The question is no longer if open banking will come to Canada – it’s when it will come. The 2025 fall federal budget specifically mentions a consumer-driven banking framework.

When exactly can we expect open banking? We don't know (and the government doesn't have an exact timeline either). But at this point, it's coming. And once it does, we have big plans in store for our GeniusCash app.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is open banking

If you're new to open banking, here's a summary of what it is, and how it can benefit you.

Open banking is a system that allows you to securely share your financial data with authorized apps and services. All of this will be done through the Bank of Canada. And what it accomplishes is allowing greater innovation in the fintech world by enabling new tools and features, while still keeping your information protected.

Say you have a bank account with one institution, 2 credit cards with 2 different issuers, investments elsewhere, and a mortgage with yet another bank. Right now, to check everything out, you have to log in to all these different places. With open banking, you could connect all these things into a single platform and see them all at once.

Want to budget better than using spreadsheets? You could connect your various credit cards and bank accounts in one place, and easily see what you're spending.

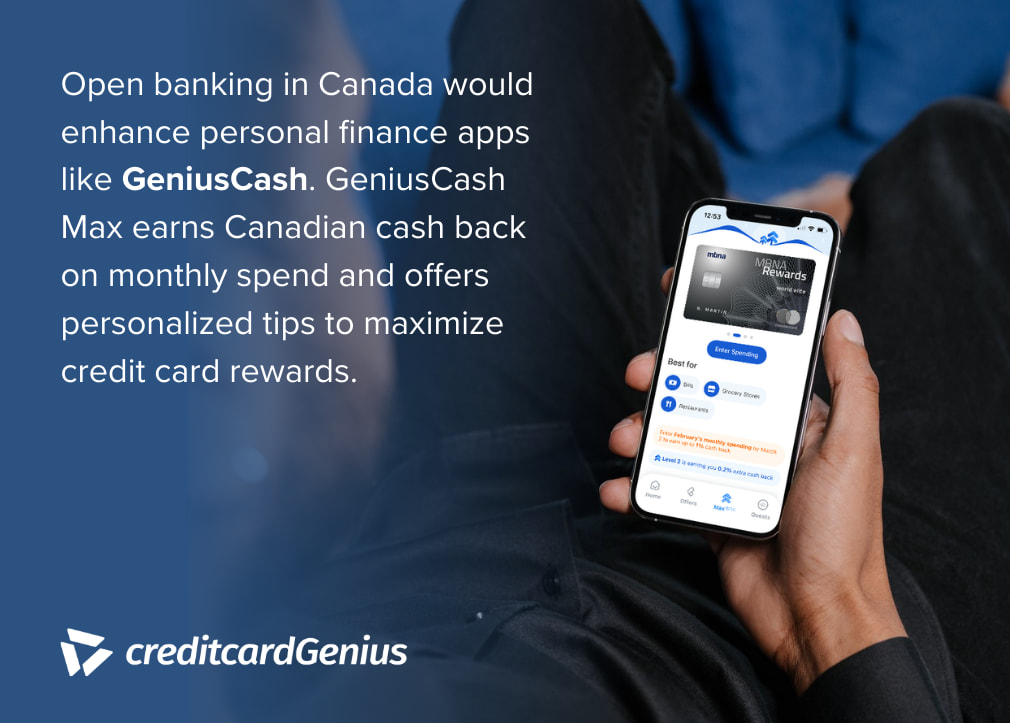

In fact, helping you track and optimize your spending is part of what we do with the GeniusCash app, and open banking would make this feature even better.

GeniusCash Max analyzes your credit card spend and provides recommendations to optimize your rewards. Right now, you select which credit cards you use and input your own monthly spend, but open banking could make all that automatic.

Without open banking, linking accounts directly requires a third-party partner, like Flinks or Plaid. We tried this solution, but moved away from it for a few reasons. It wasn’t fully reliable, not everyone was comfortable using it, and it wasn’t supported by all banks.

That’s why we updated Max to remove third-party partners, allowing Canadians to easily and securely earn monthly GeniusCash simply by entering their own spending.

With open banking, third-party services won't be needed for connection anymore. There won’t be a need to hand over your login info either; you’ll just have to let your bank know when you want an app to get access. The Bank of Canada’s formal review process will ensure your data is only available to accredited organizations, and data won’t be available without your consent.

What the government included in their budget

In the fall federal budget of 2025, the Canadian government included a full page chock-full of details.

The government acknowledged many of the issues we listed above – giving up your credentials and subjecting yourself to liability and security risks. Right now, 9 million Canadians provide their confidential login details to "screen-scraping" tools. With open banking, this won’t be necessary. You’ll be able to use fintech tools to optimize your finances without risking your credentials.

It's going to take a while, though. Consultation and policy work are set to take 12 to 18 months. After that, the government can move into phase 2, which introduces some actual functionality.

But rest assured, open banking is coming – we just don't know when.

Our current Prime Minister, Mark Carney, was governor of the Bank of England when the United Kingdom introduced open banking and saw the results. He's a big advocate for open banking, having seen first hand what it can do for Canadians.

Get ready for an even better Genius Max

GeniusCash Max will be greatly enhanced with open banking. It will make it much easier for us to connect to your banks and get you your GeniusCash.

But you don’t need to wait for open banking to start earning cash back. You can get started with Max today. Level up in the GeniusCash app, and input your monthly credit card spend to start earning real cash back on top of your credit card spend.

Learn more about how our Max feature currently works, and get ready for a vastly improved feature whenever open banking becomes a reality.

More updates on open banking

We are very keen on the introduction of open banking in Canada. We'll post updates as we see them, and our newsletter will deliver them right to your inbox.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.