 1 Mile for every $12 spent * 3x the Miles for every $12 at participating Air Miles partners * 2x the Miles for every $12 spent at any eligible grocery, liquor, and wholesale stores |

* $120 * $80K personal/$150K household |

Learn More |

Your thoughts on Porter Airlines and VIPorter

Porter is rapidly evolving from a regional airline to one that flies across Canada.

What are your thoughts on Porter’s expansion and VIPorter changes?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.