There are two Canada Post prepaid cards: the Canada Post Prepaid Reloadable Visa and the Cash Passport Prepaid Mastercard. With several fees to consider and no opportunity to earn rewards, they're certainly not among the top prepaid cards available. Still, they do offer a convenient option for the right person.

This article covers everything you need to know about the two prepaid cards available from Canada Post, as well as a few alternative options.

Key Takeaways

- Canada Post offers two prepaid credit cards: a Visa and a Mastercard.

- Both cards have several similar fees.

- The Visa charges a monthly fee, but the Mastercard only charges a monthly inactivity fee.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Canada Post Prepaid Reloadable Cards at a glance

The Canada Post Prepaid Reloadable Visa and Mastercard are like any other prepaid card. You purchase a card, load funds onto it, spend the money, and reload funds. Simple.

Plus, these cards include zero liability for purchases, which protects you from unauthorized payments. And, as an added bonus, the Mastercard allows you to carry multiple currencies on one card.

Both of these prepaid cards are only available online or at your local Canada Post.

If you think a Canada Post prepaid card might be a good fit, check out the card basics of each option.

| Fees | Rewards | Card limits | |

|---|---|---|---|

| Canada Post Prepaid Reloadable Visa card | * $10 purchase and replacement card fee * $3 load fee * $3 monthly fee * $2 ATM withdrawal fee * 2.5% foreign exchange fee | None | $10,000 maximum card balance |

| Cash Passport Prepaid Mastercard | * $15 purchase card fee * Replacement card: free * $3 load fee * $2.80 monthly inactivity fee * $3 ATM withdrawal fee * 3.25% foreign exchange fee | None | $8,500 (or a total of $30,000 per year) |

About the Canada Post prepaid cards

Overall, the Canada Post Prepaid Reloadable Visa card and Cash Passport Prepaid Mastercard operate similarly. Since merchants throughout Canada accept both networks, either card is easy to load and use.

How the Canada Post prepaid cards work

Purchase a prepaid card and decide how much money you want to transfer from your bank account to the prepaid card.

You can monitor your account balance online or on the Canada Post Prepaid card app (available in Google Play or the App Store). As you make purchases, money is deducted from the card. When you’re low on funds, simply transfer more money to the card.

Canada Post prepaid card fees

A prepaid card sounds like a great way to save money and track your spending, but don’t forget that prepaid cards often charge lots of little fees. Here’s what you’ll pay for using the Canada Post Visa and Mastercard

| Fee | Visa | Mastercard |

|---|---|---|

| Purchase fee | $10 | $15 |

| Card replacement fee | $10 | Free |

| Monthly fee | $3 | $2.80 inactivity fee |

| Load funds | $3 | $3 |

| Foreign exchange charge | 2.5% of the converted transaction amount | 3.25% of the converted transaction amount |

| Withdraw funds at a Canadian ATM | $2 | $3 |

| Withdraw funds at an international ATM | 2.5% of the converted transaction amount + $2 | USD 2.50 EUR 1.90 GBP 1.70 JPY 275.00 AUD 3.00 MXN 32.00 |

| Card refund fee | $10 | None |

These cards are relatively similar in terms of fees. One difference worth highlighting is that the Visa always charges a monthly fee, and the Mastercard only charges a monthly fee if your card is inactive. So while the Visa is cheaper to set up, it can cost you more in the long term.

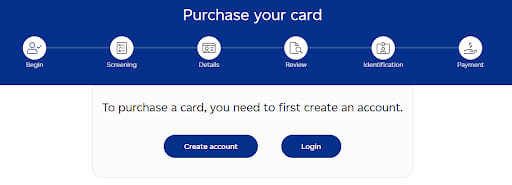

How to get a Canada Post Reloadable Visa or Mastercard

You can buy a reloadable Visa or Mastercard from any Canada Post location or purchase one on their website.

You’ll have to create an account and provide contact information. Once you’ve set up the online account, pay for the card with an Interac e-Transfer, and wait for it to arrive in the mail. Then, you can load funds.

How to add money to your Canada Post prepaid card

Once you’ve got your handy Canada Post card and used it for a while, you might be ready to add funds. There are two ways to do this:

- In-person: Take your card back to a Canada Post and tell them you’d like to add funds. You’ll pay a $3 fee plus the amount you want to put on the card. Then, you’re good to go.

- Online: Sign in to your online Canada Post account and simply transfer funds from your bank account to the prepaid card. It will take 1 to 3 days for the money to transfer.

Pros and cons of the Canada Post prepaid card

Before you head to your local Canada Post, consider whether a prepaid card is your best payment option.

Pros:

- No credit check required

- No credit score or bank account required

- Monitor your card’s balance and make transfers online

- Use the highly-rated mobile app to manage your card

- Can help you stay on budget by not overspending

- Doesn’t charge interest

Cons:

- Doesn’t build your credit score

- Doesn’t earn interest on your balance

- Doesn’t earn rewards on your spend

- The Visa costs $10 to purchase, and the Mastercard costs $15

- Monthly $3 fee for the Visa and $3 fee to load funds

- Monthly $2.80 inactivity fee for the Mastercard and $3 fee to load funds

Canada Post Prepaid Reloadable Visa and Mastercard alternatives

If the idea of paying multiple fees to use a card has you hesitating, consider your other options. These are secured credit cards, so you’ll need to deposit funds into your account to use the card. However, they avoid the fees that typically come with prepaid cards.

| Card | Rewards | Fees | Credit limits | Learn more |

|---|---|---|---|---|

| Home Trust Secured Visa | No rewards | Low-fee or no-fee options | $500 minimum deposit - $10,000 limit | Apply Now |

| Wealthsimple Cash Card | 1% back on all purchases | None | $30,000 limit | Apply Now |

| EQ Bank Card | 0.5% back on all purchases | None | $10,000 limit | Apply Now |

| Secured Tims Mastercard | * 2 points per $1 spent on Tim Hortons, gas, groceries, EV charging, transit, rideshares, and taxis * 1 point per $4 everywhere else | None | $50 minimum - $10,000 limit | Apply Now |

FAQ

Does Canada Post have prepaid credit cards?

Yes, Canada Post has two prepaid card options: the Canada Post Prepaid Reloadable Visa Card and Cash Passport Prepaid Mastercard. Both are prepaid card types available at Canada Post locations and online.

What is the maximum credit limit on a post office credit card?

Remember, since it’s a prepaid card, you don’t have a credit limit as with a traditional credit card. However, you can only have a maximum of $10,000 on the Visa or $8,500 on the Mastercard at any time.

Is the Canada Post Reloadable Visa being discontinued?

The previous reloadable Visa card offered by Vancity was no longer issued after 2021, but Canada Post offers an updated reloadable Visa available online or at local post offices. If you have an older card, you can continue to use it.

What is the best reloadable prepaid card in Canada?

Our favourite is the Wealthsimple Cash Card, our top pick on the Best Prepaid Credit Card list for 2 years in a row. Earn interest on your balance, avoid foreign exchange fees, and get 1% back on all purchases.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 6 comments