Canada’s most popular coffee shop is getting their own credit card. We’re here to introduce their own credit card – the Tims Credit Card.

With it, you’ll be able to earn Tims Rewards everywhere you shop. It’s not yet available, but we found plenty on the card.

Here’s what we know about the credit card, and how to join the waitlist so you can get it sooner.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What the Tims Credit Card is going to offer

Tim Horton’s has created Tims Financial to issue this card, but they’re not doing this alone. The card itself is powered by Neo Financial and is being issued by ATB Financial.

There’s also going to be 2 versions of the card. There’s the standard version, and they’re also going to offer a secured version for those with poor credit.

Both cards are going to have no annual fee.

The standard Tims Credit Card

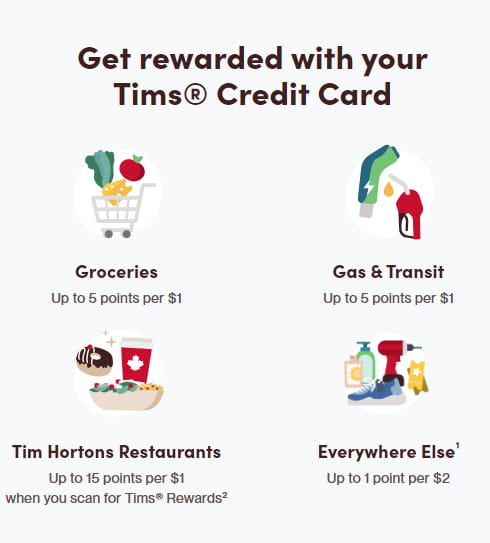

First up is the standard Tims Credit Card, here’s what it will earn you for rewards:

- 15 points per $1 spent at Tim Hortons,

- 5 points per $1 spent on groceries (excludes Walmart & Costco), gas, transit, and EV charging, and

- 1 point per $2 spent on everything else.

That’s a lot of points – but how does that translate into a percentage return? The value of Tims Rewards varies. To make the numbers easy to look at, we’ll use a value of 0.5 cents per point.

Here’s the return for each category.

| Category | Earn Rate | Return |

|---|---|---|

| Tim Hortons | 15 points per $1 spent | 7.5% |

| Groceries, gas, transit, EV charging | 5 points per $1 spent | 2.5% |

| Everything else | 1 points per $2 spent | 0.25% |

For a no fee card, that’s a terrific return on Tims purchases, while still getting you a really good return on some basics.

But that everything else rate, woof. That’s atrocious, even among the poorest no fee credit cards, which limit their base earn rate to just 0.5% back.

That being said, it still has value. If you’re a regular at Tim Horton’s, you have to at least consider this card, even if just for the Tims earn rate. As for gas and groceries, look and see what else you use, and decide if you’ll earn more for rewards than whatever else you have.

And it goes without saying, if you don’t visit Tims very often (that’s yours truly), it won’t serve much of a purpose. If you rarely go to Tims, you’re earning rewards that won’t be of much use to you.

One last thing – it will include basic credit card insurance with extended warranty and purchase protection.

The secured version

Let’s get into the secured version of the card. The “up to” you see in the earn rate language? One reason it’s there is for the secured version – it offers roughly half the rewards on purchases.

Here’s what this card earns for rewards:

- 5 points per $1 spent at Tim Hortons,

- 2 points per $1 spent on groceries (excludes Walmart & Costco), gas, transit, and EV charging, and

- 1 point per $4 spent on everything else.

And how that translates into a return at 0.5 cents per point.

| Category | Earn Rate | Return |

|---|---|---|

| Tim Hortons | 5 points per $1 spent | 2.5% |

| Groceries, Gas, Transit, EV charging | 2 points per $1 spent | 1% |

| Everything Else | 1 points per $4 spent | 0.125% |

A lot lower. But, it’s still an excellent credit card in this category, as it’s a very rare secured credit card that also offers rewards.

As to the minimum security deposit that’s required, nothing is said. So you’ll have to check back once it’s updated.

Join the waitlist and see the full details for yourself

The credit card isn’t available yet – its actual release date hasn’t been revealed yet.

You can join the waitlist and see all the details for yourself by heading here.

Tims also has a press release on their new credit card, which you can look at here.

Will you get the Tims Credit Card?

That’s our take on the Tims Credit Card, based on what we know so far.

What are your thoughts on the Tims Credit Card?

Will you get it or leave it?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 227 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 227 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 3 comments