Our new and improved Max feature on the GeniusCash app has landed. This update solves your frustrations with bank connections and supports almost all of the Canadian credit cards out there.

You can input your spending in just a few seconds, see if you’re on top of your points game, and even discover new ways to level up your money and rewards.

Discover how the new Max feature works and the reasons why we changed things up for the better.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is the GeniusCash app and Max?

GeniusCash is our very own cash back rewards app.

- Optimize your spend by category to get all the rewards you deserve

- Find and claim the latest GeniusCash offers

- Earn rewards by completing financial learning quests

- Use Max to earn up to 1% extra cash back* on your credit card spend

With our new and improved Max feature, you can add your credit cards to an in-app wallet without needing to connect to your bank. All you need to do is select your card and input your spend. Max will analyze your spending, show you what you’re getting for rewards, and even suggest cards that could earn you more rewards.

And on top of that, you can earn real cash back on all your spending, starting at 0.1% all the way up to 1%. Get a GeniusCash offer through the app or complete financial learning quests to level up and earn more.

How the new Max works

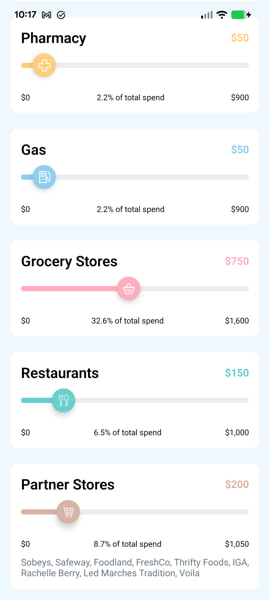

We've overhauled how Max works, completely removing third-party connections. Simply tell Max which credit card(s) you have in your wallet, and adjust the Max sliders for each of your cards to match your monthly spend for each category. Estimate your total spending in increments of $100 and your spending by category in $50 increments.

And that's all you have to do. It might take a little time to figure how much you're spending and get the category sliders just right, but you’ll quickly see that it's a much simpler system.

No more logging in to unreliable connections. No more missing out on GeniusCash because Flinks and/or Plaid can’t access your accounts. And most importantly, no more providing login details to third-party platforms.

Partner stores

The Max updates also give you a brand-new way to maximize cards where you receive bonus offers for spending at select stores – you can properly account for the rewards you're earning. This applies to cards like PC Mastercards at Loblaws stores, Scene+ cards at Sobeys, and Canadian cards at, well, Canadian Tire.

Before, your spending would have gotten lumped into the "grocery" or “general” category. Now, you can use the “Partner Stores” slider to enter this spend and make sure you’re getting the right bonuses at the right stores. Here's an example of what it looks like for one of our favourite cards, the Scotiabank Gold American Express Card.

Every month, you'll have until the 15th to enter your previous month's spending. That way, you can make sure to earn your rightful GeniusCash for the previous month’s spending, and you’ll have a heads-up on how you can maximize your spending for the next month.

New budget feature

Max also gives you a new breakdown of your spending, with an easy-to-read pie chart showing your spending breakdown by category.

This spending breakdown is available on both your overall in-app wallet as well as for each card you’ve added. And soon you'll also be able to see the actual cash spent in all categories, and not just the percentages.

Why we changed Max

The way Max used to work seemed simple on the surface – log in to your credit card accounts with Flinks or Plaid, and your transactions would automatically download and get categorized.

However, like many things financial, it wasn’t as straightforward as we had first hoped:

- Not all credit card issuers provided account access

- Plenty of miscategorized transactions

- Unreliable connections that needed frequent reconnections, or connections that wouldn't work at all.

The all-new Max feature eliminates these problems and simplifies the way you analyze and maximize your spending.

Here's hoping open banking comes to Canada

Open banking in Canada would fix the problems we encountered when we launched Max, offering easy and reliable connections to all your accounts and improved automatic categorization.

But it's not here in Canada. Yet. Here's hoping for open banking in the future, so that we can make it even easier to help you level up your money and rewards with GeniusCash Max.

Download GeniusCash to explore the new Max

Download or launch the GeniusCash app to add your cards and start earning rewards.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.