Pros & cons

Pros

- Get up to 50,000 welcome bonus points.

- Earn 5 points per $1 spent on at Marriott properties.

- 2 points per $1 spent on all other purchases.

- Annual free night certificate worth 35,000 points.

- Automatic Silver Elite status.

Cons

- Lower acceptance as an American Express.

- Lower insurance coverage amounts compared to similar premium cards.

Your rewards

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 50,000 points which translates to an estimated $485.◊

For all welcome bonus details click here.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With Marriott Bonvoy American Express Card, here's how you earn rewards:

- 5 points per $1 spent at Marriott properties

- 2 points per $1 spent on all other purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For Marriott Bonvoy American Express Card in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Travel packages | $882 | |

| Hotels | $751 | |

| Transfer to Aeroplan for flights | $642 | |

| Flights | $364 | |

| Merchandise | $286 | |

| Gift Cards | $263 | |

| Car rentals | $101 |

Calculating your annual rewards

$36,000 annual spending x 2.09% return on spending = $751 annual rewards

$751 annual rewards − $120.00 annual fee = $631 net annual rewards

Details and eligibility

- Estimated Credit Score

- 660 - 724

- Personal Income

- N/A

- Household Income

- N/A

- Annual Fee

- $120.00

- Extra Card Fee

- $0

- Card type

- Credit

- Purchase

- 21.99%

- Cash Advance

- 21.99%

- Balance Transfer

- N/A

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 90 days

- Travel Accident

- $500,000

- Flight Delay

- $500

- Baggage Delay

- $500

- Lost or Stolen Baggage

- $500

- Hotel Burglary

- $500

- Rental Car Theft & Damage

- Yes

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

Marriott Bonvoy American Express Card's 3.1 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Top cards from American Express

Marriott Bonvoy Amex credit card review

The Marriott Bonvoy rewards program is quite possibly one of the most flexible travel rewards programs in the world. That strength translates into the Marriott Bonvoy American Express being the card of choice for many travel-savvy Canadians.

Here's what makes it special.

Earning Marriott Bonvoy points with the Marriott Bonvoy Amex credit card

As a Marriott Bonvoy card, it's not surprising that you'll be earning Bonvoy points on all your purchases.

And the earn rates are pretty impressive too:

- 5 points per $1 spent at Marriott properties

- 2 points per $1 spent on all other purchases

But what can you use these points for? Read on.

What you get with your points

Points can be redeemed for valuable free hotel nights at any participating Marriott property. Their sub-brands include big hotel names like:

- Ritz-Carlton

- Renaissance

- Courtyard

- Residence Inn

- Delta

- Sheraton

- Four Points

- Westin

- W Hotels

- Le Meridien

So you have lots of options when finding a location to redeem your rewards. We value a typical Marriott point at 0.97 cents when redeemed for a free night.

And more importantly, points can be transferred to more than 40 airline rewards programs worldwide ‒ most of them at a 3 to 1 ratio. The best part is one of those programs happens to be Aeroplan, which we value at an average of 2 cents each.

Keep in mind that most rewards programs don’t have any airline partners and those that do usually allow you to transfer only to a handful of partners. 40 is completely unheard of.

Why choose Marriott Bonvoy's airline miles transfer option?

First, airline miles are many times more valuable than standard rewards points. Second, you're free to choose the airline rewards program that gives you the highest value depending on where and when you're travelling. That’s a travel hacker’s dream come true.

Bonus: If you transfer points to miles in 60,000 chunks, you'll get a bonus of 15,000 points which translates to an extra 5,000 miles in your chosen airline rewards program ‒ that’s a 25% bonus which makes that 3:1 ratio even better.

With this said, your points are worth a little less – only 0.83 cents, and that's factoring in the bonus.

Here's a summary of every option for redeeming your Marriott points:

Just keep in mind the above values are mostly averages, which means you can often get even more (or even less) value out of your points, depending on your exact redemption choices.

To determine the value of your points in a specific redemption, use the following formula:

Cost of redemption / points used x 100 = value of points in cents

For example, if you redeemed 20,000 points for a hotel room that would normally cost you $200, this is how you'd calculate the value of your redemption:

$200 / 20000 x 100 = 1 cent

In this case, you're getting more than the average value – so it's a good deal.

4 benefits to the Amex Marriott Bonvoy card

This American Express card has other sweet features. Here's what else it has to offer in addition to the rewards.

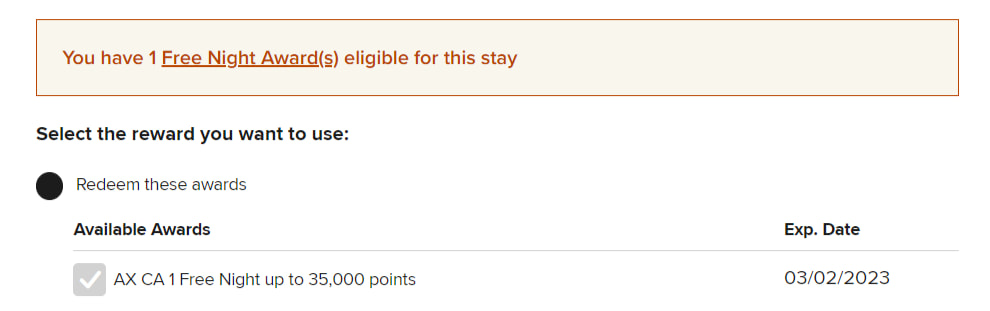

1. Annual free night certificate

The best part of having the Amex Marriott Bonvoy card – it comes with an annual free night certificate.

Every year on your card's anniversary, you'll get a certificate added to your account worth 35,000 points.

Simply book any hotel night using rewards and as long as it's 35,000 points or less you'll be able to use your certificate to pay for it.

Here's what the checkout screen looks like if you're eligible to use it.

It's a sweet way to get a free night and it's simply because you have this card. In fact, this free night more than offsets the annual fee of $120.

Just note you won't get the certificate in your first year you have the card – it's only awarded in subsequent years and you'll receive it around 8 weeks after your card's anniversary.

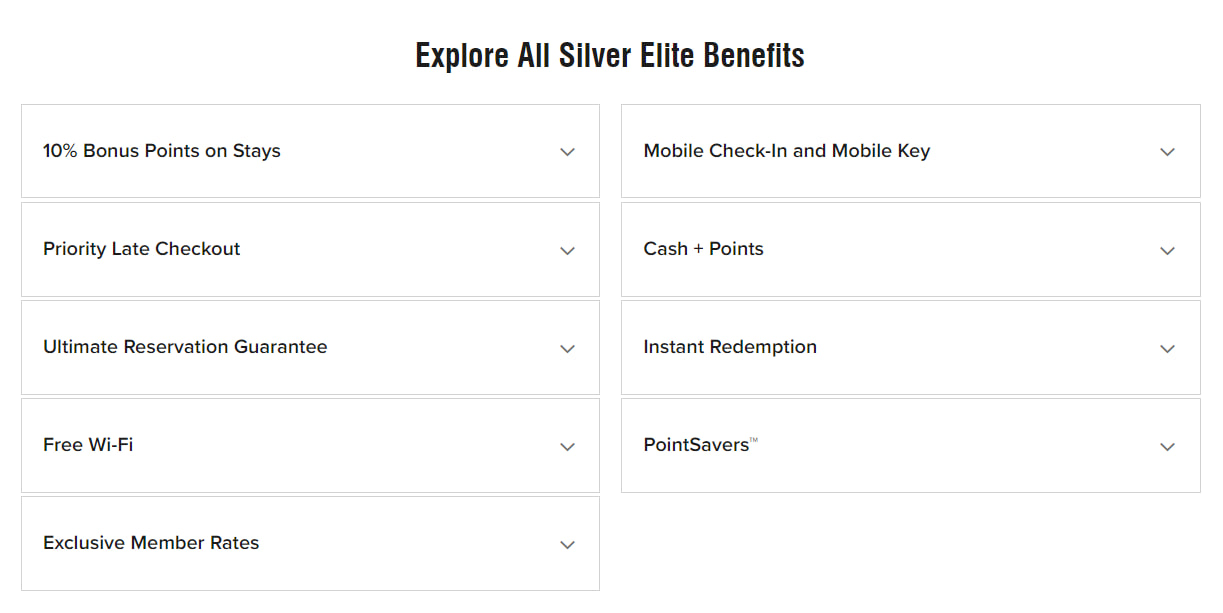

2. Automatic Marriott Bonvoy benefits

There are other Marriott Bonvoy benefits you'll get every year on top of the annual free night.

They are:

- automatic Marriott Bonvoy Silver Elite Status and

- 15 elite night credits.

The Silver Elite status is particularly noteworthy. It gives you free benefits whenever you're staying at a Marriott.

Here's what it includes:

You can learn more about these benefits here.

As for the free elite night credits, it's a fast track to Gold Elite status. You'll only need to stay 10 nights at a Marriott property to get Gold status, instead of staying 25.

Speaking of Gold Elite status…

3. Automatic Gold Elite status when you spend $30,000 per year

If you're a big spender, you may end up with Gold Elite status anyway.

Spend $30,000 per year, and you'll earn Marriott Bonvoy Gold status, and all the extra benefits that come with it.

Here's what Gold Elite offers.

4. A sweet welcome bonus

While you won't get a free night certificate in your first year, the welcome bonus more than makes up for it.

You'll earn 50,000 Marriott points after spending $1,500 in the first 3 months. Depending on the hotel you're looking at, that could potentially be worth several free nights.

2 Amex Marriott Bonvoy downsides

But the Amex Marriott Bonvoy card isn't perfect – here are 2 things you'll want to keep in mind.

1. Amex acceptance

It's a concern for some – Amex cards aren't as widely accepted as Visa or Mastercard.

And it is true, although it's somewhat overblown. Here's where you can learn more about Amex acceptance to help soothe your fears.

2. Not the greatest insurance

The travel insurance included is just ok. It only offers 8 types, with lower coverage amounts than premium cards.

If travel insurance is a priority for you, you may want to look into something else.

Comparison of the Marriott Bonvoy Amex to the Amex Cobalt card

There are other cards that can also earn you Marriott Bonvoy points – Amex Membership Rewards cards.

Amex points convert at a 5:6 ratio to Marriott, so let's see how the Amex Marriott card compares to the

| Marriott Bonvoy American Express Card | American Express Cobalt Card | |

|---|---|---|

| Welcome Bonus | 50,000 bonus points (terms) |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) |

| Earn Rates | * 5 points per $1 spent at Marriott properties * 2 points per $1 spent on all other purchases | * 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases |

| Marriott Points Earned Per Year | 51,600 | 64,800 |

| Other Perks | * Free annual night * Automatic silver elite status | * More ways to redeem points for travel * Transfer points 1:1 to several airline partners |

This all depends on what you value more. The Cobalt card earns more points on all your purchases. However, the Marriott has the trump card – the annual free night. That's essentially an extra 35,000 points you would earn per year.

The Cobalt card has one advantage – it has higher value rewards, thanks to its airline transfer and other travel redemption options. While Marriott also has airline transfer options (and plenty more of them), Amex points transfer at a much better rate – 1:1. At worst, 4:3, so you don't lose as much value.

So really, it's up to you to decide which is better. If you're only planning on transferring points to Marriott, it's likely that the Marriott card is for you. However, any other travel redemption will be better with the Cobalt card.

What do you think of the Marriott Bonvoy Amex card?

These are our thoughts on the Amex Marriott Bonvoy. What about you?

Leave us a user review so others can see what you thought of it.

FAQ

What does the Marriott Bonvoy Amex earn for rewards?

The Marriott Bonvoy Amex earns Bonvoy points at these rates:

- 5 points per $1 spent at Marriott properties

- 2 points per $1 spent on all other purchases

You can use your points for not only free hotel nights, but also transfer them to multiple airline partners or get merchandise.

What benefits come with the Marriott Bonvoy Amex?

The Marriott Bonvoy Amex comes with the following benefits:

- annual free night certificate,

- automatic Silver Elite status, and

- 15 elite night credits.

What are the annual fee and income requirements of the Marriott Bonvoy Amex?

The Marriott Bonvoy Amex has an annual fee of $120 and no income requirements.

Key benefits

User reviews

Reviewed by 10 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

Very convenient when you're travelling, and Mariott own many hotel chains in many country, rewards are great, payment system is really convenient and customer support is very usefu!

The 1 free hotel night a year really makes this card worth it, and they've improved the process over the years. Only reason I got rid of it is because I don't need hotels as often anymore

The Marriott Bonvoy rewards seem amazing to me. The value of using the points to stay at their hotels seems to be terrific value. The value seems much better than using the points for flights to me. We have had our Aeroplan card for decades & our Marriott Card for less than 5 years. The value of the hotel nights we have received over less than 5 years is much greater than the value of the flights we have received from our Aeroplan card over decades. We have had dozens of free rooms that sometimes are worth more than $500/night if we had to pay for them, & we still have enough points for dozens more. We watch for the rooms that use the least points & also for point savers which give you 5 nights for 4 nights worth of points. We love this card!

A poor replacement for the original Canadian Chase Marriott Visa. Does not include the “no currency exchange surcharge” that was on the Visa. It also has limited acceptance in Canada. While the 15 nights credit and annual free night is tempting, it still falls short of the Chase Visa, which is still available in the US. I’ve changed to the Scotia Bank Passport Visa because of the currency exchange.

The old Marriott Chase card gave us the free worldwide currency option, It looks like they removed this benefit