There’s been a lot to unpack with the new Aeroplan program. With big changes to both earning and redeeming miles, there’s been lots to sift through and think about.

And the fun doesn’t end with Aeroplan credit cards. The branded credit cards associated with the program are also getting some changes as well (none of this will apply to credit cards that allow transfers to Aeroplan).

Here’s what’s in store for cards issued by Amex and CIBC.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

New benefits for all Aeroplan credit cards

All Aeroplan credit cards will be receiving the same set of benefits when travelling with Air Canada. Whatever the current cards offer in Air Canada benefits will be going away, and are being replaced.

All of these changes will take effect on November 8. If you already have an Aeroplan credit card, there’s nothing you have to do, they will kick in automatically.

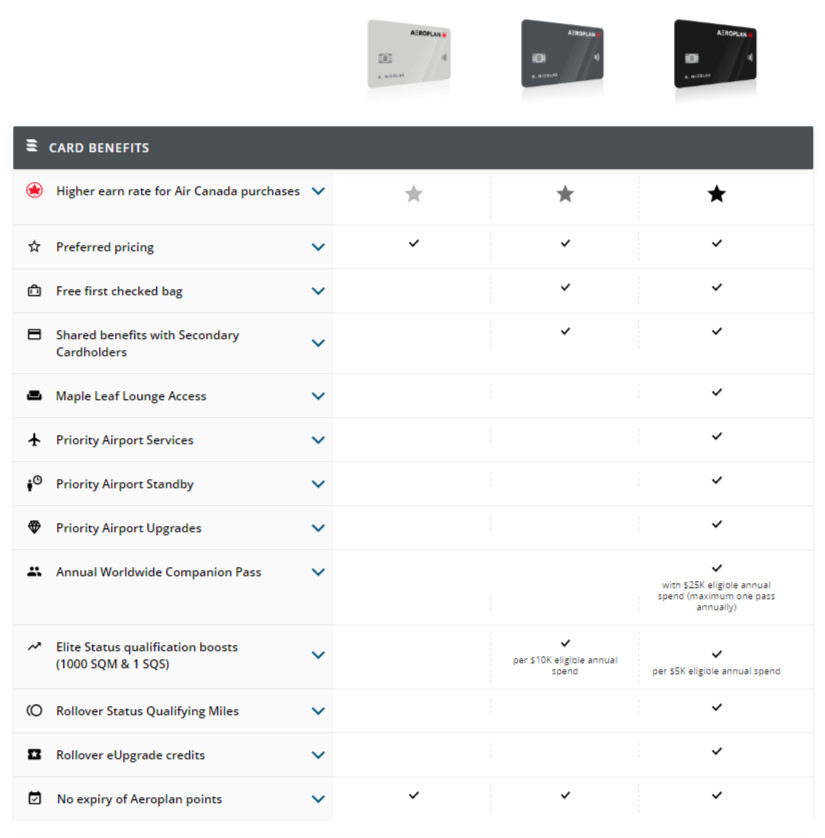

There are 3 tiers that a card can fall into. Note that there’s both a personal and business credit card benefits chart, but we’ll be focusing on the personal chart here.

You can read the full details on every perk here, but we’ll go over the bigger ones now.

Preferred pricing

Anytime you book a flight using your Aeroplan points, you’ll receive preferred pricing. You’ll need fewer points to book your rewards flight, just by having an Aeroplan credit card.

How many points can you save? There are no details on that yet. After the new program launches, we’ll be doing a deep dive on the value of the new Aeroplan program, and we’ll get an idea of how much you could save.

The best part? This perk is available on all tiers.

Benefits available to supplemental cardholders

Have some secondary cardholders on an account? The benefits are extended to them as well. Amex has an interesting twist to this as you’ll see farther below.

Free first checked bag

Right now if you have an Aeroplan credit card that has free checked bags, it’s limited in some way. For the high end premium Visa Infinite Privilege and Amex Platinum cards, you have a set number of free bags per year, and those are only available to the primary cardholder.

For Aeroplan Visa Infinite cards, you only get the first checked bag free for the cardholder, and only on Aeroplan flight rewards. Less than stellar.

But now? You’ll get the first checked bag free on every Air Canada flight! And, up to 8 companions travelling on the same reservation also get a free checked bag. A big step up in savings when you travel with Air Canada.

Elite status qualification boost

For the frequent flyer who gets elite status every year, having an Aeroplan credit card can help earn qualifying miles and segments.

Cards in the silver tier will earn 1,000 bonus Qualifying Miles and 1 Status Segment when you spend $10,000. If you’re in the black tier, you only need to spend $5,000 to get the same miles and segments.

Priority airport benefits

For those with cards in the black tier, a host of priority airport benefits are coming your way, and not just for the cardholder, but for 8 others travelling on the same reservation as well.

You’ll get:

- priority check-in,

- priority boarding,

- Maple Leaf lounge access (primary cardholder only), and

- priority baggage handling.

This is one area where some Aeroplan cardholders may see a drop in benefits. If you have an Aeroplan Visa Infinite card, you already get the first 3 when travelling on an Aeroplan rewards flight.

Annual worldwide companion pass

The last major benefit we’ll cover is the annual worldwide companion pass. Spend $25,000 annually on a black tier card, and you’ll get one companion voucher per year.

For $99, plus taxes, fees, and carrier surcharges, you can take another person with you on the exact same itinerary. And, there’s no limit to where you can use it. If Air Canada flies there, you can use your companion voucher to go there.

This alone can lead to some big savings, but only IF you’re able to spend the full $25,000 annually on the card.

CIBC Aeroplan credit card changes

Here we ahve CIBC, Aeroplan’s original credit card partner. All of their Aeroplan credit cards will be getting new names, on top of other changes that are in store.

CIBC Aerogold Visa Infinite

Starting with the CIBC Aerogold Visa Infinite, which will be joining the Aeroplan mid tier. Its new name will be the CIBC Aeroplan Visa Infinite.

The annual fee will be going up, from $120 to $139.

Like its twin, the TD Aeroplan Visa Infinite, a small change is in store for its earn rates. Right now, it earns:

- 1.5 points per $1 spent on Air Canada, gas, drugstores, and groceries, and

- 1 point per $1 spent on all other purchases.

It will be seeing a change to drugstore purchases, which will be decreasing to 1 point per $1 spent.

It will also be gaining mobile device and hotel burglary insurance coverage.

CIBC Aerogold Visa Infinite Privilege

The CIBC Aerogold Visa Infinite Privilege will be called the CIBC Aeroplan Visa Infinite Privilege, and will be joining the upper Aeroplan tier.

A big change is in store for the annual fee, going from $399 to $599.

The earn rates are going to see some big changes as well. Right now it earns:

- 1.5 points per $1 spent on Air Canada, gas, drugstores, and groceries, and

- 1.25 points per $1 spent on all other purchases.

When the changes come, it will earn:

- 2 points per $1 spent on Air Canada purchases,

- 1.5 points per $1 spent on gas, groceries, travel, and dining, and

- 1.25 points per $1 spent on all other purchases.

There are a few more changes coming to the card on top of this:

- new insurance coverage, including mobile device and hotel burglary, and

- NEXUS fee application rebate of up to $50 USD every 4th year.

CIBC Aero Platinum Visa

To be renamed the CIBC Aeroplan Visa, the current CIBC Aero Platinum Visa will be seeing some changes.

The biggest one is it’s going to be a no fee card, down from the current annual fee of $39.

The earn rates are also getting an improvement. Right now, this card earns 1 point for every $1.50 on all purchases.

After the change, here’s what it will be:

- 1 point per $1 spent on Air Canada, gas, and groceries, and

- 1.5 points per $1 spent on all other purchases.

American Express Aeroplan credit cards

Finally, we have American Express. Amex won’t have an entry level credit card, just cards that are in the top 2 tiers.

And, Amex has already decommissioned their existing AeroplanPlus credit cards, so they can’t be applied for at this time. These cards are getting new names, and brand new earn rates as well.

Amex AeroplanPlus Gold card

Joining the mid tier, the current AeroplanPlus Gold card will be renamed the

It’s not seeing any annual fee changes and will have a new earnings structure. It will no longer earn 1 mile per $1 spent on the first $10,000 (1.25 miles after that) – it will now earn:

- 2 points per $1 spent on Air Canada

- 1.5 points per $1 spent on restaurants

- 1 point per $1 spent on all other purchases

There’s one other twist to this card for supplemental cards. You can pay $50 for an additional card and the authorized user will gain access to the full benefits.

Or, you can pay no fee and simply accumulate points faster. The choice is yours.

Other than earn rates and the standard new Air Canada benefits, there’s no other changes in store with this card.

Amex AeroplanPlus Platinum card

The other card that recently was decommissioned will be known as the

It’s going to have a brand new earning structure, which previously was 1.25 points per $1 spent on the first $25,000 and then increased to 1.5 points thereafter.

Here’s what this card will now earn:

- 3 points per $1 spent on Air Canada

- 2 points per $1 spent on dining and food delivery purchases in Canada

- 1.25 points per $1 spent on all other purchases

Like the card above, you can also choose how much you want to pay for supplemental cards. $199 gets the authorized user access to the Air Canada benefits, or pay no fee and simply accumulate extra points.

The annual fee is increasing on this card, from $499 to $599.

Which Aeroplan card will you get?

There’s the overview of the new Aeroplan credit cards and what’s changing.

Which card will you go with? Or will you pass on Aeroplan credit cards for the time being?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 2 comments