Ah Canada. One of the most scenic, tolerant, and open societies in the world. With some of the greatest cities to live in, we’re the envy of many other countries. Except in one category – cell phone bills. And for those of us on Telus, we’re about to get hit with another increase.

That’s right. There will be a Telus credit card service fee increase coming on October 17, 2022.

With some of the most ridiculously expensive phone bills on the planet, it’s like they’re trying to get everyone back to using landlines forever.

In this story, we’ll go over everything you need to know about this sinister upcoming Telus surcharge. If you pay your Telus bill with a credit card, join us for a short read and another bout of tears when you see your next bank statement.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

All about the Telus credit card processing fee

One article that we’re proud of on our site is the one about how to maximize your rewards by paying your bills with a credit card. Now for Telus customers, that article becomes a museum piece. The advice loses most of its meaning with the Telus credit card service fee increase.

On October 17, 2022, Telus will start charging a 1.5% service fee for credit card payments. I mean, in this age of inflation, unaffordability, and already sky-high phone bills, what’s an extra 1.5%, right?

Well, with Canadians paying among the highest phone bills in the world, this is not a welcome change.

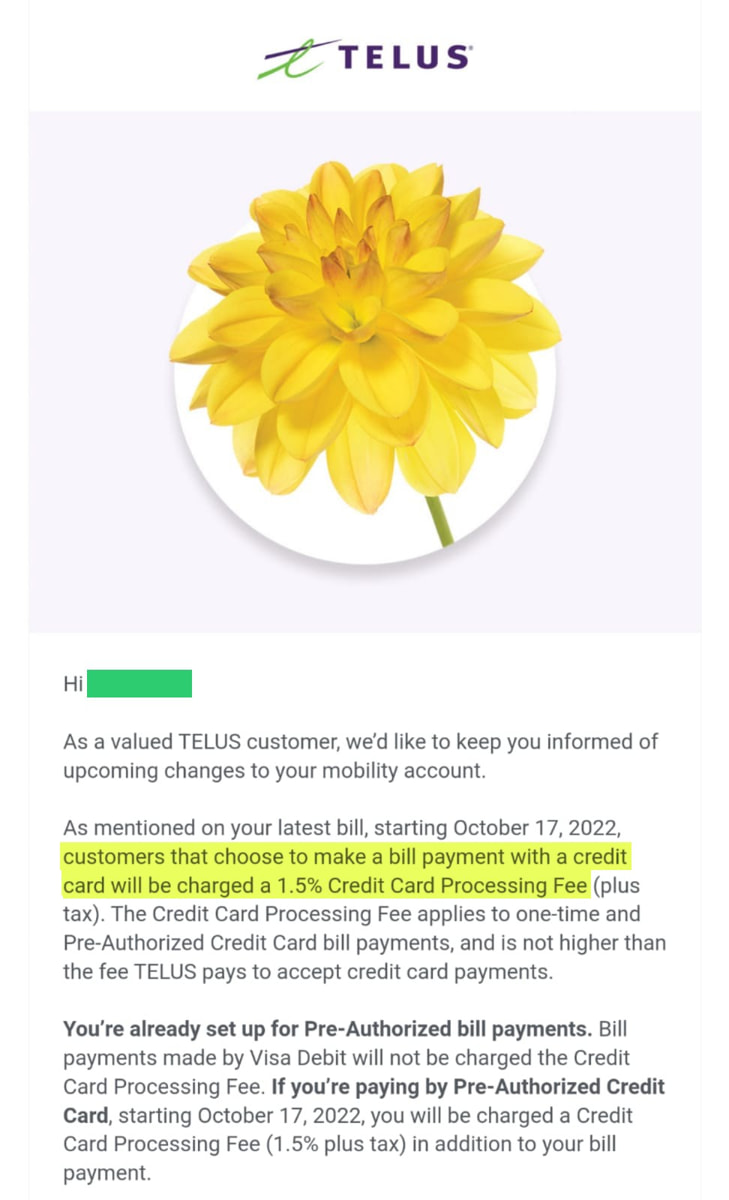

Here’s a photo of what Telus subscribers woke up to the other day.

Frankly, this is a horrible decision by Telus made purely out of greed, and purely made to squeeze as much profit as they can to pad their executive salaries.

Good news is that not everyone will have to pay. Curious if you’ll be shelling out? Read on…

Where does this Telus credit card fee increase apply?

This is actually a common question because not everyone will have to pay the extra 1.5% Telus credit card surcharge.

First, as consumer protection laws in Quebec are much more stringent than they are in other provinces, Telus users in Quebec will not have to pony up the extra cash. Our hope is that other provinces enact tougher consumer protection legislation to combat this nonsense.

Secondly, Koodo and Public Mobile customers will not have to pay the fee either (at least not for now). As you may know, Koodo is Telus’s budget-friendly brand. It currently offers lower-priced phone plans on the same network, but lacks some features such as the latest phones on contract and also does not have access to the Telus 5G network.

What this Telus credit card fee increase means for the future

The problem with Telus’s frankly greedy decision is that it sets a very bad precedent for the rest of the telecom industry in Canada. As you know, there are the big 3 who have an oligopoly over our mobile airwaves and have a death grip on the pricing.

As soon as this is announced, you can bet your bottom dollar that the other 2 major telcos (Rogers and Bell) will be champing at the bit to introduce a 1.5% surcharge as well.

And who knows, this could set off further price increases as time goes on. Imagine another increase to 2%, then 3%? Just how far they are willing to go with this we do not know.

The Telus credit card fee increase means the rich get richer

As much as Telus argues that the 1.5% interchange fee is hurting its business, it’s one of the most profitable companies in the country.

Interchange fees generally will hurt small businesses the most, but if you think about it, Telus made over 17 billion (with a B) in revenue.

Other potential reasons why Telus added this ridiculous fee

It’s not just about adding a little more profit for the corporate MBAs to point at when negotiating their next bonus.

It’s likely that one other reason why Telus wants to do this is because credit cards provide a layer of protection if something were to go wrong. A failure to provide the services described in the contract is enough reason for you to fight the charges and get your money back.

Recent example – the Rogers outage back in July. The telecom giant promised to pay affected users 5 days worth of service in the form of a refund. Considering how many users and how expensive the plans were, that was a massive loss.

If you decide that you don’t want to pay the 1.5% fee, you’ll need to either pay with cash or Visa/Mastercard debit. The problem here is that you will have no insurance coverage at all as this comes with credit cards only. Plus you won’t be able to get any of your credit card rewards or cash back that you’d normally earn.

Should I pay my Telus bill with a credit card?

It was another sad day when we realized that to pay a Telus bill with a credit card would result in an unexpected fee. Another byproduct of corporate greed.

So should you pay a Telus bill with a credit card going forward? It’s up to you. If you’re still getting a bonus in rewards or cash back of more than 1.5% on recurring payments, you may not be losing, but just earning less in the end.

Here’s a list of credit cards that can still earn you rewards on recurring Telus bills:

| Credit Card | Earn Rate On Recurring Bills | Annual Fee | Apply Now |

|---|---|---|---|

| Tangerine Money-Back Credit Card | 2% | $0 | Apply Now |

| Scotia Momentum Visa Infinite Card | 4% | $120 | Apply Now |

| SimplyCash Preferred Card from American Express | 2% | $119.88 | Apply Now |

If your card is earning you a 1.5% return or less on your recurring bills, then you’re breaking even at best, or losing money at worst.

What are your thoughts on the new Telus credit card fee?

Would you consider switching to a different provider? Or will things just end up the same in the next couple years?

Comment your opinions, gripes, and stories below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 15 comments