Some changes are coming to Rogers Mastercards on September 21, 2023. In particular, the Rogers Red Mastercard is getting a major upgrade.

And with any Rogers Mastercard, you'll unlock new phone financing options. Here's what's coming.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Rogers Red Mastercard changes

A big time change is coming to the Rogers Red Mastercard.

With this card, everyone gets 1% back. But you currently can't unlock earning 2% back everywhere unless you have both a Rogers mobile and home service of some kind and link your Rogers service and Mastercard together.

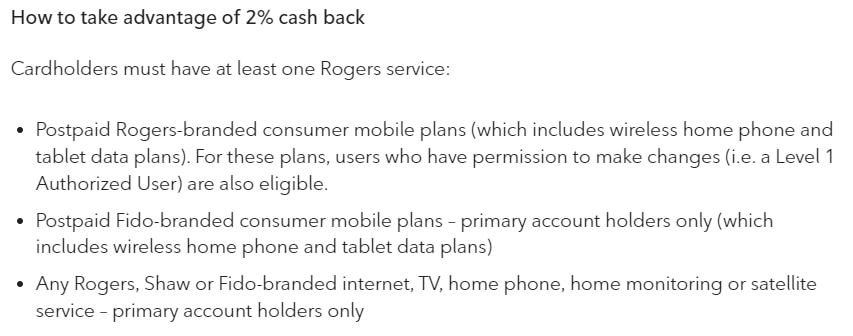

Starting September 21, 2023, it will be much easier to unlock earning 2%. You no longer need to have 2 Rogers services. Simply having 1 Rogers service will do the trick.

And what qualifies as a Rogers service is going to expand. Currently, you need to have a Rogers-branded service to qualify for the 2% back. But now it will extend to Fido and Shaw.

And of course, the 30% bonus you get when applying your cash back to your Rogers bills is still here. Meaning, if you redeem $100 cash back towards your bill, it actually pays $130.

Essentially you're getting 2.6% back everywhere you shop if you pay a Rogers bill with your credit card and redeem your rewards towards paying your bill.

If you have any of the above listed Rogers services, this card is certainly worthy of further inspection for adding to your lineup of credit cards.

What the Rogers Red Mastercard offers

If this news has piqued your interest on the Rogers Red Mastercard, here's what this card offers. I personally have a cell phone with Fido and am strongly considering getting this card.

You've seen the rewards above – 2% cash back on everything if you link your Rogers service and Rogers Bank Mastercard together, with a 30% bonus if you use your cash back to pay for your Rogers services.

And there's no annual fee either with this.

Now, if you don't have any Rogers service, you're still looking at a pretty good deal. You'll earn 1% back everywhere, which is increased to 2% on USD purchases.

There are a couple of extras. First, a welcome bonus. You'll earn No welcome bonus at this time.

If you have Rogers Wireless service, you'll also get 5 free Roam Like Home days per year. These cost up to $15 per month.

If you're wondering what services can access this, we reached out to Rogers Bank for clarification. These free Roam Like Home days are only available for those with Rogers services. If you have Fido (like me) you won't get these.

And that's about it. It doesn't include any insurance coverage. And that's giving me a slight pause on getting the card. My current card for paying my bill has mobile phone insurance. And I've used that coverage before to replace a cracked screen.

But still, I'm definitely leaning towards getting the Rogers Red Mastercard. The extra rewards are enticing, and it's for no fee too. If I do make the switch, I'll investigate whether or not it's worth switching to Rogers for wireless service to get those free Roam Like Home days. They would have saved me some decent money on my last trip outside of the country.

Longer financing options on new Rogers cell phones

Getting a new phone through Rogers? If you have any Rogers Bank Mastercard, you can spread out the financing of your new device over a longer period of time.

With any new cell phone contract with Rogers, you can spread out the financing of your new device for either 36 or 48 months, instead of the standard 24 months.

You won't save any actual cash if you take a longer financing deal – the amount you have to pay back is the same. It simply allows you to reduce your monthly payment over a longer period of time.

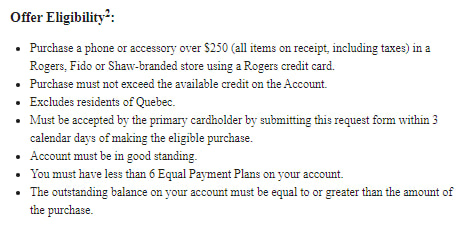

To get your credit, you have to do these things. First, you need to purchase your new phone at a Rogers, Fido, or Shaw-branded store and pay for it in full using your Rogers Mastercard.

Then, head to https://www.rogersbank.com/en/48months and enter the details of your purchase. You'll have to choose your payment term of either 36 or 48 months.

You'll get an email once your request has been processed, and it can take up to 7 days.

There's a few eligibility criteria to meet. Here's what they are.

Here are the Rogers Mastercards where you can take advantage of longer financing.

Your thoughts on the Rogers Mastercard changes

The Rogers Red Mastercard certainly has some exciting changes coming.

Will you take up Rogers on their new offer?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 12 comments