Pros & cons

Pros

- Low interest financing at many popular retailers.

- Have the option to earn rewards at some retailers instead of financing.

Cons

- Cannot be used everywhere - only at partner retailers.

- Annual fee of $24.99.

Your rewards

How you earn rewards

This card does not earn rewards on purchases.

Top related credit cards

Compare similar cards side-by-side.

Details and eligibility

- Estimated Credit Score

- 760 - 900

- Personal Income

- N/A

- Household Income

- N/A

- Annual Fee ᔥ

- $24.99

- Extra Card Fee

- $0

- Card type

- Credit

- Purchase

- 31.99% - 37.99%

- Cash Advance

- N/A

- Balance Transfer

- N/A

Genius Rating

FlexitiCard's 0.8 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Flexiti Credit Card review

The FlexitiCard is a unique credit product in Canada. Use it to pay for purchases at participating retailers and you can get interest free financing through your FlexitiCard.

Here's how this special card works.

What is the Flexiti Credit Card?

The FlexitiCard is a credit card that gives you access to low interest and low fee financing from many retailers.

You can only use it at partner retailers – it’s not accepted in all stores in Canada. And it isn’t part of a credit card network like Visa or Mastercard.

While there's no definitive list of retailers, you can peruse a sample of them on the Flexiti website.

Here’s how the Flexiti card works:

- Use your card to make your purchase

- If you choose, you can finance it

- You’ll have low, regular, and low-interest monthly payments – and your options will show up once you make a purchase and choose to enter into a payment plan

Flexiti Credit Card pros

Besides the low-interest financing, here’s what else the FlexitiCard brings to the table.

- Upgrade opportunity: For bigger purchases, you can opt for the Wave Card, which spreads financing over 5 years. It has the same annual fee but doesn’t offer interest financing.

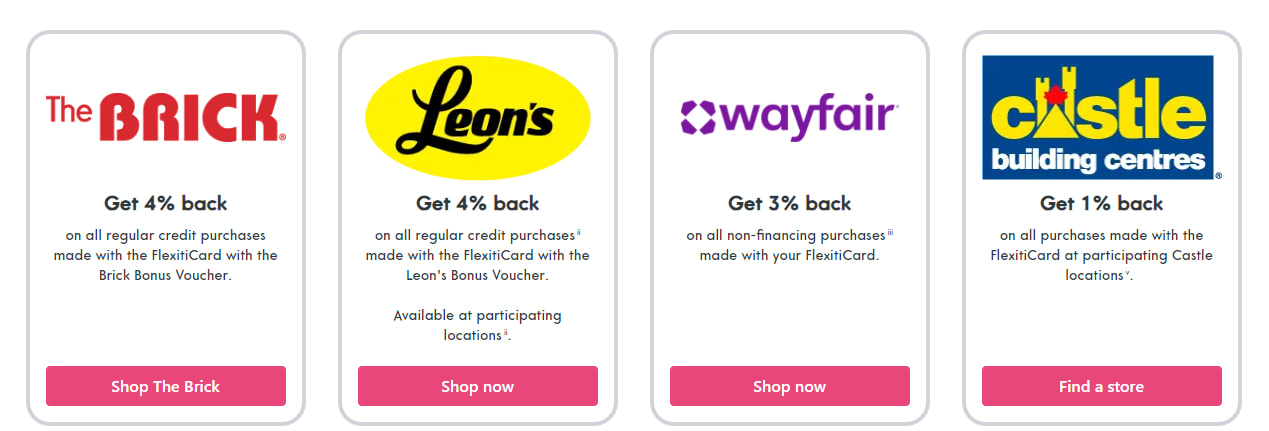

- Rewards on some purchases: If you use your card at certain retailers, you can score rewards instead of financing options.

Here's a sampling of the Flexiti rewards offers:

Flexiti Credit Card cons

Here are a few things you'll want to consider before getting the FlexitiCard.

- No details on financing options: Getting the FlexitiCard requires a leap of faith – you won’t see financing details or options until you’re ready to make a purchase.

- Can’t be used everywhere: The FlexitiCard isn’t part of any credit card network (Visa, Mastercard, American Express) so you'll only be able to use your card at Flexiti’s partner retailers.

- Annual fee: There is an annual fee of $24.99, which increases to $39.99 for Quebec residents. And the first year isn’t free, so you’ll have to pay to get full access to anything the card offers.

Alternatives to the Flexiti Credit Card

There are better alternatives to the FlexitiCard – the primary one being credit cards that offer installment plans.

This form of credit card financing gives you the best of both worlds. Pay for purchases anywhere and earn your rewards. But for purchases of larger than $100, you can also get access to installment plans to spread out the cost of your purchases. The installment length varies by issuer but terms of at least 1 year are available.

You can also consider low interest credit cards. These cards offer lower interest rates, which can save you plenty if you carry a balance.

Here are some of these cards and their purchase interest rates.

- MBNA True Line Gold Mastercard – 10.99%

- MBNA True Line Mastercard – 12.99%

- Scotiabank Value Visa Card – 13.99%

- CIBC Select Visa Card – 13.99%

- RBC Visa Classic Low Rate Option – 12.99%

Learn more: Credit card financing

Leave a review

Do you have the FlexitiCard? We’ve love to hear about your experience with the card.

Leave a user review below so others can see.

FAQ

What is the Flexiti Credit Card?

The FlexitiCard is a credit card you can use at participating retailers. You can then opt for a low-interest financing plan on your purchase. With some retailers, you can earn rewards instead of getting financing.

Is Flexiti a credit card?

Flexiti is a credit card but it's not part of any credit card network (Visa, Mastercard Amex), so it can only be used at participating retailers.

Can I use the Flexiti Credit Card anywhere?

The FlexitiCard cannot be used anywhere. It is not part of the major credit card networks and can only be used in select stores that are partners with Flexiti.

People also viewed

Key benefits

User reviews

Reviewed by 2 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

Flexiti reports monthly on Transunion Canada . Good card for furniture no additional interest installment payments.

I overpaid 78$ and I can't get it back or "spend it" anywhere.

It'd be nice to get some food.

But these companies are useless.

Never would recommend this to anyone.