How confident are you in the credit cards you have in your wallet?

It might not be something you think about often…

…but here at creditcardGenius, we never stop thinking about it.

Imagine having the right credit card made just for you…

…one that gives you:

- Affordable dream vacations paid mostly by rewards.

- More money in the bank from shopping for things you’d buy anyway.

- Low fees and low interest rates without sacrificing great perks.

- Easy instant approval while being accepted everywhere you shop.

That’s why we built Rate Your Wallet – a free and easy to use credit card matchmaker that will rate your existing credit cards based on your financial situation and what you care about most.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Introducing…Rate Your Wallet

No, it’s not Tinder. There’s no swipe left or right…

You won’t have to deal with a clunky interface, like Plenty of Fish.

Instead, we just ask: What’s important to you?

You’ll experience a fun and interactive 10 question quiz, so we can quickly get to know you and find out just how well your credit cards are working for you.

Related: Our Rate Your Wallet How-To Guide

You’ll instantly know if they make the grade, or if they should be fired on the spot.

Get insight into your wallet, instantly

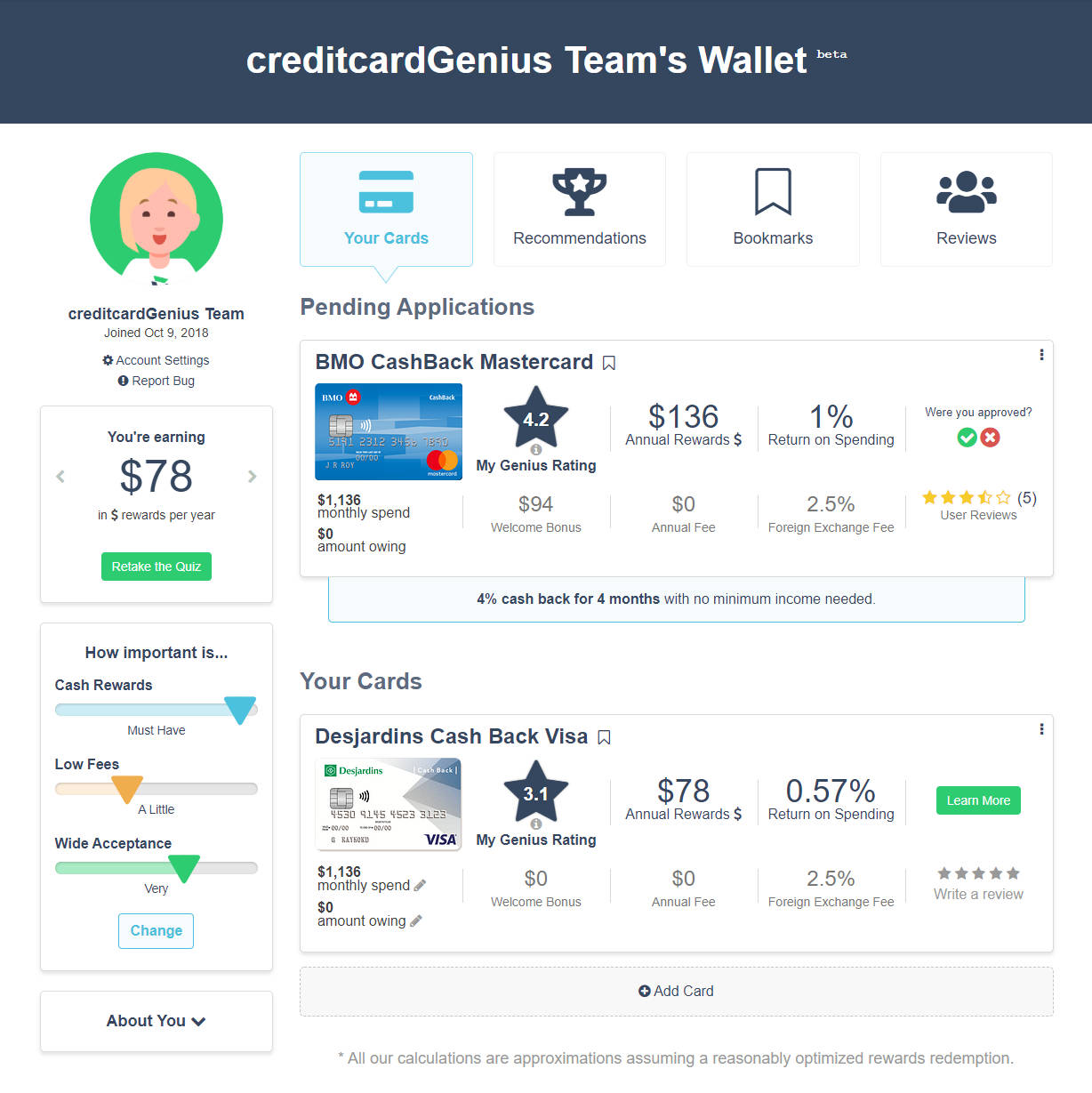

The first thing you’ll see after completing the Rate Your Wallet quiz is your own personal dashboard:

From there, you’ll get powerful insights into your wallet. Fast.

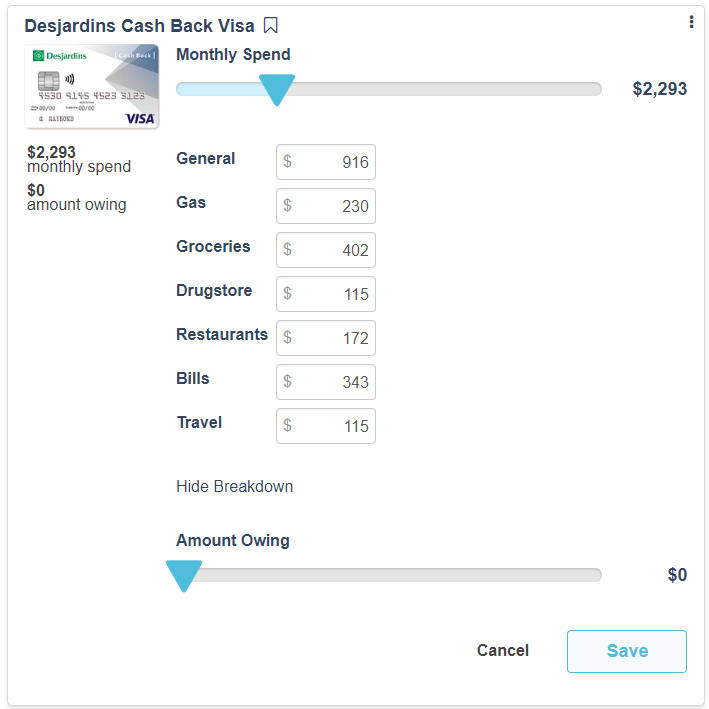

The cards in your wallet will be compared to nearly every other credit card on the Canadian market in seconds using your precise preferences, spending habits, financial information, and credit score.

They’ll each receive a personalized ‘My’ Genius Rating out of 5 telling you just how close you are to having the best available card for you in your wallet.

You’ll also get quick access to:

- how much you’re earning in rewards and paying in interest each year,

- top recommendations based on your preferences and existing cards,

- keep track of pending card applications you’ve made through creditcardGenius,

- add any card to your wallet using our intelligent card search,

- bookmark cards for easy comparison or as a future wish list, and

- see any reviews you’ve left for past or current cards you’ve had.

Is your wallet performing?

With Rate Your Wallet, there’s no more wondering if your cards are up to snuff…

…you’ll be alerted the moment they start failing you, even as your preferences change.

For example, if you tell the quiz that cash back is what you’re looking for, but you have two travel credit cards with terrible cash redemption options, Rate Your Wallet will point this out to you.

Even better, if you prioritize travel in the quiz and have a travel credit card in your wallet, but, based on your spending, there are better cards available to you, your dashboard will let you know that too.

Keep in mind, just because your cards are working well for you one month, that doesn’t mean things won’t change the next month.

Stay up to date

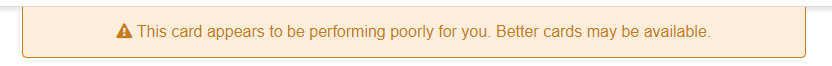

Be sure to check back in often, update your spending habits, tweak your preferences, and see what’s new. Credit card offers change frequently. So, to really get the most out of your wallet, we encourage you to keep your information up-to-date.

Get matched with the best credit cards for you

If your wallet isn’t performing well, we’ve got your back.

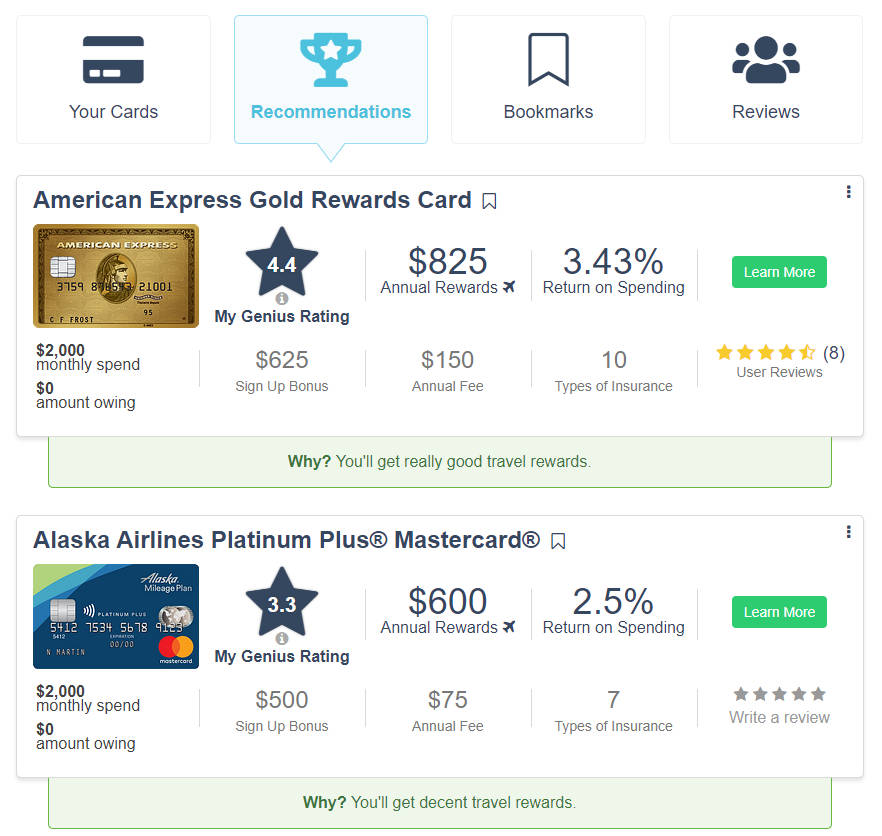

By simply clicking the “Recommendations” tab or the “Replace Card” button, you’ll be shown highly-rated credit card options that, based on our advanced matchmaking algorithm, should be a better fit for you.

Whether you’re after max rewards or you want a card that has easy approval, the recommendations offered will be tailored to you, your interests, your spending habits, and your financial situation.

You’ll only be shown cards you’re likely to be approved for based on your credit score and income. Obviously, we can’t guarantee you will be approved ‒ but we won’t waste your time showing you cards you have a low chance to qualify for.

Please note: Because these recommendations are based on the information you provide, it’s important to be as accurate as you can be when taking the quiz or updating your profile.

Save interesting cards for later

Although the Rate Your Wallet quiz and dashboard are separate from the main creditcardGenius website, there are ways you can use them together.

Anytime you’re reading a blog article or browsing creditcardGenius, you can:

- bookmark any credit card that you want to compare or look at later, and…

- apply for a credit card and have it automatically show up under your pending applications in your wallet – making it super easy to keep your wallet up-to-date.

We would love to hear from you

Our mission is to make sure Canadians have the best credit cards for them right where they belong, at home in their wallet.

Take the quiz, have a look around your dashboard, and put your wallet to the test to see if it’s time to fire your credit card.

And, as always, feedback is welcome!

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.