Best Tangerine Credit Cards in Canada for 2026

Although there are only 2 to choose from and both are issued by Mastercard, the Tangerine Money-Back Credit Card is the best Tangerine credit card in Canada. It's slightly easier for the average Canadian to qualify for this one vs. its World Mastercard counterpart, and it still has top-notch earn rates.

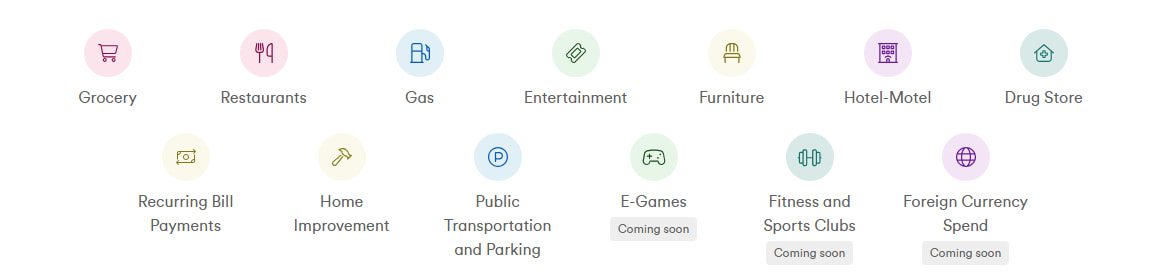

A standout feature of Tangerine credit cards is the ability to pick your own cash back categories. You can also adjust them from time to time, helping you maximize rewards and tailor earnings to your spending habits.

This article provides a detailed comparison of these Tangerine cards, highlighting their special features and limitations so you can make an informed choice between the two options.

Key Takeaways

- The Tangerine Money-Back Credit Card is the best Tangerine credit card in Canada.

- The Tangerine Money-Back World Mastercard has a slightly higher value than its counterpart, but this comes with stricter eligibility requirements.

- Neither Tangerine card has an annual fee, and both provide users with the opportunity to choose up to 3 cash back categories from a list of ten options.

- The earn rates for Tangerine credit cards are unexceptional, and they don't offer much for insurance.

Tangerine credit cards

Take a look at your Tangerine credit card options:

1. Best for the basics

Rewards:

- 2% cash back on purchases in up to 3 Money-Back Categories

- 0.5% cash back on all other purchases

The Tangerine Money-Back Credit Card is a fairly straightforward card with good earn rates on your selected categories. It’s also one of our top-ranked cards for students, applicants with limited credit history, or newcomers to Canada, thanks to its relatively low credit score requirements, no income requirements, and no annual fee. It can also be used as a balance transfer credit card, offering 1.95% interest on balance transfers for 6 months.

That said, the limited insurance coverage and poor 0.5% cash back rate on non-category purchases make it a basic card best used as a supplementary or starter credit card. Once you’ve built your credit history up, you can use the Tangerine card for your category purchases and a better earning card (we like the Scotia Momentum Visa Infinite Card) on your non-category purchases.

First-hand experience: "The Tangerine Money-Back Credit Card is a great option for newcomers to Canada. While many credit cards are out of reach due to limited credit history or low income, Tangerine stands out by offering one of the best cashback programs available to newcomers." — Team Genius member

2. Best for premium perks

Rewards:

- 2% cash back on purchases in up to 3 Money-Back Categories

- 0.5% cash back on all other purchases

While there are a lot of similarities between the Tangerine cards, the Tangerine® Money-Back World Mastercard®* has an edge because it offers more perks. You’ll enjoy a hefty welcome bonus: earn $120 bonus cash back when you spend $1,500 in the first 3 months. You’ll also receive mobile device and rental car insurance, as well as World Mastercard benefits like Mastercard Travel Pass provided by DragonPass, streaming offers, and discounts. The Tangerine Money-Back World Mastercard gives you 1.95% interest on balance transfers for 6 months, too.

Still, the Tangerine Money-Back World Mastercard has the same cash back rate on non-category purchases as the Tangerine Money-Back Credit Card – a meagre 0.5%. It also has income requirements of $50,000 personal or $80,000 household, making it much less accessible.

Tangerine Money-Back Credit Card vs. Tangerine Money-Back World Mastercard

This table shows compares the best features of both Tangerine cards, side by side:

| Tangerine Money-Back Credit Card | Tangerine Money-Back World Mastercard | |

|---|---|---|

| Annual fee | $0 | $0 |

| Cash back rewards | * 2% cash back on purchases in up to 3 Money-Back Categories * 0.5% cash back on all other purchases | * 2% cash back on purchases in up to 3 Money-Back Categories * 0.5% cash back on all other purchases |

| Income requirements | * $12,000 personal | $50,000 personal * $80,000 personal |

| Insurance coverage | 2 types | 4 types |

| Perks | * Welcome bonus: 10% extra cash back for the first 2 months (terms) * 15% H&R Block discount | * Welcome bonus: $120 (terms) * FlexiRoam * Airport lounge access * 20% H&R Block discount * Fubo TV |

Tangerine has announced a new Scene+ credit card, available on April 20, 2026.

Pros and cons of Tangerine credit cards

Since Tangerine isn’t as well-known as some of the big banks, here's a rundown of the pros and cons of holding a Tangerine credit card.

Tangerine card pros:

- No annual fees. Neither Tangerine card has an annual fee, which makes their bonus rewards categories that much better. With no fee, you'll have nothing cutting into your cash back profits.

- Balance transfer offers. If you’re carrying a balance on another credit card, Tangerine’s balance transfer offer can help reduce interest charges while you pay it off.

- Welcome bonuses. With easy-to-earn bonus cash back, you’ll enjoy some extra money in your account with these cards.

- Bonus cash back in up to 3 categories. You choose 2 categories that will earn you boosted rewards – and if your cash is deposited to a Tangerine savings account, you get to choose 3.

Tangerine card cons:

- Average rate of return. Tangerine's 2% cash back in up to 3 categories is an excellent rate of return for a no annual fee card… but it only applies to your selected categories. Spending outside your chosen categories means an interest rate of just 0.5%.

- Standard interest rates. Unless you take advantage of the balance transfer promo, you’re looking at standard interest rates of 20.95% across the board on balances you carry.

- Minimal insurance. Both cards offer basic extended warranty and purchase protection coverage, but the Tangerine Money-Back World Mastercard also provides mobile device coverage and rental car theft and damage. While useful, the package is less impressive compared to other premium cards.

- Few other perks and benefits. Many premium (and ultra-premium) travel rewards credit cards come with hundreds of dollars worth of extra perks and benefits to make your life a little bit more luxurious. Tangerine is lacking here, though it’s expected for no-fee cards.

Tangerine credit card insurance: What's included and what isn't

Tangerine credit cards aren’t known for their extensive insurance offerings, but here’s what you’ll get with both cards:

- Extended warranty for 1 year on purchases made with your Tangerine card

- Purchase protection that covers loss, theft, or damage on most new insured items for 90 days from the date of purchase

- Rental car insurance for theft and damage

- Mobile device coverage up to $1,000

- Travel Insurance, like trip cancellation, trip interruption, or emergency medical coverage

- Comprehensive travel benefits that you find in more premium cards (though the World card provides some travel-related perks)

How to choose the right Tangerine credit card for you

The most important thing to consider when choosing a Tangerine credit card is whether you meet the eligibility criteria for the Tangerine Money-Back World Mastercard. If not, you'll have to stick with the Tangerine Money-Back Credit Card, which offers many of the same features and benefits anyway.

If you do quality for the more premium option but are unsure whether it's worth it, ask yourself these questions:

- What kind of insurance coverage do you want? Will you use the mobile device and/or rental car insurance offered by the World Mastercard? If not, stick with the more basic Tangerine card.

- Will you use the World Mastercard benefits? If you don't travel often, perks like airport lounge access and access to FlexiRoam mobile phone plans won't be valuable.

- Do you want to do a balance transfer? The more premium card offers a promo balance transfer rate of 1.95% for 6 months.

- Would a discount on sports streaming services be valuable for you? Tangerine Money-Back World Mastercard users get a $30 discount on their first 3 months of Fubo sports streaming.

How to apply for a Tangerine credit card

If you're interested in applying for a credit card from Tangerine, you must be a Canadian resident and of the age of majority in your province or territory. Plus, you can’t have filed for bankruptcy in the past 7 years.

To apply, click one of our secure application links that will take you to Tangerine’s website. Then, complete an application online by providing info like your credit score, income levels, employment information, and contact details.

Once you submit the application, Tangerine will verify your information and approve (or deny) you for a card.

FAQ

Does the Tangerine credit card have travel insurance?

Unfortunately, neither of Tangerine's cash back credit cards includes travel insurance – though the Tangerine Money-Back World Mastercard does offer rental car insurance, which can be very valuable. If you want more travel coverage, though, consider a travel credit card that includes a comprehensive insurance package.

Is Tangerine a good credit card?

Yes, Tangerine credit cards are worthwhile card options. Their unique choose-your-own-cash-back-categories approach is both attractive and valuable, setting them apart from other cash back card options. Plus, Tangerine is backed by Scotiabank, which means your money and information are well protected.

What credit score is needed for Tangerine?

Tangerine cards have relatively low credit score requirements – the Tangerine Money-Back Credit Card requires a score between 560 - 659, plus a personal income of $12,000. As the higher value card, the Tangerine Money-Back World Mastercard requires a score between 560 - 659 as well as either a personal income of $50,000 or a household income of $80,000.

What is the minimum income for the Tangerine World Mastercard?

The Tangerine Money-Back Credit Card has a personal income requirement of $12,000 per year, but doesn't require any specific amount for household income. The Tangerine Money-Back World Mastercard has much higher qualifications – $50,000 for personal income or $80,000 for household income.

Who owns Tangerine?

Tangerine is owned by Scotiabank, one of Canada's Big Five Banks. Originally launched as ING Direct, it was rebranded after Scotiabank acquired it in 2012. Though it's an online-only bank, its affiliation with Scotiabank means Tangerine clients can use Scotia's extensive cross-Canada ATM network.

×2 Award winner

×2 Award winner