The Mogo Visa is a unique prepaid card, allowing members to plant trees with every transaction in lieu of traditional rewards.

… Or at least, it was.

But some major news has just come to the card – the Mogo Visa will be discontinued on June 6, 2023.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

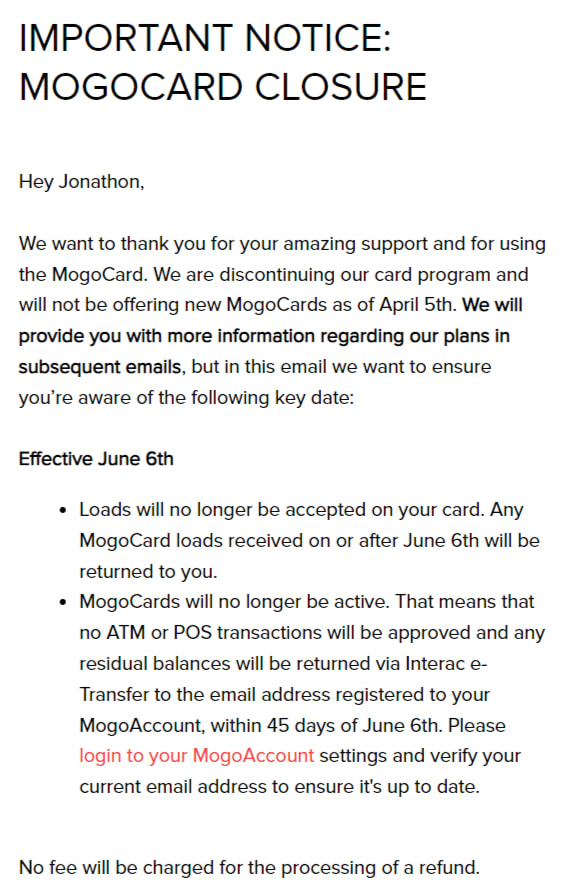

The MogoCard being discontinued on June 6, 2023

Mogo is leaving the prepaid card world behind. Effective immediately, the MogoCard is no longer available to new cardholders.

And finally, on June 6, 2023, the card will be discontinued altogether. If you have any funds still on the card after that date, Mogo will send you an Interac e-Transfer to the email you have registered with them.

Here’s the official email I received from Mogo.

An ode to the MogoCard

The Mogo Visa has never lacked for trying something new. It started out by offering 1% back in Bitcoin on all purchases.

For its first major change on June 1, 2021, it started offering 2% back in Bitcoin on all purchases. They also started doing carbon offsets. For every $1 spent, Mogo offset 1 pound of CO2 emissions.

Then, they completely revamped the rewards. They upped the ante on the carbon offset, producing the funds to plant 1 tree for every transaction made through Veritree.

They initially canned earning Bitcoin on purchases. But a couple of months later, you earned 50 bits of Bitcoin on every transaction made. That wasn’t a huge return, at most returning 4 cents per translation when the price of Bitcoin was sky-high at $80,000.

They followed that up by removing the Bitcoin on purchases when Mogo no longer had their crypto exchange, but kept the tree planting as it was.

And now, it’s gone.

As someone who has the card, I’m going to miss the tree planting – I enjoyed looking at this screen from time to time.

I’m not in the market to replace it – I simply used it for smaller purchases under $20 dollars. I’ll simply revert to my existing cards for them moving forward.

Prepaid card alternatives

If you do have this card and are looking for a new prepaid card to replace it, we’ve got a few options here for you to think about.

All of these cards have no annual fee, and they all offer the ability to earn interest on your prepaid balance.

| Prepaid Card | Earn Rates | Interest Rate | Apply Now |

|---|---|---|---|

| EQ Bank Card | * 0.5% cash back on all purchases |

0.0275% | Apply Now |

| Neo Everyday Account | * Average of 5% cash back at partner retailers * 1% cash back on gas, up to $500 spent monthly * 1% cash back on groceries, up to $500 spent monthly |

0.001% | Apply Now |

Here are the quick details on each.

1. EQ Bank Card

The EQ Bank Card is a new player in the prepaid card space. It keeps it simple with rewards – you’ll earn 0.5% cash back on all purchases.

On your balance, you’ll earn a stellar 2.75% interest. On top of all this, you’ll pay no foreign exchange fees, saving you 2.5% on every purchase not made in Canadian dollars.

2. Neo Everyday Account

Our last recommendation is the Neo Everyday Account. For rewards, you’ll earn:

- Average of 5% cash back at partner retailers

- 1% cash back on gas, up to $500 spent monthly

- 1% cash back on groceries, up to $500 spent monthly

As for interest earned, you’ll get 0.1% on your balance.

Your thoughts on the MogoCard

Now it’s your turn. What did you think of the MogoCard?

If you had it, are you looking to replace it, what would you go with?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.