Pros & cons

Pros

- Get up to $480 in bonus cash back. Plus, the $120 annual fee is waived in the first year.*.

- Up to 5% cash back on purchases.

- 13 types of insurance included.

- Roadside assistance included.

- Redeem cash back on demand.

Cons

- Low monthly spend caps on bonus categories.

- High income requirements of either $80,000 personal or $150,000 household.

Your rewards

$125 GeniusCash offer

On approval, receive $125 GeniusCash on us when you apply for BMO CashBack World Elite Mastercard using this offer page.

GeniusCash offer expires on Feb 28, 2026.

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to an estimated $480.◊

For all welcome bonus details click here.

Welcome bonus offer ends Dec 7, 2025.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With BMO CashBack World Elite Mastercard, here's how you earn rewards:

- 5% cash back on groceries , up to $500 in monthly spend

- 4% cash back on transit , up to $300 in monthly spend

- 3% cash back on gas , up to $300 in monthly spend

- 2% cash back on recurring bills , up to $500 in monthly spend

- 1% cash back on all other purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For BMO CashBack World Elite Mastercard in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Statement credits | $726 | |

| Investments | $726 | |

| Direct deposit | $726 |

Calculating your annual rewards

$36,000 annual spending x 2.02% return on spending = $726 annual rewards

$726 annual rewards − $120.00 annual fee = $606 net annual rewards

Details and eligibility

- Estimated Credit Score

- 560 - 659

- Personal Income

- $80,000

- Household Income

- $150,000

- Annual Fee

- $120.00

- First Year Free

- Yes

- Extra Card Fee

- $50

- Card type

- Credit

- Purchase

- 21.99%

- Cash Advance Δ

- 23.99%

- Balance Transfer Δ

- 23.99%

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 90 days

- Travel Accident

- $500,000

- Emergency Medical Term

- 8 days

- Emergency Medical Maximum Coverage

- $5,000,000

- Trip Interruption

- $2,000

- Flight Delay

- $500

- Baggage Delay

- $500

- Lost or Stolen Baggage

- $500

- Personal Effects

- $750

- Hotel Burglary

- $1,000

- Rental Car Theft & Damage

- Yes

- Rental Car Accident

- $200,000

- Rental Car Personal Effects

- $1,000

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

BMO CashBack World Elite Mastercard's 4.6 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Learn more about our rating methodology.

Awards

Each year for our annual credit card rankings our Genius Rating algorithm computes the best credit cards across 28 different categories. Here’s what this card has won this year:

Top cards from BMO

BMO CashBack World Elite Mastercard review

The BMO CashBack World Elite Mastercard stands out from its competitors, with a few unique benefits that aren't available on many credit cards.

Here's what this credit card has to offer.

Earning cash back with the BMO CashBack World Elite Mastercard

The simplest form of rewards, cash back, is a type of reward that can be used for whatever you like (although most credit cards only apply cash back rewards as a statement credit).

Earning cash back

With the BMO CashBack World Elite Mastercard, you'll earn bonus cash back on a variety of everyday purchases*:

- 5% cash back on groceries (up to $500 spent per month),

- 4% cash back on transit (up to $300 spent per month),

- 3% cash back on gas (up to $300 spent per month),

- 2% cash back on recurring bills (up to $500 spent per month), and

- 1% cash back on all other purchases.

And, there's a bonus cash back earn rate for new cardholders. You'll earn up to $480 cash back in the first 12 months.

Redeeming your cash back rewards

Unlike other credit cards that only issue cash back rewards as statement credits (and usually only once per year), the BMO CashBack World Elite Mastercard gives you a multitude of ways you can get your cash back.

You can choose from:

- deposits into a BMO chequing or savings account,

- deposits into a BMO Investorline account, or

- having your cash back applied as a statement credit.

You also get to choose when this happens, requesting a deposit when you have as little as $1 worth of rewards in your account.

Or, you can choose to get automatic deposits whenever you reach $25 in your account. The choice is yours.

4 benefits to the BMO CashBack World Elite Mastercard

What else is offered by this BMO Mastercard? Here are 4 other things we like about it.

1. Free roadside assistance

For those with vehicles, you'll get free roadside assistance to give you a hand if your vehicle is broken down. Or to simply get a little help if your battery dies or you get locked out of your car.

We estimate that this coverage is worth at least $69 per year.* You can learn more about how credit card roadside assistance works here.

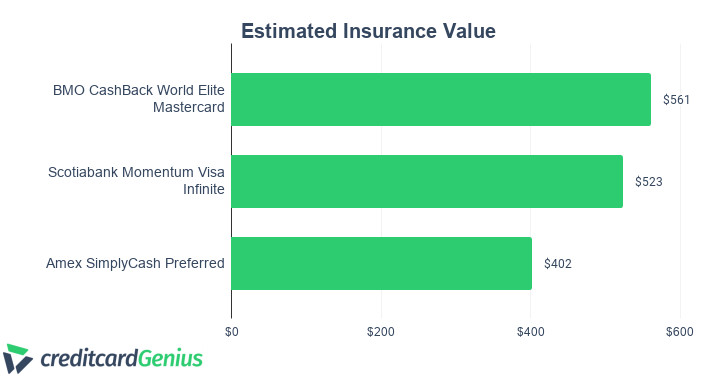

2. A generous insurance package

The insurance package is also terrific, especially for a cash back credit card.

It comes with 13 out of the

The one coverage we want to highlight above the others is Personal Effects insurance. Many cards come with delayed and lost or stolen baggage coverage – or even hotel and rental car personal effects coverage...but those are different. They only cover you while you're on the plane, in your rental car, or at your hotel.

The BMO personal effects coverage applies for the entire duration of your trip. If any of your personal items are lost, stolen, or damaged, you’re covered up to $750 per person with a $2,000 total maximum.* Cell phones and laptops aren’t covered, but most things are, including jewelry and camera equipment.

As for the value of the insurance package, here's how it compares to 2 other top cash back credit cards.

3. World Elite Mastercard

Who doesn't like extra benefits? There are also World Elite Mastercard perks at your disposal, some of which include:*

- Priceless Cities,

- World Mastercard Experiences, and

- 24/7 concierge.

You can see more of what the World Elite program has to offer here.

4. Redeem your cash back when you want

We've already said it once, but it's worth repeating. You're in control of your cash back rewards.

You can redeem them when you want, and not just for statement credits, with more flexible options including deposits into a BMO bank or investment account.

This is a breath of fresh air compared to most cash back credit cards that only offer statement credits once per year.

2 downsides to the BMO CashBack World Elite Mastercard

There are 2 downsides to be aware of with this credit card.

1. Lower annual rewards than other credit cards

While good, there are plenty of other cash back credit cards that offer better rewards for a similar annual fee.

You'll have to consider whether or not the extra benefits are worth it for this credit card.

2. High income requirements

It's a World Elite Mastercard, meaning there are also high income requirements to be eligible for this card.

These are:

- $80,000 personal, or

- $150,000 household.

These are high income requirements, and can exclude many from applying for the credit card.

To see every last detail of this card, our full blog review covers it from all angles.

Comparison to the no fee BMO CashBack Mastercard

If a $120 annual fee is a little rich for you, BMO also offers another cash back Mastercard with no annual fee – the

Here's how these 2 BMO Mastercards compare.

| BMO CashBack World Elite Mastercard | BMO CashBack Mastercard | |

|---|---|---|

| Welcome Bonus |  $125 GeniusCash + Up to $480 cash back in the first year, first year free (terms) $125 GeniusCash + Up to $480 cash back in the first year, first year free (terms) |

$20 GeniusCash + 5% cash back for the first 3 months (terms) $20 GeniusCash + 5% cash back for the first 3 months (terms) |

| Earn Rates | * 5% cash back on groceries, up to $500 in monthly spend * 4% cash back on transit, up to $300 in monthly spend * 3% cash back on transit, up to $300 in monthly spend * 2% cash back on transit, up to $300 in monthly spend * 1% cash back on all other purchases |

* 3% cash back on groceries (up to $500 per month) * 1% cash back on recurring bill payments (up to $500 per month) * 0.5% cash back on all other purchases |

| Insurance Coverages | 13 types | 2 types |

| Special Features | * Free roadside assistance * World Elite benefits * Redeem cash back on demand |

* 0.99% interest for 9 months on balance transfers * Redeem cash back on demand |

| Annual Fee | $120, first year free | $0 |

| Income Requirements | * Personal: $80,000 * Household: $150,000 |

None |

Even though it has no annual fee, the BMO CashBack Mastercard does have a couple of advantages beyond having no annual fee.

If you have some existing credit card debt, the BMO CashBack Mastercard has one of our best balance transfer offers available – 0.99% for 9 months*, a helpful opportunity to help you eliminate credit card debt.

Finally, it's also available to more people, as it has no income requirements.

In conclusion

The BMO CashBack World Elite is a well rounded credit card package with a high flat earn rate, loads of luxury perks, and 13 types of insurance. And with easy to redeem rewards, your cash will be back in your hands going to work for you in no time.

FAQ

What does the BMO CashBack World Elite Mastercard earn for rewards?

The BMO CashBack World Elite Mastercard earns up to 5% cash back on every eligible purchase.*

What perks are included with the BMO CashBack World Elite Mastercard?

The BMO CashBack World Elite perks include free roadside assistance, World Elite Mastercard benefits, and the ability to redeem cash back earned on demand.*

What is the current welcome bonus of the BMO CashBack World Elite Mastercard?

The BMO CashBack World Elite Mastercard is offering new cardholders up to $480 cash back in the first 12 months.*

Key benefits

BMO is not responsible for maintaining the content on this site. Please click on the Apply now link for the most up to date information.

User reviews

Reviewed by 55 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

Annual spending minimum of $15,000 required to waive the annual fee for the second year

The opening offer sounded so great (first three statements - 10% cashback on certain categories, capped at dollar limit). Unfortunately, the cashback amount on statements is shown only at the end of each statement (can't check midway) as lump sump vs against individual transactions. So when I manually calculated each statement, I could see it was falling way short of the promised 10%. I called BMO Customer Service twice and both times after multiple holds and checks they confirmed that the full cashback was not allocated but that is where things would get stalled. I would be promised manager reviews and call back by the end of the week and then silence. There is no email address to get back to them (the Rewards Program email says they don't deal with cashback). I am disappointed for having wasted so much time on applying, reviewing each statements and making calculations, and then talking to customer service without proper resolution, and lack of email address to communicate. Would not apply again.

I have had this card for 15 years. It has seriously gone down hill. I mostly buy gift cards with my points (they use accumulate much better). They sent a gift card 6 months ago that would not work, back and forth to customer support it has been horrible. Slow response. My buddy has a Visa Avion way better card.

Today, I received a call from 1-855-870-9268 inquiring about my interest in credit cards. However, the call was unprofessional, as there were background noises and a person giggling in a manner that suggested a lack of professionalism. I found this surprising and unexpected from an institution as reputable as BMO.

This mastercard isn't too bad for a cashback rewards card compared to what others have. The cap for groceries is pretty low now that everything is expensive that $500 be gone within couple weeks. But the good thing is that I have my other TD visa infinite cash back as a back up so no worries I get all the benefits no matter what. Their redemption from $1.00 is great, shell fuel savings of $0.02/liter isn't so wow when CAA provides $0.03, they should at least bump it to match CAA would definitely make more people to apply. So far $0.05/liter isn't too bad with 3% rewards and airmiles. To max the benefits you need to know the combos and tricks.

×1 Award winner

×1 Award winner