On September 9 2019, Paypal will introduce an update including higher currency conversion fees.

These policy changes will affect the following transactions:

- Paying for goods or services in a currency other than the currency the goods or services are listed in.

- Sending money to a friend or family member in that they receive a different currency from the currency you pay in.

So in a nutshell, if your Canadian or U.S. dollars wind up being converted into a different currency, the currency conversion fee is set to increase from a minimum of 3% to a minimum of a 3.5% currency exchange fee.

If your starting currency is anything other than Canadian or U.S. dollars, you’re looking at a change from a minimum of 3.5% to a minimum of a 4% currency exchange fee.

For all other transaction types than those mentioned above that involve conversion of currency, the fee will change from a minimum of 2.5% to a minimum of a 3% currency exchange fee.

This is bad news if you shop online using your Paypal account and tend to order from merchants that don’t use U.S or Canadian currency, or send money to friends abroad.

There’s also been some changes if you’re a Business Account holder, and some amendments to the PayPal website Payments Pro (that also has a new currency conversion fee of 3% for all transactions involving a PayPal currency conversion).

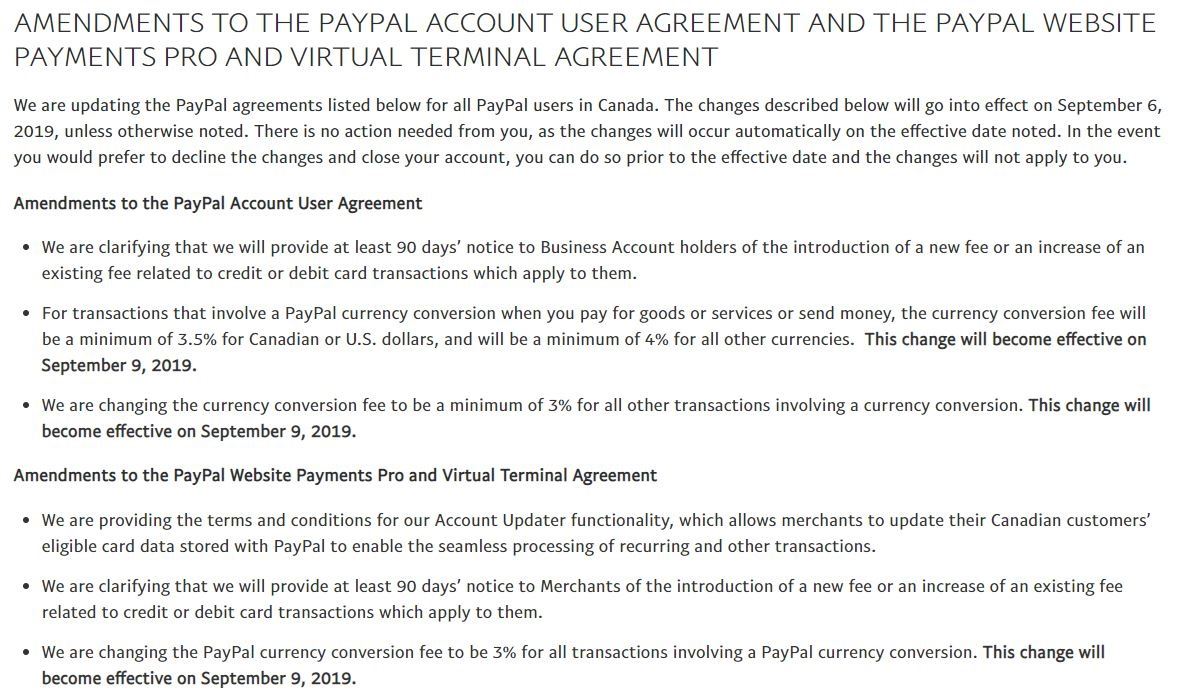

Here’s a screenshot of PayPal’s new changes listed on their website:

For more details, visit their website here.

We know a lot of people use PayPal because of privacy concerns, but just in case you didn’t want to get stung by a currency conversion fee, just know you’ve got options.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

No foreign transaction fee cards

If you were thinking a credit card might be the way to go, we recommend these two cards that don’t charge foreign transaction fees. They’ll boost your credit score (if you make your payments on time) and also earn you some cash back and rewards on the side.

Home Trust Preferred Visa

The Home Trust Preferred Visa charges a 0% foreign currency conversion charge on purchases abroad, and 1% cash back with every purchase.

As an added bonus, there’s no limit to that cash back, plus it comes with car rental collision insurance and purchase security insurance.

All of that for no annual fee? Sold.

Scotia Gold American Express

The Scotiabank Gold Amex has also stepped up its game and charges no foreign transaction fees, adding it to the very small no FX club.

If you’re willing to pay the $120 annual fee, you’ll get some pretty great rewards in return.

These include:

- 5 Scene+ points on every $1 you spend on groceries, restaurants, and entertainment – the highest of any flexible travel rewards card,

- 3 Scene+ points on every $1 spent on gas, daily transit, and select streaming services, and

- 1 Scene+ points on every $1 spent elsewhere.

We haven’t mentioned the best part…a fantastic sign-up bonus of 30,000 points when you use your card for $1,000 worth of eligible purchases in the first 3 months, and an extra 10,000 points if you spend 7,500 in the first year on eligible purchases.

That’s an up to $400 welcome bonus.

GC: $60

We want to hear from you

Are you upset about the PayPal policy changes?

Do you think you’ll switch to a no FX fee card?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner

$60 GeniusCash + Up to 45,000 bonus points + No foreign exchange fees.*

$60 GeniusCash + Up to 45,000 bonus points + No foreign exchange fees.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments