Please note this offer is no longer available. You can find current offers here.

Spring is in full force, which means you’re probably already dreaming about your upcoming summer vacation.

But some of you may already be looking ahead to your getaway next winter.

And if you are, Air Canada Vacations has an offer that runs until June 30 that you’ll want to consider.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Air Canada Vacations early bird winter sale

Air Canada is offering some early bird discounts if you book a vacation package by June 30, 2019 for travel between November 1, 2019 and April 30, 2020 to any of the following locations:

- Mexico,

- the Caribbean,

- Central America, or

- South America.

You’ll get great savings of $150 off per adult and $100 off for children ages 2-12.

But I know what you’re thinking.

Winter is finally over and you don’t want to start thinking about snow anytime soon. It’s too early to book a trip – your plans and pricing may change at any time.

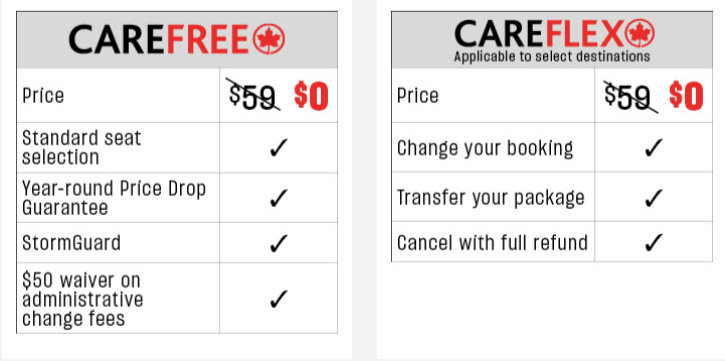

But the great part about this deal is you’ll be covered for any unforeseen changes. Air Canada is throwing in their 2 protection plans for free, normally costing $99 for the pair ($59 when purchased individually).

They’re great coverages and offer several benefits that are key to booking this much in advance.

One of these is the Price Drop Guarantee. If the price of your package drops, you can get a refund of up to $200 on an identical package.

Another great coverage under the CareFlex package allows you to make one change to your booking, free of charge depending on availability.

If you’re afraid you won’t be able to make your trip, you can also cancel with a full refund. Depending on how far in advance you cancel your booking, you’ll either get future credits or a combination of future credits and a refund.

Just note that the CareFlex coverages only apply to certain destinations. For full details on these coverages, head over to this site.

And there you have it. Great savings and free travel protections. To see what deals are available, go to this site to start planning your next vacation.

Credit cards to use

To truly maximize this sale and lower your costs even more, a credit card that offers flexible rewards is worth considering.

Aeroplan miles offer great value, for example, but when redeemed for Air Canada Vacation packages, the valuation is quite low. Preferably, you want a program that lets you redeem from any provider.

So, here are our top 2 credit card picks that will let you redeem for any travel purchase without any loss of point value from any provider, and let you amass plenty of points while you’re at it.

| American Express Cobalt | Scotiabank Gold American Express | |

|---|---|---|

| Welcome bonus | Up to 30,000 points (terms) | 15,000 points (terms) |

| Earn Rate | Up to 5 points per $1 | Up to 4 points per $1, up to 5 points per $1 starting August 1, 2019 |

| Annual fee | $120, charged out as $10 per month | $99, $120 starting August 1, 2019 |

| Apply Now | Apply Now |

Related: Credit Card Faceoff: Amex Cobalt Vs Scotia Gold Amex

American Express Cobalt

A top option for vacation packages is the

It starts off with a welcome bonus of up to 30,000 points – 2,500 points for every month you spend $500 in the first year.

You’ll also earn lots of points at these rates:

- 5 points per $1 spent on groceries & eligible dining,

- 2 points per $1 spent on gas, travel and transit, and

- 1 point per $1 spent on everything else.

Each point is worth 1 cent when redeemed for any travel booked from any provider, giving you a great return of up to 5% on your spending.

Get the full details here:

GC: $100

Scotiabank Gold American Express

Another great option for flexible travel rewards is the

To get you started, you’ll earn a welcome bonus of 15,000 points after spending $1,000 in the first 3 months.

And, similar to the Cobalt Card, you’ll earn lots of points on your daily purchases:

- 4 points per $1 spent on gas, grocery, restaurant, and entertainment purchases, and

- 1 point per $1 spent everywhere else.

You can use your points to pay for any travel you like through Scotia Rewards or any provider you choose. Each point is worth 1 cent when redeemed for travel.

Just note if you book with any provider, you’ll need enough points to cover the entire transaction. Partial redemptions are only allowed on bookings through Scotia Rewards.

And coming August 1st, exciting changes are coming to this card. The biggest of which are the waived foreign exchange fees plus the ability to earn up to 5 points per $1 spent. The full details on the upcoming changes can be found here.

GC: $60

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner  $100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.