Looking to earn flexible rewards, get superior insurance, and take advantage of a very unique perk? There’s a lineup of National Bank Mastercards to look at.

National Bank travel Mastercards offer a blend of high rewards, unique perks, and top-notch insurance.

It’s likely you’ve never heard of these cards before – they’re not advertised anywhere and National Bank has a smaller footprint in Canada than other banks.

Here are the full details on what these credit cards have to offer.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

National Bank’s À La Carte travel rewards

National Bank travel credit cards earn points through National Bank’s own rewards program called National Bank’s À La Carte Rewards.

These points can be redeemed for:

- travel through National Bank’s À La Carte travel rewards,

- travel booked through another place of your choosing, or

- merchandise and gift cards through National Bank’s site.

A big point to note about booking travel – National Bank’s site to redeem for travel purchases offers the best value, but only flights and vacation packages are eligible for point redemption at this rate:

10,000 points = $100

…and that value is what will be used to evaluate the card’s rewards earnings.

You can use your points to redeem for travel from any provider, however, you’ll need 12,000 points to save $100.

National Bank World Elite Mastercard

National Bank’s premium offering – the

To start, this card allows you to earn:

- 5 points per $1 spent on groceries and restaurants, up to $2,500 in total spend per month (2 points after)

- 2 points per $1 spent on gas, electric vehicle charging, recurring bills, and travel booked through À La Carte Rewards

- 1 point per $1 spent on all other purchases

As a World Elite Mastercard ‒ there is an annual fee of $150 and you will need either a personal income of $80,000 or a household income of $150,000.

However, if you don’t meet those steep income requirements, spending $25,000 per year on your existing National Bank credit card first should also qualify you for this card.

With points being worth a maximum of 1 cent each, you’re getting an average return of 1.55% on your purchases.

Complimentary travel benefits

The National Bank World Elite Mastercard has two major travel benefits that come at no extra cost to you.

1. Travel fee reimbursement

Tired of paying for airport parking and baggage fees?

Every year, National Bank will reimburse you up to $150 for the following travel fees that you may incur:

- seat selection,

- airport parking,

- airport lounge access,

- airline seat upgrades, and

- baggage fees (up to $100).

Simply charge these items to your card, keep your receipts, and send in a reimbursement claim for these expenses.

It’s a great way to save $150 a year on basic travel expenses, and offsets the annual fee. In our travel world, things are costing more and more, and many airlines are now charging for space in the overhead bins.

With this taken into account, let’s see what the total overall return is based on using the entire $150 travel reimbursement and our typical $2,000 month spend:

Spend: $24,000 spent x 1.55% average return = $372

Travel Fee: $150

Annual Fee: ($150)

Total Return: $372

$372 annually is an excellent return on your purchases, and pushes it among the best flexible rewards credit cards out there..

But the National Bank World Elite Mastercard doesn’t stop there…

2. Airport Lounge Access

Travel frequently through Montreal-Trudeau Airport?

National Bank operates their own airport lounge near gate 53 at the Montreal-Trudeau airport that your World Elite card gives you exclusive access to.

Simply show your credit card and boarding pass to gain entry.

Keep in mind: The lounge is only available for international passengers.

Insurance Coverages

This is where this card really starts to stand out.

The insurance package offered here is among the best you can find.

National Bank World Elite Mastercard Please review your insurance certificate for details, exclusions and limitations of your coverage.Extended Warranty 2 years Purchase Protection 180 days Mobile Device $1,000 Emergency Medical Term 60 days Emergency Medical Maximum Coverage $5,000,000 Emergency Medical over 65 15 days Trip Cancellation $2,500 Trip Interruption $5,000 Flight Delay $500 Baggage Delay $500 Lost or Stolen Baggage $1,000 Rental Car Theft & Damage Yes

The extended warranty offered here is incredibly rare. Most credit cards will only double the warranty up to an additional year ‒ but here we get triple the length up to 2 years.

The same goes for the purchase protection, most credit cards only offer 90 days, but here we get 180.

The travel insurances that are included are also hard to beat.

Let’s compare what is offered to another popular flexible rewards card with good insurance – the

Scotiabank Passport Visa Infinite Card Please review your insurance certificate for details, exclusions and limitations of your coverage.Extended Warranty 1 year Purchase Protection 90 days Travel Accident $500,000 Emergency Medical Term 25 days Emergency Medical Maximum Coverage $1,000,000 Emergency Medical over 65 3 days Trip Cancellation $1,500 Trip Interruption $1,500 Flight Delay $500 Baggage Delay $1,000 Lost or Stolen Baggage $1,000 Hotel Burglary $1,000 Rental Car Theft & Damage Yes

While this insurance package is good, it’s not quite as good as the above National Bank card. Especially if you are looking for quality medical and purchase insurance, National Bank offers a far greater dollar value for a much longer period.

In fact, National bank is one of the few credit cards that offer coverage for people over 65 for 15 days.

Keep in mind: The National Bank World Elite Mastercard does not include travel accident (common carrier) insurance.

If you don’t qualify for World Elite Cards, don’t worry, there are two other cards to consider…

National Bank World Mastercard

National Bank’s

- 1.25 points per dollar on the first $20,000 annual spend,

- 2 points per dollar for annual spend between $20,000 and $30,000,

- 1.25 points per dollar after $30,000, and

- a bonus 1.25 points for flights and vacation packages booked through National Bank’s À la carte travel agency.

This card has an annual fee of $115 (also first year free) and an income requirement that is the same as a typical World Mastercard ‒ $60,000 personal or $100,000 household. However, spending a minimum of $15,000 in a year on an existing National Bank card should also get you this one.

The earn rate here isn’t the best among credit cards. The first $20,000 in annual spend is easily matched by some no annual fee cash back cards.

But, if you spend $30,000 or more a year, you will start to see some value in points. (Although, if you’re spending that much, it’s probably better to upgrade to the World Elite Version.)

Unfortunately, this card does not offer the complimentary travel benefits that the World Elite Mastercard comes with to make up for its lower return on spending.

However, it does have the exact same insurance package.

So, if you don’t meet the income requirements of the World Elite card, but the insurance package is what you’re after, then this card could be an option.

National Bank Platinum Mastercard

Unlike the above two cards, the

With an annual fee of $70, this card will give you:

- 2 points per $1 spent on groceries and restaurants, up to $1,000 in total spend per month (1.5 points after)

- 1.5 points per $1 spent on gas, electric vehicle charging, recurring bills, and travel booked through A La Carte Rewards

- 1 point per $1.50 spent on all other purchases

It’s a passable rate of return of 1.13%, which is in line with the best no annual fee credit cards.

And although the insurance package isn’t quite as good as its World and World Elite counterparts, it still compares favourably to the competition.

National Bank Platinum Mastercard Please review your insurance certificate for details, exclusions and limitations of your coverage.Extended Warranty 2 years Purchase Protection 180 days Mobile Device $1,000 Emergency Medical Term 10 days Emergency Medical Maximum Coverage $5,000,000 Emergency Medical over 65 10 days Trip Cancellation $1,000 Trip Interruption $1,500 Flight Delay $500 Baggage Delay $500 Lost or Stolen Baggage $1,000 Rental Car Theft & Damage Yes

Again, it’s not as impressive as the World and World Elite, but it still offers the same extended warranty and purchase protection.

So, if a good insurance package and no income requirements are important to you, then this card could fit the bill.

Comparing all 3 National Bank travel Mastercards

How do these 3 credit cards compare? Here’s how they compare in several different areas.

| National Bank World Elite Mastercard | National Bank World Mastercard | National Bank Platinum Mastercard | |

|---|---|---|---|

| Earn Rates | * 5 points per $1 spent on groceries and restaurants, up to $2,500 in total spend per month (2 points after) * 2 points per $1 spent on gas, electric vehicle charging, recurring bills, and travel booked through À La Carte Rewards * 1 point per $1 spent on all other purchases |

* 1.25 points per $1 spent between $0 to $20,000 in annual purchases * 2 points per $1 spent between $20,001 to $30,000 in annual purchases * 1.25 points per $1 spent on $30,001 and more in annual purchases |

* 2 points per $1 spent on groceries and restaurants, up to $1,000 in total spend per month (1.5 points after) * 1.5 points per $1 spent on gas, electric vehicle charging, recurring bills, and travel booked through A La Carte Rewards * 1 point per $1.50 spent on all other purchases |

| Welcome Bonus | Up to 40,000 bonus points (terms) | None | None |

| Insurance | 10 types | 9 types | 10 types |

| Other perks | * $250 annual travel fee reimbursements * Free access to the National Bank lounge in Montreal-Trudeau |

None | None |

| Annual Fee | $150 | $115 | $70 |

| Apply Now | Apply Now | Apply Now | Apply Now |

Average earn rates

Let’s start with the rewards. Here’s how all 3 cards compare, using a typical $2,000 monthly spend.

The World Elite card has an edge, but it’s not as big as you think. Since the World card offers 2 points per $1 spent after $20,000 in annual purchases, it helps close the gap when spending $24,000 per year.

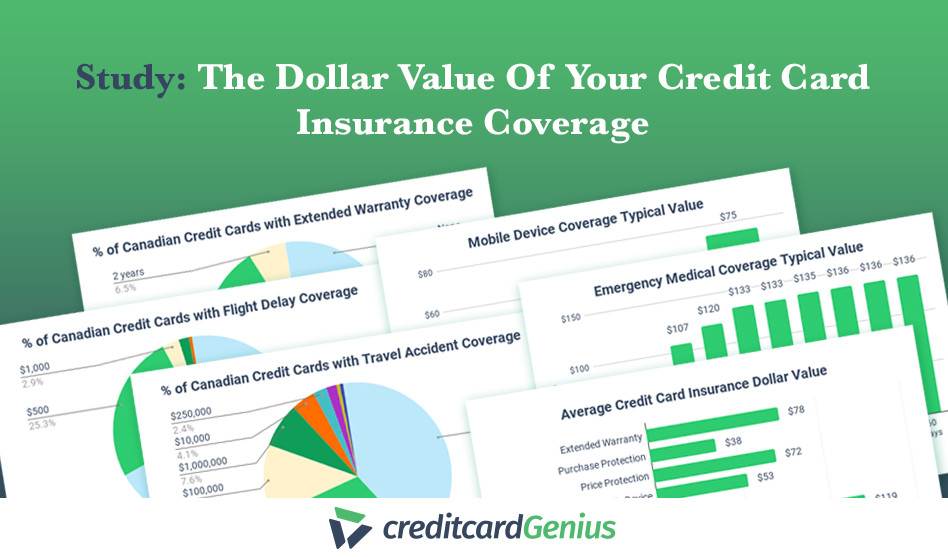

Insurance coverage

When it comes to insurance coverage, these cards all provide good value in this regard. Here is the average value of the insurance coverage, based on our study of insurance value.

The value is great on all 3 cards. The triple extended warranty and medical insurance coverages are what provides the value here.

Other perks

This is where the World Elite card shines. There’s the $250 travel fee reimbursement, and the free access to the National Bank lounge in Montreal.

The other 2 cards don’t provide much else beyond the flexible rewards they offer.

Annual fees

Finally, the annual fees. All 3 cards have a different fee:

What’s important to you?

When looking at these cards on the surface, their earning rates are average at best. However, their perks and insurance packages are some of the best and hard to ignore.

So, are these cards worth it?

It all depends on what’s important to you – if perks and an impressive insurance package matter MOST to you, then yes, these cards should be given some serious consideration.

FAQ

What rewards program do National Bank travel Mastercards belong to?

National Bank travel Mastercards are part of National Bank’s A La Carte Rewards program, which is a flexible rewards program for redeeming points for travel, merchandise, and gift cards, among other things.

What perks does the National Bank World Elite Mastercard come with?

The National Bank World Elite Mastercard comes with up to $250 in travel fee reimbursements and free access to the National Bank lounge at the Montreal airport. You’ll also get access to the typical World Elite Mastercard benefits.

Is there a National Bank travel Mastercard with no income requirements?

Yes, the National Bank Platinum Mastercard has no income requirements, making it more accessible.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 11 comments