There's nothing quite like a new credit card coming to the market (well, at least here at creditcardGenius). And Neo Financial is coming out with a new card: the Neo World Elite Mastercard.

Applications for the card will open August 2024. While the site is a little vague on the full details, we’re breaking down what we know – and using their wording as clues to what the full package will offer.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

The new Neo World Elite Mastercard: what’s on offer?

Let's start with rewards.

The Neo World Elite Mastercard will be a cash back credit card – like everything else Neo offers.

The card appears to offer a good return on gas and groceries – but the dreaded "up to" language is there.

"Earn progressively" typically means that the rewards will increase as you spend more. We'll learn more details when the card launches but it's a good start.

Then there’s 2% earnings everywhere else "with higher deposit balances." We're going to read between the lines here: it seems that what you'll earn is tied to how much money you have in a Neo Everyday Account.

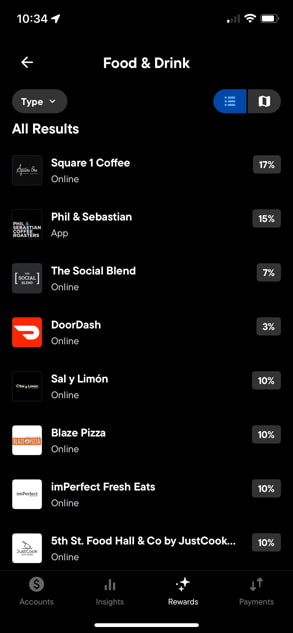

And of course, you can earn additional cash back at over 10,000 Neo partners. Here's a sampling of what these offers look like:

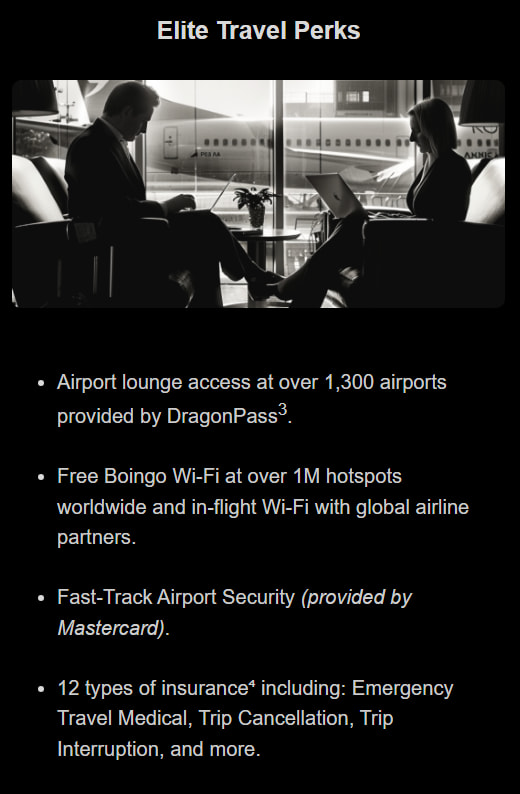

Now let’s look at insurance and other perks.

As a World Elite Mastercard, you’ll enjoy the usual perks that come with this card level. You can look forward to:

- A solid insurance package – 12 types in total

- Airport lounge access – you’ll likely need to pay $32 USD per visit

- Fast-track airport benefit – though it isn’t available in many airports, and none of them are in Canada.

And the last big question mark: annual fee and income requirements.

The card will come with an annual fee of $149, which is standard for a World Elite Mastercard. You’ll need $80,000 personal or $150,000 household income to qualify.

Our thoughts on the Neo World Elite Mastercard

There's definitely some promise here. Up to 5% cash back on a pair of essentials coupled with the ability to earn 2% everywhere is currently only seen with the SimplyCash Preferred Card from American Express.

That said, we’ll need to see the full details before giving our final verdict. Statements like "up to" and "higher deposit balances" make the rewards value murky at this time.

We'll update this post as more info becomes available. If you want to keep on top of the details, subscribe to our newsletter. We’ll break everything down and give you our hot take once we know everything about the card.

Your thoughts on the news

We've given our thoughts – what are yours? Does the card interest you? Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.