Over the weekend, Chase Canada dropped a pretty major bomb on their Amazon.ca cardholders. And although, we kind of sensed it was coming, it’s still a pretty sad blow.

Chase credit cards have had a pretty positive, enthusiastic following with Canadians, thanks to their great earning potential and lack of fees…

But the real reason they have been thought of as the “Holy Grail” of Canadian credit cards? It’s because, unlike 99% of other Canadian cards, they charge a 0% foreign currency exchange fee.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

The Break Up

When Chase Canada stopped taking applications back in April, we had a feeling Chase was falling out of love with Canada. But over the weekend they announced that they would be closing Amazon Credit Card accounts all together in March 2018 ‒ essentially leaving us feeling like they just had the “it’s not you, it’s me” non-existent talk with us.

(Not to mention the fact that the Chase Marriott also stopped taking new applicants back in September.

Update: One of our readers, David, confirmed that he got his letter from Chase informing him that the Chase Marriott will be closing on March 15th as well.)

Word From The Top

Though there has been rumors and wonderings about when Chase would close down the Amazon.ca credit card…

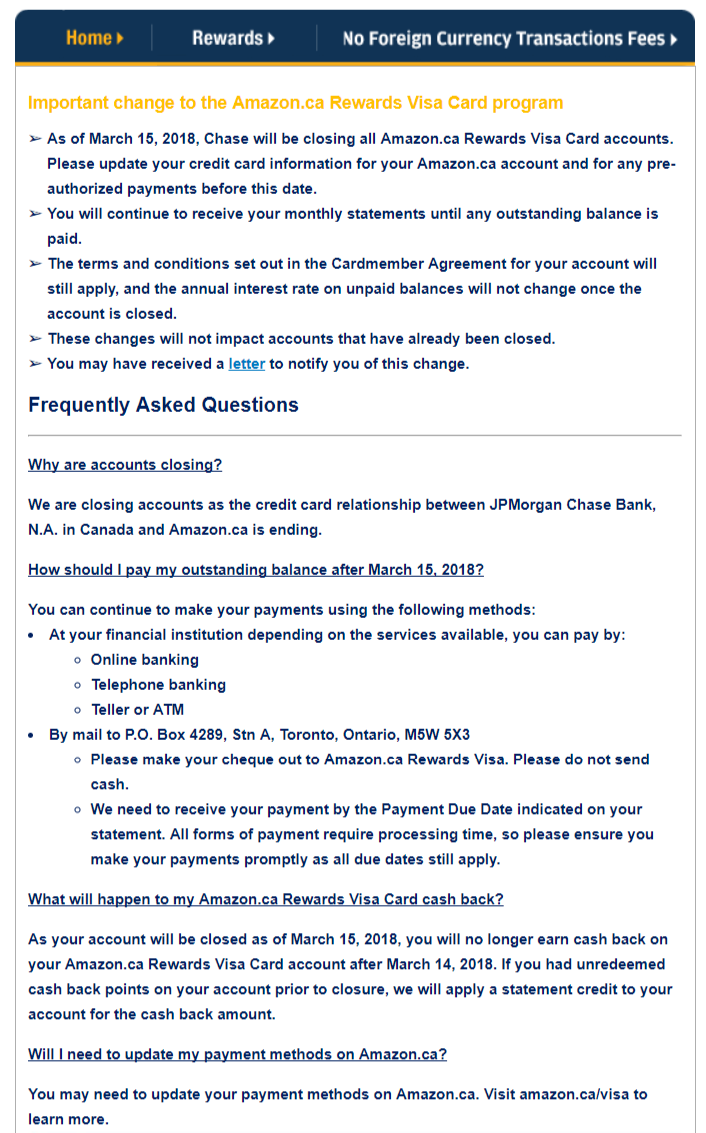

The final word has come and the following screenshot, which was taken from the Chase Canada Amazon.ca website, shows the announcement and also gives cardholders some instructions to let them know how the next few months will play out:

What’s Next

With the Chase Amazon.ca card’s future finalized, it does make us wonder when the same announcement will come down the pipeline regarding the Chase Marriott. And it also leaves many people wondering where they should look for a replacement card.

Three potential alternatives?

GC: $80

Scotiabank has recently released the above credit card that offers cardholders a number of great perks, including the coveted 0% foreign transaction fee. Although this card isn’t a no annual fee card, like the Amazon Visa, if you’re a traveler, the perks that come with it definitely make up for the annual fee. Plus, if you’re spending more than $5,500 in foreign purchases a year, the card will pay for itself and all the extra rewards and perks are just gravy.

Home Trust has the above no fee cash back card that that has a lot going for it, including 1% flat cash back and no foreign transaction fee. The only downside is they’re a smaller credit card issuer and are currently swamped with applications. You may go up to 2 months without hearing anything and reaching customer service on the phone can take hours. This situation should improve over time as they are able to adjust to the new volume of customers.

Related: New Amazon Credit Card Coming Soon (It’s A Mastercard!)

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner  $80 GeniusCash + Up to 60k bonus Scene+ points in year 1 + 6 free airport lounge passes.*

$80 GeniusCash + Up to 60k bonus Scene+ points in year 1 + 6 free airport lounge passes.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 30 comments