Please note this offer is no longer available. You can find current offers here.

One of our favourite (if not our favourite) rewards programs is Amex Membership Rewards. With plenty of high value ways to redeem rewards, and some of the best credit cards around, it’s not hard to see why.

And some news has just landed that will make one of their redemptions more valuable.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Increased cash value for American Express Membership Rewards

There’s a new Amex Membership Rewards value when it comes to redeeming your points for cash. Here’s the email that recently came in from Amex.

Previously, 1,000 points gave you a $7 discount, for a value of 0.7 cents each.

But now, those same 1,000 points will give you a $10 statement credit – the same value as redeeming for any travel charged to the card.

It’s a big change, and, this is not a limited time offer (like it was last year) – this is a permanent upgrade to the Amex Rewards Program points.

How this affects value on Membership Rewards credit cards

So how does this affect the return on Amex Membership Rewards cards?

Based on a typical $2,000 monthly spend, here’s what the previous and new average earn rates are for their 3 personal cards.

| Credit Card | Previous Cash Earn Rate | New Cash Earn Rate |

|---|---|---|

| 1.5% | 2.15% | |

| 0.84% | 1.2% |

The biggest winner here is the Amex Cobalt Card. That new earn rate of 2.15% will put it in the running for best cash back credit card this year, on top of the many other awards it always seems to win.

Obviously, the value is also much improved with the Platinum card, but its best value lies in transfer options not available to the Cobalt card – the 6 airline partners, especially Aeroplan.

But all things considered, this is a major upgrade for all Amex Membership Rewards cards.

GC: $100

Another American Express Membership Rewards promotion

On top of this terrific news, there’s another Amex Membership Rewards in Canada promotion running until June 30, 2021.

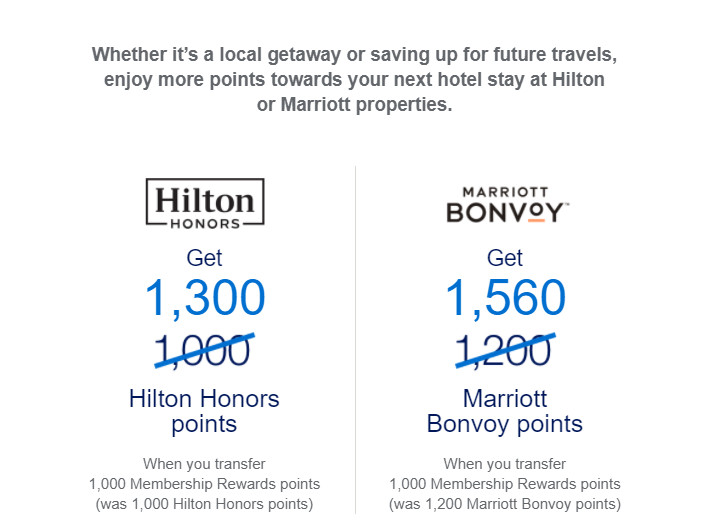

Transfer your points to either Marriott Bonvoy or Hilton Honors, and you’ll get 30% bonus points as part of the transfer.

Here’s an example of what you would get, from an email from Amex themselves.

If you’re eyeing a getaway, it’s a sweet promotion for extra hotel points.

Your turn

We don’t hide that we love Amex cards here at creditcardGenius, and this latest change only shows why.

What are your thoughts on these latest Amex changes?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner  $100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.