Please note this offer is no longer available. You can find current offers here.

A hidden gem in the Canadian credit card market is the National Bank World Elite Mastercard. And with its recent overhaul, it’s now among the best credit cards in Canada.

One area where this card has been lacking in the past – the welcome bonus offer. It often doesn’t have one. And if it does, it’s not overwhelming.

Until today.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Earn up to 70,000 bonus points with the National Bank World Elite Mastercard

The National Bank World Elite Mastercard is currently offering the best welcome bonus it’s ever had.

And, it’s an exclusive offer you won’t find on the National Bank site – you’ll get it through us! You can now earn up to 70,000 bonus points, which is worth up to $700, and you’ll also get the first year free (a $150 savings).

Here’s how you earn them.

You’ll get 30,000 points when you spend $5,000 in the first 3 months. Pretty easy.

You’ll earn another 30,000 points when you spend $12,000 in the first 12 months. Very doable.

The last part is going to be a no-go for many. To get the last 10,000 points, you’ll need to purchase credit card payment insurance for a minimum of 3 months. To do this, you’ll have to opt in when you complete your application.

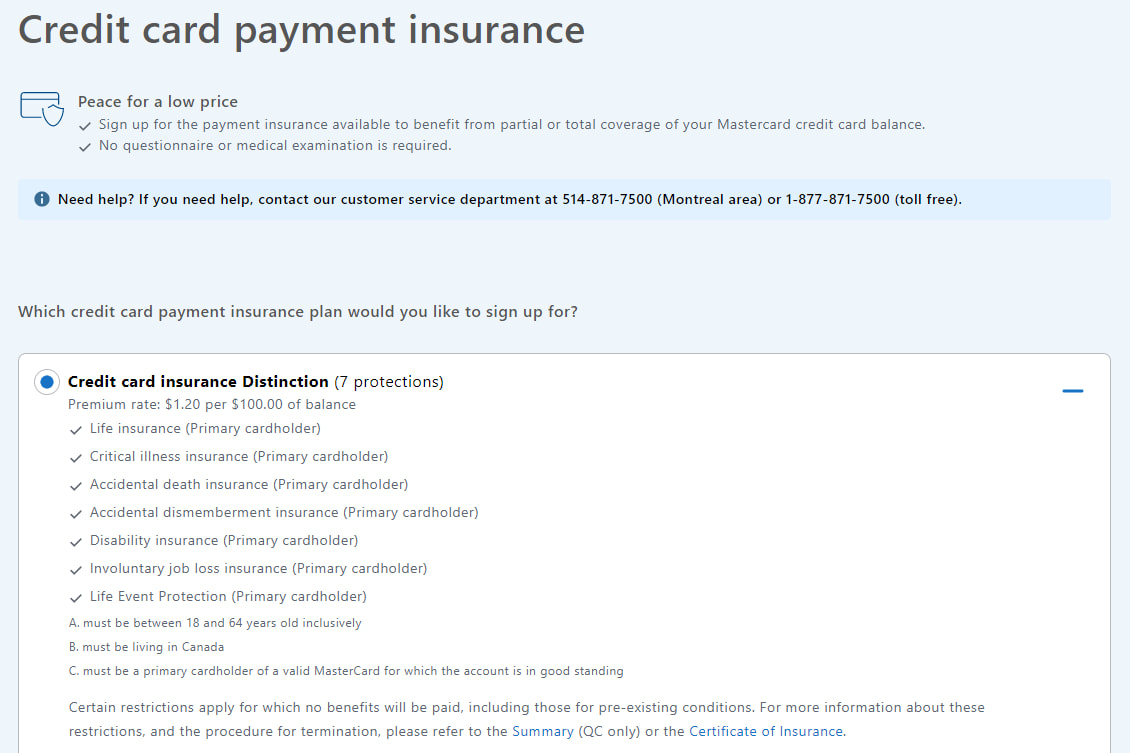

Credit card payment insurance cost for the National Bank World Elite Mastercard

For every $100 of balance you have on your credit card, this insurance will cost you $1.20. So say you had a balance of $2,000, you would pay $24.

Here are the details on what it is.

Basically, it’s an insurance that will make your credit card balance go away if certain emergency criteria are met.

If this isn’t for you (and it won’t be for many), you’re still looking at a bonus of 60,000 points.

Redeeming your National Bank Rewards

The National Bank World Elite Mastercard is a part of the National Bank À La Carte Rewards program.

For best value, you’ll want to stick to redeeming for flights and vacation packages through NBC Rewards. Each point is worth 1 cent, which gives the welcome bonus a value of $700.

But you have more options – here’s a summary of what they are, what each point is worth, and how much the full welcome bonus is worth.

| Redemption | Value Of 1 Point In Cents | Welcome Bonus Value |

|---|---|---|

| Book Any Travel | 0.83 | $581 |

| Pay For National Bank Banking Plans | 0.84 | $588 |

| National Bank Investments | 0.83 | $581 |

| Merchandise | 0.81 | $567 |

| Gift Cards | 0.77 | $539 |

| Statement Credits | 0.4 | $280 |

All about the National Bank World Elite Mastercard

New to the National Bank World Elite Mastercard? Thanks to its recent revamp, it’s one of the best credit cards in Canada.

What makes it the best? It has excellent rewards, but also a super unique perk.

First, here’s what you’ll get for rewards:

- 5 points per $1 spent on groceries and restaurants, up to $2,500 in total spend per month (2 points after)

- 2 points per $1 spent on gas, electric vehicle charging, recurring bills, and travel booked through À La Carte Rewards

- 1 point per $1 spent on all other purchases

That’s plenty of rewards on your groceries and restaurants, and a unique category for earning extra rewards: EV charging.

What does this mean for annual rewards? Based on a monthly spend of $2,000, you’re looking at annual rewards of $372, or a return of 1.55%.

But here’s where it really shines – the annual travel reimbursements. Every year you have the card, you can get reimbursed up to $150 on these travel fees:

- seat selection,

- baggage fees,

- airport parking,

- airline seat upgrades, and

- airport lounge access.

Taking full advantage of these reimbursements essentially makes the $150 annual fee go away.

And speaking of airport lounge access, this card includes it. You’ll get free access to the National Bank Lounge in Montreal Trudeau Airport – just note it can only be accessed by those travelling internationally.

It also includes a Mastercard Travel Pass membership. While it includes no free passes, you can pay the US$32 fee with your travel reimbursements.

Finally, the insurance coverage is outstanding. It comes with 10 types. Here are the details:

National Bank World Elite Mastercard Please review your insurance certificate for details, exclusions and limitations of your coverage.Extended Warranty 2 years Purchase Protection 180 days Mobile Device $1,000 Emergency Medical Term 60 days Emergency Medical Maximum Coverage $5,000,000 Emergency Medical over 65 15 days Trip Cancellation $2,500 Trip Interruption $5,000 Flight Delay $500 Baggage Delay $500 Lost or Stolen Baggage $1,000 Rental Car Theft & Damage Yes

All things considered, it’s a well-rounded travel credit card.

Will you get a National Bank World Elite Mastercard?

National Bank has a terrific credit card. And now it’s paired with an excellent welcome bonus to kickstart your next free vacation.

Will you get a National Bank World Elite Mastercard?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 227 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 227 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.