Pros & cons

Pros

- 55,000 points.

- High point value of up to 2.33 cents.

- Includes 12 types of insurance.

- Save 3 cents per litre on fuel at Petro-Canada.

Cons

- Only earns 1 point per $1 spent on most purchases (1.25 point on travel).

- Poor rewards if not redeemed through the Air Travel Redemption chart.

- High income requirements of either $60,000 personal or $100,000 household.

Your rewards

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 55k points + $120 which translates to an estimated $1,402.◊

For all welcome bonus details click here.

Welcome bonus offer ends Jun 15, 2026.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With RBC Avion Visa Infinite, here's how you earn rewards:

- 1.25 points per $1 spent on travel

- 1 point per $1 spent on all other purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For RBC Avion Visa Infinite in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Air Travel Redemption Schedule | $849 | |

| Transfer points to British Airways or Cathay Pacific | $638 | |

| Travel through RBC Rewards | $365 | |

| Charity donations | $365 | |

| Transfer points to WestJet Rewards | $365 | |

| Merchandise | $317 | |

| RBC financial products | $303 | |

| Gift Cards | $262 | |

| Statement credits | $211 |

Calculating your annual rewards

$36,000 annual spending x 2.36% return on spending = $849 annual rewards

$849 annual rewards − $120.00 annual fee = $729 net annual rewards

Details and eligibility

- Estimated Credit Score

- 660 - 724

- Personal Income

- $60,000

- Household Income

- $100,000

- Annual Fee

- $120.00

- Extra Card Fee

- $50

- Card type

- Credit

- Purchase

- 20.99%

- Cash Advance Δ

- 22.99%

- Balance Transfer

- 22.99%

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 90 days

- Mobile Device

- $1,500

- Travel Accident

- $500,000

- Emergency Medical Term

- 15 days

- Emergency Medical Maximum Coverage

- unlimited

- Emergency Medical over 65

- 3 days

- Trip Cancellation

- $1,500

- Trip Interruption

- $5,000

- Flight Delay

- $500

- Baggage Delay

- $500

- Lost or Stolen Baggage

- $500

- Hotel Burglary

- $2,500

- Rental Car Theft & Damage

- Yes

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

RBC Avion Visa Infinite's 4.3 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Learn more about our rating methodology.

Awards

Each year for our annual credit card rankings our Genius Rating algorithm computes the best credit cards across 28 different categories. Here’s what this card has won this year:

Top cards from RBC

RBC Avion Visa Infinite review

The biggest bank in Canada has one of the biggest offers that can save you big money on your next vacation with this stacked travel rewards card.

Ready for the trip of a lifetime without hitting your wallet with the cost of a lifetime? The RBC Avion Visa Infinite is a fast-earning, high-redeeming travel card with an Earth-shattering welcome bonus that brings you to the airport gate faster.

RBC Avion Visa Infinite Rewards

As the Avion Visa is an RBC credit card, you'll be earning RBC Avion Rewards points on every purchase you make.

How the RBC Avion Visa earns rewards

So what do you earn for points on your purchases?

RBC has kept it simple – you'll earn 1 Avion point for every $1 you spend with the card.

And while that doesn't seem like anything special, it's what these points are worth that makes the difference.

Redeeming RBC Rewards

In terms of travel rewards, the RBC Avion Rewards Program is one of the top contenders for rewards redemptions. That said, there are a few ways you can redeem your RBC Avion Visa Infinite points for travel.

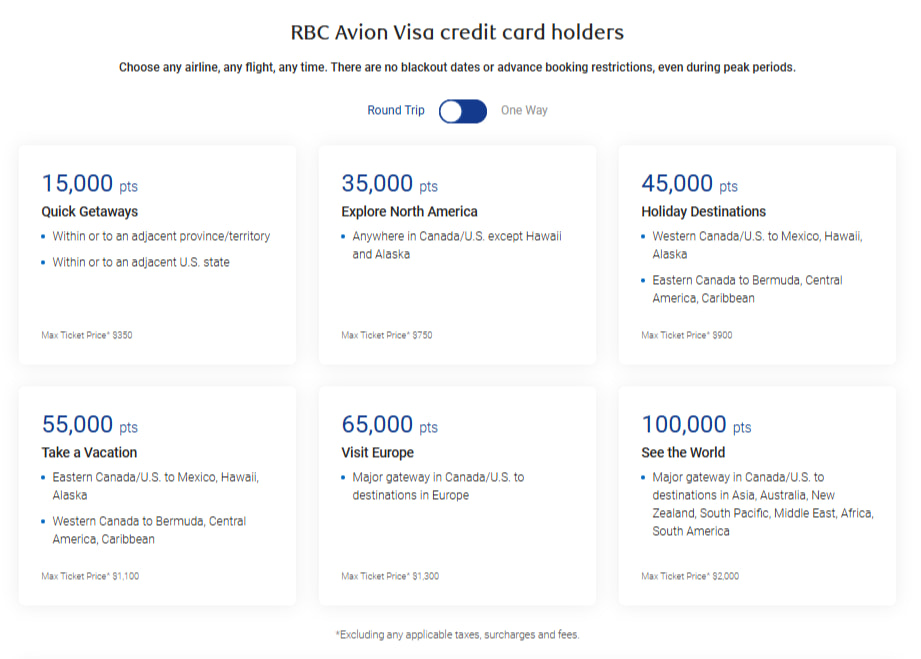

We'll start off with the RBC Avion Air Travel Redemption Schedule. There are 6 different regions to choose from, and depending on where you want to go, you'll need to redeem a certain number of points:

With the Air Travel Redemption Schedule, there's a limit to the maximum base airfare the points cover, but if you can maximize this, you're looking at a return of up to 2.33 cents per point. Just note you'll still have to pay any taxes, fees, and carrier surcharges.

Found a specific flight on a different carrier that'd be more rewarding?There are 4 transfer options you can take advantage of with your RBC Avion Visa Infinite card:

| Airline | Transfer Ratio | Airline Point Value | RBC Avion Visa Infinite Return |

|---|---|---|---|

| British Airways | 1 Avion Rewards = 1 Avios | 1.75 cents | 1.75% |

| Cathay Pacific | 1 Avion Rewards = 1 Asia Mile | 1.75 cents | 1.75% |

| American Airlines | 10 Avion Rewards = 7 AAdvantage Miles | 1.75 cents | 1.2% |

| WestJet | 100 Avion Rewards = 1 WestJet dollar | 1 Dollar | 1% |

And of course, you can also redeem points for any travel booked through RBC Rewards. 100 points gives you a savings of $1.

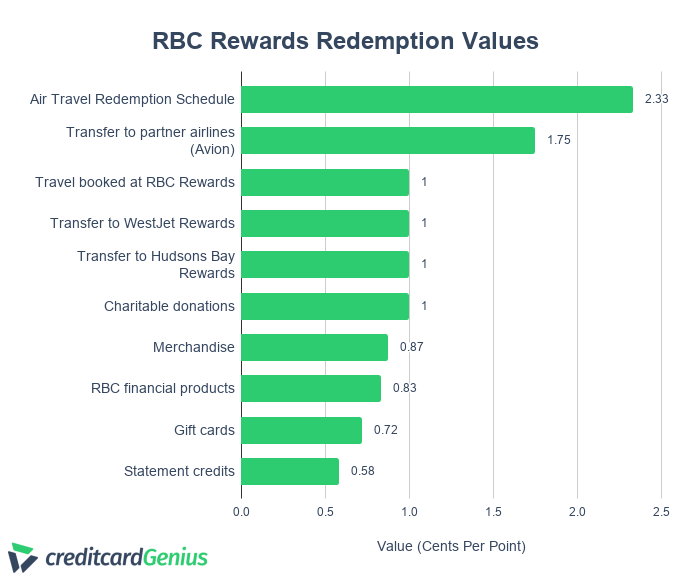

Though travel is by far the most valuable (even transferring points, though worth less, is still better) compared to other redemption options, this is still a flexible rewards card. Points you earn with your RBC Avion Visa Infinite card include:

- transfer to Hudson's Bay Rewards,

- charity,

- merchandise,

- RBC Financial products,

- gift cards, and

- statement credits.

Here's a summary of what each point is worth.

5 benefits to the RBC Avion Visa Infinite

Beyond the rewards, what else does the RBC Avion Visa Infinite have to offer? Here are 5 other things we like about it.

1. High value points

It was mentioned already, but it's worth saying again – RBC Rewards have a lot of potential value.

Redeemed properly, and you're looking at a value of up to 2.33 cents each, an incredible value for your spending, and one of the best point values available.

2. Plenty of transfer options

There's also plenty of ways you can transfer your points. First, you have 4 different airlines you can transfer points to, as described above.

But, you can also transfer your points to Hudson's Bay. 1 RBC Rewards point gives you 2 Hudson's Bay points. Each Hudson's Bay point is worth 0.5 cents, giving your RBC points a value of 1 cent each.

3. RBC credit card benefits

Like all RBC credit cards, there are 2 easy-to-use benefits out there for some extra savings.

First is with Petro-Canada. Link your RBC credit card and Petro-Points accounts together, and you'll save 3 cents per litre on fuel, and earn 20% bonus Petro-Points.

The other is with Rexall. Link your Be Well and RBC card, and you'll earn 50 Be Well points per $1 spent at Rexall.

4. Plenty of insurance coverage

The insurance is also stellar. You'll get 12 different types of purchase and travel protection.

One coverage we'll spotlight – the mobile device insurance. Not many credit cards offer it, and provides coverage for a device that goes just about anywhere you do.

5. Sweet bonus

Finally, there's a superb bonus at play. You'll earn 55,000 bonus points after your account is approved and you spend $5,000 in the first 6 months.

Those points are worth up to $1,282 when redeemed through the Air Travel Redemption chart – a great kick start to your next trip.

2 downsides to the RBC Avion Visa Infinite

For all the positives, there are a couple of things you'll want to be aware of.

1. Poor rewards outside of the travel chart and airline partners

While there is plenty of high value to be found, if you redeem outside of the redemption chart or select airline partners, you're looking at a return of 1% on your purchases.

That certainly isn't a great return on spend, and if you're only thinking about redeeming for any travel, or even transferring to WestJet, your return won't be that great and you may want to think about other credit cards.

2. High income requirements

There are also high income requirements to meet. You'll need either a personal income of $60,000 or a household income of $100,000 to qualify.

Comparison to the RBC Avion Visa Infinite Privilege

There are plenty of other credit cards that earn Avion Rewards. Here's how it compares to the super-premium RBC Avion Visa Infinite Privilege.

| Feature | RBC Avion Visa Infinite | RBC Avion Visa Infinite Privilege |

|---|---|---|

| Welcome bonus | 55,000 bonus points (terms) | Up to 70,000 bonus points (terms) |

| Annual fee | $120 | $399 |

| Rewards | * 1.25 points per $1 spent on travel * 1 point per $1 spent on all other purchases | * 1.25 points per $1 spent on all purchases |

| Other benefits | * Access to the Avion flight chart for high value rewards * Transfer points to 4 airline partners | * Access to the Avion flight chart for high value rewards * Transfer points to 4 airline partners * Visa Airport Companion membership with 6 free passes * Benefits at select airports in Canada |

| Insurance coverages | 12 types | 12 types |

| Income requirements | * Personal: $60,000 * Household: $100,000 | * Personal: $150,000 * Household: $200,000 |

Between these cards, it comes down to how much of an annual fee you're willing to pay.

If you're willing to pony up $399 per year, you'll get more rewards, insurance and perks. But if not, you're still looking at an excellent credit card.

Would you get the RBC Avion Visa Infinite?

There's plenty to like about the RBC Avion Visa Infinite.

Have this card, or have you had it in the past? Leave a review below, so others can learn from your experience.

FAQ

What does the RBC Avion Visa Infinite earn for rewards?

The RBC Avion Visa Infinite earns Avion points. On purchases, you'll earn a simple 1 point per $1 spent (1.25 points per $1 spent on travel).

What can RBC Avion Rewards be used for?

The primary way to redeem your RBC Avion Rewards is for travel, where you can redeem through a fixed points chart, transfer to airline partners, or redeem for any travel booked through Avion Rewards. There are many other ways to use your RBC rewards, including gift cards, merchandise, and donations to charity, though the return on those is lower than using them for travel.

What is the annual fee of the RBC Avion Visa Infinite?

The RBC Avion Visa Infinite has an annual fee of $120.

What are the RBC Avion Visa Infinite income requirements?

The RBC Avion Visa Infinite has income requirements of either $60,000 personal, or $100,000 household.

Key benefits

Refer to RBC page for up to date offer terms and conditions.

Corresponding legal references and product terms are available on the RBC website, which will be available and agreed upon in the customer onboarding process.

^ This offer only applies to new applications for an RBC Avion Visa Infinite or RBC Avion Visa Platinum credit card (each, an “Eligible Credit Card”) approved by Royal Bank of Canada, subject to the conditions below. Additional cardholders(s) (co-applicant and authorized user(s)) on the Eligible Credit Card account, as well as existing cardholders on any RBC Royal Bank personal credit card transferring to an Eligible Credit Card account, are not eligible for this offer.

35,000 welcome Avion points (“Welcome Points”) will appear on your monthly credit card statement within sixty (60) days after your application has been approved, provided that your Eligible Credit Card account remains open and in good standing at the time the Welcome points are credited to your account, “good standing” meaning that your Credit Card Account must not be past due for more than two (2) consecutive credit card account statement periods, closed, charged off or in credit revoked status.

You will receive 20,000 bonus Avion points (“Bonus Points”) if a total of $5,000 or more (“Qualifying Transaction Amount”) in qualifying net purchases and/or pre-authorized bill payment transactions (“Qualifying Transactions”) are posted to your Eligible Credit Card account within the first six (6) months from your Eligible Credit Card account opening date (“Period”). The Bonus Points will appear on your monthly credit card statement within sixty days (60) after you reach $5,000 in Qualifying Transactions, provided your Credit Card Account remains open and in good standing at the time the Bonus Points are credited to your account. Qualifying Transactions exclude cash advances (including balance transfers, cash-like transactions and bill payments that are not pre-authorized charges that you set up with a merchant), interest charges and fees. Credits for returns and adjustments posted to your Credit Card account during the Period will reduce the amount of your Qualifying Transactions. The Qualifying Transaction Amount is based on the transaction posting date of each Qualifying Transaction, not the transaction date. This means that transactions that take place prior to the last day of the Period will not be considered for the Qualifying Transaction Amount if they have not yet been posted or processed by the merchant, the payment network (Visa) or Royal Bank by the last day of the Period.

If you close or change your Eligible Credit Card for another type of RBC Royal Bank credit card before the Welcome Points have been credited to your account, you may lose the benefit of this offer. This offer may not be combined or used in conjunction with any other offer. Royal Bank reserves the right to cancel, modify or withdraw this offer at any time without notice, even after your application has been approved, including if we suspect that you may be manipulating or abusing it, or engaging in any suspicious or fraudulent activity, as determined by Royal Bank in its sole discretion. For complete terms and conditions that apply to the Avion Rewards Program, please visit www.avionrewards.com or call 1-800-769-2512.

† Air Travel Reward redemptions from the Air Travel Redemption Schedule start at 35,000 Avion points for a round trip long-haul flight to almost anywhere in Canada or the United States, exclusive of Hawaii,Alaska and Mexico, with a maximum ticket price of $750. All applicable taxes, service fees and surcharges are the responsibility of the traveller. For more details, including information on redeeming for first class and business class seats, visit: www.avionrewards.com/travel/index.html. For general redemption terms, conditions and restrictions that apply to the Avion Rewards program, please visit: www.avionrewards.com or call 1-800 ROYAL 1-2 (1-800-769-2512).

** If you lose your job or become totally disabled, this coverage can pay 25% of your credit card total account balance – up to $6,250 per month for up to four months. If you pass away, this coverage can make a single payment of the total amount owing on your credit card account to a maximum benefit amount of $25,000. Enrolment is easy for eligible cardholders. You may cancel at any time. Premiums are $1.20 per $100 of your account balance on your statement date (plus applicable taxes). Terms, conditions and eligibility restrictions apply. Full details are available on rbcroyalbank.com. This insurance coverage is underwritten by American Bankers Insurance Company of Florida and American Bankers Life Assurance Company of Florida, who carry on business in Canada under the trade name of Assurant®.

User reviews

Reviewed by 80 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

Our trip was cancelled due to sudden sickness of my wife with cancer , called visa they said we are intitled to refund but it's Allianz insurance that is handelling the case , Allianz always find something in the claim that they don't understand , and never read their full emails , and keep on asking for more explanation , it has been two month already back and forth with more proof and details everytime , I have a feeling they keep on pushing the case until we get tired and stop requesting .Very frustrating

Worst card to get if you looking to travel. E.g international flight with aeroplan cost 100k plus $120. With RBC rewards 120k points plus $875 when the flight cash lost is only $1200. Worst card to get

Took over 3 weeks for replacement card once reported fraudulent purchases on Privilege card (which was never resolved). Spent countless hours on phone with customer service with zero accountability.

The single worst credit card I’ve ever had. I purchased it to get the airport lounge access. This card has access to third-rate lounges in London that are overcrowded and require a reservation, and then standing room only. There are no partner lounges in Chicago, one of the largest airports. To top it off, it was declined multiple times while in Europe with no specific reason given. It worked for small transactions, but not for some of the larger hotel stays. It has a $50k limit! So much for a “travel” card. Thankfully my second free MasterCard worked every time the RBC. AVION Infinite Privilege VISA failed me.

The worst customer service I ever experienced. Every time I call they ask lots of questions and once I pass the security, they transfer me and after one hour of waiting they will hang up. They never call back the no. I called from so I guess they just don't want work.

I complained a few times but they do nothing.

I regret having an account with them. I will close it soon.

×2 Award winner

×2 Award winner