For residents of Northern Ontario, Northern Credit Union is one place you can turn to for your banking needs.

It's a full service credit union, offering a wide variety of personal and business banking products. So whether you just need a place to stash money for a rainy day, need a mortgage, or want to invest, Northern Credit Union has almost everything you might need.

Here's everything that they offer.

Key Takeaways

- Northern Credit Union is a full service bank.

- They offer everything from personal to business banking.

- Branches are located in Ontario from Thunder Bay to Arnprior.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Northern Credit Union credit cards

We'll start with what Northern Credit Union offers for credit cards. Northern Credit Union issues Collabria credit cards, which is typical of many credit unions in Canada.

The only real difference you'll see between these cards are the logos on them. Under the hood, they're all the same credit card.

Here's the quick summary on all 6 credit cards Northern Credit Union offers.

1. Northern Credit Union Visa Infinite

The Northern Credit Union Visa Infinite is a flexible rewards credit card. You can earn up to 3 points per $1 spent on purchases. You can then redeem them for things like travel, gift cards, or cash.

The annual fee is $120 and has income requirements of either $60,000 personal or $100,000 household.

2. Northern Credit Union Cash Back Visa Infinite

If you prefer cash back, the Northern Credit Union Cash Back Visa Infinite is an excellent cash back credit card, offering up to 4% cash back on purchases.

It has the same annual fee and income requirements of $120 and $60,000 personal or $100,000 household.

3. Northern Credit Union Centra Gold Visa

The Northern Credit Union Centra Gold Visa is a credit card that offers rewards and low interest rates. You'll earn 1 point for every $1 spent and get a low interest rate of 11.99% on purchases.

The annual fee is $50.

4. Northern Credit Union Cash Back Visa

Northern Credit Union also offers a few no annual fee credit cards. The Northern Credit Union Cash Back Visa offers up to 2% cash back on purchases.

5. Northern Credit Union Classic Visa

For savings on credit card interest, you can turn to the Northern Credit Union Classic Visa.

This card doesn't offer any rewards, but has a low interest rate of 12.99%. This card has no annual fee.

6. Northern Credit Union US Dollar Visa

If you spend a lot in U.S. dollars, Northern Credit Union has a U.S. dollar Visa. With these kinds of cards, you have to pay your bill in U.S. dollars.

As you make purchases in USD, you don't pay any currency conversion fees as everything is happening in U.S. dollars. Use your card with any other currency (including Canadian dollars) and you'll pay the 2.5% fee. With this card, you'll earn 1 point for every US$2 spent. This card has an annual fee of US$50.

Bank accounts from Northern Credit Union

Northern Credit Union is a full service bank, with a diverse lineup of products.

Here's what they offer when it comes to bank accounts.

1. Chequing accounts

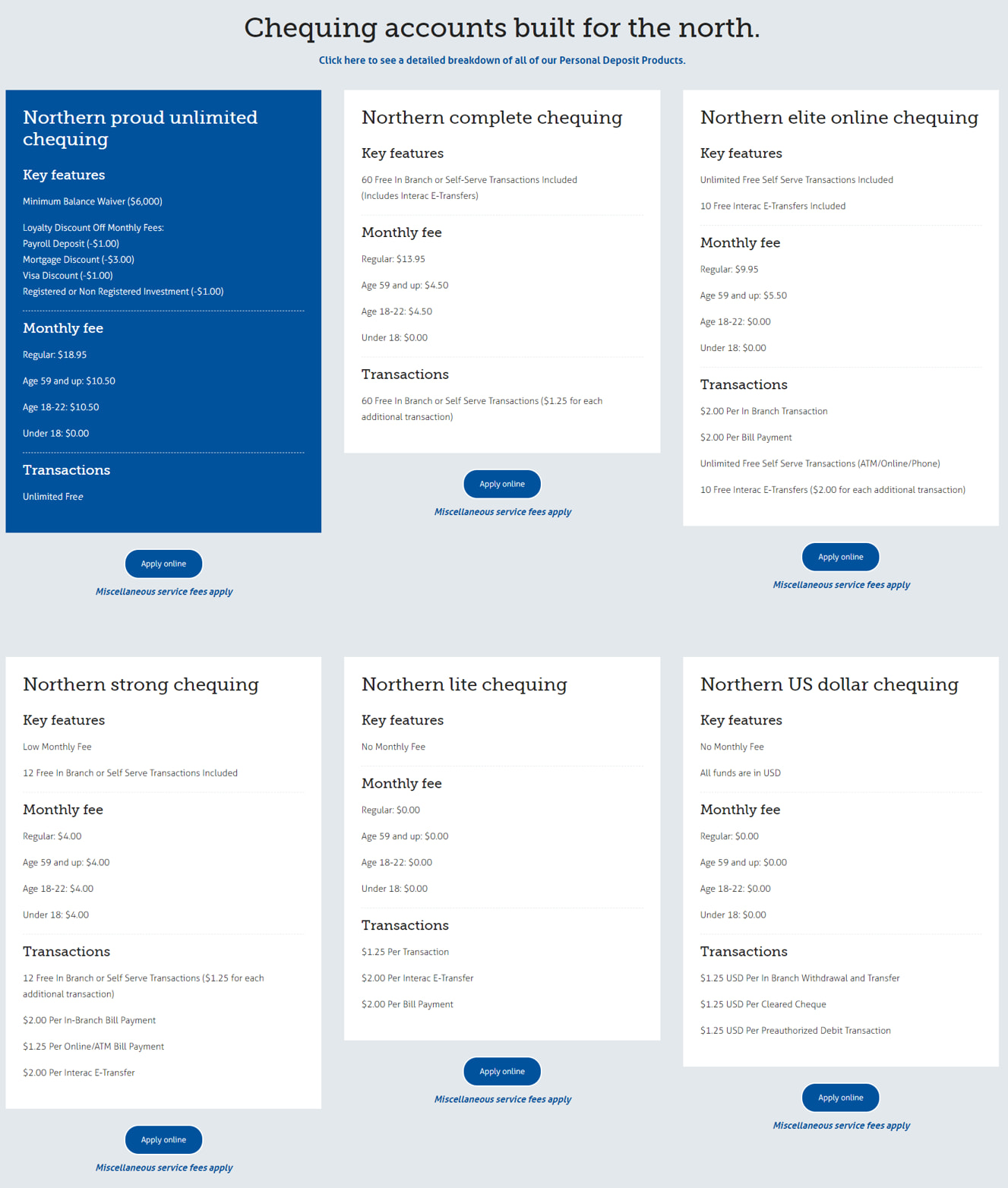

Northern Credit Union offers a diverse array of chequing accounts – 6 of them, including a U.S. dollar account.

An interesting touch with these chequing accounts is that you'll pay per month varies based on your age. If you're under the age of 18, all of these accounts are free. For certain other age ranges, they may offer a discounted monthly fee or waive it entirely.

Here's a quick summary of each account – what they cost, what benefits they offer, and the minimum balance to waive the monthly fee.

Whether you want a full-featured account with all the bells and whistles, or just need the basics, Northern Credit Union offers plenty of choices for your banking needs.

2. Savings accounts

Northern Credit Union offers a few savings accounts.

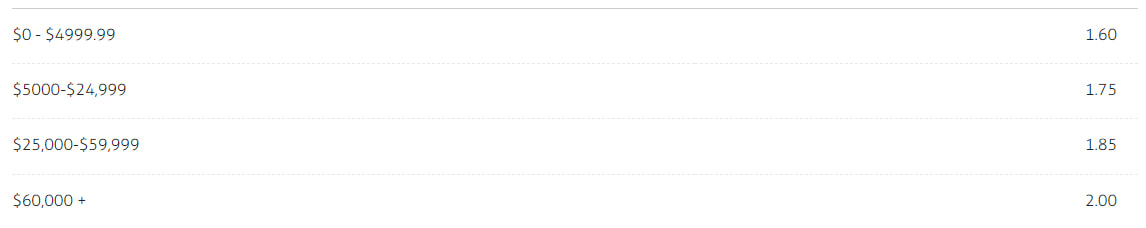

First, there are 2 basic savings accounts. These accounts offer tiered interest rates – the more you have in your account, the higher your interest rate.

The only differences between them are the free transactions. The Northern Superior Savings account offers 1 free transaction per month either in a branch or online, with a $5 charge for subsequent transactions.

With Northern Lite Savings, you don't get any free transactions, but each one only costs $1.25 each.

Here are the current interest rates.

There's also a unique savings account that functions somewhat like a GIC – the GI Savings account.

With this account, you can deposit money at any time, but you only get a 2 week window every 90 days to withdraw any money.

In exchange for this limited access to your money, you'll get a higher interest rate that isn't tiered.

Northern Credit Union other personal banking products

Northern Credit Union offers much more than just bank accounts. Here are the other personal products they offer.

1. Mortgages

Northern Credit Union offers a full suite of mortgages. Whether you just need a conventional mortgage, a high-ratio mortgage, or even a construction mortgage, Northern Credit Union has you covered.

2. Other loans

A full suite of loan products is available through Northern Credit Union. There are standard personal loans, lines of credit, and even investment loans. There are plenty of options if you need to borrow money.

3. Investments

You have plenty of investment options with Northern Credit Union. One interesting option is through Qtrade. Northern Credit Union has partnered with Qtrade to offer members access to their self-directed investment platform where you can buy stocks, bonds, ETFs and mutual funds for low fees.

They also offer the basics when it comes to registered accounts, plus they offer GICs and mutual funds through various providers.

Business banking accounts from Northern Credit Union

When it comes to business banking, Northern Credit Union offers almost everything you might need.

Here's the summary of what they offer in this department.

1. Chequing accounts

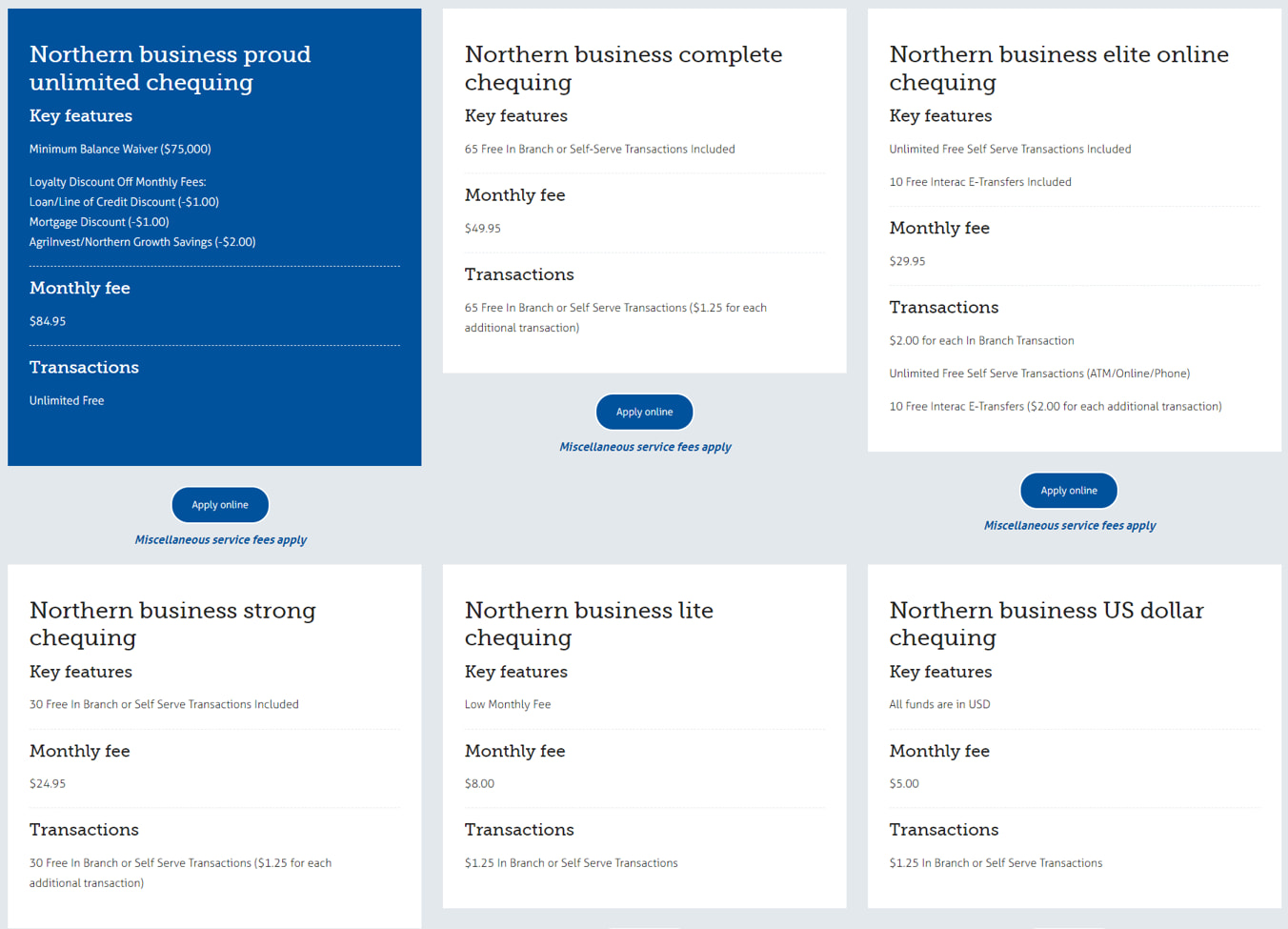

Northern Credit Union has 6 different chequing accounts, with one of them being a U.S. dollar account. The major differences between these accounts are the monthly fees and how many free transactions you get per month.

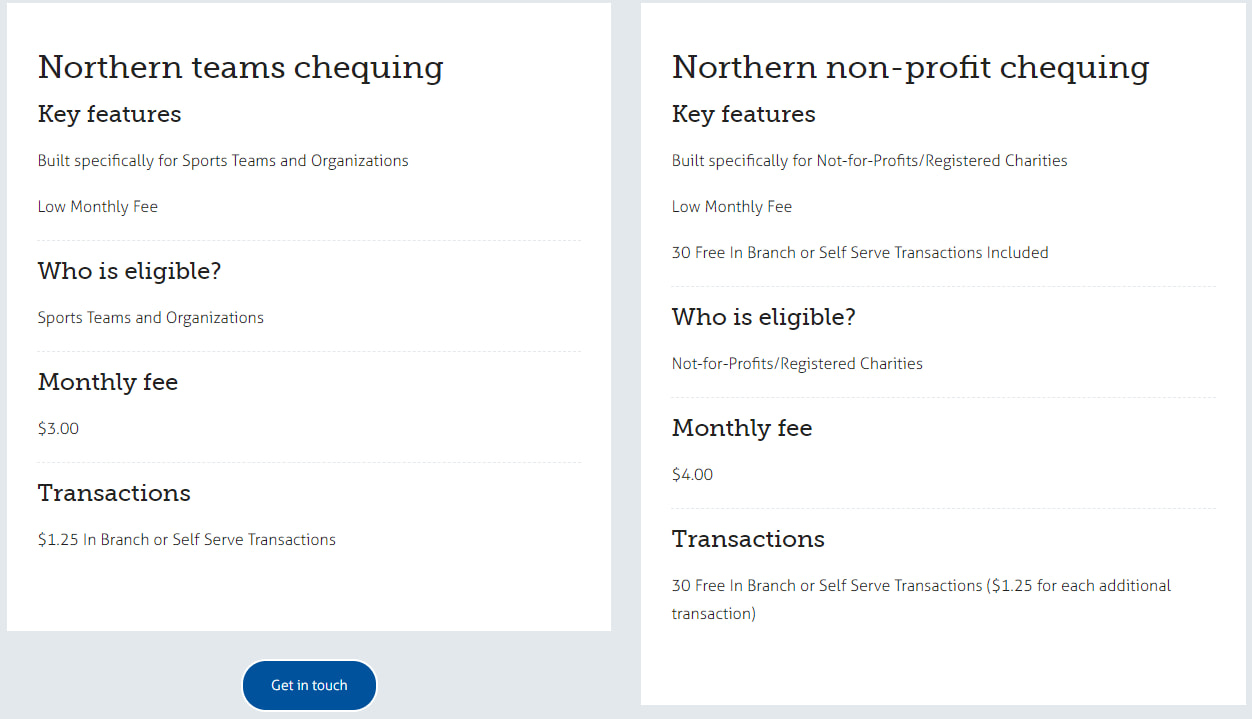

They also offer some specialty accounts for sports teams and charities/not-for-profits.

2. Savings account

There is 1 business savings account you can get. This account comes with 1 free transaction per month and has tiered interest rates. So the more you have in the account the higher interest you'll earn.

3. Loans

Whether you need a mortgage, loan, or line of credit for your business, Northern Credit Union has a variety of loan products to suit what you need.

4. Credit cards

If you need a business credit card, Northern Credit Union offers a trio of business credit cards for you to consider, with options including a premium card, no fee cash back, and one with low interest rates.

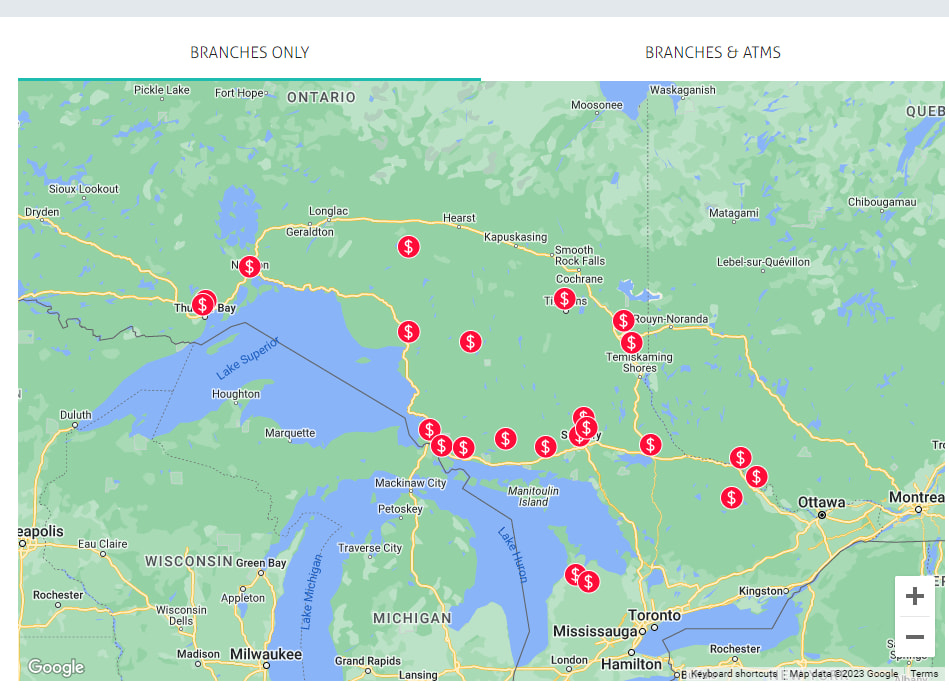

Northern Credit Union locations

So where is Northern Credit Union located? You'll primarily find branches in Northern Ontario, with a few in Eastern Ontario.

They're located from Thunder Bay to Arnprior with a few in south-western Ontario. Here's where they're located, and you can find your closest branch here.

Your experiences with Northern Credit Union

For those of you who bank with Northern Credit Union, what has your experience been like?

Would you recommend them to others?

Let everyone know in the comments below.

FAQ

What is Northern Credit Union?

Northern Credit Union is a large credit union based in northern Ontario. They offer a full suite of banking products, including chequing and savings accounts, credit cards, loans, investments, and business banking.

How do I access Northern Credit Union online banking?

Northern Credit Union online banking can be accessed by heading to the Northern Credit Union homepage and clicking on "LOGIN" on the top right corner.

Does Northern Credit Union have credit cards?

Northern credit union offers a variety of credit cards in conjunction with Collabria. They offer 6 personal credit cards and 3 business cards.

creditcardGenius is the only tool that compares 126+ features of 227 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 227 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.