American Express is known for having some of the top credit cards in Canada, with one of their cards taking home the award for best credit card in Canada.

Their top cash back offering, the Amex SimplyCash Preferred, incurred some major changes in October, and the online Amex fan club wasn’t pleased (at least initially).

Also updated: the standard Amex SimplyCash. This card saw increased earn rates as well, but wasn’t talked about as much.

Some people who like to take advantage of credit card welcome bonuses aren’t happy, but is this just a knee-jerk reaction by a certain group?

Let’s see what the Amex SimplyCash Preferred update is all about and what the increased earn rates can do for your returns.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Amex SimplyCash Preferred update – increased annual fee

Are you happy not allocating brain power to point redemptions and prefer just getting a cut of your purchases back in cash? You probably have one of Canada’s best cash back credit cards as your wallet’s daily driver.

One of your best options in Canada is the

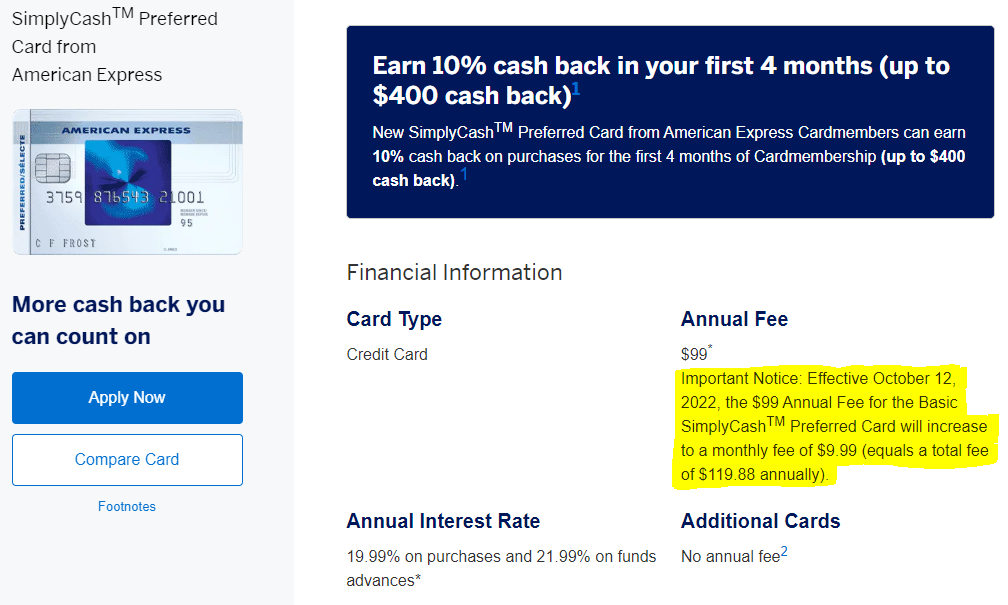

This card was known for having the best flat earn rate of any card, earning you 2% cash back on all purchases. Plus, the welcome bonus is outstanding – for your first 4 months of cardmembership, you’d earn 10% (which is capped at $400).

Now comes the annual fee. Here’s where things get a bit interesting.

Amex SimplyCash Preferred annual fee increase

The current annual fee of this card is $99. It’s not bad compared to some other cards of the same “tier” – the annual fees on those cards range from $120 to $199.

So why are some credit card communities in Canada going up in flames?

It’s because American Express is increasing the annual fee for the SimplyCash Preferred from $99 to $119.88 (which will be charged out as $9.99 a month).

Yes, it’s “closer” to some of the competing cards, but was this really necessary?

We can’t conclude why Amex is increasing the annual fee, but this isn’t entirely unprecedented.

The good news – the Amex SimplyCash Preferred earn rate upgrades

As sad as it is to see an increase in the annual fee, there is some very good news. The SimplyCash Preferred Card from American Express is getting some earn rate upgrades as well.

This is much like when the Amex Cobalt had increased earn rates to go with a newly increased annual fee. This should justify the changes better than “let’s give the C-level execs some more money.”

Here’s a comparison of how much cash back a typical $2,000 monthly spend would earn on the Amex SimplyCash Preferred, using both the current earn rates and the new ones that took effect October 12, 2022:

| Old Amex SimplyCash Preferred | New Amex SimplyCash Preferred | ||||

|---|---|---|---|---|---|

| Monthly Spend | Earn Rate | Annual Cash Earned | Earn Rate | Annual Cash Earned | |

| Gas | $200 | 2% | $48 | 4% | $96 |

| Groceries | $350 | 2% | $84 | 4% | $168 |

| Everything Else | $1,450 | 2% | $348 | 2% | $348 |

| Total Cash Back Earned | $480 | $612 |

(Just note the grocery bonus is capped at $30,000 spent per year.)

Thanks to the earn rate increases in 2 of the most useful spend categories, the typical Canadian could expect to see $132 more in annual rewards – this definitely makes up for the $20.88 annual fee increase.

Changes also coming to the standard Amex SimplyCash

But maybe the extra categories don’t impress you much. If the annual increase makes you want to trade in your SimplyCash Preferred for a pitchfork and torch, you should know there is the more basic version of the credit card with no annual fee.

The SimplyCash Card from American Express currently offers some good cash back rates (not as good as the Preferred) but without having to put money towards an annual fee. Instead of 2% like with the Preferred version, you’ll earn 1.25% cash back on all purchases. Still not bad, and certainly better than some of the really basic cards that only net you rates as low as 0.5%.

But not to be outdone, the regular version of the SimplyCash also got some increased earn rates. Here’s what they look like compared to the current rates:

And with the increased earn rates, we need to also talk about the welcome bonus.

For the first 10 months you have the card, you’ll earn $40 in statement credits in every month you spend at least $750. In the end, that’s good for $400 in total.

| Old Amex SimplyCash Card | New Amex SimplyCash Card | ||||

|---|---|---|---|---|---|

| Monthly Spend | Earn Rate | Annual Cash Earned | Earn Rate | Annual Cash Earned | |

| Gas | $200 | 1.25% | $30 | 2% | $48 |

| Groceries | $350 | 1.25% | $52.50 | 2% | $84 |

| Everything Else | $1,450 | 1.25% | $217.50 | 1.25% | $217.50 |

| Total Cash Back Earned | $300 | $349.50 |

(Again, please note the grocery bonus is capped at $15,000 spent per year.)

For the typical Canadian, these new changes see a decent increase in annual rewards – and it doesn’t come with an annual fee upgrade. You’ll still be able to enjoy the card for free.

The welcome bonus is similar to what you’d get with the Preferred card. In the first 10 months as a cardmember, you’ll get a $10 statement credit for each month you spend at least $300. In the end, that adds up to a cool $100.

Are you a fan of the Amex SimplyCash Preferred update?

There you have it, the annual fee increase and the earn rate increases are going to land on October 12, 2022.

Are these changes justified, or do you think you’re going to stand to lose more in the end? Would you keep your Preferred card, get a new one, or downgrade?

Or if you aren’t currently a cardholder, would you consider getting one now?

Share your plans in the comment section below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 10 comments