TD's credit card roster is full of valuable options, and choosing between the TD First Class Travel Visa Infinite Card and TD Aeroplan Visa Infinite Card can be tricky. But after a close, detailed comparison, the Aeroplan card comes out on top – it is, after all, one of the best Aeroplan credit cards in Canada.

This doesn't mean it's the right card for everyone. The guide below compares these cards head-to-head, considering everything from welcome bonuses to interest rates. Hopefully, this will help you can make an informed decision.

Key Takeaways

- Both the TD First Class Travel and Aeroplan Visa Infinite cards cost $139 after the first year and come with extensive insurance packages.

- The First Class Travel Visa earns you TD Rewards points, while the Aeroplan Visa Infinite earns you Aeroplan points.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

TD First Class Travel vs. Aeroplan Visa Infinite

If you know you’d like to get some type of reward for travel purchases, both of these cards fit the bill – in different ways. Here’s a quick overview of how they stack up.

| Feature | TD First Class Travel Visa Infinite Card | TD Aeroplan Visa Infinite Card |

|---|---|---|

| Annual fee | $139 (first year waived) | $139 (first year waived) |

| Welcome bonus |  $20 GeniusCash + Up to 165,000 bonus points (terms) $20 GeniusCash + Up to 165,000 bonus points (terms) | Up to 45,000 bonus points (terms) |

| Maximum rewards | 8 points per $1 | 1.5 points per $1 |

| Highest earning categories | Travel booked through Expedia For TD | Gas, groceries, and travel with Air Canada |

| Insurance types included | 12 types of coverage | 12 types of coverage |

| Special feature | Card is made from 90% recycled plastic | * First checked bag is free with Air Canada flights * Aeroplan points don’t expire as long as you’re a cardholder * Get a NEXUS rebate every 48 months |

| Best for | People who frequently book travel through Expedia or want more flexible reward options | People who frequently fly with Air Canada |

| Get started | Apply now | Apply now |

What we love about the TD First Class Travel Visa Infinite Card

Pros:

- Annual fee waived for the first year

- 12 types of insurance included

- Annual $100 travel credit

- Visa Infinite benefits

- Annual birthday bonus of up to 10,000 points

Cons:

- Additional cards cost $50

- Points only worth 0.5 cents each

If you’re looking for the card with better rewards value, the TD First Class Travel Visa Infinite Card is your best bet. As one of TD’s most premium travel rewards cards, it's not really surprising that it has steep income requirements. If you meet them, though, you’ll get a credit card that makes travel much, much easier. For instance, this Visa card gives you global airport lounge access and 4 free lounge passes.

We also love the generous insurance package, which includes 12 types of travel insurance. Want concierge service and discounts on car rentals? You’ve got 'em.

As for earn rates, the TD First Class Travel Visa Infinite Card shines. You’ll earn:

- 8 points per $1 spent on travel booked online through Expedia For TD

- 6 points per $1 spent on groceries, restaurants, and public transit

- 4 points per $1 spent on recurring bill payments, streaming, digital gaming, and media

- 2 points per $1 spent on all other purchases

But, when you book travel through Expedia For TD, you’ll get an unheard of 8 points per $1 spent.

To redeem your points, you can book travel using the Expedia For TD platform, or use another booking site – just select "cash back statement credits" to book, no matter which travel site you choose. You can also use your points at Amazon, shop the TD Rewards catalogue, or get gift cards.

Overall, the TD First Class Travel Visa Infinite Card is the more flexible option since you’re not tied to Air Canada.

What we love about the TD Aeroplan Visa Infinite Card

Pros:

- Annual fee waived for the first year (with a TD All-Inclusive Banking Plan)

- Free first checked bags on Air Canada

- Preferred Pricing on Aeroplan flight rewards

- Partial NEXUS rebate every 48 months

- Earn double points when paying with your card and providing your Aeroplan number (at Aeroplan partners)

Cons:

- Only high-value rewards are redeeming for Air Canada flights

- Majority of purchases only earn 1 point per $1 spent

While the TD First Class Travel Visa Infinite Card prioritizes flexibility, the TD Aeroplan Visa Infinite Card rewards loyalty – specifically, loyalty to Air Canada. The card starts by giving you a nice 40,000-point bonus. After that, you’ll get 1.5 points per $1 spent on Air Canada travel (along with gas and grocery purchases) and 1 point per $1 on other spending. You can boost your point earnings when making purchases with Aeroplan retail partners, too.

Oh, and enjoy a one-time anniversary bonus of 15,000 points when you spend $12,000 in your first year.

With the TD Aeroplan Visa Infinite Card, your points will never expire, which is handy for infrequent travellers. When you do fly with Air Canada, you’ll earn status faster and get a free checked bag. There are other travel perks too, like free Avis Preferred Plus upgrades, along with car rental discounts.

Swinging by a Starbucks to fuel up for your trip? You’ll earn 50% more reward stars by using the TD Aeroplan Visa Infinite Card.

How do the TD First Class Travel Visa Infinite Card and TD Aeroplan Visa Infinite Card compare?

These travel reward cards share some similarities (like annual fee and interest rates), but there’s plenty to set them apart.

Best benefits: TD First Class Travel Visa Infinite Card

It’s a close call, but the First Class Travel card has a few advantages over the Aeroplan card. For one thing, you’ll get an annual birthday bonus of 10% of what you earned over the past year (up to a bonus of 10,000 points). You’ll also get an annual $100 travel credit that you can use to book hotels and vacation packages totalling at least $500 through Expedia For TD.

The Aeroplan card gives a NEXUS rebate valued at $100 CAD – though it’s not enough to cover the entire fee. You’ll also have access to free first checked bags and preferred pricing on Air Canada flights. Travel with airlines outside of Air Canada, though, and the perks disappear.

Both cards include Visa Infinite benefits. This means you’ll enjoy access to luxury hotels, exclusive dining opportunities, and complimentary concierge services.

Best insurance: tie

If the insurance that comes with your card is important to you, you’ll be pleased to learn that both cards come with the same impressive insurance package. Here’s what you’ll get from both cards:

- Extended Warranty: 1 year

- Purchase Protection: 90 days

- Mobile Device: $1,000

- Travel Accident: $500,000

- Emergency Medical Term: 21 days

- Emergency Medical over 65: 4 days

- Trip Cancellation: $1,500

- Trip Interruption: $5,000

- Flight Delay: $500

- Baggage Delay: $1,000

- Lost or Stolen Baggage: $1,000

- Hotel Burglary: $2,500

- Rental Car Theft & Damage

Best rewards: TD Aeroplan Visa Infinite Card

An average $2,000 monthly spend will earn you more per year with the Aeroplan VI card than the First Class Travel. According to our calculations, the VI will earn you an average of $837 in annual rewards while its competitor comes in a bit short at $698.

Ultimately, though, you’ll want to consider which reward program you’d rather participate in. TD Rewards gives you more options for redemption while Aeroplan offers high value and perks when redeeming points for Air Canada travel.

Highest acceptance: tie

As Visa cards, you shouldn’t have any trouble using either card anywhere credit cards are accepted.

Highest welcome bonus: TD Aeroplan Visa Infinite Card

We’ll start by saying the TD First Class Travel Visa Infinite Card comes with a generous welcome bonus: the ability to earn up to 165,000 TD Rewards points with the annual fee waived for the first year. This puts the card’s welcome bonus value around $825, plus $139 to account for the free first year.

That said, the Aeroplan VI offers even more to new cardholders: up to 45,000 after spending $3,000 in the first 3 months and $12,000 in the first year. This gives the welcome bonus a value of about $900, plus another $139 for the annual fee waiver in the first year.

Interest fees: tie

Although neither TD offering is considered a low-interest credit card, the interest rates for purchases, cash advances, and balance transfers are pretty standard.

| TD First Class Travel Visa Infinite Card | TD Aeroplan Visa Infinite Card | |

|---|---|---|

| Purchases | 21.99% | 21.99% |

| Cash advances | 22.99% | 22.99% |

| Balance transfers | 22.99% | 22.99% |

Lowest annual fee: tie

The cards are completely equal here, with the same $139 annual fee and a fee waiver for the first year.

Lowest eligibility requirements: tie

Both cards require $60,000 in annual personal income or $100,000 in household income, which could be a sticking point for some Canadians.

Pro Tip: If you don’t meet the eligibility requirements for the TD First Class Travel Visa Infinite Card, consider the TD Platinum Travel Visa Card instead. If you don’t meet the eligibility requirements for the Aeroplan VI, check out the TD Aeroplan Visa Platinum Card card.

The winner: TD Aeroplan Visa Infinite Card

While there’s no doubt that the TD First Class Travel Visa Infinite Card is a versatile travel card with high earn rates, we have to give the crown to the TD Aeroplan Visa Infinite Card.

The Aeroplan VI offers higher annual rewards and excellent perks when you’re travelling with Air Canada. Plus, you’ll get a head start on earning those Aeroplan points with a generous welcome bonus – which all ends up in your pocket thanks to that first year free.

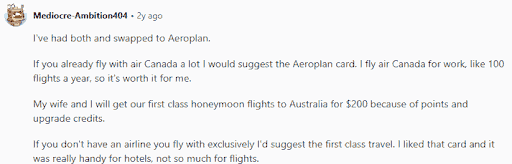

Here's what cardholders have to say

We’ve mentioned that the best card for you is the one that reflects your travel habits. If you love being able to book the best deal regardless of the airline, then the TD First Class Travel Visa Infinite Card card is a better option. However, if you only fly Air Canada, the TD Aeroplan Visa Infinite Card makes more sense.

We checked out what Redditors had to say about these cards and found similar sentiments:

FAQ

Can I transfer TD travel points to Aeroplan?

No, TD doesn’t allow you to transfer travel reward points to Aeroplan – but you can convert them into Starbucks Stars.

Is the annual fee waived for the TD First Class Travel Visa Infinite Card?

Yes, the annual fee of $139 is waived for the first year you have the TD First Class Travel Visa Infinite Card. The TD Aeroplan Visa Infinite Card offers the same fee waiver.

creditcardGenius is the only tool that compares 126+ features of 232 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 232 cards is for you.

×2 Award winner

×2 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.