For residents of the Sydney area in Cape Breton, Sydney Credit Union is one place you can turn to for anything banking related. They offer a wide range of products that may fit what you need.

And starting next year, barring unforeseen circumstances, they're going to be merging with North Sydney Credit Union, creating a slightly larger credit union in Sydney.

Their products are a little different, and it remains to be seen what will happen there. For now, here's our guide to what Sydney Credit Union has to offer.

Key Takeaways

- Sydney Credit Union branches are located in the Sydney, Nova Scotia area.

- Sydney Credit Union offers a full range of banking products, from chequing accounts, to loans, and credit cards.

- If you run a business, Sydney Credit Union runs a full suite of banking products for business owners.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Credit cards offered by Sydney Credit Union

When it comes to credit cards, Sydney Credit Union offers the typical Collabria credit cards offered by most credit unions, with these ones having a Mastercard logo on them.

Here's the quick rundown on all 6 of them.

1. Sydney Credit Union Cash Back Mastercard

The Sydney Credit Union Cash Back Mastercard is an excellent cash back credit card. It offers up to 4% cash back on purchases and comes with terrific insurance.

It has an annual fee of $120 and income requirements of $80,000 personal or $150,000 household.

2. Sydney Credit Union Mastercard

If you would prefer rewards, the Sydney Credit Union Mastercard can earn you up to 3 points per $1 spent on purchases. These points can be redeemed for travel, gift cards, or cash.

The annual fee is $120 and has income requirements of either $60,000 personal or $100,000 household.

3. Sydney Credit Union Cash Back Mastercard

If you want a no annual fee card, the Sydney Credit Union Cash Back Mastercard can earn you up to 2% cash back on purchases and comes with mobile device insurance.

4. Sydney Credit Union Centra Gold Mastercard

Offering a blend of low interest rates and rewards on purchases, the Sydney Credit Union Centra Gold Mastercard is next on the list. It comes with a low interest rate of 11.99% and offers 1 point per $1 spent on purchases.

The annual fee for this combination is $50.

5. Sydney Credit Union Classic Mastercard

If your primary goal is to save on credit card interest, you can turn to the Sydney Credit Union Classic Mastercard.

It comes with a low interest of 12.99% and has no annual fee.

6. Sydney Credit Union US Dollar Mastercard

You can also get a U.S. dollar credit card with the Sydney Credit Union US Dollar Mastercard.

With this card, you'll make purchases in U.S. dollars.

If you spend a lot in U.S. dollars, Sydney Credit Union has a U.S. dollar Visa. With these kinds of cards, you have to pay your bill in U.S. dollars as well.

As you make purchases in USD, you don't pay any currency conversion fees as everything is happening in U.S. dollars. Use your card with any other currency (including Canadian dollars) and you'll pay the 2.5% fee. With this card, you'll earn 1 point for every US$2 spent.

Just keep in mind that this card has an annual fee of US$50.

Sydney Credit Union bank accounts

The typical accounts you'll find from other banks will all be here at Sydney Credit Union.

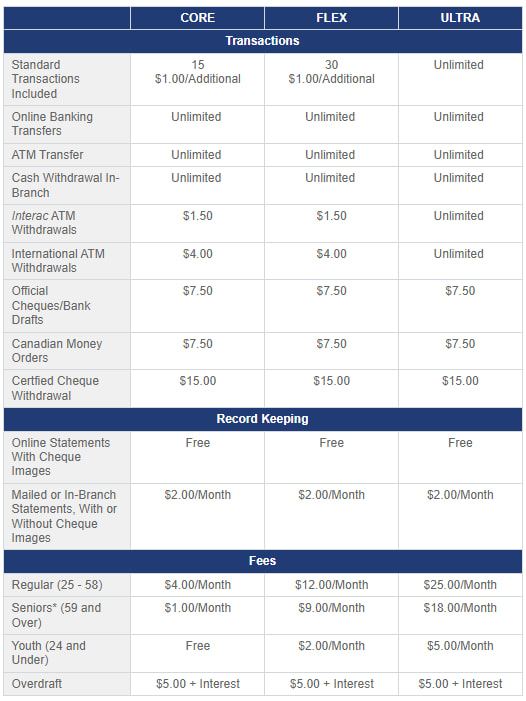

1. Chequing accounts

For chequing accounts, Sydney Credit Union offers 3 of them. While none of their accounts is free of monthly fees, discounts are given for those under the age of 24.

The major differences between these accounts are the number of free transactions and if you have to pay a fee for Interac e-Transfers.

They also offer U.S. accounts on request.

2. Savings account

Sydney Credit Union offers 1 savings account – YOUR Savings. It has no fees and has tiered interest at these rates (accurate as of December 7, 2023):

Other personal banking from Sydney Credit Union

Sydney Credit Union is a full-service bank, and can get you anything you need.

1. Personal loans

Need a loan? Sydney Credit Union offers personal loans. If you're in need of cash to consolidate debt, do some home renos, or make any large purchase, Sydney Credit Union can offer you a loan. These come with no penalties for making extra payments and with a variety of payment options.

2. Lines of credit

Sydney Credit Union also offers lines of credit. If you need a little cash, you can access your line of credit with either a personal cheque or by visiting an ATM.

You can also get a home equity line of credit. The benefit of this option is its lower interest, made possible by using your home's equity as collateral.

3. Mortgages

If you're buying a house or need to renew your mortgage, Sydney Credit Union offers mortgages.

Sydney Credit Union offers fixed rate mortgages, as well as 6 month open and closed mortgages.

4. Investing

Sydney Credit Union has a variety of investment products. Some of them are in-house (mostly registered savings accounts), and they have a partnership with Applied Wealth Strategies to offer a full range of investment products and financial planning.

Sydney Credit Union business banking

If you have your own business, Sydney Credit Union has a range of banking products to serve what you need.

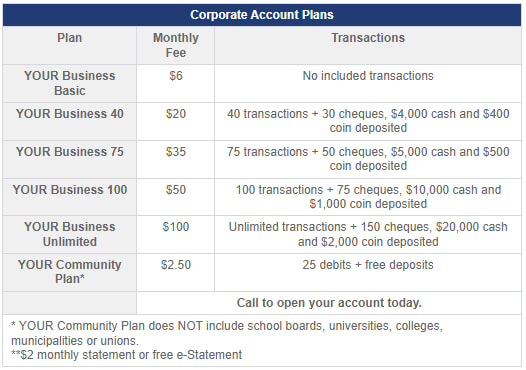

1. Chequing accounts

Sydney Credit Union offers a variety of different plans to suit how many free transitions you need per month.

There are 6 plans for businesses to choose from. Here are your choices.

There's also a U.S. dollar chequing account you can access.

2. Lending services

If you're in need of some cash, Sydney Credit Union has plenty of different products that can help.

From commercial loans, mortgages, lines of credit, and business credit cards, almost everything you need is here.

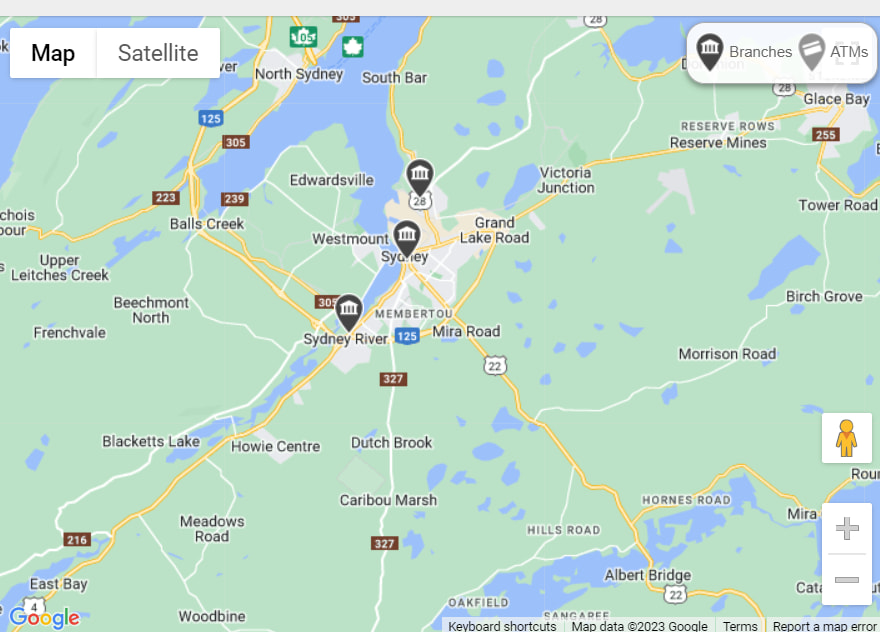

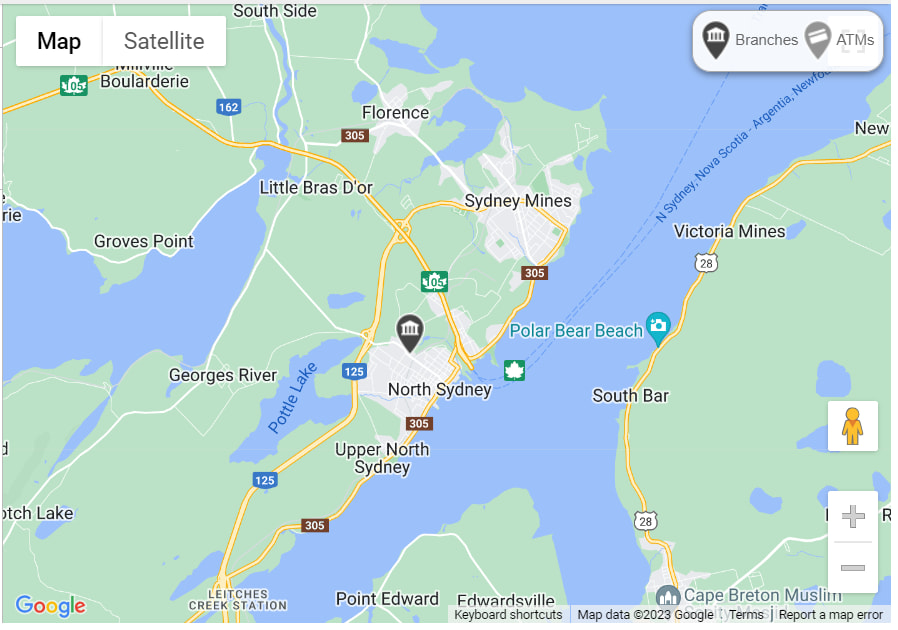

Locations for Sydney and North Sydney credit unions

Sydney (and North Sydney) credit unions are all located in the Sydney, Nova Scotia area.

Here are the locations for Sydney Credit Union.

And North Sydney Credit Union has one branch.

Whether anything changes with the amalgamation remains to be seen, but at this time, all these branches are expected to remain open following the merger.

Your experience with Sydney Credit Union

For our friends in the Sydney area, what are your thoughts on Sydney Credit Union?

Let us know in the comments below.

FAQ

What is Sydney Credit Union?

Sydney Credit Union is a bank located in the Sydney area of Nova Scotia. They offer a full lineup of financial products, including bank accounts, credit cards, and loans.

Does Sydney Credit Union have online banking?

Sydney Credit Union has online banking for their clients. It can be accessed through the Sydney Credit Union homepage.

What credit cards does Sydney Credit Union offer?

Sydney Credit Union offers Collabria Mastercards. Here are the 6 personal cards they offer:

- Sydney Credit Union Cash Back Mastercard,

- Sydney Credit Union Mastercard,

- Sydney Credit Union Cash Back Mastercard,

- Sydney Credit Union Centra Gold Mastercard,

- Sydney Credit Union Classic Mastercard, and

- Sydney Credit Union US Dollar Mastercard.

creditcardGenius is the only tool that compares 126+ features of 227 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 227 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.