The best credit card in Canada has undergone a big change – which is actually Amex implementing their existing rules.

You'll no longer earn bonus rewards on category spending with the American Express Cobalt Card. Rather, you’ll earn 1 point per $1 spent on any purchase not made in Canadian dollars.

A major hat tip goes to Rewards Canada. They track all the places you can earn bonus rewards with this card and picked up on this change.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

American Express Cobalt Card changes

Up until now, you've been able to earn bonus rewards with your Cobalt Card on all purchases – and with the ability to earn 5 points per $1 spent on groceries and restaurants (which can get you anywhere from 5% to 10% back), using the card abroad more than makes up for the 2.5% foreign exchange fee.

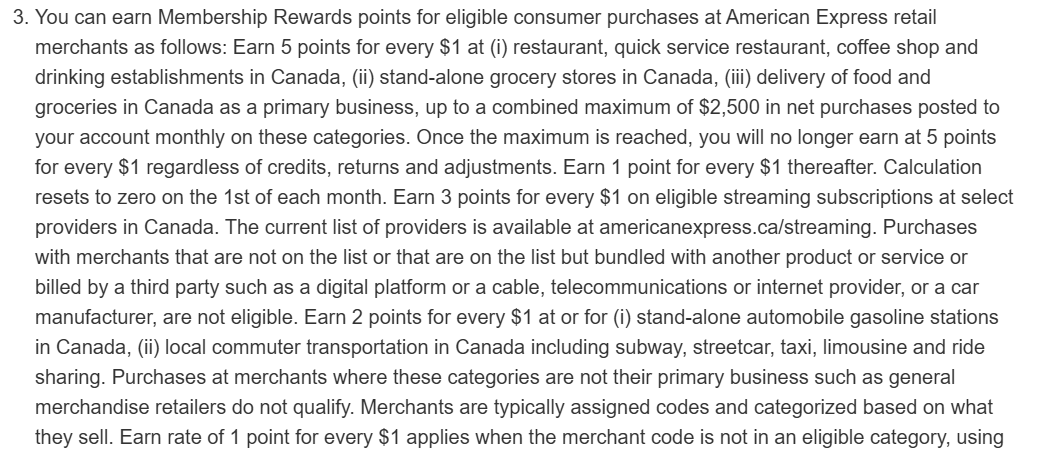

But Amex is starting to enforce their existing rules, granting bonus earn rates only to purchases made from merchants in Canada. Here's the excerpt from the terms and conditions for the card:

Earning 1 point per $1 spent gives you a return of up to 2% back (which is not guaranteed, of course), and that puts you in the red for any purchase made outside of Canadian dollars.

While not great news, this doesn't change our opinion on the card. It's still the best credit card in Canada – you just won't earn as many rewards if you use it outside of Canada.

Take note: We checked the terms of other Amex cards and they all say the same thing. We know this rule is being enforced with the Cobalt but it may also be happening with other Amex cards.

Best no foreign exchange fee credit cards

If you use your American Express Cobalt Card frequently outside of Canada (especially for restaurants), you may want to consider a credit card that doesn't charge a foreign exchange fee. You'll never be in the red with these credit cards.

The selection is limited. Here are 3 credit cards you can look at.

| Credit card | Welcome bonus | Earn rates | Annual fee + income requirements | Apply now |

|---|---|---|---|---|

| Scotiabank Passport Visa Infinite Card |  $80 GeniusCash + 50,000 bonus points (terms) $80 GeniusCash + 50,000 bonus points (terms) | * 3 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more * 2 Scene+ points per $1 spent on groceries, restaurants, entertainment, and daily transit * 1 Scene+ point per $1 on all other purchases | * $150 * $60K personal/$100K household | Apply now |

| Scotiabank Gold American Express Card |  $100 GeniusCash + Up to 45,000 bonus points, first year free (terms) $100 GeniusCash + Up to 45,000 bonus points, first year free (terms) | * 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more * 5 Scene+ points per $1 spent on groceries, dining, and entertainment * 3 Scene+ points per $1 spent on gas, select streaming services, and transit * 1 Scene+ point per $1 spent on foreign currency purchases * 1 Scene+ point per $1 spent on all other purchases | * $120 * $12K personal | Apply now |

| Home Trust Preferred Visa | None | * 1% cash back on all purchases | * $0 * None | Apply now |

1. Scotiabank Passport Visa Infinite Card

The Scotiabank Passport Visa Infinite Card is the ultimate card for travelling abroad. It charges no foreign exchange fees, plus it's a Visa, so you know you'll get worldwide acceptance.

This card comes with a Visa Airport Companion membership and 6 free passes – perfect for finding a quiet place to relax while waiting for flights. And the insurance is excellent, with 11 types included.

You'll earn Scene+ points at these rates (and the bonuses work on foreign currency purchases too).

- 3 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more

- 2 Scene+ points per $1 spent on groceries, restaurants, entertainment, and daily transit

- 1 Scene+ point per $1 on all other purchases

Add it all up and it's an amazing travel card for a $150 annual fee.

2. Scotiabank Gold American Express Card

Scotiabank also issues an American Express card that charges no foreign transactions fees: the Scotiabank Gold American Express Card.

This card also offers Scene+ points, but like the Cobalt, you won't earn bonus rewards on purchases not in Canadian dollars.

- 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more

- 5 Scene+ points per $1 spent on groceries, dining, and entertainment

- 3 Scene+ points per $1 spent on gas, select streaming services, and transit

- 1 Scene+ point per $1 spent on foreign currency purchases

- 1 Scene+ point per $1 spent on all other purchases

This card offers the standard Amex perks of Amex Offers and Front Of The Line, plus it comes with 12 types of insurance for a $120 annual fee.

3. Home Trust Preferred Visa

If you want a no fee card, there’s the Home Trust Preferred Visa. It's a basic card offering 1% cash back on all purchases, though you won't earn rewards on foreign currency purchases.

Prepaid cards with no foreign exchange fees

There are a few prepaid cards that don't charge foreign exchange fees. While not a traditional credit card, you can easily load your funds and use them while you're out of the country. Here are your options:

Your thoughts on Amex's changes

While this isn’t news we wanted to hear, at the end of the day, Amex is simply enforcing its terms.

What are your thoughts on Amex's news? Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 227 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 227 cards is for you.

×1 Award winner

×1 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.