A common question that gets asked – are U.S. credit cards better than what Canadians can get?

Truth be told, U.S. credit cards are generally better with increased rewards and lower fees. And it has to do with merchant fees. In the U.S., credit card companies can charge more to accept cards, whereas in Canada it’s somewhat legislated.

But Canadians can still get sweet cards. The best Canadian credit cards can stack up favourably against U.S. credit cards.

Here’s what we’ve found.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Summary of the best U.S. credit cards

Here’s a summary of the best U.S. credit cards and their best Canadian counterparts.

| Category | Best U.S. Credit Card | Best Canadian Credit Card |

|---|---|---|

| Best Travel | Venture From Capital One | American Express Cobalt |

| Best Cash Back | Citi Double Cash Card | BMO CashBack World Elite Mastercard |

| Best No Annual Fee Travel | Wyndham Rewards Earner Card | Amex Green |

| Best No Fee Cash Back | PayPal Cashback Mastercard | Brim Mastercard |

| Best Balance Transfer | U.S. Bank Visa Platinum | MBNA True Line Mastercard |

Best U.S. travel credit card vs. the best Canadian option

When it comes to credit cards, travel credit cards are king. They offer the most rewards, have the best perks, and come with the best insurance coverage.

Here’s what the best U.S. travel credit card has to offer, compared to the best Canadian one you can get.

Best U.S. travel credit card – Venture Rewards from Capital One

Capital One may not have a big presence in Canada (especially now that they don’t issue the Costco Mastercard), but Capital One offers plenty of top flight credit cards in the U.S.

And they happen to offer a terrific travel credit card – Venture Rewards from Capital One.

Earning rewards is straightforward – you’ll earn 2 miles for every $1 spent, which is increased to 5 miles per $1 spent on any hotels and car rentals booked through Capital One Travel.

Now for the big question – what can you do with your rewards?

The easiest way to use them is through Capital One Travel. Every mile is worth 1 cent. You can use your miles to pay for your trip upfront, or redeem them afterwards. You have 90 days to retroactively apply them to travel purchases.

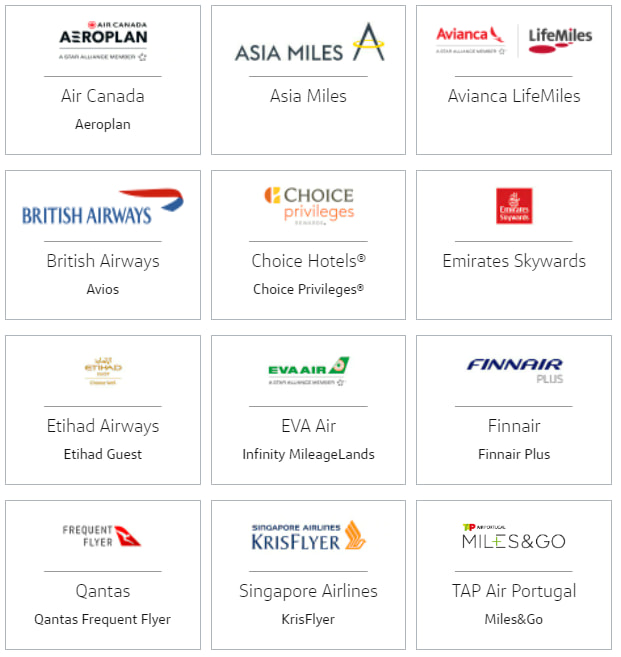

Capital One also has many different transfer partners, to help you get even more from your miles.

There are over 15 partners to choose from, here is a sample of them.

There are some big names on the list, including Aeroplan.

But the big question: what’s the transfer rate? For most partners, Capital One miles transfer at a rate of 1:1. The only exceptions are Eva Air, which transfers at a 2:1.5 ratio and Accor at a 2:1 ratio.

So let’s use Aeroplan to get some annual rewards. We value each point at 2 cents, giving this card an amazing return of up to 4% on all your purchases (10% on Capital One travel purchases).

There are some more features to this card than just these amazing rewards. Here’s what else this card has to offer:

- no foreign exchange fees,

- 2 free visits per year to Capital One lounges in the U.S., and

- Hertz 5 star status.

The annual fee? US$95, which translates to approximately CA$119.

Best Canadian travel credit card – Amex Cobalt

GC: $100

What does the best travel credit card in Canada – the

It actually compares quite favourably to the best U.S. travel credit card.

Here’s what it earns for rewards on all purchases:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

And like the Capital One card, you can transfer your Amex Membership Rewards points to other programs for maximum value.

There are only 8 here, but one of those is Aeroplan. Using a value of 2 cents per point and a typical $2,000 monthly spend, you’re looking at an average return of 4.5% on your purchases.

And of course, you can also use your points to book any travel purchase, where each point is worth 1 cent.

It doesn’t have any other special perks, but it has them where it counts – the rewards, especially if you’re a high grocery spender.

The annual fee for the card is $191.88, which gets charged out as $15.99 monthly.

How they compare

How do these cards compare?

Here’s an overview of the major features.

| Venture Rewards From Capital One | American Express Cobalt | |

|---|---|---|

| Earn Rates | * 5 miles per $1 spent on select travel through Capital One * 2 miles per $1 spent on all other purchases |

* 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases |

| Average Earn Rate | 4.3% | 4.5% |

| Perks | * No foreign exchange fees * 2 free passes to Capital One airport lounges * 16 transfer partners * Hertz 5 star status |

* 8 transfer partners |

| Income Requirements | None | None |

| Annual Fee | US$95/CA$119 | $191.88 |

On the rewards front, they’re relatively even, at least based on our typical $2,000 monthly spend. If you were to increase your grocery spending, the Cobalt Card would start to pull a clear lead.

But the Capital One card has more benefits, namely more transfer partners, and no foreign exchange fees. That’s a rare perk in Canada, although it’s quite common in the U.S.

The victor? Let’s call it a draw.

Best U.S. cash back credit card vs the best Canadian option

Let’s turn our attention to cash back credit cards.

What does the best U.S. cash back card have to offer vs. the best cash back card Canadians can get?

Best U.S. cash back credit card – Citi Double Cash

The best cash back credit card in the U.S. is a simple card – the Citi Double Cash Card.

It’s a no annual fee card, and doesn’t offer much in the way of perks or other benefits.

But it has it where it counts – the rewards. You’ll earn 1% cash back on all your purchases, and another 1% when you go to pay your bill.

As long as you pay your bill in full, you’ll be earning 2% cash back on all your purchases.

The only other feature it offers – a terrific balance transfer offer. You’ll get 0% for the first 18 months, an offer no credit card in Canada can touch.

Best Canadian travel credit card – BMO CashBack World Elite Mastercard

GC: $125

The best Canadian option is the

Here’s what this card offers for rewards:

- 5% cash back on groceries, up to $500 in monthly spend

- 4% cash back on transit, up to $300 in monthly spend

- 3% cash back on gas, up to $300 in monthly spend

- 2% cash back on recurring bills, up to $500 in monthly spend

- 1% cash back on all other purchases

How does that translate to an average earn rate? Based on a typical $2,000 monthly spend, it’s 2.02%.

This card has an annual fee of $120, but in exchange you’re getting these benefits in return:

- free roadside assistance,

- 13 types of insurance, and

- Mastercard Airport Experiences membership (no free passes).

Want to learn more about the best cash back card in Canada?Here are the full details.

How they compare

Here’s how these 2 cards compare to each other.

| Citi Double Cash Card | BMO CashBack World Elite Mastercard | |

|---|---|---|

| Earn Rates | * 1% cash back on all purchases * Additional 1% cash back when you pay your bill |

* 5% cash back on groceries, up to $500 in monthly spend * 4% cash back on transit, up to $300 in monthly spend * 3% cash back on gas, up to $300 in monthly spend * 2% cash back on recurring bills, up to $500 in monthly spend * 1% cash back on all other purchases |

| Average Earn Rate | 2% | 2.02% |

| Perks | * 0% interest on balance transfer for 18 months | * Free roadside assistance * 13 types of insurance * Mastercard Airport Experiences Membership (no free passes) |

| Income Requirements | None | * $80,000 personal or $150,000 household |

| Annual Fee | $0 | $120 |

Both of these cards offer similar rewards, at least based on spending $2,000 a month across various categories.

However, one has no annual fee, but also no perks, while the other charges $120, and includes freebies

Which is better? Well, that depends on what you want. If you just want rewards and nothing else, the Citi Double Cash Card is for you, as you would save yourself an annual fee.

But if you want a few benefits, the BMO card is better. In particular, the free roadside assistance can be enough to offset the annual fee.

Best U.S. no fee travel credit card vs the best Canadian option

Looking for a no fee travel credit card? Plenty of options in both countries.

Here are the best each country has to offer.

Best U.S. no fee travel credit card – Hilton Honors American Express Card

The Hilton Honors American Express Card offers plenty of hotel reward points for no annual fee.

Here’s what you’ll earn on all your purchases:

- 7 points per $1 spent at Hilton hotels,

- 5 points per $1 spent on dining, groceries, and gas, and

- 3 points per $1 spent on all other purchases.

But what is each point worth? We value a Hilton Honors point at 0.64 cents each.

How does that translate into annual rewards? Here’s the breakdown, based on spending $2,000 per month.

| Category | Monthly Spend | Points Earned | Annual Rewards |

|---|---|---|---|

| Hilton Hotels | $100 | 700 | $54.60 |

| Gas | $200 | 1000 | $78.00 |

| Restaurants | $150 | 750 | $58.50 |

| Groceries | $350 | 1750 | $136.50 |

| Everything Else | $1,200 | 3600 | $280.80 |

| Total | $2,000 | 7800 | $608.40 |

Those are some incredible rewards for a no annual fee card. That translates into an average return of 2.5% on purchases.

There are a few other benefits associated with Hilton:

- Free silver elite status, and

- Annual free night when you spend $20,000 per year.

It’s an incredible, no fee package.

Best Canadian no fee travel credit card – Amex Green Card

Canadians also have access to a pretty sweet no annual fee credit card – the

It earns a simple 1 point per $1 spent on all purchases. And while that may not seem like much, this card has access to the full suite of Amex Membership Rewards redemptions.

The highest value you can get for your points is 2 cents, giving a return of 2% on your purchases.

While not as good as the card above, you get many more options to redeem your points for travel. Here are each of your options:

- transfer to 6 airline partners, including Aeroplan,

- transfer to 2 hotel programs – Marriott and Hilton,

- Amex Fixed Points Travel program, and

- Redeem for any purchase charged to your card.

All these options except for Hilton will give you at least 1 cent per point.

How they compare

The comparison between these? Here are the side by side numbers.

| Hilton Honors American Express | American Express Green | |

|---|---|---|

| Earn Rates | * 7 points per $1 spent at Hilton hotels * 5 points per $1 spent on dining, groceries, and gas * 3 points per $1 spent on all other purchases. |

* 1 point per $1 spent on all purchases |

| Average Earn Rate | 2.5% | 2.1% |

| Perks | * Hilton Honors Silver Elite status * Annual free night certificate when spending $20,000 annually |

* Transfer points to 8 partners |

| Income Requirements | None | * $80,000 personal or $150,000 household |

| Annual Fee | $0 | $0 |

The actual rewards are quite a bit better with the HIlton Honors card, plus you’re getting some extra benefits on the side.

But the Amex Green Card is no slouch either, it sacrifices rewards for more flexibility.

The winner – We’d have to give it to Hilton. After all, it’s pretty easy to find a Hilton whenever you’re travelling.

Best U.S. no fee cash back credit card vs the best Canadian option

In the U.S. most of the best cash back credit cards are actually no fee – see the above cash back comparison.

If there’s one area where Canadian cards don’t match up, this is it. We’ll look at a different no fee cash back card from the U.S here.

Best U.S. no fee cash back credit card – Chase Freedom Unlimited

Another outstanding option in the no fee cash back arena is the Chase Freedom Unlimited credit card.

Here’s what you’ll earn on purchases:

- 5% cash back on travel purchased through Chase Ultimate Rewards,

- 3% cash back on restaurants and drugstores, and

- 1.5% cash back on all other purchases.

Bonus earn rates of up to 5%? And earning at least 1.5% everywhere else? The average earn rate comes out to 1.86%.

It even offers decent insurance, with 5 types included. Plus, the balance transfer offer of 0% interest for 15 months is something no other Canadian card can touch. This same rate also applies to new purchases.

The U.S. is really nirvana when it comes to cash back credit cards with no fees.

Best Canadian no fee cash back credit card – Brim Mastercard

In Canada, the best no fee cash back card is the

You’ll earn 0.5% cash back on all purchases. Plus, you can earn bonus rewards when shopping with Brim retail partners. Combined, you’re looking at an average earn rate of 0.83%.

It also comes with 4 types of insurance, and it has one benefit the Chase card doesn’t – it charges no foreign exchange fees.

How they compare

Here’s how the numbers on these cards stack up.

| Chase Freedom Unlimited | Brim Mastercard | |

|---|---|---|

| Earn Rates | * 5% cash back on travel purchased through Chase Ultimate Rewards * 3% cash back on restaurants and drugstores * 1.5% cash back on all other purchases. |

* 0.5% cash back on all purchases |

| Average Earn Rate | 2.05% | 0.83% |

| Perks | * Balance and purchase promo rate of 0% for 15 months | * Bonus rewards when shopping at Brim retail partners * No foreign exchange fees |

| Income Requirements | None | * $12,000 personal |

| Annual Fee | $0 | $0 |

Other than offering no foreign exchange fees, the Canadian card doesn’t match up. The Chase Freedom Unlimited is better in every way.

Verdict – The Chase Freedom Unlimited card, and it isn’t even close.

Best U.S. balance transfer credit card vs the best Canadian option

The last comparison we’ll make is with balance transfer credit cards. And avert your eyes, Canadian offers are way out of their league compared to what you could get in the U.S.

Best U.S. balance transfer credit card – U.S. Bank Visa Platinum

We’ve seen a couple of cards with sweet balance transfer offers. But there are even better ones – led by the U.S. Bank Visa Platinum.

What is the balance transfer offer? 0% for 24 months. If you have any credit card debt, that’s 2 years of not paying interest, and that offer also extends to new purchases.

It doesn’t offer anything else. There are no rewards, and it has standard interest rates once your offers expire.

However, these promo offers are for no annual fee.

Best Canadian balance transfer credit card – MBNA True Line Mastercard

The best balance transfer offer in Canada belongs to the

The offer? 0% for 12 months. While a superb offer in Canada, we’ve actually mentioned 3 offers here that are better than this one.

And compared to the best U.S. balance transfer offer, this card does have one slight advantage – it does have lower permanent interest rates.

But the actual offer to help save on credit card debt pales in comparison.

How they compare

There’s really no comparison here. The U.S. Bank Visa Platinum has a far superior offer, which also applies to new purchases.

The winner – U.S. credit card balance transfer offers are king, there’s no comparing them.

Comparing the best U.S. and Canadian credit cards

Let’s summarize all these credit cards in 2 key areas – the earn rates and annual fees you’ll pay.

Earn rates

Here’s what you’ll earn for rewards on these cards. We’ve excluded the balance transfer cards as they don’t offer any – they’re here to save on credit card interest.

If a Canadian card has an annual fee, it compares well to a U.S. card.

The no fee cards in the U.S. all had better rewards.

Annual Fees

Here are the annual fees for all these cards.

This is where Canadian cards fall behind, as they have higher fees than similar cards issued in the U.S.

In summary

The best Canadian credit cards can match up to U.S credit cards, but they do fall behind in rewards.

When it comes to no fee cards and balance transfer offers, U.S. credit cards tend to pull ahead of Canadian cards.

What are your thoughts on U.S. credit cards? Do they get better deals?

Let us know in the comments below.

FAQ

In general, how do U.S. credit cards compare to Canadian credit cards?

U.S. credit cards tend to be better than their Canadian counterparts, especially when it comes to no fee cards and balance transfer offers. With premium cards, Canadian cards tend to compare better to U.S. cards.

What is the best U.S. credit card for travel?

The best credit card for travel in the U.S. is Venture Rewards from Capital One. It offers a high rewards earn rate, and the ability to transfer miles to multiple partners.

What is the best cash back credit card in the United States?

The best cash back credit card in the U.S. is the Citi Double Cash Card, which offers 2% cash back on purchases for no annual fee.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner  $100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 5 comments