The American Express Aeroplan Business Reserve Card is the best Aeroplan business credit card, offering an excellent earn rate, airport lounge access, an extensive insurance package, and an incredibly valuable welcome bonus.

It's so good that it's actually one of the best business credit cards in the country.

This article reviews and assesses the top business card options from Aeroplan, including those issued by Amex, CIBC, and TD. We compare them head-to-head as well as with other top business cards from other networks and issuers.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Summary of Aeroplan business credit cards

First, here’s a summary of your Aeroplan business credit card choices. Aeroplan has 3 banks that issue Aeroplan credit cards, and they all offer a business Aeroplan credit card.

| Aeroplan Business Credit Card | Welcome Bonus | Earn Rates | Annual Fee | Apply Now |

|---|---|---|---|---|

| American Express Aeroplan Business Reserve Card | Up to 90,000 bonus points (terms) | * 3 points per $1 spent on Air Canada * 2 points per $1 spent on hotels and car rentals * 1.25 points per $1 spent on all other purchases |

$599 | Apply Now |

| CIBC Aeroplan Visa Business Card | Up to 60,000 bonus points (terms) | * 2 points per $1 spent on Air Canada * 1.5 points per $1 spent on shipping, internet, cable, phone services, travel, and dining * 1 point per $1 spent on all other purchases |

$180 | Apply Now |

| TD Aeroplan Business Visa | Up to 60,000 bonus points (terms) | * 2 points per $1 spent on Air Canada * 1.5 points per $1 spent on shipping, internet, cable, phone services, travel, and dining * 1 point per $1 spent on all other purchases |

$149 | Apply Now |

| The Business Platinum Card from American Express | Up to 120,000 bonus points (terms) | * 1.25 points per $1 spent on all purchases |

$799 | Apply Now |

| American Express Business Gold Rewards Card | Up to 70,000 bonus points (terms) | * 1 point per $1 spent on all other purchases * 10,000 bonus points every quarter you spend $20,000 |

$199 | Apply Now |

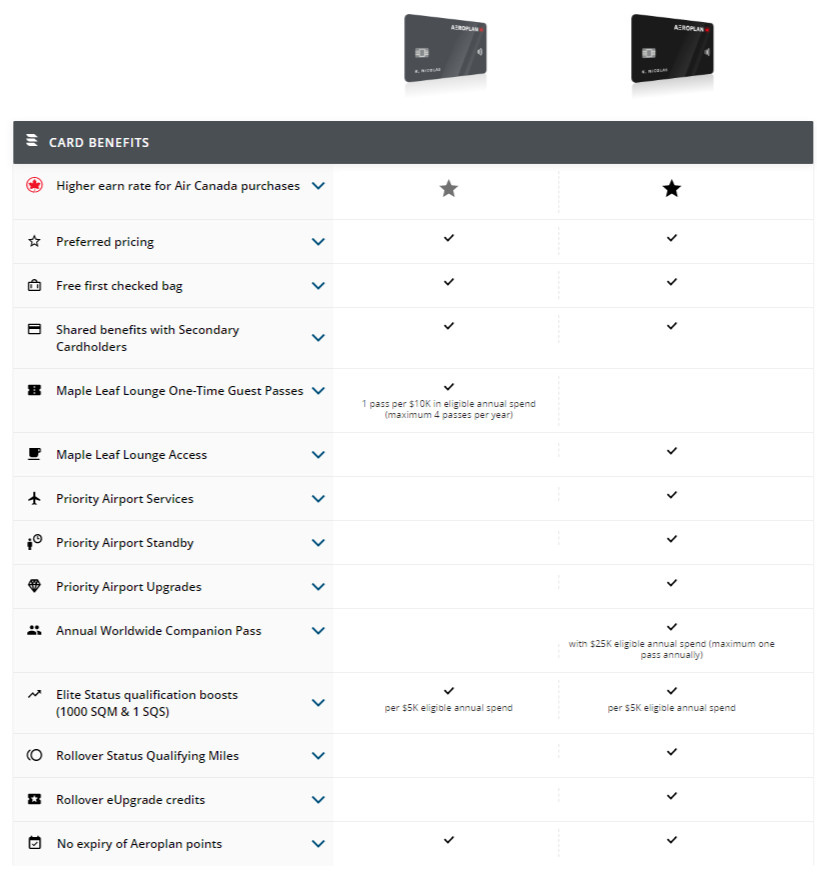

When it comes to Air Canada benefits, these benefits are standardized across their credit cards. Aeroplan business credit cards fall into 1 of 2 tiers.

American Express Aeroplan business credit card

Let’s start with the ultra-premium American Express Aeroplan Business Reserve Card. This card is an upper-tier Aeroplan business credit card, and is the only one that falls in it.

First, here are the rewards you’ll earn on your purchases:

- 3 points per $1 spent on Air Canada

- 2 points per $1 spent on hotels and car rentals

- 1.25 points per $1 spent on all other purchases

How does that translate to annual rewards? Spending $2,000 per month would give you 48,150 Aeroplan points per year.

So what about those Air Canada benefits? There’s a long list of them, here’s a listing of the bigger perks you’ll probably use:

- Preferred Pricing on reward flights,

- free first checked bag,

- unlimited Maple Leaf lounge access,

- priority check-in, boarding, and baggage handling, and

- annual companion voucher when you spend $25,000 annually.

Preferred Pricing is available on all Aeroplan-branded credit cards, and is an easy way to save on the points required for Aeroplan flight rewards.

There are also easy savings with free checked bags, priority airport services to help skip lines, and Maple Leaf lounge access to relax while you wait for your flight.

As for insurance, it includes American Express Aeroplan Business Reserve Card types – here are the full details:

American Express® Aeroplan®* Business Reserve Card Please review your insurance certificate for details, exclusions and limitations of your coverage.Extended Warranty 1 year Purchase Protection 90 days Travel Accident $500,000 Emergency Medical Term 15 days Emergency Medical Maximum Coverage $5,000,000 Trip Cancellation $1,500 Trip Interruption $1,500 Flight Delay $1,000 Baggage Delay $1,000 Lost or Stolen Baggage $1,000 Hotel Burglary $1,000 Rental Car Theft & Damage Yes

So, what’s the annual fee for all this? High at $599, so make sure to use all the benefits to get the most from your annual fee.

CIBC Aeroplan business credit card

Next up, here is CIBC’s Aeroplan business credit card – the CIBC Aeroplan Visa Business Card.

Here is what you’ll learn for Aeroplan points:

- 2 points per $1 spent on Air Canada

- 1.5 points per $1 spent on shipping, internet, cable, phone services, travel, and dining

- 1 point per $1 spent on all other purchases

In terms of annual rewards, you’re looking at 40,050 Aeroplan points earned per year if you spend $2,000 per month.

Since it’s not the upper tier, the Air Canada benefits are pared back:

- Preferred Pricing on reward flights,

- free first checked bags, and

- free Maple Leaf lounge access passes.

For the Maple Leaf lounge access passes, how many you get depends on how much you spend. You’ll get 1 pass for every $10,000 in annual purchases, up to a maximum of 4 passes per year.

As for insurance, here’s what it includes:

CIBC Aeroplan Visa Business Card Please review your insurance certificate for details, exclusions and limitations of your coverage.Extended Warranty 1 year Purchase Protection 90 days Travel Accident $500,000 Trip Cancellation $1,000 Trip Interruption $2,000 Flight Delay $500 Baggage Delay $500 Lost or Stolen Baggage $500 Rental Car Theft & Damage Yes

Finally, the annual fee? You actually get a choice. You can pay $120 (this is the “Plus” version) and get these standard interest rates:

- 19.99% on purchases

- 22.99% on cash advances and balance transfers

Or, you can pay an annual fee of $180 and get these lower rates, which vary based on your credit worthiness:

- Between 12.99% to 18.99% on purchases

- Between 14.5% to 21.5% on cash advances and balance transfers

TD Aeroplan business credit card

The last Aeroplan-branded small business credit card belongs to TD and the TD Aeroplan Visa Business Card. It’s quite similar to the CIBC Aeroplan business card.

Here’s what you’ll earn for rewards on purchases.

- 2 points per $1 spent on Air Canada,

- 1.5 points per $1 spent on shipping, internet, cable, phone services, travel, and dining

- 1 point per $1 spent on all other purchases

On top of this, you can also earn 50% more points at Starbucks when you link your TD card and your Starbucks accounts together.

The Aeroplan benefits are identical to what the CIBC Aeroplan business credit card offers.

However, this card doesn’t give you a choice in annual fee and interest rates – it takes the middle ground. For an annual fee of $149, you’ll get a lower purchase interest rate of 14.99%, but a standard cash advance and balance transfer rate of 22.99%.

American Express Membership Rewards cards

There’s another grouping of Aeroplan business credit cards you can look at from American Express – Amex Membership Rewards cards.

These cards allow you to transfer your points 1:1 to Aeroplan. Of course, transferring your points to Aeroplan isn’t your only way to use your points, but it can be the most valuable way. The beauty of these cards? You aren’t just limited to booking rewards travel with Air Canada, you have plenty of other options.

Here are your other options:

- transfer to 5 other airline programs,

- transfer to Marriott and Hilton,

- Fixed Points Travel program, and

- any purchase made to the card.

Here’s an overview of 2 Amex business cards that allow transfers to Aeroplan.

American Express Business Platinum

The ultra-premium The Business Platinum Card from American Express offers a wide range of perks.

On your purchases, you earn a simple 1.25 points per $1 spent on all purchases. That turns into 45,000 in Aeroplan points per year.

The perks it offers? Here’s a sampling of what it offers:

- unlimited access to over 1,300 airport lounges worldwide,

- automatic Marriott and Hilton Honors Gold status,

- discounted airline seats with the International Airline Program, and

- access to Fine Hotels and resorts.

There is the annual fee of $799 to consider, but take advantage of everything it offers and this card will reward you in spades while travelling.

American Express Business Gold

The last card to look at is the American Express Business Gold Rewards Card.

The rewards are pared back – an easy 1 point per $1 spent on all other purchases, 10,000 bonus points every quarter you spend $20,000. You can also earn 10,000 bonus points every quarter you spend $20,000.

If you spend $2,000 per month, you’re looking at earning 36,000 Aeroplan points per year.

The annual fee for this package? $199.

Looking for other small business credit cards? Here are some of the best small business credit cards in Canada.

Comparing Aeroplan business credit cards

Let’s compare all 5 cards listed above and see how they look.

1. Earn rates

Most of us are most interested in the rewards credit cards offer.

Here’s how many Aeroplan points you can earn per year for all of them if you simply spent $2,000 per year.

With 1 exception, the Amex cards have the advantage, with the TD and CIBC cards taking the middle ground in terms of rewards.

2. Perks included

What about the perks? Based on our study of perks, here’s the dollar value of each card’s package.

Perks really are the domain of American Express.

3. Annual fee

Finally, here are the annual fees for all of them.

So it looks like there is a price to pay for those fancy Amex cards. It’s up to you to decide if it’s worth it.

Will you get an Aeroplan business credit card?

If you travel on occasion, an Aeroplan business credit card will let you pile up rewards you can then use for your business or even yourself.

Do you have an Aeroplan business credit card?

Are you planning on getting one?

Let us know in the comments below.

FAQ

What Aeroplan business credit cards are there?

There are a handful of Aeroplan business credit cards in Canada. First, there are Aeroplan-branded credit cards, which include:

- American Express Aeroplan Business Reserve Card

- CIBC Aeroplan Visa Business Card

- TD Aeroplan Visa Business Card

There is also a pair of Amex Membership Rewards cards that allow members to transfer their points 1:1 to Aeroplan. They are:

- The Business Platinum Card from American Express

- American Express Business Gold Rewards Card

What are some benefits to having an Aeroplan business credit card?

Some benefits to having an Aeroplan credit card include:

- Preferred Pricing on reward flights,

- free checked bags, and

- Maple Leaf lounge access.

Who issues Aeroplan business credit cards?

Aeroplan business credit cards are issued by American Express, CIBC, and TD.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments