The RBC Value Program might not get as much attention as its loyalty rewards counterpart, RBC Avion Rewards, but that doesn’t mean it’s not worth checking out.

If you’re a regular RBC account user and you often reach for your debit card, the Value Program allows you to earn Avion points. Plus, if you have several RBC products and a qualifying bank account, RBC waives your monthly fee.

We’ll explain more and help you decide if the Value Program makes sense for your spending style.

Key Takeaways

- Enroll in the Value Program to earn Avion points on debit purchases.

- Sign up for additional RBC products to waive monthly account fees.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is the RBC Value Program?

The free RCB Value Program gives you Avion points on debit purchases with your RBC card and allows you to save on monthly account fees if you have 2 or more RBC financial products.

Think of the RBC Value Program as an added perk

To be clear, the Value Program is not the same as the RBC Avion Rewards Program, which earns you Avion points for using your RBC credit card.

How to earn RBC Avion points

If you already have an eligible RBC account, you’ll have to book an appointment, call customer service, or visit a branch to enroll in the Value Program. To open an RBC account and enroll in the Value Program, call customer service or head to a local RBC branch.

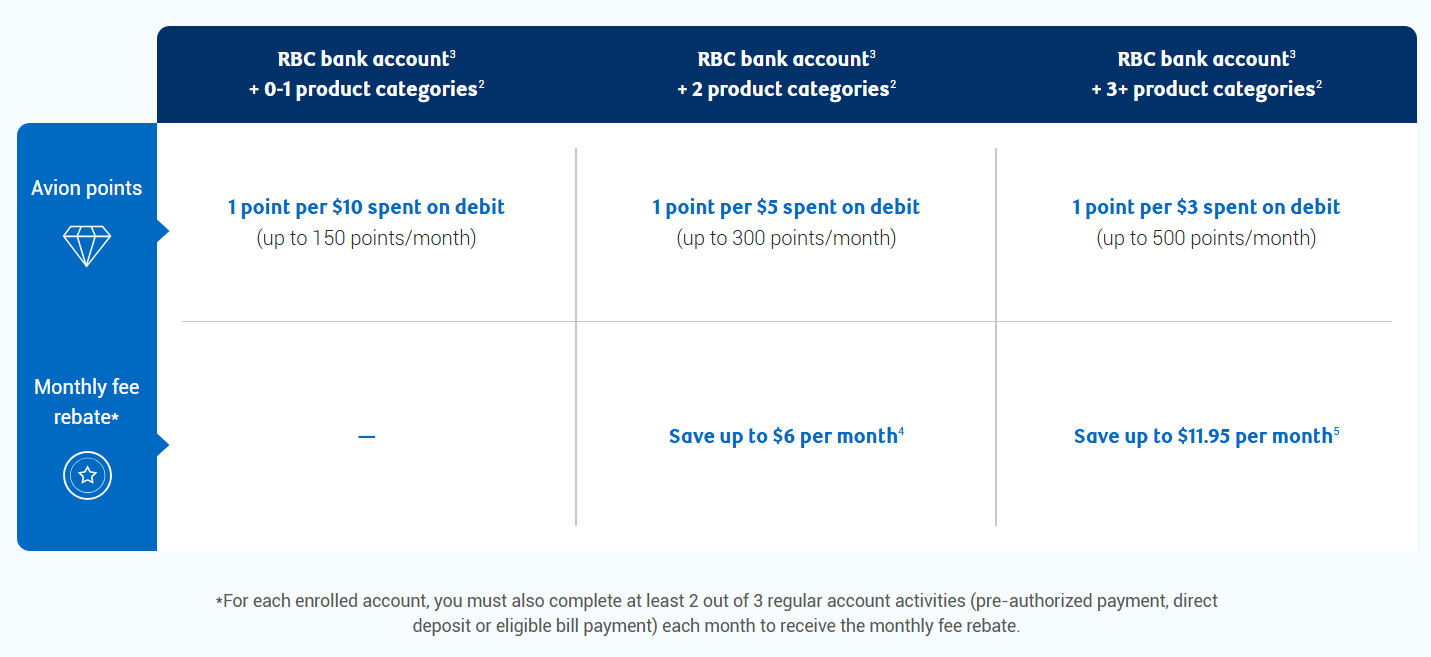

Once you’re enrolled, you’ll earn Avion points whenever you use your debit card – but the number of points you earn depends on how many RBC products you have.

On the low end, you might only earn 1 Avion point per $10 spent. If you have at least 3 products, you’ll get 1 point per $3 spent.

Here’s how it breaks down:

While the Value Program is separate from Avion Rewards, you can combine your points. To do so, just log into your RBC Rewards account and transfer your points from one account into the other.

RBC Value Program requirements

You must be using an eligible RBC account to participate in the Value Program. These accounts include:

- RBC Day-to-Day Banking or Savings

- RBC Advantage Banking (includes RBC Advantage Banking for students)

- RBC Signature No Limit Banking

- RBC Enhanced Savings

- RBC High Interest eSavings

- RBC VIP Banking

- Discontinued programs: RBC No Limit Banking, RBC Student Banking, RBC No Limit Banking for Students

Once you have an eligible account and are signed up for the program, you’ll earn Avion points on your debit purchases. To have your account fees waived, you’ll need to sign up for at least two RBC product categories. These include:

- RBC personal credit cards

- Personal investments

- Mortgages

- Linked small business relationships

Note that you can’t count two of the same products as different categories. For instance, if you have two personal credit cards, you can only count them as one product category.

You must also complete at least two of the following account activities every month to keep the monthly fee rebate:

- A direct deposit

- A pre-authorized payment

- An eligible bill payment

The Takeaway: The RBC Value Program rewards people who use RBC for most of their everyday banking.

Pros and cons of the RBC Value Program

Sometimes, a classic pros and cons list can help you decide if a rewards program is right for you. Here’s how the RBC Value Program compares:

| Pros | Cons |

|---|---|

| * Can avoid monthly fees for many basic RBC accounts | * Must sign up for additional RBC products |

| * Can earn a modest amount of additional points | * Avion’s debit earn rate is low |

| * You may already have qualifying RBC banking products | * Additional RBC products can charge fees |

| * Doesn’t fully waive the fee for RBC Signature No Limit Banking or RBC VIP Banking |

Is the RBC Value Program a good way to earn Avion points?

If you’re hoping to maximize your Avion points, the Value Program isn’t your best option. Sure, you’ll get a few points for daily purchases made with your debit card, but if you want to quickly accumulate points, using an RBC Avion credit card is your best bet.

FAQ

How do I avoid monthly fees at RBC?

If you have an RBC account and sign up for 2 product categories, RBC will waive up to $6 per month in fees. Sign up for 3 product categories and you’ll save up to $11.95 per month.

Does RBC have a loyalty program?

Yes, you can join RBC Avion Rewards to use the points you accumulate through the RBC Value Program. Redeem Avion points for travel, charitable donations, merchandise and gift cards, RBC financial products, discounts, and statement credits.

How much are 55,000 RBC points worth?

How much your Avion points are worth depends on how you redeem them. For instance, if you redeem 55,000 points using Avion’s Air Travel Redemption Schedule, your points are worth 2.33 CPP for a total value of about $1,280. However, if you cash out your points for a lower-value option like statement credits or bill pay, you’ll only get 0.58 CPP for a total value of around $320.

creditcardGenius is the only tool that compares 126+ features of 227 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 227 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.